The term “open banking” may soon be supplanted by “open finance,” a broader term encompassing much more than payments. Alternatively, both terms may simply fade into the background. Not because they’re unimportant — quite the opposite.

The ability of banks and credit unions to facilitate quick and secure access to third-party products and services that draw on consumer account and transaction data will not only become a competitive necessity, but potentially a leveler between giant and smaller institutions.

Such a transition, which turns the traditional banking model of a fortress on its head, will take some time to fully play out. However it is already well under way in many respects and many countries. And though it’s common to hear that the United States lags in adoption of open banking, that depends on how you view the situation, observes Kieran Hines, Senior Banking Analyst with Celent, author of a report on open banking and open finance.

Europe, the U.K., India, Hong Kong and Singapore have already implemented regulator-led open banking frameworks. In Europe this was accomplished by PSD2 and in the U.K. by the “Open Banking Implementation” — each taking effect in the 2018-19 timeframe. In both cases experts confidently predicted an explosion of third-party providers (TPPs) taking significant share from traditional institutions, who were required by the regulations to provide access to payment account data to licensed TPPs, when consumers and businesses agree to such access.

There was no explosion, however.

Instead, there has been a great deal of fintech development, particularly in the U.K., but much of that was happening anyway.

The reality is that it’s one thing for a regulation to require APIs to be available, Hines tells The Financial Brand, but it is quite another thing to have all the standards in place and to have the developer and consumer experiences be optimal.

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

As the Celent report points out, it wasn’t that long ago that “the concept of opening up of data and banking services for consumption by third parties was … anathema to an operating model that has always been based upon providing customers with a security-first service offering.”

That’s now changed, driven by growing consumer and small business willingness and eagerness to use fintech-developed financial applications as much as by regulations. It just wasn’t the “binary change” many expected, in Hines’ words.

The U.S. banking market has not taken a regulatory-driven approach to open banking, so far, but followed a market-led path. And far from lagging the rest of the world, the country has seen a great deal of activity that reflects “open banking” even if it isn’t labelled as such.

“Things happen organically in response to demand [in the U.S.] and it’s working very well in many areas,” Hines states. “Certainly this is clear if you look at it through the lens of the number of TPP organizations consuming APIs.” In Europe, there were about 300 TPPs registered under PSD2 at the end of the first quarter of 2020, he states. In the U.S., by contrast, just one aggregator, Plaid, has more than 2,500 organizations registered to use their API.

Pandemic Impact on Open Banking

COVID made the use of digital essential as the primary means of conducting banking business. “The pandemic has made financial institutions realize that the future of the industry is not going to be dependent on in-person interactions,” states Brandon Dewitt, Co-Founder and CTO of digital banking provider MX. “And so financial institutions must have more and faster digital connectivity and more data availability to serve their customers.”

For many institutions that means increased collaboration with fintech providers, many of which may already be accessing the data of a given institution’s customers through screen scraping and other techniques.

Even though Celent’s Hines believes open banking is a long-term development, he does think the pandemic could have an impact on the trend. For one thing it has spurred demand for the kinds of applications that focus on budgeting, savings and financial management to help consumers get through the current economic stress.

For another, the increased focus on digital banking enablement projects could help open banking for two reasons: 1. Making it easy for fintech developers to get on board with the bank’s APIs. 2. Making it easy for customers to sign up for new digital offerings. In the U.K. and Europe there is little standardization in those two processes, he notes.

“If you’re running a third-party application and your customer finds that one or two times in every 20 or 30 attempts things don’t work or the information’s out of date or they’re asked to resubmit their credentials, that drives people away from these services,” Hines observes.

This is a significant issue as banks and credit unions begin to embrace such third-party arrangements.

“The point at which a customer decides to engage with a TPP is a potentially dangerous one for a bank, as a poor experience could lead to a weakening of the overall customer relationship,” the Celent report states. “Justified or not, many customers would see their existing financial service provider as the block to them enjoying the benefits of a new customer friendly TPP product if the sign-up or future use of a service is poor.”

Read More:

- Open Banking Is Key to Relevance in Payments for Traditional Institutions

- Open Banking Fintech Partnerships Required For Better CX

Why Open Banking Benefits Banks and Credit Unions

Financial institutions are adept at risk-management, but why would they want to take on the potential risk of openly allowing third parties to access customer data if the institution may get blamed for any problems?

There are two reasons:

- It’s what consumers, including small and midsize businesses, increasingly want.

- It benefits the institution.

Under open banking consumers must give consent for access to be granted, and Celent states that the way third-party consent is managed presents banks and credit unions with an opportunity to maintain customer loyalty and to build their position of trust.

“The data that financial institutions manage is as important as the money they manage on behalf of consumers.”

— Brandon Dewitt, MX

MX’s Dewitt adds a further insight: “In the kind of mobile and app-based world we’re all growing up in right now, if you’re the institution enabling people to have successful interactions — providing clean connectivity that is supportable and reusable over time with applications like Acorns and Hello Digit — you’ll get higher adoption and you’ll be the one people trust to host and manage that data. Quite frankly the data that financial institutions manage is as important as the money they manage on behalf of consumers.”

Dewitt says fewer than 20 financial institution in the U.S. have set up an open banking portal to facilitate the kind of access he just described. However, Dewitt predicts that in the next 12 months, the total in the U.S. will jump to about 200.

The reason, he tells The Financial Brand, is the “fast-follower” effect. Already seven of the top ten U.S. banks have such API portals and the capability will quickly move down to the scale of the top 200. Beyond that he expects that the entire banking industry will have this capability within several years as Fiserv, FIS and Jack Henry build out these portals for smaller banks and credit unions.

“With many smaller community institutions I’ve spoken with this is certainly on their horizon,” Dewitt states. “I believe that [open banking] is a major part of the future of serving their community as these communities become technically more proficient.”

Relationships More than Profits

“There are different ways to approach open banking,” adds Hines, “and one of them is to position yourself as the trusted gateway for your customers to explore a range of innovative services. The argument there is if you believe that your customers want to consume the services, then you can either help them access those and create positive things from a customer relationship perspective. Or you make it difficult, which risks having the reverse effect.”

“You can either help customers access third-party service and create a positive customer relationship, or you can make it difficult, which risks having the reverse effect.”

— Kieran Hines, Celent

The Celent analyst believes open banking through API portals is already fairly well established on the corporate banking side and he expects the SMB space will emerge faster than retail.

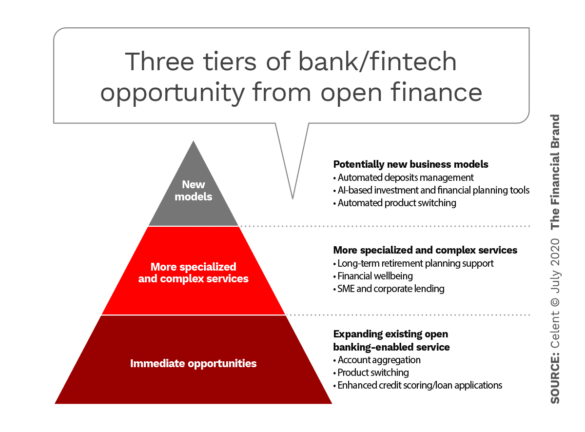

“On the retail side the initial play has been around account aggregation to allow consumers to see their entire financial account positions, which is great, but doesn’t do much for profitability in and of itself,” he explains. As mentioned, however, it helps deepen the customer relationship.

Some financial institutions worry about consumers drifting to other providers, Hines acknowledges. But overall, the Celent analyst believes the upside is stronger.

“The first, and most pertinent message for financial institutions is that open banking is arguably a far greater opportunity for banks than it is for [third party providers] or other market entrants,” Celent states. “Incumbent financial institutions have the products, customer bases, and — most importantly — the trust of these customers.”

Another positive benefit from adoption of open banking, depending on the standards used, is eliminating so-called screen scraping. Virtually everyone agrees that the practice, in which third parties use consumer-supplied passwords and account numbers to get banking information, should go. A number of banks, notably JPMorgan Chase and PNC, have blocked the practice, in the interest of protecting their customer’s data.

“The only reason that [fintechs] screen scrape is because it is the only path for them to get at that data,” Dewitt maintains. “Once you offer a more reliable, more secure and faster path, I think they’ll abandon it overnight.”

Regulation and Standardization

No one’s predicting a PSD2 requirement in the U.S. However, other regulations could come regarding access to and use of data beyond what already exist. Both Dewitt and Hines agree that in the U.S. the formation of various consortia regarding the use of financial data, such as the Financial Data Exchange (FDX) and The Clearing House, have helped promote open banking and forestall the need for implementing regulations. FDX has begun to build consensus among financial institutions and users of bank APIs in regard to data sharing standards, according to Celent.

As a reminder that regulations are never far away in banking, however, on July 24, 2020 the Consumer Financial Protection Bureau announced plans to issue an Advanced Notice of Proposed Rulemaking toward the end of 2020 regarding consumer-authorized access to financial records. According to the bureau, the ANPR will seek input on how emerging market practices may be in conflict with the access rights required by the Dodd-Frank Act; accountability for data errors and consumer control over access, and interaction with the Fair Credit Reporting Act.

Moving in a different direction, FDIC, just a few days prior to CFBP’s announcement, issued a request for input on a public/private standard-setting partnership and a voluntary certification program to promote more efficient adoption of innovative technologies. The initiative aims to “reduce regulatory and operational uncertainty that may prevent financial institutions from … entering into partnerships with technology firms,” the agency stated.