Between $30 trillion and $40 trillion in assets will transfer from Baby Boomers to their children and grandchildren over the course of the next two decades, as CNBC reported. This transfer of wealth has the potential to fundamentally change the way the banking industry conducts business, yet there has been little conversation about the consequences for those community-based financial institutions that fail to prepare for the changing needs of the younger generation.

There is a stark age gap between customers of community banks and credit unions on the one hand and large banks on the other. The ICBA reports that the average age of a community bank customer is 51. And over half of credit union members are now 53 or older, according to Credit Union Journal. In addition, the World Council of Credit Unions noted that 71% of U.S. non-members between the ages of 18-24 are “not at all familiar” or “not very familiar” with credit unions. All this means that the transfer of wealth might be coming on faster than community institutions expect.

Why Robo-Advisors Are a Threat to Community Institutions

To keep these assets during the wealth transfer, banks and credit unions will have to embrace the preferences of the Millennial and Generation Z generations, whose engagement will be key to the long-term success of the institution.

Unfortunately, most wealth management services offered by community financial institutions tend to cater to those with assets of over $250,000, a threshold met by only about one in six Millennials. This is due in part to a reliance on in-person, manual investment counseling. This method leaves community institutions that offer wealth management services with a two percent utilization across all generations, which makes long-term wealth management success unattainable.

To fill this gap in investing needs, robo-advisors began to gain popularity during the past few years. These apps, built by non-bank fintech firms, made it easy for users to invest with a small up-front amount. At first, community banks and credit unions may not have seen these apps as a threat, since they did not infringe on the core services offered by the organization.

“Over time, robo-advisors have proven that a strong user interface and simple-to-use services prove especially attractive and ‘sticky’ to consumers.”

— Mark Allen, Access Softek

Over time, however, robo-advisors have proven that a strong user interface and simple-to-use services prove especially attractive and “sticky” to consumers. Early adopters of fintech robo-advisors will be less likely to move their money out of their robo accounts when they reach the threshold community banks and credit unions typically establish for wealth management services.

Even more threatening, these fintechs are now directly competing with banks and credit unions with traditional banking options. In 2019, for example, Betterment and Wealthfront launched savings and checking accounts for their users. Earlier this year, Wealthfront announced that they were entering the mortgage space, making one more threat to the services community banks and credit unions often see as one of their strongest product lines.

Bring Investing to the Masses with Digital

What the rise of digital has proven in the past decade is that digital tools and automation will be the resources that drive long-term success. The BAI Banking Outlook survey found more than 60% of Millennials and Gen Z consumers would switch their primary financial service organization for better digital banking services.

This generation’s willingness to change financial institutions poses a significant strategic threat to smaller organizations. If they are unable to gain traction among this generation — particularly among those that are children of existing customers — many of the institutions’ assets stand to move elsewhere over the next decade.

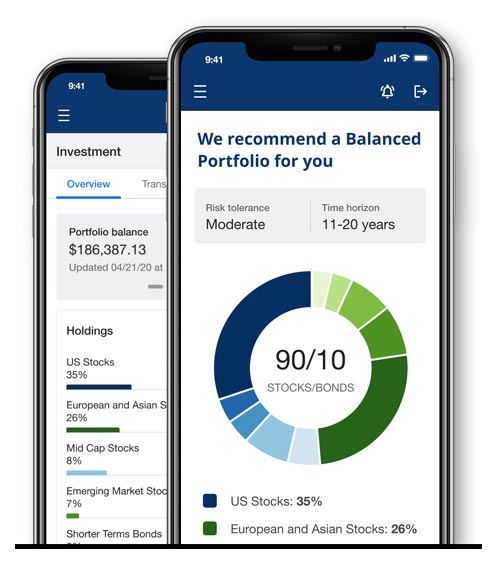

Offering a digital solution for investing directly through the local bank or credit union attracts new customers and has potential to retain Millennial and Gen Z consumers who might be tempted to move their money elsewhere. Keeping these customers’ desire for seamless, easy-to-use, digital tools top-of-mind, the right digital investing tool works alongside the online and mobile banking platform, creating a one-stop shop for their financial needs.

This is also a way to pay-up the community financial institutions’ mission of financial inclusion. A digital tool can help save on any costs to the bank, making it easier to provide investment services at a much lower minimum. This allows every consumer at a community institution, no matter how much or how little they have, to begin growing their wealth.

This also helps community banks and credit unions create a more complete digital experience that rivals that of large banks or other financial institution competitors. Having digital tools at their disposal helps give them a leg up on competition as they usually have better interest rates and can provide a more personal touch to the customer relationship.

Keeping the Wealth Inside the Institution

As assets mature and wealth grows over-time, users will foster the relationship formed through the digital wealth management tool into a relationship with the institution’s financial advisor. Such a long-standing relationship mitigates the customer’s desire to change financial institutions; creating a mutually beneficial relationship in which both the institution and its customers thrive when it comes to wealth management.

Community banks and credit unions are known for their drive to deliver financial services in a personal, relational way to their community. Most aim to serve customers who would be otherwise left out of the traditional wealth management offerings by providing services at rates and thresholds that make them much more feasible for the everyday consumer to attain. For those who want to keep existing wealth inside the institution, digital tool implementation, especially for investments, must be part of their strategy.

When community-based financial institutions provide these tools, they strengthen their chances for long-term success and viability in the future.