Among its many effects on financial institutions, the global pandemic made clear that the gradual process of modernizing systems and processes at many financial institutions must accelerate. But to what new standard? Before recalibrating strategic initiatives, banks and credit unions need a better idea of where they stand relative to peers in terms of plans for growth.

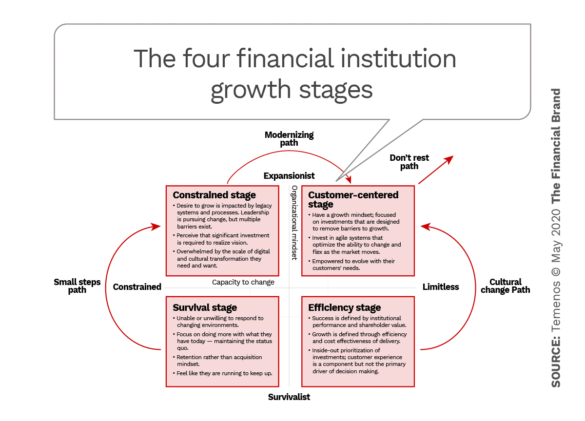

Just before the pandemic ramped up in the U.S., bank technology company Temenos partnered with The Financial Brand to conduct a benchmark survey of banks and credit unions to assess their ability to innovate and grow. Fundamentally this involves two key measurements for each institution: 1. Its organizational mindset (culture of decision making), and 2. its capacity for change. These two factors form the foundation of a growth matrix.

195 banks and credit unions participated in the survey, ranking themselves through a series of questions relating to the two key measures. For “organizational mindset,” the ranking ranged from “We are simply investing to survive” to “We are passionately investing in growth.” For “capacity to change,” the scale ranged from “We are significantly constrained by our culture and infrastructure” to “We have an agile culture and infrastructure that gives us limitless possibilities.”

The answers placed each institution in one of four “growth stages”: Survival, Constrained, Efficiency and Customer-Centered. Each is described in the diagram below. While the optimal path is not linear, there is a progression.

“Ultimately, the most successful financial institutions live in the top right, delivering customer-centered organic growth,” the report states. However, even that is not a static goal. These institutions can’t rest if they wish to remain two steps ahead of the competition.

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

The Bigger the Institution, the More Constrained

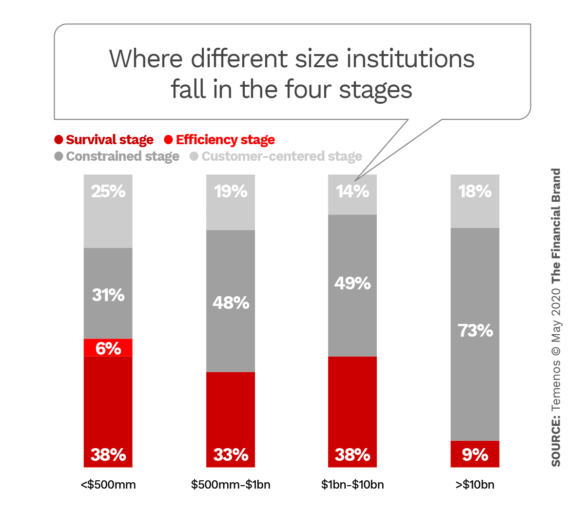

The report contains a template with which financial institutions can benchmark themselves against the study results and to see which of the four stages they fall into. For the sample overall, just over a third (34%) classify themselves in the survival stage, while nearly half (46%) struggle with “constrained growth.” Not quite one in five (19%) consider themselves “customer centered.” A very small number report themselves in the “efficiency stage.” The report concludes that the latter stage is not a viable option for most financial institutions.

The larger the institution, the more likely it is to be constrained by legacy systems and processes. Almost three quarters (74%) of respondents over $10 billion in assets indicate they are constrained. Smaller institutions tend to be in survival mode, although a quarter of the smallest are also customer centered. Concerning this split result, the report notes that some smaller institutions can use their size to advantage by building agile infrastructure and streamlined decision-making. Others, however, are caught in a “risk-averse, traditional decision-making framework that is hard to break out of.”

62% of the respondents were banks and 38% were credit unions. As the report states: “Credit unions are more likely to be in the constrained stage than banks, because they are evolving their cultures and pushing growth, but their ambitions are being hampered by rigid legacy systems. Banks are more likely to be in the survival stage, less likely to have any explicit growth plan, and more likely to be battling both cultural and infrastructural barriers that are preventing them from moving forward at the pace they want.”

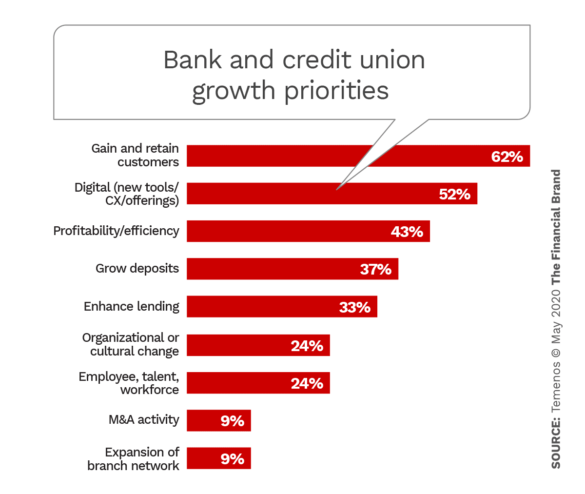

Key Differences in Overall Growth Priorities

Overall, the responding institutions consider such traditional factors as customer acquisition and retention, deposit growth and profitability to be among their top growth priorities. That much is not surprising. Yet the second-highest priority for the group overall, at 52%, is digital enhancements. What makes this even more noteworthy is that this number came before COVID-19 forced so many consumers to conduct banking business digitally, leading to a big uptick in digital banking app downloads and usage. Odds are that digitalization would be an even higher ranked priority now.

Banks and credit unions in the survival stage focus more on growing deposits and less on organizational change and M&A growth than the group overall.

Institutions classifying themselves in the constrained stage are also more focused on deposit growth and less focused on profitability/efficiency than the overall group. They are also somewhat more focused on growth by M&A and branch expansion.

The customer-centered banks and credit unions in the sample are even more strongly focused on growth overall, and on gaining and retaining customers in particular than the group overall. They focus somewhat less on new digital tools by comparison — perhaps because they already are using them — and less on branch expansion.

Read More:

- Cautious Banking Leaders Ambushed By Their Strategic Blindspots

- How to Grow Deposits in a Weird Rate Environment

- Financial Wellness Strategies Crucial to Growth for Banks & Credit Unions

Lack of Investment in Growth Holds Many Back

Temenos probed what areas banks and credit unions were investing in to drive growth. This teased out some additional points of emphasis.

For example, more than four out of five institutions overall (82%) say they are investing in their people, which could encompass compensation, hiring, training and tools to enhance employee capabilities.

Here are some of the other growth-related investment percentages reported:

- Enhancing core systems 67%

- Innovating financial products 64%

- Customer service 64%

- Reinventing branch experience 55%

- Innovative new apps 55%

- Increasing marketing spending 43%

- Increasing branch footprint 33%

- Expanding advisory business(es) 25%

The report notes that banks and credit unions in the survival stage “are significantly less likely to be actively investing in any of the growth drivers.” They recognize that core systems are a significant barrier to growth, but find this a significant investment. The report spells out several things these banks and credit unions can take to move forward. It emphasizes setting a realistic roadmap with easily achievable goals, for example.

Those institutions in the constrained stage identify core system inflexibility as their largest pain point. They can’t quickly fix their infrastructure problems. So they are developing multiple approaches to moving forward. The report urges these institutions to identify features, functions, or experiences where they have flexibility to experiment and to “seek creative workarounds.”

Customer-centered institutions already have the ability to innovate built into their business model, the report states. Yet they also recognize they must continue to improve leadership, customer centricity, customer experiences, and their current systems and processes. Their growth investment puts equal emphasis on developing innovative financial products and ongoing cultural development. Unique among the sample, members of this group are increasing their marketing budget, recognizing that telling their story is a critical part of further success.

The final section of the report profiles two traditional financial institutions that are in various stages of their growth plans. A fintech, not included in the study, is also profiled for comparison. The three are:

- ORNL Federal Credit Union, $2.4 billion in assets. Customer-centered growth stage.

- SpiritBank, $670 million in assets. Survival stage.

- Fintwist, digital payment app and card. Customer-centered growth stage.