With the growing adoption and use of mobile banking, the financial services industry is building new functionality and selling models that can enhance the consumer experience. Moving beyond a miniturized online banking app, banks and credit unions are developing new ways to leverage advanced analytics, mobility and location-aware technology that can provide real-time solutions where and when the consumer is in most need.

This capability comes at a time when competition is increasing and digital differentiation has become more difficult. It also comes at a time when waiting for the consumer to raise their hand is no longer a viable business strategy. Instead, financial institutions need to leverage the digital data that is available to provide highly personalized geo-targeted services that anticipate needs.

The Importance of Location-Based Offers

Location-based offer (LBO) technology is able to confirm the location of a mobile user and send offers to the user that are relevant based on insight contained within the banking organization’s database. According to the Cognizant report, U.S. Consumer Banks and the Potential of Location-Based Offers, location-based offers are increasingly important due to several factors:

Location-based offer (LBO) technology is able to confirm the location of a mobile user and send offers to the user that are relevant based on insight contained within the banking organization’s database. According to the Cognizant report, U.S. Consumer Banks and the Potential of Location-Based Offers, location-based offers are increasingly important due to several factors:

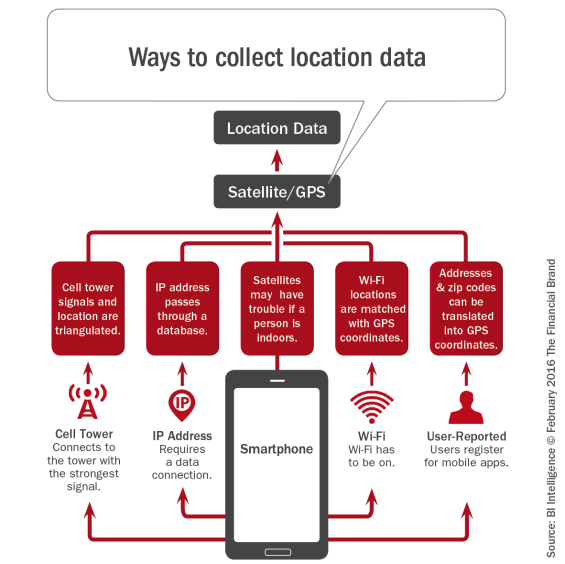

- The ‘LBO trifecta’ of mobile devices, geolocational technology and advanced analytics. With three-quarters of consumers owning a smartphone, advancements in GPS systems and increased use of predictive analytics, there is a growth in location-based services. According to a Cisco survey, 46% of consumers are interested in having personalized offers delivered to their mobile devices, while 38% are open to receiving personalized promotions related to products and services.

- Diminishing consumer loyalty. The digital consumer is more likely to switch banking organizations if their needs are not met. They are also more informed and more likely to shop online, making the availability of real-time, custom offers even more important to retain loyalty.

- The need to differentiate. Banking products, in general, have become commodities at a time when consumer needs have become more diverse. This has put pressure on banks and credit unions to develop offers that are tailored to individual consumer needs.

- The growth of digital platforms. Mobile technologies combined with advanced analytics provides the opportunity to engage with consumers during their optimal moment of financial need (such as when they walk into an auto showroom or electronics store, when balances fall below a certain level or even during the new account onboarding process). This engagement may be as simple as sending a text message (SMS) or email.

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

How Banks Are Fortifying Their Data Against Increasing Cyber Threats

This webinar from Veeam will detail the value of working together across your organization to be better prepared in cyber defense and response readiness.

Read More about How Banks Are Fortifying Their Data Against Increasing Cyber Threats

The Benefits of Location-Based Offers

The primary benefit of location-based offers is that it allows financial institutions the ability to move beyond traditional, calendar-based promotions to provide more relevant content in real time. This includes the cross-selling of banking products based on need, the offering of outside merchant offers to increase loyalty of current customers and the recommendation of services that can alleviate a potential negative event (overdraft, fraudulent activity, etc.).

The primary benefit of location-based offers is that it allows financial institutions the ability to move beyond traditional, calendar-based promotions to provide more relevant content in real time. This includes the cross-selling of banking products based on need, the offering of outside merchant offers to increase loyalty of current customers and the recommendation of services that can alleviate a potential negative event (overdraft, fraudulent activity, etc.).

According to Cognizant, banking needs to follow the lead of retailers, turning to smart engagement techniques, including using multiple sources of information, to create contextually meaningful offers to consumers. “Banking is well positioned to improve the relevance of offerings, since they possess detailed insight into customers’ transaction history and spending behavior,” says the report. “Using this granular data – from demographics to psychographics – banking can create highly customized offers that steer customers to the “right” merchandise or service at the right moment and at the right place.”

Additional benefits of location-based services include an additional security layer that can validate transactions by comparing the user location with the location of the transaction, and the ability to offload rudimentary inquiries such as the location of the nearest ATM or branch. Other location-based applications are the ability to book appointments at a branch location and the identification of a customer as they enter a branch.

“There are two primary drivers to bridging the online and offline experience. The first is relevance. Increasingly, apps that are used regularly and ones that deliver a great customer experience have utility, relevance, and ease of use. The second is context awareness. Consumers are coming to expect different experiences and features depending on whether they are pre-shopping at home, navigating their way to somewhere, or in-store and shopping.”

John Puterbaugh, Managing Partner and Chief Digital Officer, BlueSoho

The Challenges of Location-Based Offers

According to Cognizant, the biggest challenges when executing location-based offers include:

According to Cognizant, the biggest challenges when executing location-based offers include:

- Security and privacy of user data. Recent data breaches in the retail industry have made consumers more concerned about their personal information. the success of an LBO initiative will hinge on the effectiveness of security controls.

- Legacy systems. Legacy systems can be difficult to access when trying to leverage advanced analytics for personalized offers. If all product silos can’t effectively accessed, the potential for mis-targeting increases, with the resultant reduction in consumer satisfaction with the efforts.

Executing Location-Based Offers

Effectively executing location-based offers takes a combination of technology tools and strategic planning. Cognizant recommends the following steps for a bank or credit unions hoping to execute a location-based offer program.

Effectively executing location-based offers takes a combination of technology tools and strategic planning. Cognizant recommends the following steps for a bank or credit unions hoping to execute a location-based offer program.

- Goal-setting. “Banks should break down their objectives, such as the specific products they want to highlight through LBOs, then prioritize them. For example, banks can send vehicle loan offers to a customer’s smartphone when the customer is actually at a dealership,” says the report.

- Location planning. Geographic boundaries should be set for each offer or service. How wide should the geofence be around physical branch offices? For retail-centered programs, which retailers should be included? For product-based offers, which consumers should be included and when should offers be delivered?

- Campaign planning. “Financial institutions need to deepen their understanding of customer traffic and shopping behavior by analyzing data about a customer’s location, buying patterns and personal preferences,” states Cognizant.

Offers can consist of either a “push” message (offers are delivered to a mobile device based on location and/or need) or “pull” messages (a consumer logs into a mobile app to access an offer). Offers can be based on a consumer’s location and/or timing. By analyzing previous consumer buying patterns, an accurate prediction of the best time to present an offer can be made by the bank or credit union.

The Future of Location-Based Offers

The ability to execute and benefit from location-based offers will only improve over time as technology improves, mobile usage increases and the usage of consumer insights becomes more effective. These improvement will increase the benefits to financial institutions, consumers and partnering retailers.

Ultimately, the application of insights for improved targeting and sales should become integrated into the daily lives of the consumer – moving banking from an outside influence to a desired partner. The use of consumer data to deliver offers to consumers at the right time and place will be the key to success in a more digital world that expects nothing less.