Given that one in four people worldwide is a Millennial, there have to be some variations in outlook and circumstance among this immense slice of humanity. Even though much has been said about how stressed-out Millennials are over their finances — high debt loads, rising costs, stagnant wages — some Millennials make pretty good money.

Research and consulting firm Spectrem Group probed the views of the high-income end of the Millennial cohort to see if making at least $100,000 ($150,000 if married or partnered) made a difference in their views on money, wealth, success and financial services.

A healthy paycheck does make a difference. Yet it doesn’t remove all the financial angst this generation experiences. It just shifts the focus.

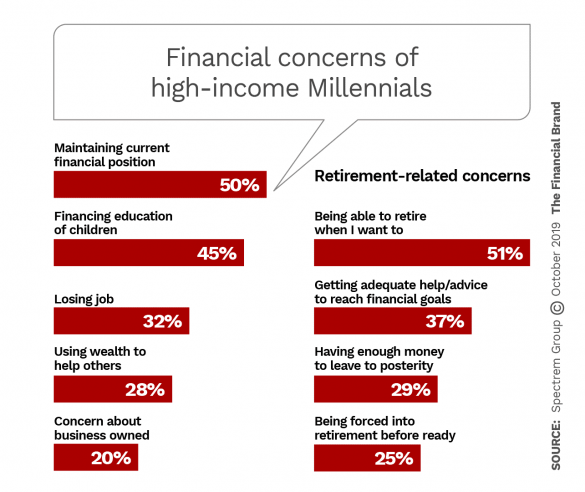

One difference: High-income Millennials aren’t fretting about making ends meet day-to-day, the way half of the overall generation is, according to a Credit Karma survey. However, half of the wealthy Millennials polled do worry about maintaining their current financial position and being able to retire when they would like to.

How to Help With Millennials’ Top Money Concerns

In some ways, the Spectrem survey results show that well-off Millennials don’t differ all that much from earlier generations. They worry about retirement, about being able to afford sending their kids to college, and even leaving money to others.

While there is not much any bank or credit union can do to assure that Millennials keep their jobs, they can definitely offer advice and solutions regarding ways to finance a child’s education. Some of that may happen in a branch, but a financial institution must be able to provide the kind of intuitive digital budgeting and planning tools that Millennials (and younger consumers coming after them) expect. In that way banks and credit unions can help to address Millennials’ worries about both “current financial position” and “being able to retire when I want to.”

Takeaway No. 1: Higher-income Millennials are already confronting issues of much greater financial complexity than many of them are prepared for. Traditional financial institutions have an opportunity to help them out through education and the kind of tools that Millennials will expect. But it’s not an open-ended invitation. Dozens of nonbank competitors are already well entrenched, with more arriving all the time.

Read More:

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

‘Give Us Financial Management Tools’

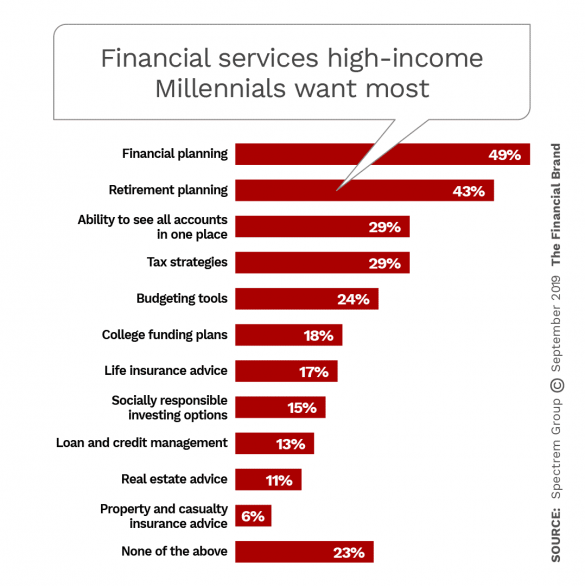

When Spectrem asked what services they look for from financial providers, higher-income Millennials presented a long list, some of them relating more to wealth management than traditional retail banking. Yet the choices are a clear indication of what this particular segment of consumers wants help with, and what they want to see from their financial institution — or, frankly, from whomever steps in to fill the need in a way that satisfies them.

Two planning needs top the “wants” list: — financial planning and retirement planning. Many financial institutions are convinced that by turning their branches into “centers of advice” that they will not only extend the useful life of their branch network, but meet the needs of younger generations who need help and are not averse to in-person experiences. Whether that requires a “cafe branch” experience is an open question. But most observers agree on this: The interaction has to be personalized and informed by data. And judging by even just the results of this one survey, many Millennial consumers will prefer to handle things themselves.

The desire of high-income Millennial consumers to be able to see all accounts in one place and for “budgeting tools” emphasizes that while this generation’s needs are not all that different from others, its expectations for how those needs will be met are different. And those expectations are shaped every day by the experiences that consumers have with large and small digital innovators that have come to dominate consumer interactions, particularly with younger consumers.

“Personalization and efficiency are two characteristics that drive Millennial consumption and loyalty,” notes Good Life Consulting in a white paper. “Banks carry a stigma of being complicated. Millennials are accustomed to streamlined online experiences where pre-filled portals, artificial intelligence, and customized journeys make their online experiences effortless.”

Takeaway No. 2: If an institution is still thinking about becoming a mobile-first institution, Millennials — high-income or average-income — won’t wait. This is the generation that jumped on the Venmo person-to-person mobile payment app when it first came out, and signed up for Chime, Aspiration and other fintech-powered neobanks and financial solutions. If banks and credit unions want to be the place that Millennials choose to help them address their concerns and build financial stability, they must be able to provide personalized products and services, powered by data, in person and digitally.

Read More:

- How Community Banks Can Compete In The Digital Age

- Millennials, Gen X and Even Boomers Will Ditch Banks for Amazon

[leadgen[

Adjust Your Marketing to Millennials’ Preferences

Not only should the overall banking experience become personalized, bank and credit union marketing needs to follow suit to be effective with high-income Millennials.

“Sending millennials marketing material targeting to previous generations is not only wasteful, but could also support the belief that banks are out of touch with the expectations of the millennial population,” Good Life Consulting states.

The Spectrem Group research makes a strong case for personalization in financial product design, experience and marketing. Its findings point to the fact that the high-income portion of Millennials has unique characteristics from the typical overarching generalizations of the huge group.