Now more than ever, we are seeing digital transformation at the most progressive institutions moving beyond mobile banking upgrades and modest changes in back office technologies to becoming organization-wide initiatives. With budgets increasing and new advanced technologies being implemented, ownership of the digital transformation process at leading banks and credit unions is moving up the organizational chart, with the more digitally mature institutions having the process led by the the CEO or even the board of directors. We are also seeing greater cross-functional engagement across market-leading institutions.

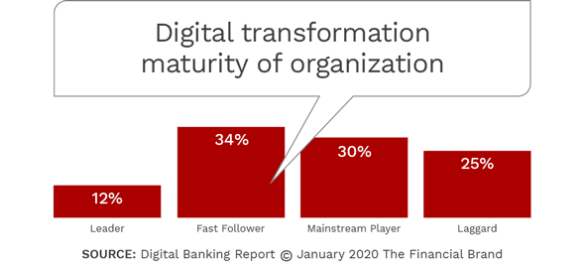

Understanding how leading organizations are managing their digital transformation process is more important than ever to the future competitiveness of banks and credit unions of all sizes. Unfortunately, as we found in the area of innovation, a surprisingly small number of financial institutions (12%) consider themselves to be digital transformation ‘leaders’, with 34% considering themselves to be ‘fast followers’ and 55% stating they were either ‘mainstream players’ or ‘laggards’.

Delivering on the promise of digital transformation requires powerful technology as well as an agile approach to delivery, design thinking and organizational integration. To review the findings in this year’s State of Digital Transformation Digital Banking Report, we interviewed Alan Trefler, Founder and CEO of Pega and the sponsor of this year’s research.

Trefler not only provides insights on where the industry is from a technology perspective, but also discusses the challenges of embracing new business models, finding the right talent, changing internal cultures and creating customer engagement.

Read More:

- Digital Future of Banking Requires New Leadership Model

- Fintech Expert Chris Skinner Reveals Keys to Becoming a True Digital Bank

- What Makes A Great Digital Banking Transformation Leader?

Fractional Marketing for Financial Brands

Services that scale with you.

How Banks Are Fortifying Their Data Against Increasing Cyber Threats

This webinar from Veeam will detail the value of working together across your organization to be better prepared in cyber defense and response readiness.

Read More about How Banks Are Fortifying Their Data Against Increasing Cyber Threats

What trends do you see regarding digital transformation in banking?

Trefler: While there is progress in the banking industry, chaos still reigns quite broadly. You have banks who have learned that they’re not going to be overrun by fintech firms because many of them have strong reputations and relationships, but they still know that there are huge risks out there.

Trefler: While there is progress in the banking industry, chaos still reigns quite broadly. You have banks who have learned that they’re not going to be overrun by fintech firms because many of them have strong reputations and relationships, but they still know that there are huge risks out there.

Frankly, I think many are struggling trying to figure out what their mission should be. Should their mission be to emulate the fintech firms? Should their mission be to try to create more platform-oriented solutions that will enable them to engage more broadly with their customers? How do threats and opportunities like open banking apply to the banks?

I think that there’s a lot of wrestling in financial services that tie to all of these points.

Does it surprise you that, for the most part, only the biggest and smallest organizations seem prepared for digital transformation?

Trefler: I actually think the problem rises all the way to the largest organizations. While they may be doing a variety of things, a lot of them are struggling to actually get the outcomes they desire. One of the things that we’ve observed is that banks, even very large banks, are making several really well-intentioned but disastrous mistakes.

As an example, while all the banks talk about organizing around clients or customers, they accidentally ignore that by organizing around channels. They’ve got a group that’s responsible for the web channel, and they got the mobile group, and then they got the group worrying about the contact center and the person trying to put up messages on the ATM. Unfortunately, when you want to be able to offer a customer an experience that can begin in one channel, pause and then move to another channel … you are out of luck.

Does the challenge go beyond seamless multichannel integration?

Trefler: Another area where people aren’t thinking end to end has to do with product silos. What they’re thinking of is just department to department or function to function. This sort of siloed mentality is extremely dangerous for businesses, especially in a digital ecosystem where consumers expect their entire relationship to be accessible in a seamless manner.

Finally, everyone says that they want to achieve automation and they want to be able to digitize to be able to drive the costs and increase speed. But, so much of what’s going on these days is just task automation. It’s not organized around outcomes at all.

For true digital transformation, organizations must put logic into channel delivery, think about outcomes as opposed to just automating tasks and understand that product silos will kill you. These are the traps that are undermining and creating chaos in organizations.

From the consumer perspective, we’re just not treating our customers in a coherent fashion. Which is why there needs to be a completely different way of looking at this.

Does it concern you that so few organizations consider themselves to be digital transformation leaders?

Trefler: One of the advantages of not being a pioneer is that you get to learn from what you see other people doing. But we see lots of organizations that have almost fostered an intentional blindness and are not thinking holistically about what other organizations are doing. Some are just trying to add quick and dirty solutions.

Many times organizations look at other organizations and say, “Hey, I’m a fast follower. What are the leaders doing?” Then, they don’t actually validate that those early adopters are getting the benefits desired. And as a result, they’re not really learning from those organizations. Many of them are just repeating the same mistakes.

Read More:

- Becoming a ‘Digital Bank’ Requires More Than Technology

- How Bank of America and Chase Get Mobile Account Opening Right

Shouldn’t financial institutions transform their organizations based on their own objectives?

Trefler: Being able to have a defined and achievable strategy is one of those things that mid-sized organizations should be able to be really good at because the problems are often simpler than their larger peers. But, if you’re a mid-size institution thinking that you want to create a little innovation hub in Silicon Valley, you need to realize that nearly all of these haven’t paid off for the big players who have done it.

Also, if you want to follow one of the players who just operates on mobile, but your value proposition is that you have real people, then you’ve thrown away your advantage. You need to put what you’re choosing to do as a follower into a context that makes sense for you, not just one of the brand names.

Can institutions achieve cost containment and still serve the customer well?

Trefler: Cost containment is both achievable and a reasonable goal to go after while you’re doing digital transformation. If you do it right, cost containment and a coherent client experience can march along together. But, if you just go after cost containment, you can make some of those mistakes of locking yourselves into more silos.

It goes back to being able to have a strategy … have a picture in your mind of how your organization wants to evolve over time.

As part of digital transformation, what role should branches play?

Trefler: As I mentioned earlier, strategies differ from bank to bank. For instance Chase (one of our clients) has actually adopted an active branch strategy because they recognize that you can contain the costs with a lot of automation and with branches designed differently.

Alternatively, look at Amazon opening stores. The idea that you want to be a purely digital organization can make sense for a brand new startup. But, if you’re an organization that is looking to retain a reputation and retain a customer segment, then I believe you need a mix of channels to be able to engage the consumer in the way they want to be engaged. Otherwise, you’ll just be driven out of business by the people who will probably do the tech stuff more effectively than you.

How do the different delivery channels need to be integrated?

Trefler: It’s more important than just having the channels talk to each other. They must be designed so that the logic and the processes don’t get buried in any of the individual channels. Otherwise the world gets ossified and too complex.

We talk about thinking from the middle out … from being able to have a customer engagement engine – like we have built for Commonwealth Bank of Australia – that’s going to drive consistent, coherent personal engagement across all the channels. This must be tied to a workflow engine that knows how to deal with the different backends that exist – which the bank may not even own in the future.

In a world of open banking, that backend may be somebody else’s loyalty product, somebody else’s credit instrument, etc. You’re just bringing it together and presenting it as a bundle to the consumer.

Thinking from the middle – from the heart of your business out – gives you a completely different perspective than trying to think from the channel in. We’ve seen organizations that are really starting to have meaningful impact. By my understanding, it’s the way they draw the picture that makes a difference.

Is this similar to Amazon, where they have stores to buy products and others to make returns?

Trefler: You see evidence in other industries as well. For example, a tremendous amount of telephones are sold through third-party channels that aren’t the brick and mortar corporate stores. What is critical is that across all these channels there is a coherent client engagement engine aligned around the way the client is engaged, your knowledge about the customer and what you tell the customer. It needs to be sensible and needs to be real time. That’s what we see as the difference, frankly, regardless of industry.

Is it a concern that the research found such a low use of data and AI on behalf of the consumer?

Trefler: We have an AI customer engagement platform that’s used by one of the top three banks in the U.S. that is uses data and AI to make personalization happen for its clients. To do that, you’re not just thinking about AI in a theoretical sense – like how do I find patterns in the data? Instead, firms need to think about how they deliver that AI to the desktop, to the call center, to the ATM. How do they deliver that AI in an omnichannel way that is coherent, where if a customer has an experience in one channel, the bank knows about it and can influence what happens in the next channel.

That is true AI in practice. Unfortunately, so much of what we see going on is kind of AI and BS.

So is there a ‘personalization gap’ around AI?

Trefler: There’s a big difference between being able to theorize and being able to operationalize. I think that’s a gap that AI has fallen into and we’re seeing some customers come through the other end of it and boy, are they getting amazing returns.

For instance, at Pega, we try to make real time AI consumable and enable the insights to plug into actual business solutions. We understand, for example, what the key elements are that make somebody decide whether they need a new credit card or how they should divide their credit portfolio, and then how to bring that to the customer in real time.

If the offer doesn’t work, how do you learn from that and stop annoying the customer with the same offer they don’t want. Those are what I would describe as the linkage between the highly theoretical AI and the highly operational AI.

How will digital transformation impact jobs?

Trefler: I think that the opportunity here is to actually uplift and improve the technology that is now central to pretty much every job that exists in a financial services institution. For example, when you look at some of the problems that banks have had around opening accounts, a lot of this is because the banks have rules and processes and roles that are not connected to a technical background.

There’s a great opportunity to create tooling that makes it easier for people to change jobs and to do new processes and engage with their customers, but also puts the guardrails around that. The idea is not to digitally transform little transactions, but digitally transform the actual end to end customer experience … the microjourney that organizations do with their clients all the time.

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

How do we need to change the culture around digital transformation?

Trefler: I think there are two parts. One is what’s called design thinking concepts. The whole way that you think about using and deploying the technology. We’re actually building that into the technology itself. The technology guides you and walks you through the workflows that you need as an implementer to help make sure that you are hitting your business objectives.

The other part is around technology. While culture is important, we have a bunch of companies out there now that are just amalgams of dozens or more different legacy systems glued together. It’s a collection of technical debt in a mess. The technology must be built that supports the digital transformation goals of the company.

How important is speed and flexibility?

Trefler: I think agility is critical. The reality is it’s almost impossible to get things perfect the first time. And the whole culture of becoming more agile has to be based on the thought that we should be quick to deploy what we call a ‘minimum lovable product’. The changes must also be easy and reliable and safe to extend and evolve. That’s what we call a ‘build for change’ vision, that we think will differentiate the future winners from the losers.

What’s been the biggest change that you’ve seen in the marketplace during your tenure?

Trefler: The biggest change I’ve seen is one that’s really come on over the last five years, which is the movement of Pega as a company from being a software company to become a service company … where what we’re delivering is outcomes. And doing that whether they’re running on Pega Cloud or whether they choose to run it on their own cloud.

We also see the market increasingly expect an ‘as a service’ treatment. For instance, an organization just pays a monthly fee and they’ve bought ‘mobility as a service’ that includes lots of financial services products in it. That transition is going to be what makes it super important for organizations to think in that ‘middle out’ fashion that I was talking about.

It’s in the middle that you’ll hit the different channels with amalgams of offerings, some of which have come from your company and some of which don’t. And boy, that’s going to upend a lot of these businesses like auto lending for example, and a whole variety of other offerings.

Solution providers are reaching beyond their traditional boundaries to create guidance and provide insight and provide partnership like we do with our customers. And frankly, financial institutions need to be able to do this with theirs as well.