It is clear we are in disruptive times, where there is no marketing playbook. As workers are sent home and businesses close, most consumers are experiencing more stress than they ever imagined. If you are like me, you have also received a lot of communications from every company you are connected with discussing how they are responding to COVID-19.

Unfortunately, most of these communications do very little than state the obvious, and almost none are personalized regarding how the brand will make my life easier. This is especially true in financial services. Augie Ray, a VP analyst for Gartner warns against communication that talks about your values instead of the benefits to the consumer.

Is mentioning that you are striving to keep your employees and customers safe a differentiating virtue? I hope all banks and credit unions are trying to do this. Similarly, does an email telling me that you are trying to continue operations uninterrupted set you apart? I would be very concerned if you were just closing down your organization completely for a month. Here is a portion of an email I received from my bank.

“As we continue to navigate these uncertain times, the safety and well‑being of our customers and employees remains our top priority … Putting the health of our customers and employees first, we strongly recommend that you leverage all of the available tools and resources for self‑service banking and 24/7 account access through our mobile, online and voice banking services.“

The problem with a marketing message that states the obvious and doesn’t go further to assist me with my financial needs during this crisis is that it can do more harm than good. Instead of telling me to conduct my banking digitally (placing the burden on me), why not deliver a highly personalized message about how you will assist me if I don’t know how to make a remote deposit, if I can’t make my mortgage payment or if I need a small business loan?

Providing a general message of ‘support’ as opposed to a personalized communication does not show that you know me, are willing to look out for me or that you will reward me for the relationship I have had for over a decade. Just as frustrating is giving me a general phone number to call. This assumes I know what options are available. Is my situation a ‘hardship’ or simply a question regarding how to do online bill pay?

“Should you encounter hardship as a result of coronavirus, please call us at 1‑888‑xxx-xxxx to discuss your options. We offer an array of hardship relief options for which customers may be eligible depending on their product(s) and needs.“

As email boxes and social media become flooded with messages about COVID-19, how can a bank or credit union stand out from the crowd, or at least show a heightened level of empathy and authenticity? Instead of traditional marketing and sales messages, now is the time to show the consumer you understand their pain. Done right, they will reward you with greater loyalty and word of mouth support in the future.

Read More:

- Coronavirus Forcing Financial Institutions to Revamp Contact Centers

- How Banking Providers Can Help Consumers in the Coronavirus Economy

- Coronavirus Crisis: The Future of Cash, Checks, Credit Cards & Crypto

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Uncharted Territory for Marketing Organizations

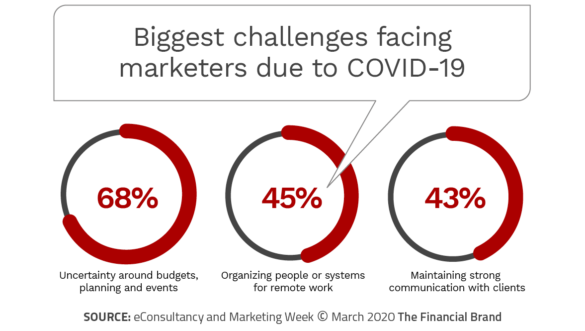

Most marketing departments have never been faced with building a communications program around an international crisis such as a pandemic. In a survey conducted by Marketing Week and Econsultancy, uncertainty around budgets and strategies was cited by 69% of respondents, while adjusting to working remotely was cited by 45%. Finally, 43% stated that maintaining strong communication with customers was a key area of concern.

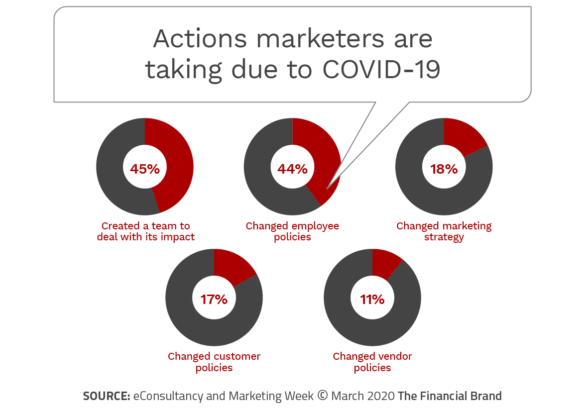

The actions taken by marketing departments change daily, but at the time of the survey, 45% said their company had created a team specifically to deal with the implications and impacts of the outbreak, while 44% changed employee policies in areas such as remote work, travel and bonuses. It was also found that organizations had already changed marketing strategy as well as consumer and vendor policies.

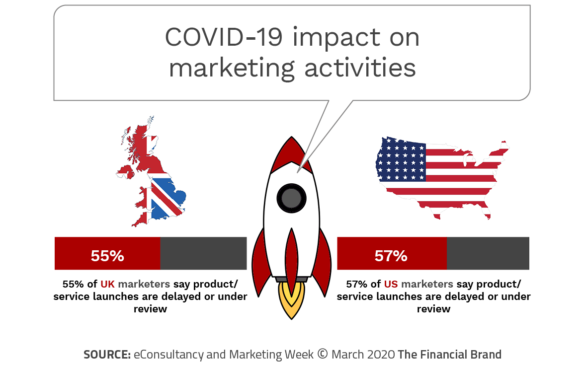

According to the research, “While the outbreak has halted many current or impending campaigns and product launches, the situation is also likely to affect the pipeline of what’s to come. The majority of marketers (62% in the UK and 63% in the US) say that marketing budget commitments are delayed or under review.”

This may not be the best time to scale back marketing efforts, however.

Opportunity for Personalized Solutions

The global pandemic may be a marketing communications opportunity if the message is both helpful and timely. If your communications help consumers deal with the personal economic issues they are experiencing, the message will be welcome. If the communication is specific in nature and provides a way to relieve stress … today … it will stand out from the rest of the communication the consumer is receiving.

The key is to achieve brand-oriented goals with personalized ‘what’s in it for me’ (WIIFM) messaging. This can be achieved with personalized offers or with content that educates the consumer on how to conduct banking better using digital channels. The key is to be able to deliver personalization, at scale, in real time.

“We’re seeing so many banks realizing we need to accelerate the notion of representing a single consumer across the entire bank,” stated Rohit Mahna, SVP and General Manager of Financial Services for Salesforce in an interview with the Banking Transformed podcast. “I’m hoping out of these hurdles and challenges related to this crisis, we’re going to see the industry really accelerate things that we’ve been talking about for a long time.”

This is not an opportunity to simply send a consumer to your website. This should be highly targeted communication with direct links to DIY solution content (preferably delivered via text for higher impact). Avoid any solutions that require the consumer to visit a physical location. By the time the message gets read, that option may be off the table due to local or regional restrictions.

Most importantly, there is an opportunity to provide proactive advice centered on the consumer’s needs rather than the organization’s portfolio needs. “This is the one time when you have to really take a step back and say, ‘this is not about the product, this is about the individual … this is about the household'”, stated Mahna. “This is about understanding what the consumer’s exposure is. How can we help them with that?”

Proceed With Caution

“The global pandemic may or may not be a business opportunity for your company, but treating it as a marketing opportunity risks reputation and relationship damage,” stated Gartner’s Augie Ray.

He recommends that organizations execute a COVID-19-themed marketing campaign only if the communication meets the following criteria:

- You are saying something different than other organizations you compete with.

- You are saying something that goes beyond what they expect your brand to say (not just that you are keeping people safe)

- You can state how your solution solves a consumer pain or challenge in the title and subject line.

- That your solution can solve a consumer pain right now.

To accomplish the above criteria requires speed, agility and scalability. The message must be relevant in the instant it is delivered since the situation around COVID-19 is so fluid.

There’s no playbook around how to communicate with consumers during a pandemic. What may work for one industry or company may not be best for your organization. As a result, it is more important than ever to test, measure, listen, adapt and adjust marketing strategies over time. Done well, your brand will be rewarded with greater loyalty. Done poorly, the result may be irreversible damage to your brand.