“Buy now, pay later” evokes images of the 1950s and ’60s, when “layaway” plans were a staple of installment lending. The arrival and popularity of credit cards, with their near-universal acceptance and convenience, pushed aside buying “on time,” even for higher ticket consumer goods.

But some key factors have begun to change the scenery, and now plastic is in the crosshairs. Multiple new ways of obtaining short-term consumer loans — as purchases are being made — are beginning to impact card use.

“Point-of-sale finance is a new application of an old idea. You’re going to see more traditional lenders come up with competitive offerings.”

— Paul Siegfried, TransUnion

Technology-enabled Point-of-sale Finance, or Point-of-sale Lending, has become attractive to all three legs of the consumer credit stool. It appeals to consumers who want what they want — now — but with somewhat more control and more flexibility than traditional credit card purchases allow. And it appeals to both online and store-based merchants who want even more ways to enable them to make a sale while the consumer is hot to trot. Some of the trendiest online merchants, with major appeal to Millennials and Gen Z purchasers, have climbed aboard point-of-sale acceptance.

Players jumping into point-of-sale finance range from mainstream banks large and small to large ecommerce and traditional retailers to credit card and payments companies to fintechs like Affirm (founded by PayPal Co-Founder Max Levchin) to specialized firms that function as go-betweens serving lenders, merchants and their ultimate borrowers.

Getting a precise fix on the size of this market is difficult because there are different ways of providing the service. Credit bureaus like TransUnion don’t back out point-of-sale personal loans, explains Paul Siegfried, Senior Vice President and Credit Card Business Leader. However, he says, this form of finance has been growing as more providers are drawn to it.

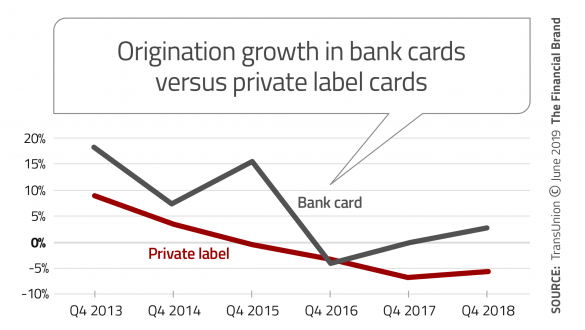

Some types of goods and services have seen low-tech use of POS finance for years. Dental practices, for example, have offered third-party financing for elective procedures like braces. Siegfried says evidence is mounting of more widespread use. One manifestation is the falloff in use of private label cards in comparison to bank cards, which Siegfried credits more to growth of point-of-sale financing. He says that consumers who may have previously financed purchases from clothing to electronics to home improvement materials with a private-label card have leaned towards POS finance.

Read More: Six Major Trends in Lending for Financial Marketers

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Why Point-of-Sale Finance Growing in Popularity

How large is the point-of-sale market, potentially? A commonly cited projection, made a couple of years ago, comes from Accenture, which believes point-of-sale finance could represent a more than $1.8 trillion opportunity.

What has driven this shift in appetite from the American-as-apple-pie bank card to an updated throwback to the earliest days of post-World War II consumer finance? Four factors have been at work:

- Millennials became a bigger part of the consumer credit picture. Many didn’t want to live off credit cards, but often they couldn’t or didn’t want to put off certain larger purchases, such as furniture, and travel, especially meaningful for a generation that some say treasures experiences over things.

- Algorithms and lightning-fast data communications created the ability to check credit records and weigh a consumer’s relative risk almost instantly. A key element of today’s POS finance programs is speed, plus convenience.

- With the mass adoption of mobile phones and the arrival of the Age of the App, the ability to access a form of credit nearly as simple as the credit card became more practical. If more and more people’s “card” is actually their smartphone, then flashing an approval code on their phone from a point-of-sale lender isn’t much of a stretch.

- Helped along by fintech-enabled online marketplace lenders, the attraction of what had been a less-popular form of consumer credit grew. Personal loans, often obtained to consolidate credit card debt at lower rates, have become respectable again, and so loans, rather than credit card charges, have become an acceptable option for payment.

“Point-of-sale finance is a new application of an old idea,” says TransUnion’s Siegfried. “And you’re going to see, at the point-of-sale, more traditional lenders come up with competitive offerings.” One difference from some “classic” programs is that the credits are not collateralized with the purchase.

Third-party companies that offer POS finance market as hard to merchants to accept these programs as to consumers. They emphasize that greater sales will result, and some, in their marketing, specifically point to the fact that the merchant will receive 100% of the sale price, even though it is being financed. Contrast this with the bite that credit card programs typically take, especially from smaller sellers who don’t have the negotiating muscle of major retailers.

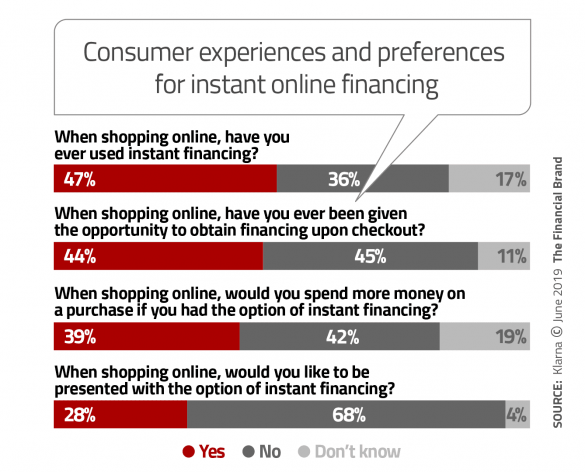

In a late 2018 study, Citizens Financial Group found that 76% of consumers surveyed said that they are more likely to make a retail purchase if a payment plan backed by a “simple and seamless point-of-sale experience” is available. Interestingly, the study found that for two-thirds of the consumers, the desire for credit cards is satiated — they want more credit, but they don’t want more credit cards.

“The bottom line is that consumers want a simple and easy experience when they make a large purchase, and we believe that this research shows that retail brands can modernize their payment model by moving away from the co-brand/store credit approach of the past,” Citizens Financial said in a report on the study. “We’ve seen this first-hand as the financing partner for well-known technology brands and believe there is tremendous opportunity in this space.” One such effort by Citizens is offering payment plans for iPhones upgraded in Apple Stores. In a blog the banking company notes that its portfolio of what it calls merchant-financing loans has grown to over $1 billion in four years.

The Filene Research Institute estimated several years ago that the total POS finance market stands at roughly $391 billion in the U.S.

Read More: Most Bank & Credit Union Digital Lending Efforts Come Up Short

Looking at a Selection of Point-of-sale Programs

The Citizens survey found that a major appeal to consumers of these programs is certainty. TransUnion’s Siegfried notes that in some other countries credit card balances can be paid on installment plans, on request, but in the U.S. that’s not been the case. The bank’s survey indicates that three out of five consumers like fixed monthly plans with clear payment terms. That is an earmark of the point-of-sale programs. At some point, the consumer selects the term of the loan they are requesting and the periodic payments follow from that.

Here is a small sampling of what’s being offered, or coming, by a wide variety of providers:

• JPMorgan Chase will introduce My Chase Plan in later 2019. The company indicated in an investor presentation that there is $250 billion in outstandings not held by Chase that its own consumers have racked up on other issuer’s cards. The new service will allow Chase cardholders to choose among past card purchases of $500 or more and to finance them for longer periods for a fee, rather than paying interest. There will also be a feature added to the Chase card app that will enable selected creditworthy consumers to slice off a portion of their card’s approved credit line and treat it as a personal loan for larger purchases. Interest charges would apply to those transactions.

Chase will also adopt features similar to the “Pay It, Plan It” program launched by American Express in 2017. Amex offers certain cardholders the ability to use its card app to choose to either leave a charge in the current card balance, or to spin it out as an installment loan. Consumers pick the term right on the app.

• Mastercard announced the acquisition of Vyze in April 2019. Vyze is a point-of-sale technology platform that allows merchants to offer a selection of different lenders’ credit programs. Vyze works in both store and online environments. Mastercard is promoting the acquisition as benefiting both its lenders and its merchants.

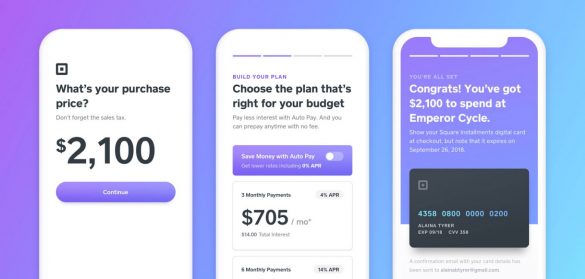

• Square offers Square Installments. Consumers can apply in store or at home on their smart phones, and choose their preferred payment plan. The program was launched in late 2018.

• Amazon, whose store card is provided through Synchrony Bank, offers the ability to use the card as a “buy now, pay over time” vehicle. Consumers can choose to pay over six, 12, or 24 months.

• Synchrony is also piloting a point of sale approach called SetPay.

• Walmart offers consumers the ability to pay over time on both store and website purchases using Affirm. Affirm is one of the dominant players in point-of-sale.

• IKEA the assemble-yourself furniture chain from Scandinavia, offers two cards to consumers. One of these is the IKEA Projekt card, which offers payment plans for six, 12, or 24 months. The card is backed by Comenity Capital Bank, a U.S. direct bank that provides credit programs for retailers.

Numerous other providers are in, or entering this space. Among them are Klarna, Bread, Blispay, and Acima.