Social media giant Facebook remains the best way to reach Millennials … for now. New data point to some potentially important shifts that bank and credit union marketers should consider for their Millennial strategies. Research by Clever, a fintech company active in the home-buying space, throws a spotlight on the differences in digital platform use and habits between younger and older U.S. consumers — specifically: platforms used, impact of friends and influencers, privacy concerns, and inbound marketing preferences.

The importance of the Millennial generation has been stressed for years. Financial marketers get how this huge group, currently age 23 to 36, will shortly be the largest single generational segment, hitting 73 million U.S. adults in 2019, according to Pew Research. There is an abundance of well-entrenched stereotypes already extant about Millennials. The challenge for marketers has always been, how best to approach this large and diverse group.

The research from Clever helps put some real numbers on Millennial habits and preferences, contrasting them with older consumers.

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Facebook Dominates, But Has Challengers

No financial marketer using social media can overlook Facebook. The platform accounts for about 25% of all online ad spending. Used effectively, Facebook enables banks and credit unions to highly target their marketing based on the consumer behaviors, likes, and dislikes. How effective are Facebook ads compared with ads on other social platforms?

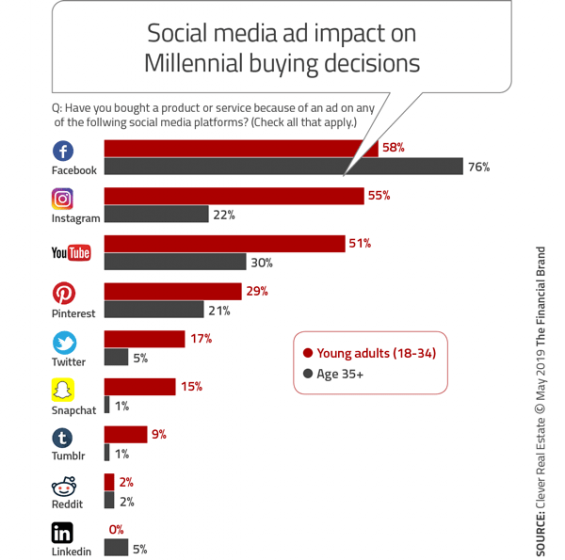

Clever asked the 1,100+ consumers in its survey specifically if they had bought a product or service because of an ad they saw on a social media platform, and, if so, which platform.

Facebook clearly remains the big kahuna of social, but as digital marketing analyst Thomas O’Shaughnessy, the report’s author, notes, “Facebook is starting to lose favor among Millennials and older generations alike.” The survey found that more than seven out of ten Millennials (77%) are concerned about Facebook’s use of their personal data. The company has announced changes to address privacy concerns, and several e-commerce initiatives, but O’Shaughnessy points out that the company’s business model is based on using users’ data. “They’ll need to find a way to be transparent and come up with less creepy ways to use data,” he observes. That may or may not happen or happen quickly,

Meanwhile, YouTube, owned by Alphabet, Google’s parent, and Instagram, owned by Facebook, are becoming staples of online media consumption for younger adults, says O’Shaughnessy, and these ad platforms are leading to more conversions for marketers, at significantly higher levels than for adults age 35 and older.

Supporting that, 64% of U.S. adults between the ages of 18 and 29 use Instagram, as reported by Statista. The figure drops sharply to 40% for the adults between the ages of 30 and 49.

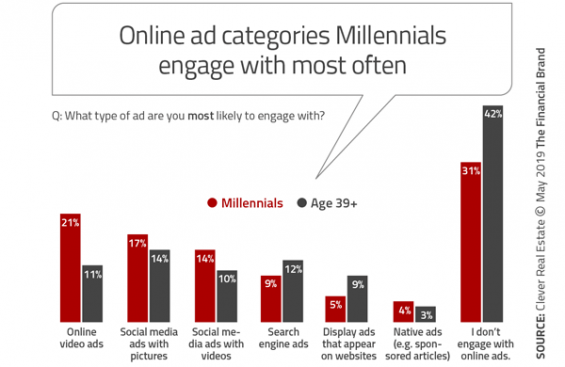

Video is the medium of choice for Millennials, who watch more digital video than traditional television, and this trend is powering not only increased use of the YouTube and Instagram platforms, but impacts their engagement with digital advertising.

The Clever research found that Millennials are more likely to engage with social media ads that feature video and images, and, with the exception of search engine ads and display ads, are more likely than older (39+) adults to engage with any digital ads they see.

O’Shaughnessy defines engagement in this context as any kind of online interaction (clicking, liking, sharing, etc.). As shown in the chart, almost a third of Millennials claim they don’t engage with online ads at all. However, O’Shaughnessy tells The Financial Brand that he suspects that percentage is more “commentary” than a true indicator of actual behavior.

“A lot of respondents probably do click on ads, they just don’t realize it,” he says, pointing out that the line between advertising and content continues to blur. Or perhaps they just don’t want to admit that they do. Either way, O’Shaughnessy maintains that “in-your-face” advertising doesn’t work online, especially among Millennials, and that’s more of what this stat is getting at.

Marketing on social media is more about sharing. In a study of 76 North American brands that market effectively to Millennials, brand strategy boutique FTT found that most of these companies gave Millennials a reason to share their brand message by making sharing easy “and by sponsoring content they knew was already share-worthy rather than by exclusively buying advertising space on social media.” They understood that social media is not a media channel but rather a sharing platform, the firm states.

Read More:

- Millennials, Gen Z Love Banking Brands That Champion Financial Wellness

- Can Financial Marketers Hit The Millennial Moving Target?

- 6 Big Millennial Marketing Mistakes Financial Brands Cannot Afford to Make

A Little Help From Friends and Influencers

Influencer marketing is not a mainstream tactic for many financial institution marketers, although some of the biggest banks are using it effectively. It can be particularly effective in targeting Millennials, several marketing experts agree.

Clever’s research backs this up. 44% of Millennials have bought a product or service recommended by an online influencer, compared to only 28% of Baby Boomers and Generation X respondents.

Millennials are drawn to authentic, relatable people, observes marketing consultant and author Barry Feldman. “They appreciate the unfiltered honesty of bloggers, vloggers, and YouTube personalities.” Many influencers, he adds, have sizable, active followings of potential buyers who pay attention to their blogs and social media feeds.

In addition to influencers, Millennials give ear to what friends say online. Clever’s research found that 65% of Millennial respondents said they are more likely to buy a product or service if a friend recommends it on social media, compared to only 40% of Baby Boomers.

“All of this data suggests creating organic conversations around your product or service — and getting influencers and friends to talk about it — is a winning strategy for marketing to millennials in 2019,” O’Shaughnessy states.

3 More Millennial Marketing Insights

The research from Clever Real Estate uncovered additional data of use to bank and credit union marketers.

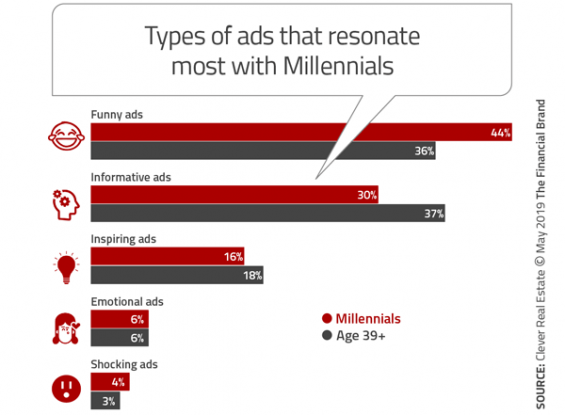

1. Make ’em laugh. Just over two out of five of Millennials say humorous ads resonate with them the most, moreso than with older consumers. Informative ads also score well in contrast to emotional or shocking ads.

Humor can be a risky play, not least because the same ad can have one person rolling on the floor while another other thinks, “dumb” or “offensive.” Even so, more financial institutions seem to be venturing into humor.

2. Embrace a cause. 74% of Millennials say they’d buy a product or service if the company behind it supports a cause they personally believe in, according to Clever. Reinforcing this, a separate study by RetailMeNot found that 61% of all U.S. internet users would recommend a brand to their friends that aligns with their social values.

Here, too, however, the currents can be tricky to navigate. “One of the biggest mistakes a brand can make is portraying idealistic or fake narratives on their channels,” says FutureCast President Jeff Fromm. “Both Millennial and Gen Z consumers especially are realistic and expect authentic stories shared by real people.”

3. Data for value? Not so fast. Inbound marketing may not be the best choice for mining valuable data from Millennial prospects. Clever found that only 32% of Millennials (and only 15% of 18-24 year olds) would be willing to submit their name, email and phone number for a downloadable resource, such as a guide to homebuying.

“People don’t like the idea of trading their information for a downloadable guide, because they aren’t sure how a company will use that data,” says O’Shaughnessy. He believes phone numbers in particular — which for Millennials are almost always a mobile number — is a sticking point for many respondents. “My guess is the rise of robo-dialers has users hesitant to give out their phone number.”