The continuing embarrassment of a once-proud banking brand seems to keep on going, ever since September 2016, when regulators first slammed Wells Fargo for a much-recited history of sales sins that included opening accounts for consumers without their knowledge or consent.

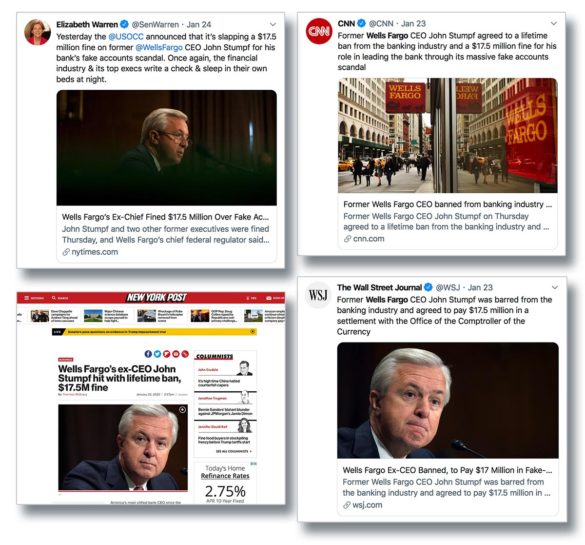

In January 2020 the matter came full-circle, in a sense, when federal regulators announced major legal actions with eight former Wells Fargo leaders who served during the period of the bad practices. This included a settlement with former Chairman and CEO John Stumpf that carried a whopping civil money penalty — $17.5 million — and his personal banishment from further involvement in banking. Under a federal banking “prohibition order” someone can be prohibited from being involved in the affairs of any insured banking organization without prior regulatory approval.

“A lifetime ban on a CEO of a big bank is unprecedented in the megabank era that started in the 1990s,” observed The Wall Street Journal. “When big companies do wrong, it’s rarely the big boss who pays the price,” said The New York Times.

Ongoing Brand Angst Keeps Hitting Former Industry Favorite

Since the sales scandals first broke, Wells’ brand has undergone nearly continual battering. Further revelations of sales fakery, regulatory criticism of controls, imposition of multiple regulatory oversight measures, political pillory at the congressional and even presidential levels, and more, just keeps coming. Such pressures led to the resignation of Tim Sloan, an insider and the first full-time CEO to follow the initial scandal revelations, who had attempted to clear away the past with a new compensation scheme that eliminated the incentive pay arrangement in place when the bad sales practices occurred.

Sloan’s departure led to the appointment late last year of an outside leader, Charlie Scharf, formerly of The Bank of New York Mellon Corp. Broad regulatory investigations of sales practices at the country’s other major national banks followed the initial scandal, effectively putting a spotlight on sales methodologies in the court of public opinion.

Stories of the pressures on frontline employees to make sales by any means were legion. A tweet sent near the time the agency charges came out quoted a section of the federal papers where an employee who served in the 1991 Gulf War said the atmosphere at the bank for employees with sales responsibility was more stressful than he’d seen in his tour.

Read More: Wells Settles Sales Fraud Cases for $3 Billion but It’s Not Over

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

“We made some terrible mistakes and have not effectively addressed our shortcomings,” Scharf said during the bank’s yearend 2019 earnings conference. “… we must have a strong foundation and move with an extreme sense of urgency to remediate our historical issues.”

Days later, the Comptroller of the Currency dropped one of the biggest bombshells yet in the whole affair, announcing the actions against Stumpf, resulting in the settlement mentioned earlier, as well as legal actions against seven other former Wells Fargo officers. Personal liability for actions taken on a bank employer’s behalf isn’t unknown, but regulators pull out the “lifetime ban” on rare occasions and bankers rarely worry that what they do on the job will affect their personal legal affairs.

“The actions announced by the OCC today reinforce the agency’s expectations that management and employees of national banks and federal savings associations provide fair access to financial services, treat customers fairly, and comply with applicable laws and regulations,” stated Comptroller of the Currency Joseph Otting. The Comptroller is a veteran banker himself.

The “sales practice misconduct,” in the terminology of the agency documents, “persisted for at least 14 years, beginning no later than 2002.”

OCC Settles with Two Others, Charges Five More

The agency announced personal cease and desist orders, less stringent than a lifetime ban, as well as civil money penalties, under settlements with Hope Hardison, formerly Wells’ Chief Administrative Office and Director of Corporate H.R., and Michael Loughlin, former Chief Risk Officer.

The regulator also released an official “notice of charges” — subject to a regulatory hearing process unless individuals settle — calling for prohibition orders for Carrie Tolstedt, former head of Wells’ Community Bank, and Claudia Russ Anderson, former Community Bank Group Risk Officer. The community bank group is the Wells retail banking organization. The action also includes cease and desist orders for James Strother, former Chief Counsel, David Julian, former Chief Auditor, and Paul McLinko, former Executive Audit Director. Both the Times and the Journal report that Tolstedt intends to fight the agency charges. The Times quoted Strother’s lawyer saying the charges were false.

The notice of charges also includes civil money penalties on all five bankers in that group. The highest is a $25 million proposed penalty for Tolstedt. That is higher than the settled amount with Stumpf. The agency papers noted that Stumpf had already forfeited approximately $70 million in various types of compensation.

Read More:

- Get Over Wells Fargo Already and Start Cross-Selling Again

- Banking on the Hard Sell: How Cross-Selling Can Kill Your Culture

- There’s a Better Answer Than Sales-Based Incentives

How Not to Run a Financial Institution Sales Program

A key OCC statement from the often-scathing 100-page notice:

“Community Bank management intimidated and badgered employees to meet unattainable sales goals year after year, including by monitoring employees daily or hourly and reporting their sales performance to their managers, subjecting employees to hazing-like abuse, and threatening to terminate and actually terminating employees for failure to meet the goals.”

“A report compiled in 2017 by Wells independent directors, quoted by OCC, determined that the sales goals were ‘untenable,’ ‘unrealistic,’ and ‘unattainable’.”

The weighty, yet often dramatic document could be turned into a manual of how not to run a sales and marketing effort. Literally pages and pages trace what employees and leaders were reported to be saying and thinking as the practices continued. Section headings state things like “The Magnitude of Illegal Activity Over 14 Years was Immense” and “The Controls Were Intentionally Designed to Prevent Detection of the Overwhelming Majority of Sales Practices Misconduct.” Retail bankers and marketers could learn a good deal from reading the document.

Sections dealing with the cited individuals drill down minutely into alleged activities and behaviors, each going on for pages, with some of the material redacted with thick black lines.

Another excerpt: “The Bank tolerated pervasive sales practices misconduct as an acceptable side effect of the Community Bank’s profitable sales model, and declined to implement effective controls to catch systemic misconduct.”

And this: “The Community Bank’s business model and the senior leaders of the Bank presented a stark dilemma to employees every day for 14 years: they could engage in sales practices misconduct — much of which was illegal — to meet their goals, or they could struggle to meet their goals and face adverse consequences, including losing their jobs.”

A report compiled in 2017 by Wells independent directors, quoted by OCC, determined that the sales goals were “untenable,” “unrealistic,” and “unattainable.” One story in the document concerns the wife of a senior Wells official who received two debit cards in the mail — both unrequested.

In a section titled “The Community Bank’s Sales Goals Were Unreasonable,” OCC relates that in 2002 Wells began promoting an internal goal summarized as “Going for Gr-Eight” and “Eight is Great,” meaning selling at least eight products to every consumer served by the bank. An internal analysis in 2008 indicated that maintaining that pace would require increasing sales goals by double digits each year. Sales goals were hiked until 2013, though the independent directors’ report indicates that “they were still set at an unachievable level.”

Costs of a Comeback Still to be Tallied

The OCC document also lists the many expenses the bank has had to incur to deal with the aftermath of the scandals. One with a marketing bent: “In 2018, the Bank launched a marketing campaign called ‘Re-Established,’ to rehabilitate its reputation from the negative effects of sales practices misconduct. The ‘Re-Established’ marketing campaign cost hundreds of millions of dollars.”

Scharf has said that he is reviewing many operations and he had already begun making staff and other changes although he hadn’t been at Wells that long.

“The OCC’s actions are consistent with my belief that we should hold ourselves and individuals accountable. They also are consistent with our belief that significant parts of the operating model of our Community Bank were flawed,” Scharf wrote in a memo to Wells Fargo employees. “At the time of the sales practices issues, the Company did not have in place the appropriate people, structure, processes, controls, or culture to prevent the inappropriate conduct.”