Todd Harper, chairman of the National Credit Union Administration, recounts a story he heard not so long ago from a federal credit union examiner who came across a very small credit union still charging 1.9% on car loans. At the time the going rate was 4.5% or higher.

Harper, in his retelling, says the lending team had simply grown so used to years of low interest rates that it hadn’t thought to ratchet up with the Federal Reserve hikes. “Look, the market’s moved,” the examiner chided the credit union. “You should be moving with the market.”

The credit union — “a very small institution,” Harper emphasizes again — adjusted accordingly. “We wouldn’t expect to see that type of behavior in a larger one,” he adds. “And we would treat it very differently.”

The story of this apparent aberration underscores the importance to the top credit union regulator of how the entire industry handles interest-rate risk and liquidity risk, as the battle for deposits grows more aggressive. Harper and his two fellow NCUA board members approved a 2023 supervisory priorities letter to credit unions that emphasizes both factors.

One small credit union getting stuck in an interest-rate groove is statistical noise. But NCUA has been training examiners in the challenges that come with the changing macro environment, to avoid bigger issues.

The evolution of the credit union industry is very much on Harper’s mind these days. He has prioritized maintaining consumer protection and retaining a sense of the credit union mission while strongly encouraging innovation in products and technology.

In an interview with The Financial Brand, he discussed how the challenges facing the industry are changing in real time, against the backdrop of an economy that seems to be breaking all the rules.

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Credit Unions Loom a Lot Larger Now

When Harper says, “This is not your father’s or even your grandfather’s credit union system,” he could just as easily be adding the word “my” in front of those references. His grandfather actually started a soap factory’s credit union in the 1930s and his father started a teachers’ credit union in the 1960s.

While traditional credit unions are still common — three out of five credit unions are below $100 million in assets — larger credit unions make up a greater share of the industry now.

For example, the number of credit unions with assets of at least $1 billion more than doubled, to 412, from 2012 to the end of the second quarter of 2022. Those institutions, as a group, hold three out of four deposit dollars contained in the nation’s credit unions.

As of the end of the third quarter of 2022, there were 4,813 federally insured credit unions, versus 6,888 at the same point in 2012.

NCUA has scaled back some rules for the small institutions, but from those with $500 million of assets and up, “we’re expecting more sophistication and greater planning,” says Harper. “They’ve got the scale.”

He says $1 billion of assets is where credit unions typically begin to look more like community banks, rather than specialized lenders.

Consolidations have swollen the ranks of these more sizable credit unions, along with organic growth, some of it spurred by pandemic-era stimulus money.

This growth trend made a policy reversal necessary in early 2022. NCUA readjusted its position on when larger credit unions must switch to being examined by its Office of National Examinations and Supervision (ONES), rather than by regional examiners.

At first the threshold had been set at $10 billion in assets — partly in recognition of the relative risk to the agency’s National Credit Union Share Insurance Fund. However, the growth of institutions moving toward that line became such that it was raised to $15 billion to avoid having to make a major reallocation of NCUA resources to the national examination office to accommodate new “graduates.”

At the same time, more stringent requirements — especially stress testing and capital planning mandates — are still being applied to the credit unions over $10 billion of assets but that will now remain in the regional system. (ONES-examined credit unions across all sizes are also subject to targeted exams, such as reviews of single functions, like information security or lending.)

Auto Loan Trends Getting Extra NCUA Attention

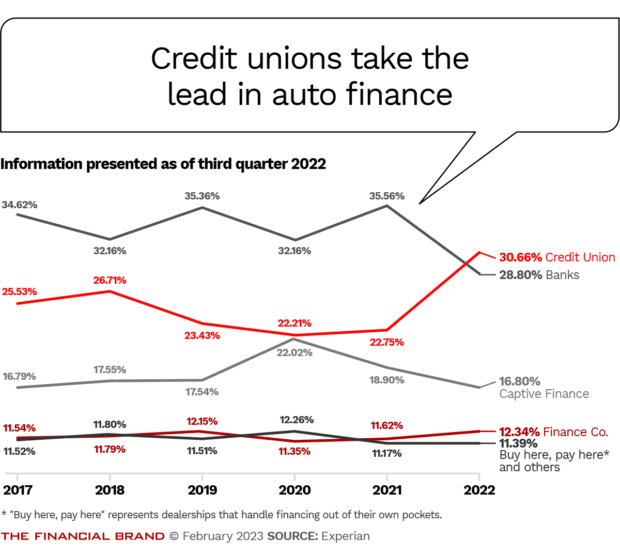

Historically, the bread and butter of credit unions has been auto loans, which represented 32.4% of the industry’s lending in the third quarter of 2022, according to NCUA figures. That’s the quarter when Experian’s market share data, shown in the chart below, had credit unions pulling ahead of banks in loan volume, accounting for nearly 31% of all U.S. auto loans.

Part of what helped that trend were lower rates at credit unions versus banks, in some cases perhaps too low. “I think some credit unions were lagging the market, in terms of adjusting their rates,” says Harper. “I suspect many of them are doing so now. It’s certainly something we’re looking at overall.”

In particular, a trend toward lengthening terms for auto loans is of concern to the agency. Higher prices and longer lives for many vehicles have led to loans as long as seven years across all lenders, not just credit unions. In some cases, trade-ins have come before loans are paid off, which has prompted credit union lenders to roll old financing into loans for the owner’s next vehicle.

“So you are seeing cases where there are more than 100% loan-to-collateral ratios being underwritten,” says Harper. “That’s something I’m watching closely. I’m hoping it is being priced for correctly.”

He adds that NCUA examiners are reviewing pricing “to make sure credit unions don’t get caught in a bind.”

Read More:

- 2023 Forecast: Auto Lending Will Rev Up — But at a Price

- How Auto Lenders Can Help the Growing Ranks of Troubled Borrowers

- 2023 Consumer Loan Trends: High Demand, Rising Delinquencies

Avoiding the Historical ‘Savings Institution Trap’

Something that helped the credit union system through several crises was its former low participation in mortgage lending, but activity in this loan sector has changed significantly. In late 2022, 44% of the industry’s lending was in mortgages and other real-estate credit, and it has been higher in recent years.

“I’m not saying this to cause concern,” Harper explains. “It’s just that in many ways, credit unions have become what the old savings and loans once were.”

This is part of why NCUA has emphasized attention to interest rate risk. Many credit unions hold mortgages on their books, rather than selling them into the secondary mortgage market, says Harper.

“If they’re lending long, for 30 years, they really do need to make sure that they’re managing their interest rate risk appropriately,” says Harper. The agency’s supervisory letter notes that higher interest rates have slowed down some loan prepayments, reducing cashflows back to credit union lenders.

Harper, who’s been involved with credit union issues for about 20 years, is the first NCUA staffer to move up to the board. He spent roughly six years in staff positions such as as director of public and congressional affairs and chief policy advisor to the chairman, before joining the board in 2019. He was designated chairman in 2021.

He also had worked more than a decade on Capitol Hill, including a stint as a legislative staffer for a congressman, prior to the NCUA staff position.

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

How Banks Are Fortifying Their Data Against Increasing Cyber Threats

This webinar from Veeam will detail the value of working together across your organization to be better prepared in cyber defense and response readiness.

Read More about How Banks Are Fortifying Their Data Against Increasing Cyber Threats

How Fintechs Could Be Changing Credit Union Dynamics

Federal regulatory agencies have been paying increasing attention to the interplay between the fintech industry and traditional institutions.

For NCUA, there is an added dimension, Harper says. Fintech is seen as a way to increase access to financial institution services through tech tools. In early 2023 the regulator named its first director of financial technology and access, Charles Vice, to be the board’s advisor on both tech developments and the ways those developments can help the agency improve and increase consumer access.

“We recognize that fintech and access ought to go together in the credit union space,” says Harper. “So we are working to identify what is safe and sound technology and what is consumer financial protection friendly technology.” Harper says part of the agency’s hope is that technology can bring more consumers into credit unions, perhaps in time by setting up mobile phones as digital mini branches.

He says the industry traditionally relied on face-to-face meetings with credit union members to see who could be helped with financial advice. Now he expects data analysis to help pinpoint those whose lives could be improved by specific credit union financial services.

Harper says that compared with banks, many credit unions are not as far along the curve of tech adoption because of their smaller size. “The largest credit unions are certainly marching ahead into this,” he says.

As more credit unions partner with fintechs — most don’t have the size or budget to even consider acquisitions, he notes — agency oversight will become essential.

To some, the emphasis on fintech may seem a bit late to the game. Fintech is hardly a new wrinkle. Are regulators in a period of catch-up or were they simply waiting to see where fintech was going?

“Great question,” says Harper. “I would say it depends on the product or service and that it’s perhaps a little bit of both. Sometimes you may not fully understand the implications of something until it’s been scaled out a little bit.”

Read More: Where Are Bank-Fintech Relationships Headed?

Why NCUA Broached Digital Ledger Technology

There’s also an element of trying to get ahead of the industry’s own curve, according to Harper. In December 2021, for example, NCUA issued a supervisory letter describing its expectations for credit union activity with digital ledger technology.

The document chiefly dealt with credit unions having third-party relationships with providers of digital asset services, such as cryptocurrency. Among the letter’s points were that NCUA was not barring federal credit unions from having such relationships, but making clear that it didn’t want the institutions to function as agencies or brokers of the assets. Expectations for compliance, due diligence and disclosures were set.

Regulators and Fintech:

Chairman Todd Harper explains that there is a balancing act between NCUA setting big picture expectations, to establish the groundwork for the industry, and not interfering with exploration and experimentation.

“Digital ledger technologies could have some real long-term implications,” says Harper. “For example, how are deeds recorded? How are appraisals set and made?” These are all areas that go far beyond any appeal for letting members dabble in crypto.

Harper thinks the broader implications for digital ledger technologies could rival those of the World Wide Web. “Twenty years ago, we didn’t really understand how it was going to affect our financial services daily life,” Harper says.

A key goal for NCUA in the new Congress is to continue to press for authority to examine vendors to the credit union industry. NCUA had such authority at the time of the “Y2K” challenge, but it lapsed.

Increasingly, Harper says, the agency feels the need to be able to examine vendors — “it is mind boggling” that it lacks the authority, he adds. Even if it could draw on banking agency vendor exam reports — which it can’t — this wouldn’t reflect a review oriented to credit union needs. Also lacking is enforcement authority over the industry’s vendors.

“It’s a real blind spot within the system that I worry might be the place where we see vulnerabilities coming forward on the cybersecurity front,” says Harper. It includes companies providing such activities as information technology, loan underwriting, payments and mortgage originations. He knows of cases where vulnerable vendors triggered problems for credit unions.

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Fractional Marketing for Financial Brands

Services that scale with you.

A Challenge: How to Get More Credit Unions Started

“There used to be a time within the credit union system where there was tremendous growth in the numbers and we would be adding several hundred a year,” says Harper. Those days are gone, but even in the face of continuing industry consolidation, Harper says NCUA still sees a handful of new charters each year.

Increasingly they are for serving specialized niches. In 2021, for example, the agency approved the charter of Maun Federal Credit Union, a specialized no-interest institution founded to serve Islamic members. Its services are compliant with Sharia, or Islamic law, which restricts the practice of paying or charging interest. (Maun means “small kindness” in Arabic.)

One of the barriers to starting more new credit unions is the challenge of capital. As nonprofits, they lack the appeal for capital from conventional investors. Harper says the industry needs “philanthropic capital,” such as from charitable foundations.

One accomplishment Harper cites has to do with minority credit unions. (More than 500 credit unions classify themselves as such.) In a change that he says was a long-time coming, NCUA will now compare minority credit unions to each other, as a peer group, rather than using asset-size comparisons.

Harper explains that minority credit unions often have higher expenses and higher delinquencies than other credit unions — “but at the end of the day their chargeoffs are fine.”

In time, Harper would like to work to encourage a fund for minority credit union capital formation, somewhat along the lines of a fund the Federal Deposit Insurance Corp. developed for minority banking. In the meantime, the examination policy shift is a beginning.