With competition for banking relationships being so intense, many banks and credit unions have opted for offering more and more services for free. This is especially true if a consumer opts for an expanded relationship that not only includes a checking or current account, but also a savings account and/or credit relationship. Some institutions even add ancillary products and services with the intention of positioning their foundational product(s) for increased engagement and loyalty.

In a strategy that dates back to my early days in the banking industry (before many of our readers were born, let alone entered financial services) ‘packaged’ bank accounts have been the response for organizations wanting to offer more – either for a small monthly fee or at no charge – to the customer or member. For the right consumer, a packaged account can be a way to save money, increase insurance coverage, provide peace of mind, etc.

These added services are sometimes available to both retail and small business customers, with offerings varying based on the type of account opened and objectives of the financial institution. The selling proposition in the branch or online is that the combined cost of the various elements contained within a packaged account exceeds the annual fee (assuming there is one).

Read More:

- Financial Marketers Must Tap Data to Build Digital Cross-Selling Engines

- 7 Common Sense Ways to Increase Bank Cross-Selling

- Have Traditional Checking Accounts Become Obsolete?

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Rationale of Fee-Based Packaged Accounts

Providers of packaged account solutions to banks, credit unions, insurance firms, etc., provide a vast array of services intended to increase the perceived value of the account compared to the competition. With the cost of acquiring (and retaining) a new customer increasing every year, the importance of maximizing every market advantage as the consumer shops becomes greater. It is also increasingly important to build loyalty and improve the likelihood of retaining the account and customer. In theory, the benefits of group buying and packaging of of valuable services benefit the consumer, the financial institution and the solution provider.

Having a strong perceived value-based offering is even more important as consumers are increasingly opening (and closing) accounts digitally, without a branch visit. Strategists hope the consumer will think twice about closing a relationship if there are more than a dozen features not available at other financial institutions. The logic is that replacing all of the components contained within a packaged account is both time-consuming and costly.

Finally — and often the strongest bottom line benefit — is the potential for non-interest fee income. For consumer accounts, financial institutions can increase revenues per customer by as much as $60 per account per year. For small business customers, the amount of fee income can be as high as $250 or more.

What Enhancements are Offered?

As mentioned, packaged accounts could be a win-win-win for consumers, the financial institution and the ancillary product solution provider(s). Some financial institutions offer just one variety of enhancement package, while others offer various tiers with incremental services and monthly fee. Below are some examples of what a customer or member may get from a packaged account:

- Buyers protection and extended warranty

- Accidental Death and Dismemberment

- Cellular Telephone/Device Protection

- Identity fraud expense reimbursement coverage

- ID theft recovery kit

- Phone and web resources to safeguard identity

- Debit and credit card registration

- Identity Monitoring

- Automated alerts of key changes to credit reports

- Credit reports

- Travel and entertainment discounts

- Health related discounts and savings

- Cash-back rewards for debit/credit purchases

Normally, financial institutions will send out multiple communications to existing customers and members to convert a basic account into a packaged account. In addition, there will be strong emphasis on up-selling a new customer or member the enhancements as part of the new account opening process as well as during onboarding. This will be done in the branch as well as digitally and through direct channels. Often an incentive is paid for the selling of these packaged accounts.

The Flaws With Cross-Selling Fee-Based Services

In today’s digital world, compared to 10 (or 40) years ago, the consumer can more easily compare offerings from their financial institution and determine if there is a fair value transfer from their financial institution for their business. In fact, many consumers are determining whether all of their business relationships make sense … often and instantaneously. If the perceived value of the relationship does not more than offset the fee, the consumer may go back to a basic account, or worse yet, close their relationship altogether because they feel they were duped.

The challenge for many organizations is that the focus is on selling the packaged account and not reinforcing the value over time. This is a flawed strategy. Just because the “math” works on paper for the bank and the customer doesn’t mean that the customer sees this value the same way.To change this paradigm, organizations need to conduct better training of sales personnel to better position the services from the perspective of the consumer, and to build ongoing reinforcement messaging that will highlight the benefits of the product.

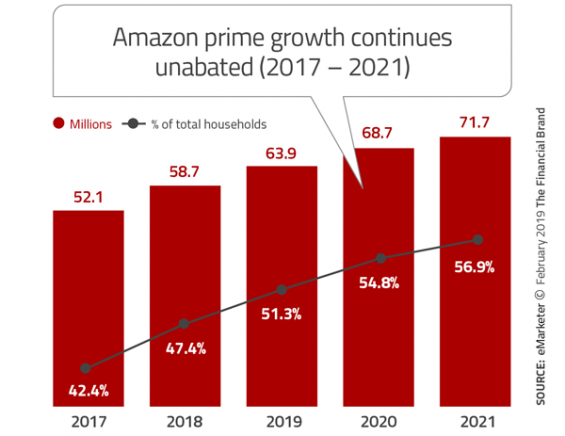

A great example of equitable value exchange is Amazon Prime membership. In 2018, Amazon increased the cost of Amazon Prime membership by close to 20%. Despite the fact that the initial benefit of Amazon Prime (free shipping) was no longer unique in the marketplace, members not only did not close their accounts – membership growth continued.This is because consumers believed they were getting a much higher value from Amazon than the annual membership fee. More importantly, all Amazon Prime members are constantly reminded of the benefits of membership.

Consumers Don’t Want to be Sold Banking Products

So, let’s say you have a packaged account or just want to increase the penetration of any product or service. Your organization has built a competitive offering, created a great digital information tool and website/mobile landing page, conducted basic training, and even done focus groups to validate the perceived value of the service. Unfortunately, nobody is buying the service and the net inflow of incremental accounts has stalled. What’s going wrong?

First of all, your internal and external focus could be on “selling” the service as opposed to positioning the product for the consumer to buy it. This flawed strategy is most likely reinforced in training, outbound communication, targeting of households and even incentive programs. Wells Fargo is a great (terrible) example of what can occur if the focus moves from helping to selling. And, in a digital marketplace, the consumer can quickly and easily determine if the value of what they are receiving exceeds their cost. The most damaging impact may not be the loss of accounts, but the loss of trust.

The flaws of “selling” as opposed to “listening” are made more damaging by the power of digital communications. This is because, as opposed to involving humans or learning from customer engagement, many digital marketing programs still involve “push” selling. This simply speeds up the process of selling as opposed to refining the message. In addition, even with advanced technology, nothing will ever replace genuine human interaction, even if digitally delivered. It’s the key to acquiring and retaining your customers and members.

In other words, don’t use your website, digital communication and mobile banking platforms do your selling for you. Engage with the consumer first using conversational strategies, then determine the right combination of packaged services that will meet their needs.