Bank and credit union marketing executives have likely already felt pressure from the head office over their 2020 budgets. Ad budgets in particular face scrutiny in every downturn and the coronavirus-induced recession everyone is now expecting (and which may already be here) is no exception. Advertising budgets in the 2008 recession resulted in ad spending declines for two straight years, eMarketer states.

The retrenchment is already beginning. A late-March survey of 44 global brands by consulting firm Ebiquity found 80% planning to cut media spending for the rest of 2020, according to Ad Age. Half of the respondents expect to slash ad spending by more than 20%. Online media spending, however, was predicted to decline by only 2%. The bulk of the cuts, according to the survey, would come from out-of-home, print and radio.

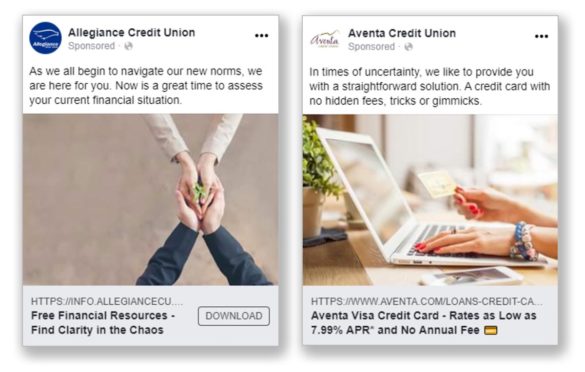

A separate survey by Advertiser Perceptions, finds that 48% of responding advertisers are increasing spending on Facebook and 37% will increase spending on Google, Ad Age notes.

In a worst-case economic scenario, banks and credit unions may have to join in a massive marketing pullback, but that scenario is far from certain, and the industry is entering the post-pandemic period in strong financial position overall.

Still, marketers will have their work cut out for them to even maintain existing ad budgets. A 2019 article in Harvard Business Review provides a good foundational argument for doing so. Based on an analysis of more than 5,000 businesses over the last four business cycles researchers found that 14% of the companies were able to accelerate growth and increase profitability. One key difference was that they invested in growth, not just cost savings.

To build on that general theme, The Financial Brand reached out to three firms that specialize in financial institution marketing strategies: Adrenaline, FI Grow Solutions and Strum.

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Ad Budgets: Cut, Increase, Stay the Course?

A clear consensus on this point is that cutting all advertising is a poor strategy. “While you need to first help your customers get through these difficult months, you can’t lose sight of protecting your brand and readying for the challenge ahead of marketing strategically for growth and health,” says Mark Weber, CEO and Principal at Strum.

“‘Going silent’ risks losing share to non-traditional financial brands … like Rocket Mortgage.”

— Mark Weber, Strum

“‘Going silent’ not only risks losing consumer brand awareness and positive perceptions, Weber adds, but could result in market share lost to other financial brands — including fintechs — that step up visibility to fill the vacuum left by others. “We’re already seeing increased broadcast ads by non-traditional brands like Rocket Mortgage, stepping in to offer help and guidance,” Weber notes.

Adrenaline sums up its recommendation to financial institution clients as: “Shifting, not silence.”

“That means banks and credit unions shouldn’t pull back on marketing communication entirely, but instead shift toward a new allocation of resources reflective of this moment,” explains Juliet D’Ambrosio, Senior Director of Strategy.

At the start of the crisis, FI Grow Solutions paused all digital ads on behalf of its bank and credit union clients as they determined the best path forward, as noted by Founder and CEO Meredith Olmstead in a blog. Subsequently all Google pay-per-click ad campaigns were resumed by the clients, she states, “because if people are in market for a financial products or service, these institutions want to continue to be considered.”

“As long as your marketing efforts aren’t tone-deaf you could make an impact and reach a lot of new potential customers.”

— Meredith Olmstead, FI Grow

In response to questions from The Financial Brand Olmstead observes that, “There are more people online right now than we’ve seen in a long time, and competition has dropped significantly. As long as your efforts aren’t tone-deaf you could make an impact and reach a lot of new potential customers.”

She recommends using your institution’s ads to highlight the good works it’s doing in the community and loan programs for people in financial difficulty.

Read More: Mobile Eclipses TV, Forcing Shift in Digital Ad Choices for Financial Marketers

Which Media Channels Make the Most Sense?

“Channels now are direct-to-couch,” quips Kristin Ronca, Group Account Director at Adrenaline. She points to the major shift into in-home channels like streaming video, TV, digital content, plus audio platforms like Spotify and Pandora as people shelter-at-home. “All of these channels have seen increased ratings,” Ronca states.

“This is not a time for chest-beating, celebrating your brand or making strong competitive claims. This is a time for empathy.”

— Juliet D’Ambrosio, Adrenaline

Different generations consume media differently, adds D’Ambrosio. “TV viewership among Boomers is way up. For Millennials and Gen X, streaming and digital video along with social media are on the rise.”

Social media costs have dropped significantly, Olmstead notes. “We are seeing great engagement and click-through rates across channels like Facebook and Instagram.”

In her blog, Olmstead wrote that in the first part of April she had seen impressions and clicks with ads on social media costing less that half of what they had cost previous to the pandemic. One example she gives is of an auto loan ad that dropped from $1.31 per landing page view before the coronavirus to $0.34. She says the change results from a combination of increased online users and a decrease in competition due to businesses cutting budgets.

Out-of-home ads (billboards and transit) have been hit hardest by the pandemic for obvious reasons, Weber notes. Normally they are a financial institution staple in the spring and summer when people are outside and on the move, he observes.

“Out-of-home contracts can be challenging if not impossible to get out of without major fee penalties,” says Weber. “However several outdoor companies are offering make-goods and extended flights to build back promised impressions.”

What Suggestions Do You Have for Messaging and Tone?

“Credit unions and community banks that are close to their clients, have well-differentiated brand positions and support the heart of their communities are made for a time like this,” states Mark Weber.

To play off that strength, however, they need to pivot to be a lifeline providing solutions to help consumers and businesses manage finances and stay afloat, Weber states. There should be much less focus on products, in other words, unless the product brings immediate relief. Auto loan refinancing is one example.

Regarding overall marketing tone: “We’re in this together” has been an almost universal message during the pandemic. It’s a good theme, all the experts agreed, but if there’s no follow-through with relevant, meaningful action, then it loses its resonance.

“Actions will speak louder than any words you choose,” Olmstead states. “Saying ‘We’re in this together’ is okay, but why not show you’re in this with the community, instead? Highlighting how you are helping people is so important right now.”

“The place to start with messaging is through the lens of empathy,” states Adrenaline’s D’Ambrosio. “An empathy-led approach means looking at this pandemic through the lens of your audiences and their needs. This is not a time for chest-beating, celebrating your brand or making strong competitive advantage claims,” she says. “This is a time to speak to audiences.” Two key questions for the marketing team, D’Ambrosio suggests, are: “What do your audiences believe most about you? What do they need to hear from you now?”

More Tips on Messaging and Tone

Strum CEO Mark Weber offers these additional suggestions to financial marketers:• Avoid cliché or Pollyannaish phrases like “Everything will be fine.” You can’t be in people’s shoes who have lost their jobs and can’t pay rent anymore. You can be the solution.

• Uncertainty and fear will grow as the economy declines. Be simple, direct and clear in your tone of voice.

• Position your messaging in helpful and optimistic ways to help consumers take early, smart actions to cut expenses and build up savings. Financial health and wellness may rise in importance rapidly later in 2020 and beyond.

• There will be a flight to value and simplicity as the recession deepens. Price, rates, fees, quick payments — along with easy-to-use online and mobile solutions — will all matter more than ever.

• Values will only rise in importance during the crisis and its aftermath. Lead with your own values and purpose, but only if they are inspiring and authentic to who you are — not “fluff.”

Read More: Neobanks Pile Into Digital Marketing Channels and TV Advertising

What Should Marketers Be Doing Now to Prepare for the Recovery?

One practical recommendation from Meredith Olmstead is the simple reality that in the coming months of a likely recession “marketers are going to need to prove their worth.” She suggests putting together extra highlights to show senior team members and creating some high-impact reports to show the value of staying the course with marketing during this challenging time.

Otherwise, she warns, your team will have to work twice as hard to get back into a competitive position when things begin to improve.

The folks at Adrenaline, while observing that no one knows what a “recovery” is going to look like after a global economic retraction, nevertheless see some opportunities.

“We’re seeing this as a short-term spectrum of change, leading to a longer-lasting remaking,” states D’Ambrosio. Financial institutions should be clear-eyed that things won’t really go back exactly like they were before, she adds. They can use this enforced pause to “optimize your branch network and reimagine your digital channels, using data as lens for the long-term health of your brand.”

Strum’s Mark Weber picks up on that theme, suggesting it would be wise for banks and credit unions to prepare not just for when the recovery begins but to build an intelligent, data-led marketing strategy for what lies beyond. The booming pre-pandemic years, he maintains, kept most institutions from doing this.

“Now may be a pivotal moment to rethink your marketing priorities, spending and marketing investment measurements,” Weber states. “Analytics solutions can no longer be pushed off years into the future without a huge cost and inherent weakness to your future growth.”