The COVID-19 pandemic has dramatically changed the way people interact with each other and with brands, online and in person. Understanding consumers’ evolving concerns and needs will be key to standing out as a financial institution that handled the crisis well, both from a marketing and user experience perspective.

I specialize in enterprise Search Engine Optimization for financial services, which gives me access to a wealth of information about how people’s behaviors have been influenced by new anxieties and lifestyles. My SEO analysis has both broad and deep relevance for marketers wondering how COVID-19 has reshaped how people search, spend and live. Some of these trends might only last as long as the pandemic continues, while others could have long-term implications for almost every industry, not just financial services.

CFPB 1033 and Open Banking: Opportunities and Challenges

This webinar will help you understand the challenges and opportunities presented by the rule and develop strategies to capitalize on this evolving landscape.

Read More about CFPB 1033 and Open Banking: Opportunities and Challenges

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

As Search Behavior Evolves, So Must SEO Tactics

The combination of COVID-19 and the subsequent quarantines around the world have led to a global change in search behavior. We’ve seen an 8%-9% decline in search traffic in financial services, within the field of banks and credit unions, due to the coronavirus.

Now, while financial services search traffic overall has declined, there are trends that are on the rise. Searches for products such as refinancing are up, whether for homes, cars or student loans, and even some card issuers have seen an increase in downloading of card apps. What’s really interesting is we’re seeing people with sub-par credit reaching out far more to get a new credit card, while people with above-average credit tend to be looking to reduce debt as much as possible right now.

Consumerism has shifted, as people are looking at an uncertain future and many Americans have lost income. We’ve seen a shift from desire-based purchases to essential purchases. Your SEO content and outreach needs to demonstrate your understanding of these changes, not fight against them.

We’ve seen growth in searches for industries that offer products perceived as healthy, such as milk alternatives (almond milk et al.) compared to cow’s milk, or Beyond Beef® rather than actual beef. Fitness as well as mental health are rising in awareness, but with an obvious search emphasis on things that can be done in isolation. This overall mindset should be driving your brand’s SEO perspective on new content.

On a technical level, SEO marketers also need to consider the May 2020 Core Update, which created volatility throughout Google’s Search Engine Results Pages (SERP). [See here for context on Google core updates.] I’ve been seeing that sites with recently published content related to financial services — both in mid- and upper-funnel stages — have seen a boost in rankings. On the other hand, those that have dated content have subsequently seen a drop on page one of Google searches.

Don’t Stint on Any Marketing Channel

If you’re looking for an answer as to which marketing channel you should prioritize, the short answer is that you shouldn’t.

Whether you reduce your paid spend in favor of organic channels, cut social for SEO or any other variation on that theme, it likely won’t produce the results you want. We’ve seen these tactics fail before, and with social media and content consumption only rising (75% of consumers are now using social media daily), this is not a moment to pull back.

If budgeting is a concern, aim to produce highly relevant content that is designed for social media channels. Social and video engagement has gone up dramatically throughout the pandemic. “Snackable” one- to two-minute videos aren’t just a short-term strategy for the home-bound and bored but something that will likely become a go-to of successful marketing campaigns, as they perform well on social platforms, YouTube and Google.

Across all channels, your calls to action need to be updated. If you’re a bank or credit union that typically pushes users to a local branch or to a sign-up page, for example, you need to be coming up with new ways to connect with people and move forward with leads. And one of those ways needs to be upper-funnel and mid-funnel content that relates to consumer lifestyles.

Content is Being Consumed Faster Than Ever

Content has always been important — but now it’s critical.

Consumers stuck at home have been living on social media feeds, news sources and their favorite websites, and that’s where you need to be if you want to be seen or even considered in the purchase journey. In particular, upper funnel lifestyle content is having an enormous moment, with advice around how to make money or save money doing particularly well. Angles that content could explore are topics like how to budget if you’ve been laid off or furloughed. More optimistically, a financial institution in Florida might run content along the lines of “The Top Ten Ways to Save on a Vacation Rental in Florida.” The key point to remember is that people are searching by certain topics, not for your institution specifically.

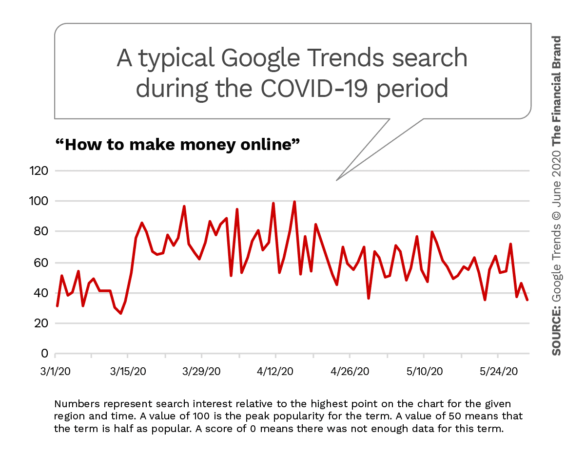

A great resource for sparking ideas is Google Trends, which can give you quick, up to date insight into what people are thinking about, and is both free and more reactive to current events than many paid SEO tools.

Use Google Trends searches as jumping-off points for lifestyle content that relate well to your target audience and which tie strategically back to your products — but don’t make it a hard sell. You want to be genuinely engaging with and providing value for people if you want your content to be relevant and widely shared. This is like “double-dipping,” because shares could potentially mean backlinks in the SEO world.

Do you hear that and think “That sounds like a waste of money” or “That’s not us”? I’ll be blunt: It needs to be you or you’re going to be irrelevant.

My firm has banks and card issuers all creating upper-funnel lifestyle content since COVID-19 arrived when that was hardly on their radar before. At this point, all of our clients are working on this kind of content as a core pillar of their SEO strategy. Brands that ignore lifestyle content will continue to fall behind.

Once you have great content, users need to be able to find it. That means you need to build authority. Getting your PR team to distribute your content is going to be a critical driver of success. Make sure the pages you’re promoting have the proper technical factors, with on-point schema markup so that search engines can easily interpret the content and its purpose and Google AMP, to help speed things up for your mobile users. Working on schema can help your institution’s content wind up in Google’s Answer Box, which is a place consumers tend to home in on.

Authority makes up such a large portion of the Google algorithm. Some even report its share as high as 45%, although no one truly knows. If you don’t put some dollars behind it, you’re doing your content a disservice.

While Google loves to say, “Create great content and you’ll be found,” we all know how many websites create amazing content … and nobody knows they exist. That’s why your content needs to be supported by social, paid campaigns, display campaigns, and, most importantly, digital PR. [Digital PR agencies work to produce high-quality backlinks, social media mentions and improvement in clients’ SEO.]

Read More: Why Organic + Paid Social Is a Powerful Strategy for Financial Marketers

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Anticipate Changes in What Consumers Need, In-Branch and Online

As re-opening begins in different phases around the world, having a well-communicated and well-coordinated plan is going to be vital if you want people to return to your live and virtual storefronts.

For example, considering branches, be upfront and clear about the security protocols you’re taking:

- Can people drive up to your bank or credit union without having to go in it?

- Are you cleaning the cards you handle before returning them to consumers?

- How are tellers maintaining hygiene in branches?

People are already concerned about this, so sharing your awareness and sensitivity will make them feel understood, not afraid.

It’s vital to keep all your online information as current as possible during this constantly changing situation. If your local branch hours have changed, that needs to be updated on your Google My Business page. When a person goes to your branch and it’s closed during your stated business hours, that will lead directly to bad reviews and bad press — I’ve already seen it happen.

Even if you’ve taken every precaution, assume that many people will be reluctant to do in person what can be done just as easily online. More users are banking on their mobile devices — even in the 55-65 age group what we’re seeing is outside of the old norm. You need to prioritize how fast your mobile experience is and how well your app is performing.

And if you don’t have an app, you need to invest in one today.

‘New Normal’ Isn’t Just a Cliché

Many of the trends we see now were already emerging, and COVID-19 has only accelerated them. Taking more industries and interactions online, increasing social media and “snackable” content engagement, and an emphasis on health and wellness are trends you should expect to outlast the virus. The impact of COVID-19 and quarantining on consumer choices can hardly be overstated, and these social changes and evolving consumer needs should be thoughtfully integrated into any competitive marketing strategy.