Shifting requirements for the physical footprint in modern banking represent a challenge yet also an opportunity for financial institutions. To remain relevant, here’s how banks and credit unions can rethink, refresh and renew branches.

While the old real estate saying “Location, location, location” still holds a lot of weight in today’s competitive environment, there’s more to it. Having the right branch in the right place staffed with the right people is mission critical.

Branch visits are projected to decline 36% through 2022, so the future branch channel is either an asset to a financial brand — a critical touchpoint with consumers who may not come in very often — or a liability because many banks and credit unions have deferred maintenance significantly. A huge number of bank and credit union branches across the country require an investment of funds and focus to remain relevant.

One of the top issues facing financial institutions as disruption continues to rock the environment is how to adapt the physical channel to optimize customer experience. Banks and credit unions must meet consumers where they are. Sometimes that’s online and sometimes that’s in a branch where a more consultative banking experience can occur. For midsize brands, there are genuine budgetary challenges around making the most of the digital consumer-facing brand while also maintaining that physical presence. To avoid wasting time and money, they need to determine the ideal for their branch experience at any given time — essentially, their “north star.”

While it will evolve, taking the vital step of finding that position cannot be skipped, because it informs and influences every step of the customer journey to come. Whether an institution goes about improving an existing branch network or focuses on expanding into new markets via merger or acquisition, leveraging the ideal branch experience is central to successful optimization.

How Banks Are Fortifying Their Data Against Increasing Cyber Threats

This webinar from Veeam will detail the value of working together across your organization to be better prepared in cyber defense and response readiness.

Read More about How Banks Are Fortifying Their Data Against Increasing Cyber Threats

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

How to Execute Both Visual and Operational Change

Whether banks are updating their current networks or even deploying new branches in new locations, changes tend to fall into two central categories of improvement: visual and operational.

Visual enhancements include everything from interior in-branch brand components and communications to design elements like upgraded finishes and furniture. Also vital to consider as part of visual enhancement is the outside of a branch. You can’t simply place a new sign on the side of the building and call it an upgrade. After all, a consumer’s first impression happens as they approach the front door.

Make the most of that first impression. Exterior branding should differentiate your branch from competitors down the street. Remember, consumers are judging whether a company is one they want to affiliate with based on how the branch looks from the outside. They’re also making decisions based on the concept of “perceived convenience” in a market. That means when a customer sees attractive locations with smart signage, subconsciously it registers that the institution will be there for them when they need it. With the right exterior presence, branches will also skew more progressively and forward-thinking in consumers’ minds.

Visual modifications trend toward more transitional changes in the look and feel of a branch. Operational enhancements, on the other hand, are more expansive — and expensive. Of course, this larger transformational change requires greater investment, because it combines upgrades to both visual elements and functional capabilities inside. At the operational level, the focus is on both the branch’s form and function, impacting how people use and move through the space to truly shift how the branch operates. The result is a modern, efficient flow that is the best representation of the brand.

Read More: Trends in Branch Design From Banks and Credit Unions Around The World

Prioritizing an Institution’s Physical Makeover

Given the scale of a branch network, even with smaller and mid-sized institutions, a complete overhaul of every one would be unrealistic for most institutions.

Working with institutions to maximize physical branch channels, we are finding a large proportion — more than 50% — are opting for transitional changes over complete transformations.

These institutions are looking to make headway and unify their branches to brand standards, but can’t justify such a full-scale change. While this transition moves beyond a simple refresh of visual elements to align with the brand, it doesn’t go as far as completely altering the operational practices and processes of the branch.

One advantage to transitional spaces is that institutions won’t have the inconvenience or expense of substantial renovations. Another vital consideration is what a massive overhaul might mean to particular communities. Depending on the locale, a complete branch transformation may be off-putting to locals.

In these communities, transitioning the branches serves as a signal to both staff and the customer base that this branch location isn’t closing (a negative), just updating (a positive). Transitioning says that the bank is committed to the neighborhood and cares about the customers and community.

Frequently when financial institutions are planning for change to their networks, they tend to focus on the overwhelming prospect of a complete overhaul, rather than on the building blocks of change.

That’s because transformation is really blue-sky thinking — focusing on what could be in the future rather than what should be in the next few months.

Whether it’s because of acquisition or atrophy, the number of branches in a network in need of an update could intimidate the hardiest of banking brands. Realistically, what’s needed is progress — through a transitional, tiered approach.

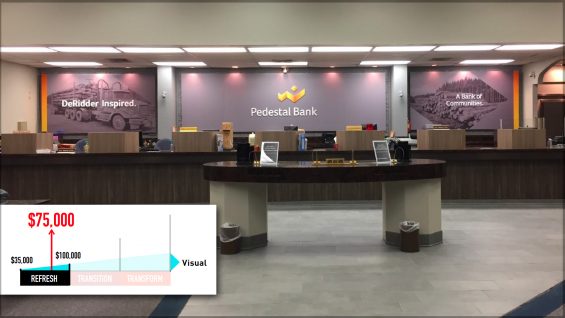

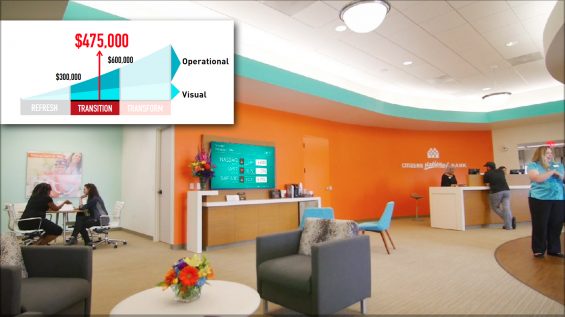

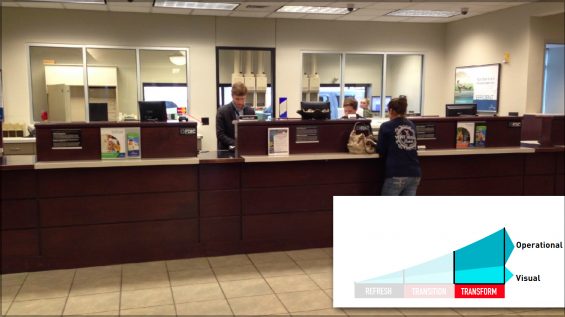

As institutions consider the practical realities of network optimization, lower budgets result in a focus on visual features like exterior signage and interior design. In transitional spaces, the budget incorporates visual upgrades while functionality is assessed and augmented. With transformation, spaces are completely overhauled, deploying new zones of experience and incorporating operational efficiencies.

Read More: Top Branch Trends for Banks and Credit Unions

Renovation Makes a Big Difference for Branches

While lower budgetary spending is required at the refresh tier that doesn’t mean those revived spaces don’t pop. Updating elements like lighting, flooring and color palette can result in a dramatic change.

Here are some cases where institutions chose to renovate rather than rebuild.

Pedestal Bank: This institution’s refreshed space incorporates modernized color palettes and finishes for a contemporary composition.

Citizens National Bank: This transitional space utilizes the identical footprint, but achieves so much more in terms of how the space operates. This transition shows how to shift not only how the space looks, but how it functions, as well. This transition introduces new zones of experience and repurposes areas that had little value moving forward as was. (Citizens recently changed its name to VeraBank.)

Origin Bank: This transformational effort shifts not only how the space looks and feels, but fundamentally, how it functions.

This fresh space introduces entirely new zones of experience, removing areas that don’t function well and looking at operational efficiencies within. This space takes away a clunky teller line that no longer represents the bank’s primary function today — a consultative experience in a clean, modern and comfortable environment.

Read More: Are Your Bank’s Branches Too Small to Survive?

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Where Should Your Branch Network Change?

While the physical channel of experience is surely the most difficult for bank brands to optimize, it’s still the best place for fostering the consultative experience that banking is known for. Like many of your peers, you probably have physical space within your branches you don’t need, but closing down branches seems reactionary and may not reflect your bank’s future state. A sharp knife can be more effective than a crude, heavy ax.

While the number of in-branch transactions may be on the decline, high-value, consultative experiences will likely still be taking place inside your branches. It’s also important to note the value of strategically leveraging physical presence in a geographic area as a branding beacon. Consumers still venture into the real world.