In the blink of an eye the working world has embraced Zoom, Microsoft Teams and their ilk to enable working from home. That transition has opened many eyes and will likely have lasting impact on how banking — and business — is conducted as the global pandemic recedes.

Has the banking industry also switched overnight to a world in which digital-only institutions will now dominate? Will the thousands of community and regional banks and thousands of credit unions typically categorized as “traditional” slide quickly into irrelevance?

To explore the importance of being a digital-only institution now compared with having a mix of digital and traditional, the The Financial Brand reached out to the CEOs of three financial institutions:

- TAB Bank, a digital-only bank based in Ogden, Utah, and operating nationally.

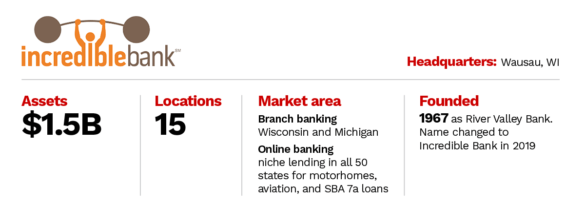

- IncredibleBank, a traditional community bank based in Wausau, Wis., that also has a national online lending business.

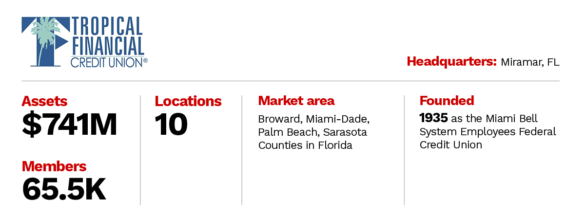

- Tropical Financial Credit Union, based in Miramar (Miami), Fla., serving a four-county area.

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Why Phone and Video Contact Ease Anxiety

One of the more striking observations from all three institutions is that even while use of mobile banking apps has jumped sharply during the pandemic, phone-based contacts, and videoconferencing, also went through the roof.

All three institutions have online and mobile banking capabilities. Yet the ability to also handle non-digital queries has proven to be key to building trust, loyalty and satisfaction during the crisis.

TAB Bank, an online business bank, has no branches. Customer queries are handled mostly by phone or email, says CEO Curt Queyrouze. He says the bank is in the process of standing up a new communications system that will enable it to shift the contacts more to live chat, text and videoconferencing. Already, however, with 95% of the bank’s employees working from home, the possibilities of videoconferencing quickly became apparent.

“Most of my world is videoconferencing right now, all day long,” Queyrouze states. That includes frequent meetings with employees as well as with clients, consultants and tech companies, using the Microsoft Teams and Zoom platforms that incorporate video and data-sharing functions. Queyrouze says it helps greatly for staff to be able to see each other while working safely at home. He believes customers also benefit.

“You can say to a customer who is struggling to use an application, ‘Let me see your screen’,” he explains. “We can work with them through the video connection as if we were sitting right there with them.”

Digital Needs Relationship to Succeed

Wisconsin’s IncredibleBank is both digital and traditional. The community bank set up a national digital bank in 2009, initially as a high-rate deposit funnel. It subsequently moved the unit away from that role into various types of online niche lending. At the same time, IncredibleBank is also a branch-based community bank with 15 locations.

One of the lessons the bank has learned from its digital banking operation is the need for a relationship beyond just a digital connection, according to CEO Todd Nagel. This is accomplished through a live call center the bank operates. Nagel states that when the institution dropped out of the online high-rate deposit market, they didn’t actually lose that many accounts, which he attributes to the relationship established through the call center.

When the COVID-related stay-at-home measures hit full stride, Nagel says, the call center’s phone traffic jumped to 100% above average, with many calls coming from their national deposit customers. By contrast, live chat dropped to zero. People wanted to speak with someone.

“When you answer the phone live, customers’ anxiety drops way down compared with having to leave a message saying, ‘I think I’m in financial trouble'”

— Todd Nagel, IncredibleBank

The bank routed the overflow volume to its branches, where a handful of essential employees still works. So if a call is not answered after two rings, the bank’s phone system routes it to all 15 branch locations. By the third ring somebody usually picks up.

“I’m telling you,” Nagel states emphatically, “when you answer the phone live, customers’ anxiety drops way down compared with having to leave a message or send a text saying, ‘I think I’m in financial trouble. Can you please call me back?'”

Like Queyrouze at TAB Bank, Nagel has also embraced videoconferencing, doing group Zoom meetings with 100 business clients and bank-wide Zoom sessions with his 300 employees, most of whom are working from home.

Half of Tropical Financial Credit Union‘s ten branches don’t have drive-up facilities, and so they were temporarily closed due to the pandemic, according to Richard Helber, CEO. However, he says the branches with drive-ups have not seen much use. Instead, there has been huge spike in call center traffic as well as a large uptick in mobile and online banking use as consumers check to see if their stimulus money came through and manage their bills. The credit union is offering members 90-day interest free loans during the crisis, which generated a lot of calls and inquiries, according to Helber.

Inbound call wait times have grown long. So the credit union prompts people to use inquiry forms on the website, and many do so, Helber states. The institution responds to the web inquiries by email because it doesn’t have a chat function yet. Much can be done on its mobile app, however. But Helber says there is a clear distinction between consumers who are really engaged with online tools and do everything that way and those who’ve never done it before and prefer to call.

Does Digital-Only Have an Edge?

Helber, who has led Tropical Federal for ten years, says branch and ATM traffic has been declining steadily for most of that time, while online, mobile and card transactions keep rising. He expects that to continue, which will bring changes in branch operations (discussed below). Nevertheless, even though some surveys indicate that Gen Z and Millennials are comfortable with online-only institutions, Helber says that surveys the credit union has done of younger consumers in their market indicate that they still like a physical presence. It just doesn’t need to be on every corner.

Much of the appeal of the online-only banks like Ally, Discover, Marcus and CIT is their high-yield savings accounts, notes Helber. These are of great interest to older consumers as well. He feels the online-only advantage is centered more on economics than demographics.

TAB Bank’s Queyrouze counters that while surveys uncover that many consumers say that a branch location nearby is important to them, they often don’t come into the branch for months after opening an account. So there is a disconnect between the survey statements and the reality. Even if they visited once a month, which most don’t, how strong a tie is that building? he asks. “When you can customize the banking service to your customer, I think that’s where the connection comes.”

Circling back to the point about customer support, IncredibleBank’s Nagel maintains that live call capability is the Achilles heel of many digital-only banks. J.D. Power research confirms that contact center experience at direct banks like Ally and Marcus is not their strong point, even before the pandemic hit.

“There’s only so many problems you can solve on a website or in an app,” says Nagel.

That said, he does agree that if a digital-only bank can efficiently handle a high volume of calls, then yes, their technology does give them an edge.

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

How Banks Are Fortifying Their Data Against Increasing Cyber Threats

This webinar from Veeam will detail the value of working together across your organization to be better prepared in cyber defense and response readiness.

Read More about How Banks Are Fortifying Their Data Against Increasing Cyber Threats

What CEOs Think Will Change As a Result of the Pandemic

The economic impact of the pandemic will have major implications for banks and credit unions, whether digitally advanced or not. Yet this economic impact very definitely plays into the question of digital advantage.

Here’s how Helber explains the situation: Like many institutions Tropical Financial has been reducing its physical presence and increasing investment in electronic channels for some time. Helber says the credit union’s management team is now having discussions about whether to accelerate that process. For example, not reopening a closed branch that has a lease coming up. Helber says a key question, is: “How long can we afford to keep serving people?”

“The bigger impact for us will not be charge-offs,” Helber continues. “It will be the interest-rate environment. When the Fed lowered rates from 2.25% down to ten basis points, our revenue was cut. That set the financial industry back about five years.” The downstream of this, Helber states, is that the “capital investments we all have going on in digital transformation — artificial intelligence, chatbots and all the other things that we’ve got to transition to — are put on hold until we see what’s on the other side of this pandemic.”

That position means that institutions that have already made these investments — or, to be fair, made more of them since Tropical Financial and others have been investing right along — will have an advantage. TAB Bank, for example, was able to shift from 10% working at home to 95% in three weeks in early March due to having digitized most of its operations already. Overall, Queyrouze sees much opportunity as the country comes out of the downturn.

IncredibleBank is something of a hybrid, and Nagel is upbeat for its prospects overall. The growth rate of digital banking — already moving higher — will accelerate further because of the pandemic experience, he believes. “People are developing new habits. As they become more comfortable with technology they’re using it more.”

But he doesn’t concede the point on his 15 branches. He expects them to become more about service, less about sales with branch teams becoming digital ambassadors to help people with their technology. Nagel believes branches will become more important in their respective communities as they become much more advice and service oriented. “We have higher-paid, better-skilled professionals who can do more for customers when they come in.”