Online-only banks, avoiding the costs of branch networks, have paid up for deposits for years. But research from BAI indicates that this is not the only draw for consumers.

On the flip side, part of why many traditional banks and credit unions have kept their status as primary financial institutions is that old standby — branches.

“Legacy players must reevaluate their approaches to consumers and their competitive stance vis-à-vis direct banks or cede ground to this growing cadre.”

This competitive balance will shift, however, as Millennials continue to be the central focus for financial marketers, and Generation Z increasingly becomes a market force to be reckoned with.

The research also tweaks the meaning of being a primary financial institution. Traditionally, it’s the account relationship the consumer uses to run a good deal of their financial lives, and typically where payroll gets direct deposited, and more. By implication, the primary financial institution also took the lion’s share of a given household’s deposits. But that may be changing, according to BAI’s findings.

The survey made it clear that legacy players must reevaluate their approaches to consumers and their competitive stance vis-à-vis direct banks or cede ground to this growing cadre of rivals.

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Why Consumers Choose a Direct Bank

Something underscored by BAI’s research is that the consumer increasingly picks and chooses among many institutions’ offerings, going for the “best of breed,” in the words of Mark Riddle, Director, Research and Content Delivery. Bank and credit union marketers and strategists can talk about relationship banking and some still think in terms of cross-selling, but consumers have the opportunity to be better informed shoppers than ever, thanks to the web.

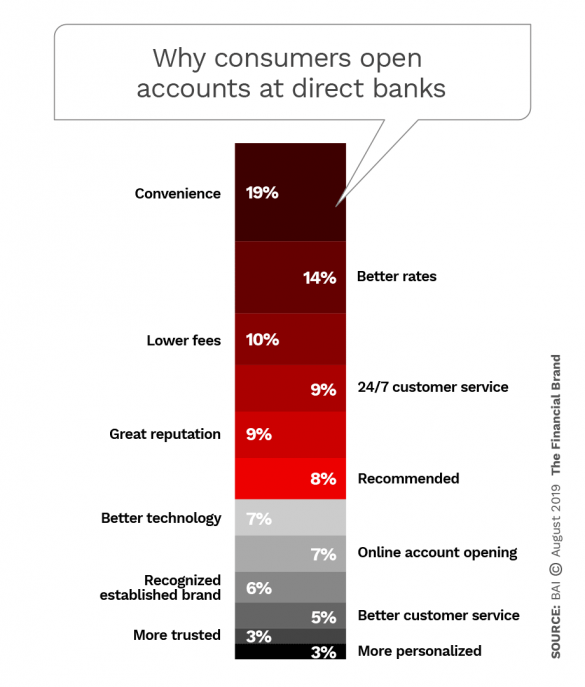

As a result, “overall, the reasons that consumers open accounts at direct banks are very fragmented,” says Riddle. “We found a lot of reasons, with no one reason being super dominant.”

The survey sample consisted of consumers who had opened deposit accounts of any kind with a direct bank. One of the surprises was that consumers, asked why they had done so, ranked convenience, not rate, as the top reason. Convenience beat rate by five percentage points over the entire sample, as shown in the chart below.

Riddle says this variety of reasons for picking direct banks poses a marketing challenge. “Because there’s no single, dominant reason to drive them to open accounts at direct banks,” says Riddle, marketers can’t concentrate on any one factor. It’s like having an archery target with six bullseyes and three arrows.

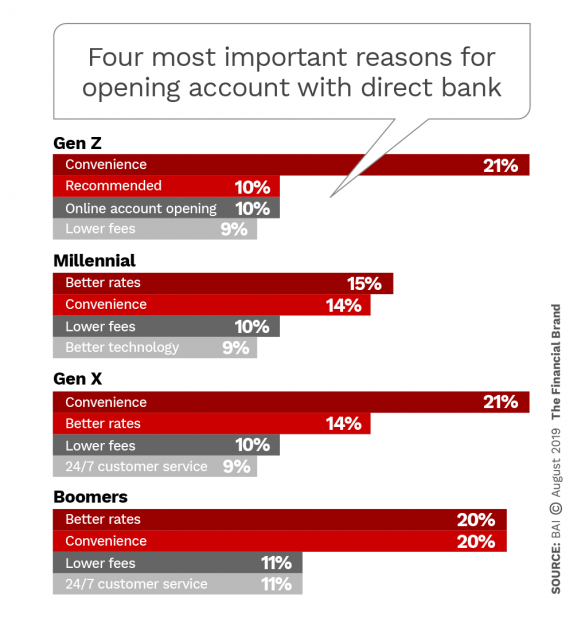

The other wrinkle is that while the chart shows the overall ranking of top reasons to pick a direct bank, matters look different when the priorities of the four principal generations are considered, as illustrated in the second chart above. No one factor dominated the mix.

Convenience can be defined many ways in banking services and its meaning has evolved each time a new service channel came on the scene. Four decades ago, being open late on Fridays or open until noon on Saturdays was state of the art convenience. Today it’s everything from branch hours to apps, depending on the need and the consumer.

“I had really been thinking of convenience initially in a more traditional sense — branches and ATMs,” says Jason Mencias, Manager, Research, at BAI. “But once there was a reset in my thinking to a more digital mindset I could see that factors like ease of account opening, seamless digital technology, and 24/7 customer service are drivers of convenience for direct bank customers.”

Riddle believes that online banks realized early on that because they did not start off as consumers’ primary financial institution, and often still aren’t, that they would have to shine by comparison on that front — especially to take in deposits from traditional players.

Nevertheless, Mencias stresses that rates and fees play an important role in the decision about staying with a current provider or moving all or part of a banking relationship to a new institution, online or traditional.

“Those who indicated that their main bank was a traditional institution are a little bit more sensitive to fees and rates,” says Mencias. “Those are areas where traditional institutions don’t perform as well in comparison to direct banks.”

Read More:

- Was Chase Bank’s Digital-Only ‘Finn’ Spinoff a Viable Strategy?

- Why the End of Chase’s Finn is Not the End of Digital-Only Banking

Being Primary Banking Provider Means More — and Less

An overall finding of the BAI study is that the battle to be a consumer’s primary financial institution is being won by large traditional banks, according to Mencias. When consumers were asked what type of institution served as their primary provider, 52% reported large banks, 19% direct banks, 16% community banks and credit unions, and 13% regional banks.

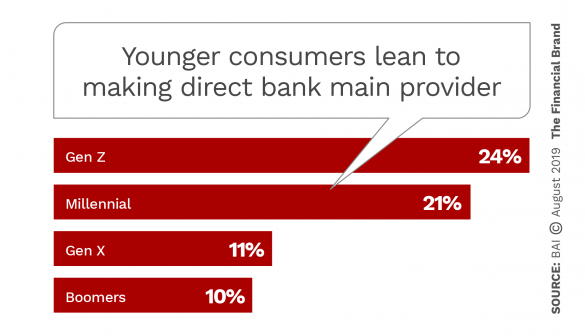

How long this pattern will last is open to question. The study asked consumers if they would potentially change providers, and make a direct bank their primary institution. As the chart below shows, the younger the consumer, the more likely this is the case — cause for reflection among institutions that have not been taking online competition seriously. Already, while 19% of the entire sample reported that a direct bank was their primary, for Millennials that number hit 25%.

Mencias notes that these numbers are comparatively low, overall. “This illustrates the uphill battle that direct banks will have to win over primary checking customers,” he says.

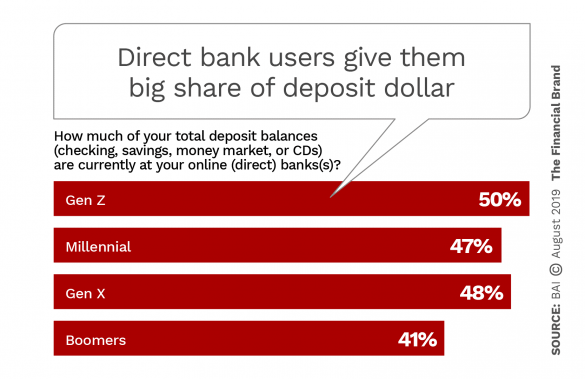

But a twist here concerns the meaning of primary bank versus what’s going on with deposits. While many of consumers in the survey base — who all had an account with a direct bank — did not consider their direct bank to be their primary institution, their dollars often go to the direct players.

In fact, the study found that direct banks receive quite a fat chunk of the consumers’ “total deposit wallet.” Among Gen Z consumers direct banks get the same share that traditional banks and credit unions do.

In addition, of consumers whose primary institution is a direct bank, on average 62% of their total deposit balances are with the direct bank. By contrast, for consumers whose primary provider is a traditional institution, the average was only 43%.

“So, although the direct banks’ primacy is low, their share of wallet is pretty good,” says Riddle. “However, they are still leaving some money on the table and that’s checking and savings accounts, which have a lower cost of funds.” Direct banks frequently pay up for MMDAs and other deposits.

While traditional players have a leg up here now, that could change, according to the research. The survey found that almost three quarters of the sample would consider opening a checking account with a direct bank. This was with the proviso that they would receive benefits such as fee-reimbursements. In terms of the generations, 93% of Gen Z would do so, followed by 83% of Millennials, 76% of Gen X, and 52% of Baby Boomers.

“It’s apparent that the younger generation are more open to banking digitally,” observes Mencias.

Branches: The Most Valuable Millstone Ever?

Strong opinions give the edge to online brands that never owned a single branch brick. However, as is often the case where branches come up, the most important opinion is that of consumers.

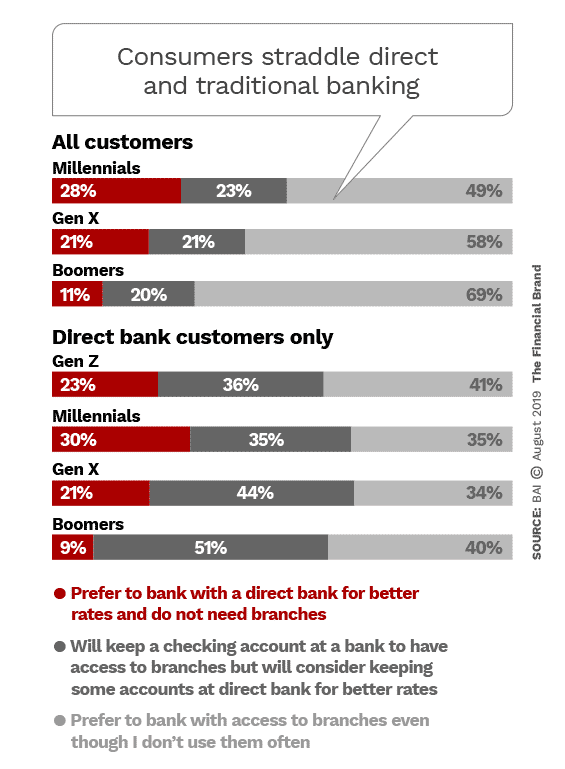

Increasingly a situation is coming to a head. Data from the new survey and other BAI research show there is still a strong interest in branches across all consumers. Even among consumers banking with direct banks, a third or more of each generation has a strong interest in being able to go to branches when they wish or need to.

Taking the data as a whole, “traditional banks are losing a little bit of relevance over time by generation, but this is a slow change,” says Riddle. He adds that incentives such as cash bonuses could override the desire to have branches available, especially among younger consumers.

“The best shot for direct banks is obviously among the new generations,” Riddle continues, “because they are already more inclined to kind of ‘cut the cord’.”

Mencias suggests that direct banks might take a clue from European banks. Over there the concept of shared ATM networks has morphed into shared branches, which include direct bank access. In the U.S. the credit union business has been utilizing multiple networks of shared branches over the years.

Read More: Busting The Three Biggest Myths About Retail Branches in Banking

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Framing a Competitive Do-List for Traditional Players

“Overall, consumers see advantages to both traditional and direct banks,” Riddle says, “so there is no clear cut answer, no magic bullet for success. Consumers pick among convenience, rates, and technology.”

The analysts gave some steps for tweaking traditional banking lineups to better counter the trend:

1. Take a hard look at your fees. Generation Z, the next batter up, has a strong aversion to fees. Nearly half told BAI that they would consider fees as a reason to find a new primary bank.

2. Think cash incentives. Large traditional banks have been stocking the primacy fires for some time now with big cash incentives. The analysts suggest tying the incentives to some ongoing requirement, rather than just giving it away.

3. Improve your online account opening. Remember the study’s findings regarding digital convenience. No bank or credit union dares to ignore that.

4. Consider cash back for debit card usage. Generation Z makes extensive use of debit service, and building a debit version of credit card cashback programs should prove very sticky.

5. Improve your mobile banking app — now. “Consumers are looking for clear and easy to understand apps to deposit checks and pay bills,” says Riddle.