Consumers still have the same financial needs that they always have — to access credit, pay their bills, plan for retirement — but it is no longer clear that they need to source these services from traditional financial services providers. Consumers, it seems, are increasingly happy to effectively “build their own bank” and cherry-pick the services they want from an array of options, including brand-smart, digitally-savvy new entrants. In the process, they are undermining the value chain that has traditionally defined retail banking models.

A global survey fielded in tandem by Cognizant, Marketforce and Pegasystems shows that financial institutions are desperately working to stay current, but they largely remain adrift in a sea of new innovations and evolving consumer expectations.

The report’s findings reveal that retail banking providers understand their digital journey will be wrought with challenges, risks and opportunities. However, they are deeply concerned about the constraints that legacy systems place on them as they try to plow forward, particularly considering the risk-averse culture that dominates financial institutions.

Unfortunately, many financial executives say they do not expect to achieve key digital milestones for another five years, but by 2020, it may already be too late.

Millennials: The Omnichannel Generation

Financial institutions are scrambling to remain relevant with this critical consumer segment. In fact, 79% of respondents in the study said that their organization would have to “change its operations significantly” in the next five years to keep pace Millennial consumers.

For financial services organizations seeking to emulate the customer-obsessed experiences pioneered by digital leaders like Amazon, this “Millennialization” trend has clear operational implications. Flawless service in all channels will increasingly become table stakes, as consumers continue to fuse their online and physical experiences.

70% of institutions say video chat will largely replace branch appointments within five years.

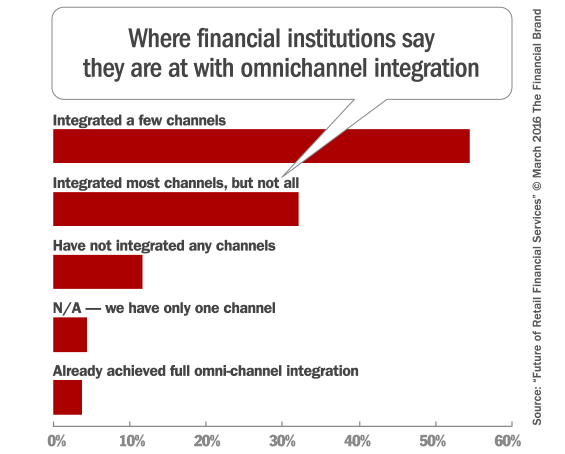

Just under 4% of financial institutions claim they have achieved full omni-channel integration. And while 85% have integrated at least some channels, a startling one in ten say they have yet to integrate any channels at all, leaving their customers exposed to inconvenient and inconsistent service. This is already a source of frustration for customers. Another study found that financial consumers typically have to use two communication channels to resolve service issues, and more than half said they frequently received conflicting information from the different channels.

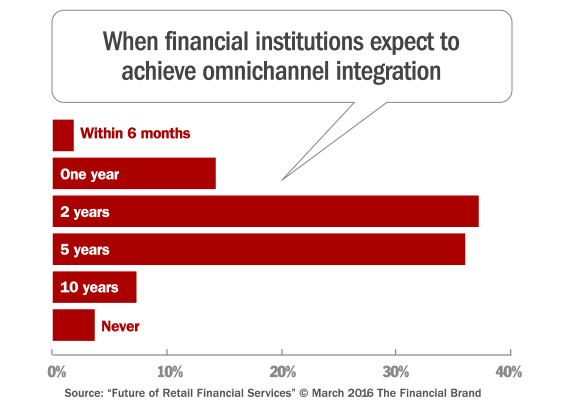

Banking providers realize that this is not sustainable, and the vast majority are now investing heavily to close the gap. More than half (53%) believe they will achieve full omnichannel integration within two years, and 89% will get there within five years.

Somewhat contradicting their confidence in an omnichannel strategy, 64% of financial institutions say they believe a digital-only model is viable.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Data Analytics: The Power of Personalization

Too many organizations still rely on blunt customer segmentation tools — income, age and mailing address. And all too often, financial consumers have to repeat the same information over and over when interacting with their bank or credit union. This doesn’t fly in the Digital Age.

Banks and credit unions must be able to leverage the tide of new data to better understand consumers and deliver a more personalized experience. 93% of financial institutions agree that finding innovative ways to provide value-added services to customers based on data-driven insight will be “crucial to their long-term success.”

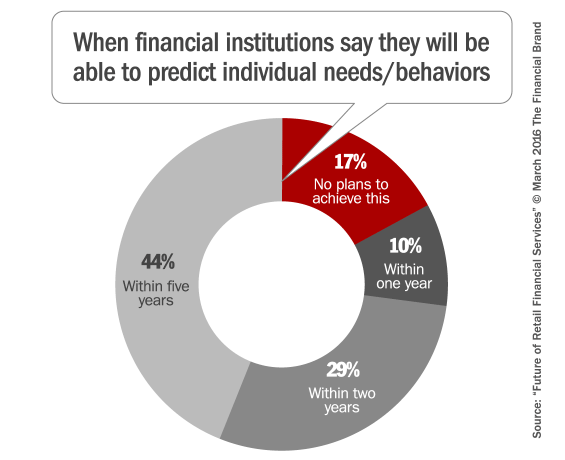

In the future, every aspect of the financial industry can be personalized — from products and services, to marketing messages and the user experience. Three out of four financial institutions say they want to be able to offer this extreme level of personalization, with 83% saying they hope to be able to predict needs and preferences on an individual basis within five years.

The path to personalization will not be an easy one for financial institutions. The top obstacle to personalization was the availability of sufficiently rich customer data, cited by 87% of respondents. A similar number also say they are struggling to find sufficiently powerful analytical tools to crunch the data. And practically no one feels they are ready or able to tackle “big data.”

Legacy systems remain a huge roadblock to personalization. Not only are core systems dated and clunky, the various different third-party modules that have been bolted on over the years further compound the problem; 85% said a lack of single customer view thwarts their efforts to personalize.

“Achieving a holistic view of the customer has long been a challenge for financial services organizations, with customer data held in disparate product and departmental silos, blinkering their view of the customer and creating disjointed customer experiences,” the report points out. “It is clear, however, that with agile digital new entrants snapping at their heels, time is running out for financial services organizations, and resolving the long-running saga of legacy systems must now be a priority.”

The Future of Self-Service

In the future, customer service will increasingly mean self-service. Indeed, back in 2011 Gartner predicted that by the end of this decade, 85% of customer relationships would be managed without human intervention. This year the advisory firm identified self- service as one of the top three CX priorities for organizations26 as consumers increasingly seek out the convenience of DIY.

Millennials are particularly keen on self-service options, making the DIY shift essential if financial institutions hope to win business from this tech-savvy, self-reliant generation. Even Millennials, however, say they prefer the personal touch when it comes to more sophisticated financial products, such as investments.

By offering a self-service route for low value transactions and routine tasks, organizations will then be able to spend more time serving those who still require personal attention, be it to handle more complex issues or to meet an individual’s preference for human interaction.

Customers are increasingly happy to engage with non-human interfaces to resolve their service issues. In the study, 76% said the widespread use of virtual assistants such as Siri on the iPhone means customers are more willing to engage with automated assistance and advice. Almost three-quarters the survey’s respondents believe that in the future customers will interact with a human-like avatar until they reach the point of needing to speak to a real person.

Yet financial services organizations fall far short of offering a fully-automated self-service model — just 38% say they can meet a majority of customer requirements through automation. This means six out of ten organizations are failing to deliver a service that not only keeps customers happy, but also lowers the cost to serve.

Systems must also be readied for the rise of the DIY customer, but again legacy systems create problems for financial institutions. 94% say their legacy systems are the main bottleneck in meeting consumer demands for full self-service.

While full self-service may lie years off for the majority of banking providers, many are already deploying a range of services and tools to help guide customers through online interactions: static help pages (used by 81%), online chat (80%), co-browsing (79%), and avatars (58%).

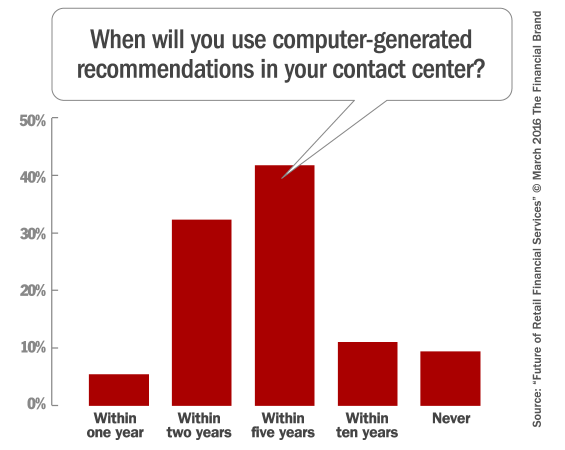

In the meantime, what happens when self-service options (or the lack thereof) don’t cut it? Customers fall back to the safety net of the contact center. Hopefully data analytics and automation can play a role and improve the contact center experience. 85% of financial institution agree that increased use of computer-generated recommendations in contact centers would reduce errors and ultimately improve outcomes.

Despite this compelling business case, research findings show budgets for investments in this area have not yet been unlocked, with just one in five making extensive use of computer- generated recommendations to guide contact center staff.

Internet of Things (IoT) & Wearables

A new hyper-connected world is emerging. A torrent of machine-to-machine communication is generated huge volumes of data from our digitized payments, social media postings and web movements.

In 2016, 5.5 million new things will get connected to the internet every day, with 6.4 billion connected things in use worldwide by the end of the year — that’s up 30% over 2015. And by 2020, there will be 20.8 billion internet-connected things.

Unless they keep pace with the IoT , they will be blind to much of the data their customers are generating as they move through this new hyper-connected world. As data-driven insights power business transformation, from risk prevention to hyper-local personalization, the gap between the ‘data haves’ and ‘have nots’ will widen, marking a clear divide between the winners and losers of the IoT age.

Perhaps that’s why 73% of financial institutions say they expect to integrate wearables into their channel strategy within the next five years. 91% believe it will be common for consumers to make financial transactions using wearables within that same five-year period.

The vast majority (86%) of financial institutions believe that once consumers recognize the data potential of the IoT, they will increasingly seek to benchmark their own behavior against their peers. Coupled with gamification techniques, this type of data-sharing could become both enticing and engaging for consumers.