New research and evolving consumer behavior point to the necessity of banks and credit unions rethinking the value of incremental change. It’s more than even digitalization — a rethinking of the core retail banking model may now be underway.

According to research from Cornerstone Advisors, roughly three out of ten consumers say they would open a checking account with Amazon that was bundled with other services (e.g., cell phone damage protection, ID theft protection and roadside assistance). And they’d be willing to pay $5 to $10 a month. Consumers also said they would switch banks for a checking account bundled with services that help them save money, add convenience, and offer protection for an additional $5 to $10 monthly fee.

Another survey of consumers, conducted in the U.K. by CitizenMe with Zuora, found that while almost three quarters don’t pay a monthly banking fee, nearly half (45%) would pay a monthly bank fee in order to receive subscription media services such as Netflix and Amazon Prime, arranged for by their banking provider. The U.K. survey also asked what add-ons would entice consumers to switch banks. The highest response was media services like Netflix (40%), followed by smartphone insurance (28%), utility services (24%), travel insurance (19%), air travel miles (13%) and ride hailing service (10%).

Challenger banks have taken notice. Several that have free basic accounts, including Revolut and Starling, offer premium services for a set fee that include obvious financial perks like free ATM withdrawals, but also features like travel insurance. Spare-change investment app Acorns launched Acorns Later, a retirement plan combined with several value-added services including dividend reinvestment and automatic rebalancing for $2 per month.

In 2018, Meed, a U.S.-based fintech, partnered with Valley National Bank in Oklahoma (since rebranded as Vast Bank) to announce a subscription-based mobile banking program. The Meed package at Vast Bank includes checking, savings, a debit card and a line of credit up to 75% of a person’s savings for a subscription fee of $9.95 a month. A unique feature allows Meed users to earn an ongoing revenue stream for signing up additional family and friends through social sharing. Subsequently the Meed platform, powered by SAP Banking Services and Axxiome Digital, went nationwide under the brand “Meed Banking Club.”

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

The Semantics of ‘Subscription’ vs. ‘Bundle’ or ‘Package’

In some ways, banking by subscription may seem like a head scratcher those in the industry. For decades, banks have been charging monthly fees for checking accounts — the fees varying by how many add-ons were included, like free checks, ATM access, etc.

Traditional “packaged accounts” included travelers checks (remember those?) and other goodies. Much of that was swept away in the rush to offer free checking. Even though the majority of consumers avoid paying anything for the core checking account they pay fees for an assortment of things like overdrafts, and foreign ATM transactions.

So is the talk about subscription-based banking truly different? Clearly some within and outside of banking think so.

Customers Bancorp CEO Jay Sidhu, believes banks should consider the Amazon Prime model, which, of course, charges consumers a subscription fee for a variety of services — including free shipping. Sidhu proposes the idea of a checking account that would charge consumers $15 per month and offer such benefits such as no overdraft fees, a guaranteed higher interest rate, and discounts on such products as cellphones.

“Focusing on maximization of short-term fees is not a sustainable model” in banking, Sidhu told S&P Global Market Intelligence in an interview. “Building a sustainable model means you have to make it customer-centric and add value so that you’re improving the customer’s life.”

But Sicily Axton with HarperCollins Leadership says it is a mistake “to think consumers can be assessed a fee for the same things that have been given away in the past.”

“Without additional value added, it is more likely to appear that the banking industry is simply trying to find a way to make more money,” she cautions.

Indeed the global consulting firm McKinsey finds that overall 40% of ecommerce subscribers have canceled their subscriptions. However, McKinsey also says that subscription ecommerce consumers can be sticky once they find a service they like.

But having banks and credit unions offer cellphone discounts or Netflix subscriptions along with debit cards and CDs … “Is that banking?” some might wonder.

A comment from the 2019 Ernst & Young NextWave Consumer Financial Services report is telling. Financial services firms market how different they are, but “very few firms have changed anything fundamental about their value propositions,” the report states. Banks and credit unions seek to be distinctive by offering digital engagement for greater access and convenience, however, “outside of general marketing campaigns and brand refreshes, the industry has changed little. The business model is still driven by products,” according to the report.

Read More:

- Confronting the Greatest Risks Facing The Future of Banking

- Three Customer Experience Lessons From Amazon

A Picture of a Reimagined Financial Services Industry

EY Principals Nikhil Lele and Yang Shim, authors of the subscription banking report, cite examples of industries that have been reframed by tech-powered developments — smartphones (by the iPhone), ecommerce (by the launch of Amazon Prime and free delivery), and streaming services (by Netflix). The two industry analysts believe that over the next five years, retail banking as well as insurance and wealth management will be similarly reframed. Their take on the subscription model is less about popular add-ons, however, than about a complete change of focus.

“Consumer financial services firms will need to shift their strategies to differentiate on trust, financial health and bundled offerings that transcend product-centric selling and present more holistic and personalized value propositions,” the EY report states. The industry will move to a subscription-based model, yes, but it will be built around a financial wellness platform for consumers, EY predicts.

The consulting firm warns that there is a very real risk of one of the big technology companies launching a subscription-based consumer financial services offering. If that occurs it could quickly put the traditional banking industry on the defensive. “A large technology player can come in and offer access to holistic services and bundles — even if it’s just an offering of the experience that sits on top of the bundles themselves — that can be significantly disruptive,” Lele says in a Tearsheet podcast.

Consumer Paradoxes Drive Banking Outcomes

Based on extensive consumer research, EY identified several paradoxes governing the consumer financial world. These underlie its recommendation of a subscription-banking model. Here are three of the paradoxes, in brief:

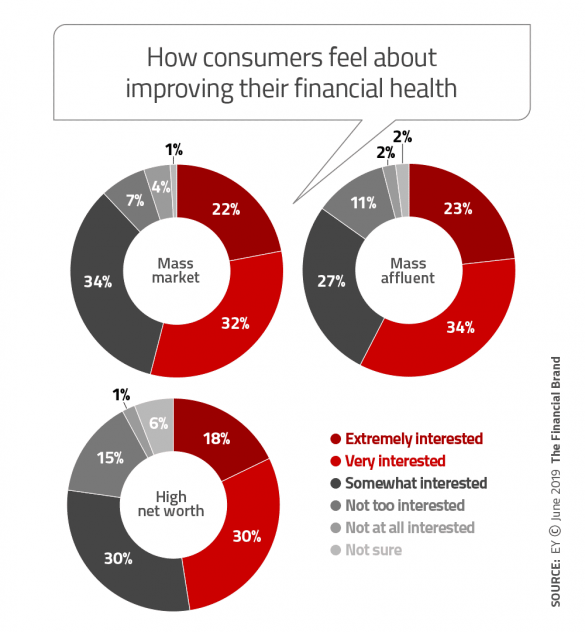

Financial health paradox. Consumers think they are financially healthy, but evidence says many are not. One example: outstanding credit card debt in 2019 is up 210% from 2009. Despite their misconceptions, however, most consumers have an interest in improving their financial health.

Trust paradox. Consumers trust their primary financial provider, but distrust the financial services industry overall. Trust is particularly important, EY states, because consumers have become accustomed to sharing personal data digitally when they get something in return.

The financial services industry, however, lags other sectors in delivering the personalized benefits and price transparency that consumers expect in return for sharing information, EY maintains.

Convergence paradox. More financial institutions look and act the same, while claiming to be different. This situation has been exploited by fintech firms, the report states. And while that has led to some new opportunities for banks and credit unions, it also has enabled new entrants to attract customers rapidly.

Read More:

- Five Innovation Trends That Will Define Banking

- Millennials and Money: 30+ Trends Financial Marketers Need to Know

- 5 Steps to Jumpstart Your Own Netflix Model in Banking

How Banks Are Fortifying Their Data Against Increasing Cyber Threats

This webinar from Veeam will detail the value of working together across your organization to be better prepared in cyber defense and response readiness.

Read More about How Banks Are Fortifying Their Data Against Increasing Cyber Threats

CFPB 1033 and Open Banking: Opportunities and Challenges

This webinar will help you understand the challenges and opportunities presented by the rule and develop strategies to capitalize on this evolving landscape.

Read More about CFPB 1033 and Open Banking: Opportunities and Challenges

Why Subscription-Based Banking Must Be Developed

EY analysts drew several conclusions from their research about what the banking industry will look like five years from now.

1. Give consumers control. Relating to the trust paradox, the consulting firm believes that banks and credit unions that adopt full price transparency and give consumers the ability to own and control their own personal financial data are likely to be rewarded.

2. Offer a personal financial health platform. Consumers’ misperception of their financial health represents a big opportunity for traditional financial institutions to help people get a clearer picture of reality. EY suggests that a financial health platform powered by artificial intelligence can become consumers’ “personal financial operating system.”

Among other features, such a platform would provide a dynamic wellness score that adjusts in real time based on spending, saving, borrowing and investing.

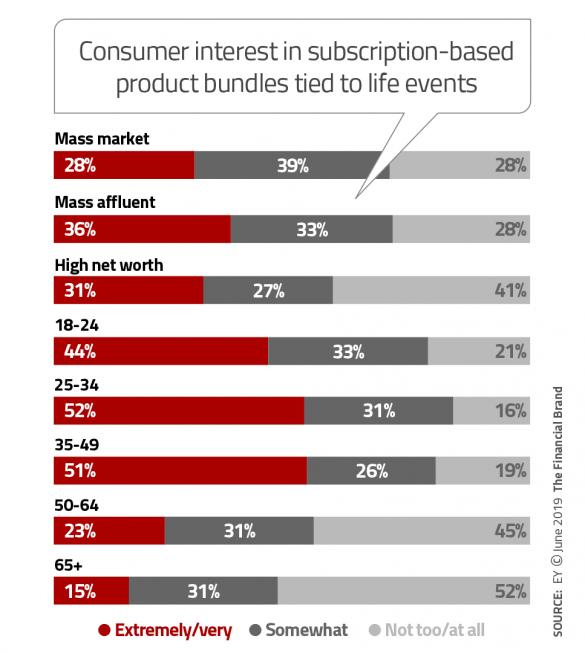

3. Shift to a subscription model. “Consumer finance will become the next subscription model, unbundling products and re-bundling personalized and holistic value propositions based on life events,” EY maintains. The firm tested the concept among consumer survey respondents. The financial subscription model tested carried an annual fee and a bundle of products and service associated with specific life events, a financial health monitor and “pre-curated access” to professional services as well as some nonfinancial services.

EY found the greatest interest overall for subscription-based bundles (extremely/very interested) to be in three life-event categories: Starting your first real job 64%; Getting married 56%; Having a child 54%.

Read More:

- Top 10 Retail Banking Trends and Predictions

- What Banks & Credit Unions Can Learn From Netflix About Digital Support

Fast-Following Could Be Risky in This Case

In its research for the NextWave report, EY also modeled the results of having a technology platform firm such as Amazon and Google offer a financial services subscription to core customers in the banking, insurance and wealth management industry segments. It concluded that banking institutions and wealth management firms in particular are vulnerable to tech firms if the latter came out with a financial services subscription service first.

However, if banking providers and tech companies were both to offer competing subscriptions, the research uncovered that “financial institution customers prefer to get their subscriptions from their financial providers rather than from a technology firm.”

While that finding is reassuring, EY warned that large technology firms can enter the competitive landscape relatively quickly. Financial institutions must act quickly, the firm concluded, to put a competitive offering in place.