When a new marketing officer took over at a large community bank, she fit right in on the institution’s retail side, but she couldn’t get any traction with the business bankers.

They told her that they didn’t need any help from Marketing … actually, just one thing. If she’d just make sure the bank’s impressive annual report was ready on time, that was all they wanted. They loved handing out that glossy report to business customers. Clearly, they felt that as “real bankers” they didn’t need any help.

“Marketers know when their institutions’ leaders take them seriously as strategic partners — and when they are figuratively being patted on the head, and told to go back to their desks.”

In time this marketer broke down that barrier. She proved her department’s worth to the business bankers. But it took time and much effort. In the end, top management increased her budget to enable her to add more marketing staff.

That’s a story that resonates with many financial marketers. They know when their institutions’ leaders take them seriously as strategic partners — and when they are figuratively being patted on the head, and told to go back to their desks so their seniors can make the big decisions.

The perennial question: What does it take for Marketing to be taken seriously?

It’s been a long time since the job consisted solely of ordering teddy bears and toasters and placing the occasional print ad. Modern financial marketing entails over a dozen communication channels, potentially; a deep understanding of data analytics; a grasp of rapidly evolving technology and tech-infused competition, just to name a few challenges.

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers. Read More about Send the Right Offers to the Right Consumers Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind. Read More about The Financial Brand Forum Kicks Off May 20th

Send the Right Offers to the Right Consumers

The Financial Brand Forum Kicks Off May 20th

Yet in more than a few institutions, Marketing still hasn’t quite “arrived.”

Cornerstone Advisors surveyed chief marketing officers of mid-sized financial institutions concerning the factors they see as inhibiting financial marketers’ ability to be more strategic in their jobs. The study, conducted by Ron Shevlin, Director of Research, finds that two points especially influence Marketing’s role — senior management’s view of Marketing as a key player in strategy setting, and Marketing’s ability to take a meaningful part in the strategic process. (The survey was sponsored by Vya.)

Survey respondents were asked to what extent their marketing departments influence or impact the strategic direction of their institutions. The average rating was 6.6 on a scale of 10. The research finds that 28% of respondents rate their influence as 5 (“some impact”) or lower, while 37% rate their operation as highly impactful at 8 or higher.

The study looked at five key areas, which it dubbed the “five habits of strategic marketing influencers.” These areas concern how marketers feel they allocate their time, how strong their relationships are with other functions in their institutions, how well they use technology and digital marketing, their skills with data and analytics, and how well they handle strategic planning for marketing.

Read More: 5 Ways Financial Institutions Can Squeeze More from Marketing Budgets

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

1. How Well Do You Manage Your Time?

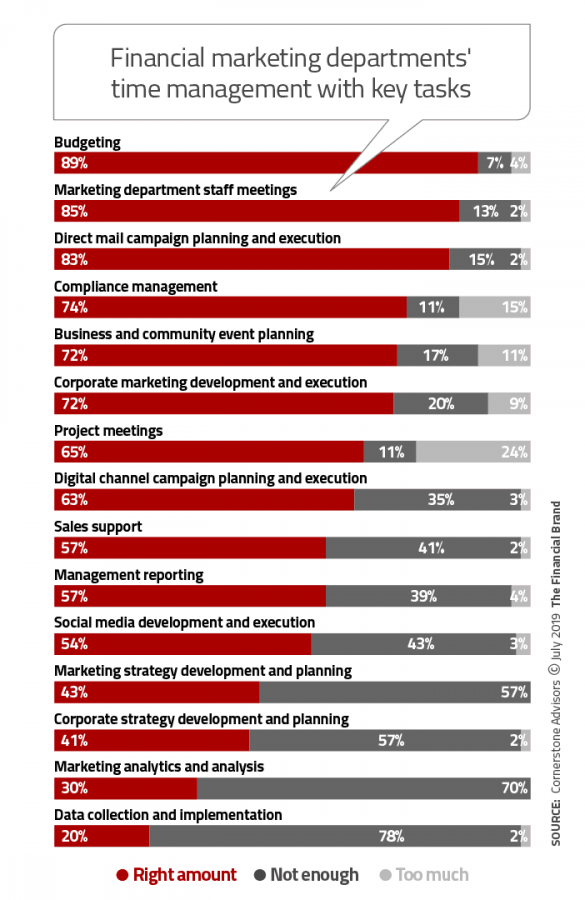

Chief marketers juggle quite a lot internally and externally and the study asked respondents to rate their time allocation in 15 key areas.

The self-ratings, shown in the chart below, indicate that there are several areas where marketers feel they are severely under-investing their time. Among these are activities directly touching on strategy, including marketing strategy development and planning, corporate strategy development and planning, marketing analytics and analysis, and data collection and implementation.

Respondents were asked how their rating of spending the “right amount” of time presently compared to three years ago. In many categories they report substantial improvement, but in general the lowest degrees of improvement were seen in the four areas mentioned above, all involving strategy. In three of these areas — corporate strategy, marketing strategy, and marketing analysis and analytics — marketers who rated their functions highly impactful overall scored themselves as having improved significantly as well.

Time management can be pretty subjective. Observes the report: “Few of the respondents think they’re spending too much time on any particular marketing activity. Just 14% of the high-impact institutions think they spend too much time on compliance management and event planning. In contrast, 38% of low-impact institutions say they’re spending too much time on compliance, and half think they spend too much time in project meetings.”

2. How Well Does Marketing Work with Other Functions?

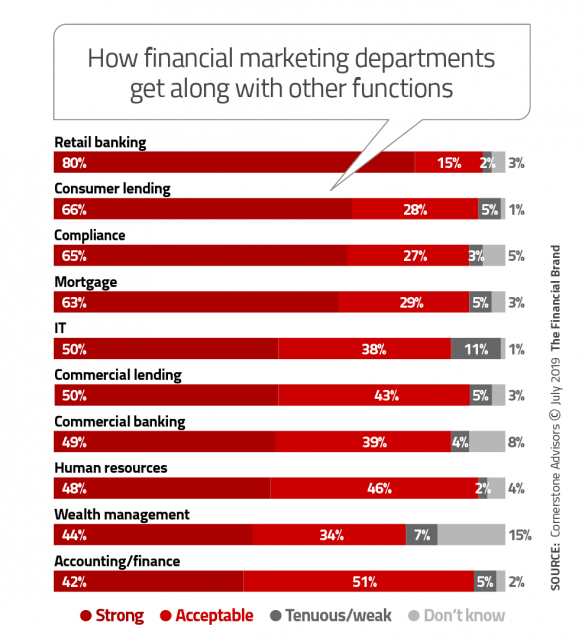

The survey delved into the relationship between Marketing and other staff and line functions. The closer a function is to consumers, the more likely the marketers rated the relationship as strong. Examples include retail banking, consumer lending, and mortgage lending.

A bit of a surprise comes in the reported degree of strength in the working relationship with Compliance — 65% of the sample say relations are strong and 27% more term them acceptable. Interesting, given how often, at professional conferences, each side complains about the other — “Compliance is the ‘Department of No’!” versus “What are those wild people in Marketing doing now?!,” for example. Perhaps this finding reflects the two functions finding some middle ground.

While respondents didn’t report significant disconnects overall, there was a yellow light.

“Looking through the lens of strategic impact reveals some differences between institutions,” the report states. “A significantly larger percentage of the institutions with high strategic impact have stronger relationships with IT, Accounting/Finance, and Human Resources than the institutions in the low strategic impact segment.”

The report concludes that most marketing functions appear to get along well with their internal clients. What sets the strongest apart is that they can get along with other support functions as well.

Read More: Financial Marketers Desperate for Talent to Fill Data, Digital, Tech Roles

3. How Effectively Do You Apply Marketing Technology?

Marketing technology adoption has been surging, and not just in financial services. In a cross-industry study of trends in the U.S., the U.K. and Canada, Gartner in late 2018 found that adoption of marketing tech has boomed over the last two years, with personalization, attribution and advertising technology among the leaders. Gartner found that in the U.S., installations of advanced marketing technology rose by 20 percentage points in just two years. Leading tech forms in the U.S. include email marketing, web content management, surveys and insights, content marketing platforms, and digital marketing analytics.

The Gartner data underscores how far marketing has transformed.

Indeed, Cornerstone observes that “financial institutions in the high strategic impact group more consistently make effective use of the marketing technologies they’ve deployed than do institutions in the low-impact group. This is particularly true for email marketing systems, social media management systems, and marketing resource management systems.”

Key financial marketing tasks impacted significantly by technology

| High-impact Institutions |

Moderate-Impact Institutions |

Low-Impact Institutions |

|

|---|---|---|---|

| Campaign targeting | 71% | 52% | 35% |

| Revenue generation | 54% | 35% | 6% |

| Lead generation | 50% | 30% | 0% |

| Performance measurement | 33% | 35% | 12% |

| Sales enablement | 31% | 30% | 12% |

| Customer engagement | 30% | 39% | 18% |

| Compliance management | 25% | 22% | 24% |

| Lead nurturing | 21% | 9% | 0% |

Source: Cornerstone Advisors © July 2019

The firm notes something curious: respondents across all categories of institution report low rates of effective use of customer relationship management systems. One CMO interviewed by Cornerstone for this project explained that these systems actually serve sales staff more than Marketing.

The researchers also report that among high-impact marketing functions, implementation of digital marketing is higher. In fact, one out of three of the high-impact group say digital marketing is their main thrust.

4. How Integral are Data and Analytics to Your Marketing?

Pick your cliché. Data is the new oil, the new gold, the new … While banks and credit unions sit on top of tons of transaction and behavioral data, many aspects of data analysis remain to be implemented.

Adoption varies across the categories of high-, moderate-, and low-impact institutions. “While marketers across the board are consistently using tools and technologies like paid search engines, re-targeting and digital behavior data, low-impact institutions are lagging in their use of A/B testing and propensity-to-buy models,” Cornerstone reports.

How Banks Are Fortifying Their Data Against Increasing Cyber Threats

This webinar from Veeam will detail the value of working together across your organization to be better prepared in cyber defense and response readiness.

Read More about How Banks Are Fortifying Their Data Against Increasing Cyber Threats

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

5. How Well Do You Perform Strategic Planning for Marketing?

While this area of research is somewhat within the marketing department’s own walls, Cornerstone finds some surprises that bear on the bigger picture. The researchers say they were surprised to find that not every institution in the survey maintains a formal marketing plan. Even among the high-impact players, one in five don’t do so. Among moderate- and low-impact departments the rate of not using plans is even higher.

“Another surprise to us was how infrequently the chief marketing officer presented at board of director meetings,” the report states. CMO appearances before the board occur often at just a quarter of high-impact institutions and only 12% of low-impact institutions.

The researchers found that a factor influencing Marketing’s role in institutional strategy that’s not directly reflected in the five traits reviewed is the perspective of the institution’s own CEO.

In this section of the study, the team finds polar opposites. On one hand, in three out of four high-impact institutions CEOs tend to see Marketing as critical to strategic decisions. But among low-impact institutions, few CEOs see Marketing as a strategic contributor.

What Can Help Marketing Gain a ‘Seat at the Table’?

Cornerstone recommends four steps:

- Make promotions for the institution something that everyone owns. When efforts are seen as something the whole institution shares in, greater collaboration can develop.

- Speak your peers’ language and put yourself in their shoes. When other functions have projects that could use Marketing’s help, a little cooperation helps lubricate the machinery. Learning to understand the lingo of other functions also helps.

- Automate all the everyday stuff. This will free up staff to concentrate on tasks that require human involvement, like cooperation with other functions.

- Market thyself, marketer. Cornerstone and financial marketers interviewed agree: To win over the CEO and others in management takes a proactive effort.

Says Cornerstone: “Marketing needs a story in order to change executives’ perceptions of the department. Develop Marketing’s story by providing stellar customer experience, partnerships and data.”