In recent months, we’ve seen financial brands turn to social media more than ever before to communicate with customers, shareholders, and employees. The primary driver for this uptick in social media usage was crisis management — providing transparent information, reassuring customers, and addressing recession fears in the wake of an unprecedented crisis.

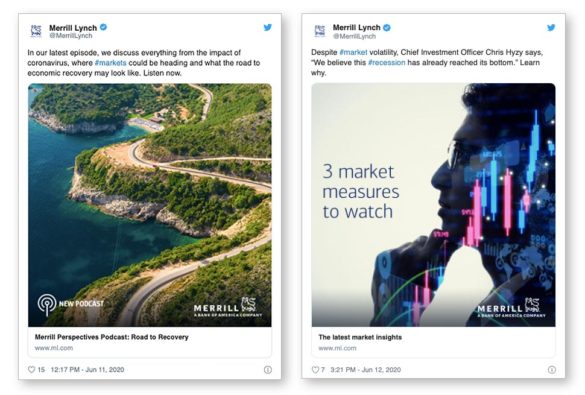

Here are two examples of how Merrill Lynch is reassuring stakeholders on Twitter.

However, as the world adapts to a new normal in the aftermath of COVID-19, this increased demand for digital engagement will continue. As such, forward-looking financial organizations will replace many traditional sales strategies with social selling.

What Is Social Selling?

Social selling is the process of using social media channels to find, connect with, understand, and nurture prospective clients. It’s a much warmer experience than the traditional cold call for both the seller and the prospect.

If your financial advisors are using LinkedIn for prospecting or sales intelligence, you’re already engaged in the basics of social selling — even if you’ve never actually used the term to describe your online activities.

The Social Selling Opportunity

Social selling empowers employees to engage with prospective clients at a much earlier stage in their buying journey. The earlier they engage, the more time and opportunity they have to build rapport and trust — a crucial factor since financial services is still among the least trusted industries, according to Edelman’s 2020 Trust Barometer.

In 78% of financial services organizations, advisors are already using social media to drive sales revenue. Why? Because it works:

- Social sellers outperform peers who don’t use social by 72%.

- Teams that leverage social media see a 21% increase in pipeline velocity.

- There is 33% less churn from customers acquired via social selling.

It’s evident that social selling presents an incredible opportunity for financial institutions. However, without a formal social selling program — including people, process, and technology — it can be a compliance and brand reputation nightmare.

Building a Social Selling Program

Social selling programs are a requirement for modern sales teams. Programs can be as simple or complex as a bank or credit union is comfortable with.

In some organizations, the social selling program is owned by the corporate or digital marketing team; in others, it’s owned by the advisor marketing team or a dedicated social selling team. Some institutions build their own processes and best practices; others bring in professional services organizations to put the foundations in place and train users.

One thing is certain: the choice of technology can mean the difference between widespread adoption or a failed project.

Based on where an institution is at with social media, they could start at any of three stages in a crawl-walk-run roadmap.

Stage 1: Encourage social novices

Stage one focuses solely on sharing curated content. This stage allows more conservative organizations to retain control over the corporate content their employees are sharing. It also helps sales employees become familiar with the technology and gain confidence sharing work-related posts on their personal social channels. As well as providing curated content for employees to share, organizations can provide resources to help novices optimize their LinkedIn profiles so they’re putting their best foot (or face!) forward.

Stage 2: Enable social experts

Once financial institutions are comfortable with their employees’ activity on social media, they may want to encourage more advanced usage. Stage two of the social selling roadmap focuses on more advanced tasks like creating and scheduling audience-specific content and setting up social listening streams to monitor for buying signals.

Stage 3: Activate social superstars

The final stage on the social selling journey for financial institutions is encouraging advisors to become more data-driven in their efforts so they can leverage social media for intelligent lead generation and lead nurturing. By connecting social selling data with CRM data from platforms like Salesforce or Microsoft Dynamics, advisors and program managers can see the tangible impact social media has on their sales numbers.

Keeping the program simple in the beginning and scaling up to an advanced level is the best way to ensure social selling success. This approach helps advisor networks to become comfortable with social selling technology and learn new skills. Advisors can access new functionality whenever they’re ready for it instead of being confronted with a confusing interface from day one. Further, formal programs like this ensure that all content being sent by advisors is checked in real time for compliance and archived securely.

Uniting the Entire Customer Experience

As Forrester analyst Mary Shea put it in a blog, “No one is going to close a deal on Twitter. I would argue that no one actually closes a deal on the golf course, either. But playing 18 holes with a client or prospect can be an important part of the overall relationship strategy, especially when working deals with long cycles. Social is really no different, it just takes less than 4.5 hours.”

Unlike other relationship building tactics, social media is accessible to all clients, from the largest to the smallest. It is also a powerful data-generating technology that, when combined with other tools in an organization’s technology stack, can provide a clearer picture of the customer journey and connect the dots to create a more unified customer experience across marketing, sales, and customer service.

Scalable social selling

Social selling in financial services is not a one-off project. When done right, it is a multi-stage, multi-year journey. So whether you’re starting with social novices, social experts, social superstars, or a blend of all three, you need a platform that can fit your diverse needs now — and scale as you grow.

With more than 18 million customers, Hootsuite is the global leader in social media management, trusted by employees at 80% of the Fortune 1,000 and over 400 finance, insurance, and banking customers worldwide. Plus, it’s the only social media management platform with real-time compliance built in.

Read More: