For the fourth consecutive year Avoka, now part of Temenos, has evaluated the ability for financial institutions to enable new customers to apply for products and services online and with mobile devices. The 2019 State of Digital Sales in Banking report measures the sales readiness of 60 large and mid-size banks in North America, Europe and Australia. There was also a sampling of small and mid-sized banks in the US for the purpose of comparison of capabilities by size of organization.

The research examines institutions’ websites directly, online and with a mobile device, to determine how easily a new customer can open an account. While the full account opening process could not be completed by the researcher, specific components of digital account opening were evaluated, using Avoka’s patent-pending Transaction Effort Score methodology.

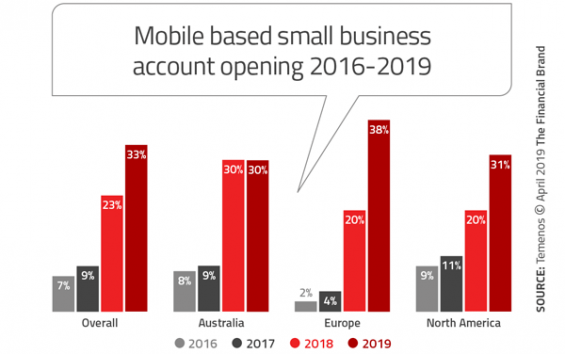

Key findings from the 2019 research:

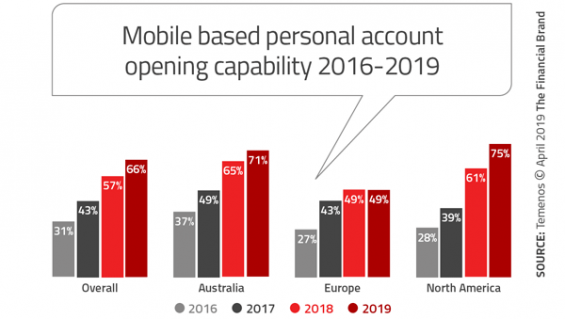

- The largest US banks now lead the world in digital sales adoption for Personal Banking with up to 75% being mobile-enabled.

- There is only a 10% difference between mobile and desktop digital account opening capability at major banking organizations.

- Mobile account opening capabilities for small and large banks are relatively even, with both outranking mid-market organizations ($75B+) by a factor of 5x.

- Globally, digital account opening for personal banking deposit accounts is available at 76% of larger financial institutions.

Read More:

- Half of Largest Banks Have Reached ‘Digital Promised Land’

- Is Your Bank’s Sales Strategy Digital-Ready?

- Three Customer Experience Lessons From Amazon

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Improving Digital Selling within the Customer Journey

Financial institutions globally are looking for ways to improve the overarching customer experience. With more consumers becoming digitally adept, the financial impact of improving digital capabilities throughout the customer journey is greater than ever.

No part of the customer journey is more important than the transition from “shopping” to “purchasing,” often referred to as the “acquisition and onboarding” process. Similar to the retailing industry, complexity and friction at this stage of the customer journey makes the difference between success and failure. And unlike the days when consumers opened accounts in branches, there is no recovery from failing to make the digital purchase process easy and intuitive today.

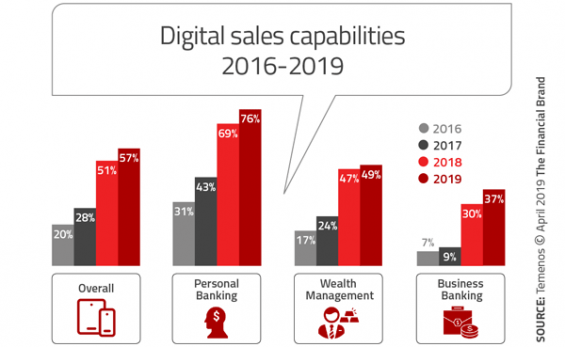

Over the past 12 months, banks worldwide continue to commit significant resources to developing digital account opening and onboarding capabilities. Based on the Temenos research, the most recent results indicate that while the largest banks doubled number of all types of accounts enabled for digital sales from 2017 to 2018, this year’s research saw a significantly more modest improvement. As was the case in 2018, much of this progress can be attributed to the personal banking sector, where 76% of products worldwide can now be applied for digitally.

Mobile Sales Becoming Ubiquitous for Larger Banks

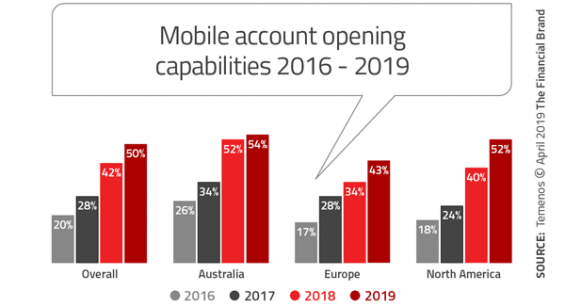

Moving beyond just enabling digital account opening online, there continues to be a strong commitment to mobile account opening with larger financial institutions. To qualify as mobile, an account opening application must be responsive to screen size and convenient to use on a small device, and not require download and installation of a dedicated app.

The Temenos research shows that the “capabilities gap” between mobile and desktop digital account openings over the past two years has been reduced from over 50% in 2017 to only 10% this year. With the largest banks, mobile account openings are quickly becoming the norm for all types of accounts, allowing consumers to not only shop on their mobile device, but also buy on their mobile device as well.

According to the research, “Over two thirds of [personal banking] products worldwide are mobile-enabled, more than double what was measured in the first survey three years ago. The fastest action this year was North America, with another big jump, now ahead of Australia for the first time. Europe was static at under 50% mobile enabled.”

Improving Omnichannel Experiences

As much as many in the financial services industry would love to return to the days of a simple sales funnel, nothing could be further from reality in today’s digital-first world. Similar to making a purchase from Amazon, today’s consumer wants to be able to move from one platform to another seamlessly, without being required to start over.

A consumer wants to be able to start a purchase on a mobile device or online and move to a completely different channel or to finish the process in a branch. If they don’t remember to reengage, they expect to be contacted and assisted the rest of the way if necessary. Most important is the recognition by financial institutions that a large percentage of engagements are not completed in one session.

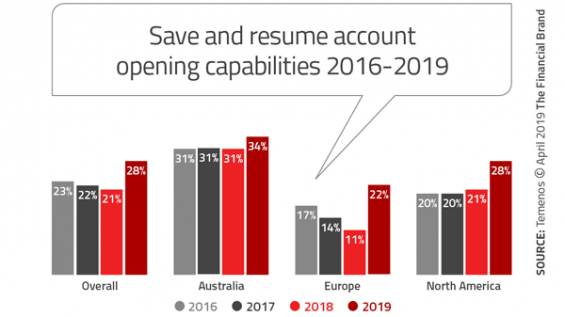

The key to a seamless omnichannel account opening is “Save and Resume” functionality. In other words, the ability to stop a new account opening process and then resume the process later – even if resumed on another channel. This must be possible without requiring the establishment of a full username, password, or download of software.

Unfortunately, while progress has been impressive with basic digital account opening functionality, the ability to seamlessly stop and resume account opening at a later time has lagged. With only 28% of digital account openings having this functionality, the banking industry is not building its applications with a recognition of a multitasking world.

Mid-Market Banks Fall Behind Smaller and Larger Counterparts

Increasingly large banks are using their scale, in addition to financial and human assets, to position themselves as the most progressive digital organizations. Combined with the ability to purchase and deploy the most advanced technologies, this has resulted in significant advantages in acquiring new customers – especially Millennials.

Larger banks ($150B – $2,500B) not only have a financial and technological advantage, they benefit from a head start in the deployment of all digital account opening capabilities, allowing them to gain a share of mind advantage through media and word of mouth. While the digital new account functionality around business banking and wealth management still lag, the largest organizations continue to outperform all other asset classes.

Smaller banks (<$20B), while not having the financial capabilities of the very largest banks, benefit from lower customer expectations combined with less tangible customer experience benefits of friendliness and strong existing loyalties. With less complex product lines, fewer product silos and increasing support from large solution providers, smaller organizations tend to be adequate for digital account opening of personal accounts and stronger for comparable digital opening of small business accounts.

Finally, mid-sized banks ($20B – $150B with an average asset size of $75B) tend to have the worst of both worlds with regard to digital account opening. On one hand, they underperform the largest financial institutions with digital account opening of personal accounts, while also underperforming small banks with digital small business account opening.

According to the study, mid-sized banks “don’t enjoy the simplicity of the small institutions yet they do not have the financial and IT resources of the giant banks, with years of internal development behind them. As a result they are vulnerable from both sides, lacking the personalization of the small and the technology scale of the large banks.”

Many Banks Playing Catch-Up

Digital consumers are setting expectations that few financial institutions appear to be matching. They want to be able to shop for and open all types of new accounts with ease and simplicity. They want the experience to replicate what they receive from the best tech firms, including the ability to move from device to device without starting over. Most never want to visit a branch or to be asked the same question more than once.

Unfortunately, despite positive trends presented in the 2019 State of Digital Sales in Banking report, most institutions are only scratching the surface. Not only is there a tremendous underperformance for all but personal account openings, functionality such as “save and resume” is not available at the majority of financial insitutions. More concerning is the reality that most of the high marks for digital sales continue to be garnered by only the largest organizations.

Derek Corcoran, Chief Experience Officer, Temenos said: “Globally, banks that invested in digital transformation projects three to five years ago are beginning to see the fruits of their labor in the form of improved customer-facing digital capabilities hitting the market. With banks mostly solving only the basic requirements of digital account opening for personal banking, much opportunity still exists for banks to implement advanced retail features, as well as digital sales channels for wealth management and business banking.”