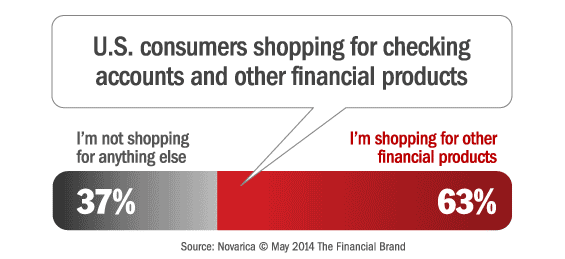

In a recent survey on FindABetterBank, 63% of consumers who are shopping for checking accounts are also shopping for other financial products. Proactively engaging these new relationships through dedicated on-boarding programs is critical to growing wallet share.

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Read More: 5 Secrets to Onboarding Success

Even though shoppers consider branch locations important when they choose a primary financial institution, many will only visit branches very infrequently. That means fewer opportunities to cross-sell. The survey indicates that a majority of people shopping for checking accounts have additional product needs. If your banks or credit union doesn’t have a dedicated on-boarding program, you’re leaving money on the table — new customers represent the greatest opportunities to cross-sell.

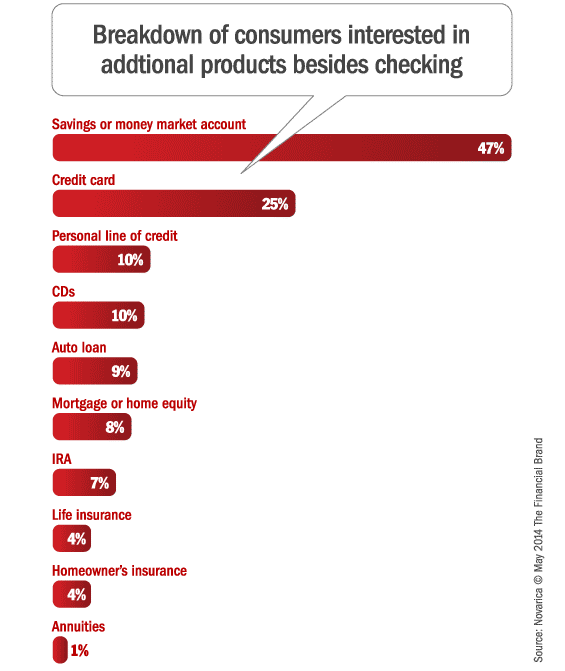

But what should you offer? The research reveals different opportunities exist among certain age and income groups.

Gen-Y consumers are the best cross-sell targets. Data indicates that Gen Y consumers are most likely to be shopping for more than a checking account. Not surprisingly, they are 38% more likely to be shopping for credit cards than older consumers. Young consumers like rewards and are concerned about incurring fees. Credit card products with attractive rewards, easy payments through transfers from checking, and text and email payment reminders will help win-over more of these consumers.

High-balance consumers want more deposit products. Consumers on FindABetterBank who’s lowest daily balances are more than $5,000 are 50% more likely to be shopping for savings or money market accounts and 200% more likely to want to park some money in CDs. On-boarding program that include personal outreach from a branch manager with special offers for these products will help deepen these new relationships.

Shoppers 50 or older are least likely to be looking for additional banking products. The most difficult segment of new customers to cross-sell is people over 50 because they already have established relationships. Our survey found shoppers over 50 were most likely to be shopping for only a checking account.