The ongoing pandemic has changed Americans’ views on work, finances and quality of life. Many Americans now put mental health and time with friends ahead of things like income and retirement account balances. Whether these views become permanent remains to be seen, but for now they are a significant change that bank and credit union marketers need to take into account.

This isn’t to say, of course, that people don’t care about money. They of course do, but that has changed also. Many are taking a closer look at their bottom line, focusing on budgeting to grow their finances and increase their resilience in a more volatile economic environment.

Banks and credit unions have an opportunity to deepen relationships by ingraining digital tools and financial information into the customer experience, especially for those experiencing financial hardship. That’s the conclusion of KeyBank’s 2022 Financial Mobility Survey.

Work-Life Balance Beats a Big Salary

The survey polled Americans about their financial lives and attitudes and discovered many had reconsidered their work and economic priorities. One notable finding is nearly two-thirds of Americans (62%) now believe that work-life balance is most important compared with 22% who say a high-paying salary is most important.

Many Americans have redefined their financial and personal priorities, placing a greater emphasis on activities that will instill a greater sense of health in both their minds and wallets, Mitch Kime, Head of Consumer Lending and Payments, KeyBank, said in the report.

No Longer 'Show Me the Money':

While financial wellness used to be driven mostly by paychecks and account balances, it is now also guided by mental health considerations and emotional factors.

During the shutdowns of 2020, furloughs and shifts to remote work led many Americans to contemplate their careers. Two in ten have made a career change since the pandemic began, most commonly choosing to retire (22%) or leave their job for a different role (21%). Those who shifted roles were predominantly younger, with the average being 37 years old, according to Prudential research.

Read More: Should Banks Add “Financial Therapists” to Their Wellness Programs?

While many workers seek remote work options, others look to go part-time. The Prudential survey found a third of workers who switched jobs during the pandemic took less pay in exchange for better work-life balance. 20% of those workers said they would take a 10% pay cut if it meant they could work for themselves or have better hours.

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Financial Resilience and Upward Mobility Still Matter

While Americans are shifting their priorities, they haven’t abandoned their financial goals. 46% say the pandemic has altered their financial priorities, and nearly half said it has made them think more about how to grow their finances, according to KeyBank’s data. Additionally, consumers are also taking a greater interest in their mental health, with many equating lifestyle factors to financial resilience.

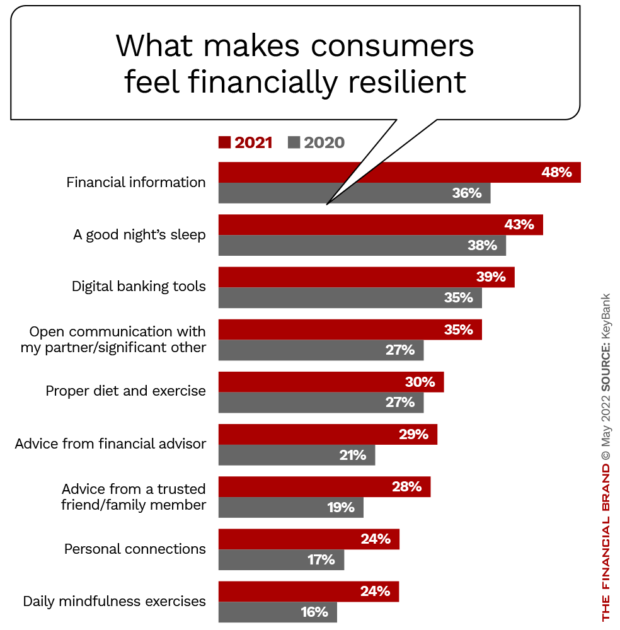

For example, 43% of consumers said in 2021 that a “good night’s” sleep makes them feel more financially resilient. Additionally, 30% noted proper diet and exercise, while 24% noted personal connections or daily mindfulness exercises in helping improve financial resilience.

As economic issues are often tied to other quality of life issues, an upward spiral of health, happiness, good relationships and life satisfaction can also lead to better conditions to promote financial resilience. Meanwhile, financial stress can lead to a downward spiral of issues that impact mental health, physical health, productivity and social engagement.

One-third of Americans say they have faced notable challenges over the past year, and approximately half said living through the pandemic led them to think more about how they can grow their finances. Not surprisingly, Americans earning less generally express less financial savviness and confidence compared to those making more.

But one thing that makes Americans across the board feel more financially resilient is financial information. More than half (53%) say they have become more financially aware due to their challenges in 2021, the KeyBank survey found.

To increase their resilience, about a third (29%) say they identify and prioritize needs versus wants. As they create monthly budgets and revisit them weekly, they say that access to financial information is crucial in making these spending decisions. But still, only a quarter of consumers budget, based on the survey data, so there is a lot of room for growth in this area.

Read More:

- Both Banks & Fintechs Blow It With Financial Wellness… What’s Wrong?

- Go Beyond ROI With ‘Return on Experience’ in Banking

- BofA Crushing It with Financial Wellness App (Here’s Why)

Financial Wellness Should Be Part of Bank CX

The KeyBank findings reinforce an Ernst & Young recommendation that financial wellness should be integrated into banks’ customer experience strategies. EY calls financial wellness “the ability to make confident, well-informed money-related decisions resulting in financial security for both the short and long-term.”

Changing Attitude:

Once (and sometimes still) thought of as a 'feel-good' concept, financial wellness is now being seen differently. Ernst & Young believes it is a long-term driver of revenue.

The consulting firm says financial wellness goes way beyond buying a home, saving for retirement, or paying a bill. It’s about thinking of finance as a utility that is continually available to support overall well-being.

While such financial well-being has typically been considered a personal responsibility, EY strongly believes banks should play a greater role. Through digital tools and connectivity, banks and credit unions can now significantly influence their customers’ financial lives. And those that help customers improve their situation or resilience can be seen as good stewards while also benefitting financially.

“A move like this makes good business sense — increasing customer loyalty at a time when banking customers are switching providers more than ever,” say EY analysts. “For financial institutions, making these customers more secure should prove a long-term source of revenue.”

Read More: Top Five Customer Experience Trends in Banking for 2022

Banks and credit unions can expand customer experience from being essentially good customer service and a good banking app by becoming a partner in new life priorities. Aside from budgeting tools, there are several other ways that financial institutions can help customers improve financial resiliency. One example: automated savings plans and savings products built into loan plans can help consumers grow funds automatically.

There are also strategies to help people pre-commit to healthy financial behaviors, such as when Digit asked users how much of their tax refund they wanted to save before receiving it.