The old adage says “People don’t buy drills because they want drills. What they want is holes.” But that’s all wrong. It’s not even holes that people really want. They want whatever having holes is going to accomplish for them — like mounting a bike rack on a garage wall.

It’s all about solutions. The rest is just detail, and people increasingly would just as soon let someone else handle the details.

Accenture finds that solutions are now the main focus of consumers’ shopping. They aren’t homing in on the individual components, or providers, who, working together, make the ultimate solution possible. They will go for the provider who figures out a seamless, painless way of putting the whole process together. They don’t even care much what field the packager comes from, so long as the final package gives them what they want with a minimum of hassle, friction and pain points.

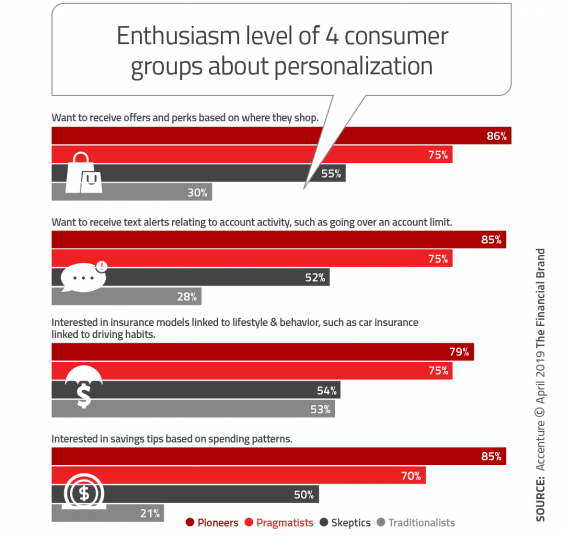

This is not to say that consumers want standardized packages that look like what everyone else wants and gets. Often, everything must be selected, prepared, and matched to our own preferences.

The challenge, as Accenture capsulizes it, is “to accommodate a million markets of one.”

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Mass Customization Isn’t an Oxymoron

“What we are looking at is ‘mass customization’,” says Bruce Holley, Senior Managing Director at Accenture. “The opportunity for banks now is to tailor things to individuals at each individual’s time of life. Technology today enables us to do that in a relatively seamless way.”

“This is a very interesting time. Consumers actually want something from banks. This is a huge opportunity if they get the packaging right.”

— Bruce Holley, Accenture

Holley thinks consumers have wanted packaged yet personalized approaches for some time, but only recently caught on that this has become possible. He notes that the study found that many consumers are more willing than ever to provide personal information in the hopes of gaining superior experiences.

Accenture cites the auto market to illustrate this trend. Cars are now thought of as “mobility solutions” — and this doesn’t necessarily involve buying a car, but enabling mobility while wrapping in insurance; financing in the form of credit, leasing, renting, or some other wrinkle; maintenance; and other ancillary services.

It’s “one-stop-shopping,” but with a difference. Once that phrase meant being able to go to one source and buy all the “ingredients” one needed under a single roof. Now, it means going to a packager to get it all done at once — highly personalized “take-out,” not shopping, and not meal kits. This thinking is in keeping with a concept that banking futurist Brett King argues for in Bank 4.0, in which what we consider today to be “banking” in a separable, identifiable form becomes functionality embedded in a bigger whole.

In some ways this is a natural evolution from “one-click” buying, where the financial element of ecommerce purchases becomes more or less a frictionless given.

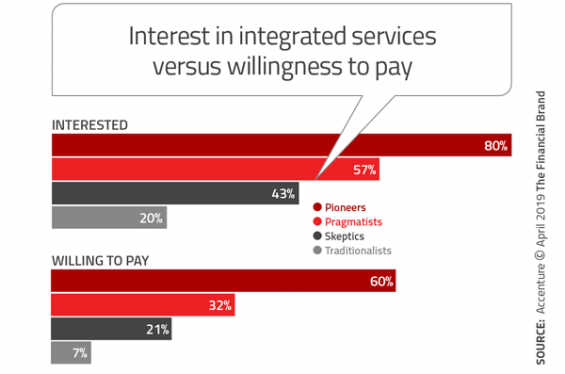

“Integrated propositions represent a major opportunity for financial services providers, and our survey shows interest from more than half of respondents,” according to Accenture. “However, financial providers have work to do to position these integrated propositions attractively. Currently, a lower percentage of consumers surveyed would be prepared to pay, despite showing interest.”

“This is a very interesting time,” says Holley. “Consumers actually want something from banks. This is a huge opportunity if they get the packaging right.”

Read More:

- Personalization in Banking Can’t Be Disguised as Cross-Selling

- 4 Myths Preventing More Fintech+Banking Partnerships

- 94% of Banking Firms Can’t Deliver on ‘Personalization Promise’

DBS Marketplace: What Mass Customization Can Look Like

There is a risk to the trend Accenture foresees: “Consumers are agnostic about the provider,” Holley warns. “Whether the final package comes from one provider or multiple providers doesn’t matter to them either.”

There will be a tremendous “first mover” advantage here, Holley predicts. For the most part, “no one has really executed against the idea yet, we’re still in a very academic setting.”

Making packaged approaches a reality will require developing “ecosystems,” in the firm’s parlance, that can pull all the pieces together, through partnerships, developing new skills to supplement core skills, or otherwise. Holley thinks that, to a degree, banks have a leg up here. One advantage for banking companies is renewed trust, especially as strong guardians of data.

“Providers should aim to position themselves as a trusted advisor within an ecosystem of alliance, vendors and partner organizations, each of which can deliver a particular aspect of an integrated proposition,” says the study. Accenture adds that a bank is not the orchestrator of the overall package, it runs the risk of its brand becoming lost in the recipe.

DBS Bank Ltd., in Singapore, has established several integrated ecosystems under its DBS Marketplace brand. This includes marketplaces devoted to cars, home sales and rental properties, travel, and electricity.

Accenture specifically discusses the DBS Car Marketplace in its report. DBS Car Marketplace is a joint venture between the bank and two car sellers. The marketplace is available to both car sellers and car buyers, with the home page serving as a dual portal for both purposes. The bank-powered car marketplace has become Singapore’s largest direct seller-to-buyer marketplace.

The Financial Brand took a closer look. Everything DBS has done can be replicated in the U.S. Car sellers can snap a photo of their vehicle and upload it for listing on the participating sales platforms. The marketplace also connects them with a service that checks out cars for sale. Car buyers can shop for vehicles on the service’s platform and use budgeting tools as needed. Buyers can apply for DBS auto loans. The site also offers owners discounts on insurance and roadside assistance.

In the DBS annual report, management cites the marketplaces as one of numerous ways that the company is “Making banking invisible.” The annual report summarizes not only the consumer-oriented marketplaces, but other commercially oriented systems where the bank has been injecting financial services into an ecosystem.

In the annual report, David Gledhill, Chief Information Officer, notes that DBS has published over 350 APIs (application programming interfaces) and connected with more than 90 corporate partners who connect to DBS API gateways. Over 3,500 registered developers, he states, “are working to enhance customers journeys by integrating DBS APIs such as points redemptions, funds transfers, rewards, bill payments, etc., into their solutions.”

The potential ranges far beyond cars in the U.S. Accenture’s report points out that USAA is, on its own, an example of an ecosystem that can generate customized packages of financial experiences. USAA has banking, insurance, and more under its own roof. In the mortgage area, for example, it offers access to a network of real estate agents familiar with the needs of its consumer base; mortgage financing and home insurance; and even a tool that monitors home value on an ongoing basis.

Read More:

- Digital Future of Banking Requires New Leadership Model

- 7 Financial Institutions Taking Innovation Labs to the Next Level

Warning Signs: Some Like Off-the-Rack Just Fine

The excitement of more convenient ways of serving consumers has to be tempered by some cold reality — not all consumers embrace the promise of a convenient new world. Some would be quite happy if progress butted out, actually. Worldwide, indeed, about as many feel ambivalent or worse about such change as would favor it.

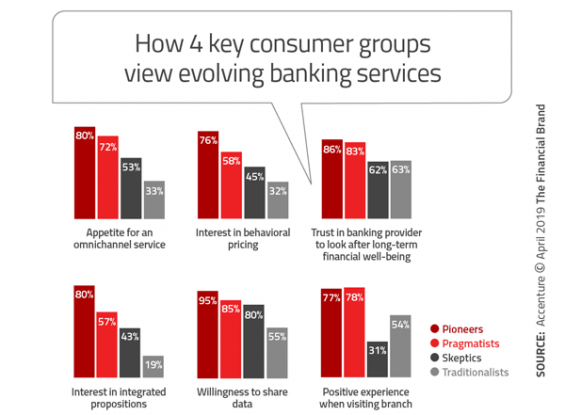

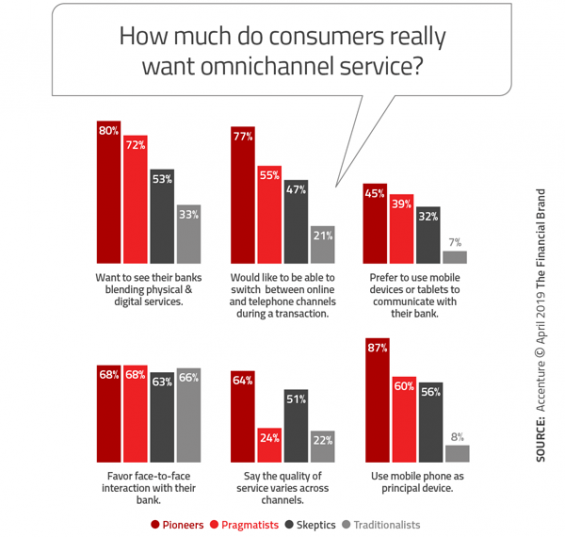

One of the keystones of the Accenture report is that consumers worldwide can be divided into four “personas” that aren’t all fans of where pundits say the industry should be heading. The four groups are organized by characteristics, rather than more traditional demographic features.

1. Pioneers are tech-savvy and centered on mobile devices. They crave innovation. One in five consumers in the U.S. fall into this category, and tend to be male and are often younger than 34. Four in five like the idea of packaged services.

2. Pragmatists are interested in personalization, yet a bit wary of it. For them tech is a means to an end, and not a personal passion. They expect good value from providers, and they are generally happy with the service they are getting. Control over their accounts ranks high on their priority list. Pragmatists represent 26% of the U.S, and spread fairly evenly across demographic groups.

3. Skeptics, 33% of the sample, make an interesting mix. They’re often unhappy with their financial providers — even alienated and often untrusting — but they aren’t big fans of tech either. More than one in three is under 35, making them a long-term challenge for those marketers who think everyone that age loves tech solutions. Skeptics have little interest in integrated packages, don’t want personalized products, and generally don’t want to try out new channels. Skeptics make up only 16% of the U.S.

4. Traditionalists prefer humans to tech, to the point they avoid tech. They also tend to have low — and falling — levels of trust in financial providers. Only one in five care to use financial apps or websites. Integrated package services? Not interested, thank you. Traditionalists tend to be 55 and older, representing only 21% of the global sample but a shocking 40% in the U.S.

Holley says the drastic differences in interest in integrated services underscores the need for institutions to know their consumers, rather than adopting strategies based on national and international trends.

“There are very local contexts that add much more flavor and nuance for a financial institution’s understanding, and that should guide how you execute against the concept of the four personas,” says Holley. “It’s really important to understand who your core segments are. Personas are very helpful for thinking who and how you serve — and the cost of serving them. You need to be able to provide profit as well as value to clients.”

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Key Remains Knowing Consumers

Ultimately, the challenge here is much like the one that banks and credit unions have faced since the advent of online banking services: No channel really gets left behind.

“Who your client base is should be the first question,” says Holley, “because we’ve seen consumer personas skew from one institution versus another. Know thy customer. You’ll never go wrong.”

Beyond this, says Holley, is knowing what your institution is really about, and what it can be about. The four personas represent not only types of consumers currently among the institution’s base, but types with differing potential to be new relationships. For those institutions who can reach Pioneers and Pragmatists, there are prospects waiting to be wowed with integrated packaged services.

Attitudes towards data sharing differ among the four personas, though even among Traditionalists, generally over half of those surveyed are willing to share personal data in order to obtain some benefit. 63% of Traditionalists will share data that brings them better pricing based on health, driving behavior, exercise habits, and so forth. Pioneers are nearly unanimous in being willing to share data for all reasons.