Mocking those with money is a popular pastime. The rich are an easy target. There are relatively few of them — the much vilified 1% — often stereotyped as greedy, corrupt, amoral — people who unblinkingly pay bribes to ensure their children can punch their own ticket to wealth by getting into the best schools.

In the “Conflicted States of America,” many resent the rich, but would also like to join them. And then you have Warren Buffet and Bill Gates and hundreds if not thousands of others among America’s wealthy who fund scholarships that send other people’s kids to college, and endow programs, entire schools, hospitals and much more.

Add into this complicated mix the wealth gap — which is widening and has become a huge political issue. Financial marketers live and breathe money, and help sell what it can do. But do you really understand how other Americans, even yourself, really feel about it?

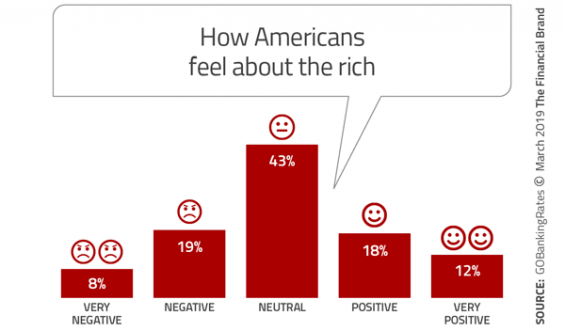

On balance you’d think that the public at large would skew negatively toward the wealthy. In reality, however it’s surprisingly balanced. Asked by GoBankingRates how they would describe their feelings toward “the rich,” one out of five Americans (27%) say they have negative or very negative feelings toward them. 30% have positive or very positive views, and the rest, 43%, are neutral.

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

How Banks Are Fortifying Their Data Against Increasing Cyber Threats

This webinar from Veeam will detail the value of working together across your organization to be better prepared in cyber defense and response readiness.

Read More about How Banks Are Fortifying Their Data Against Increasing Cyber Threats

‘I’ll Be Rich Someday. Until Then, Tax The Suckers’

The fact that more than seven out of ten American consumers don’t hate the wealthy might just be because they kind of like the idea of getting rich themselves. Many people still believe that by dint of hard work and brains you can pull yourself up to a better place financially.

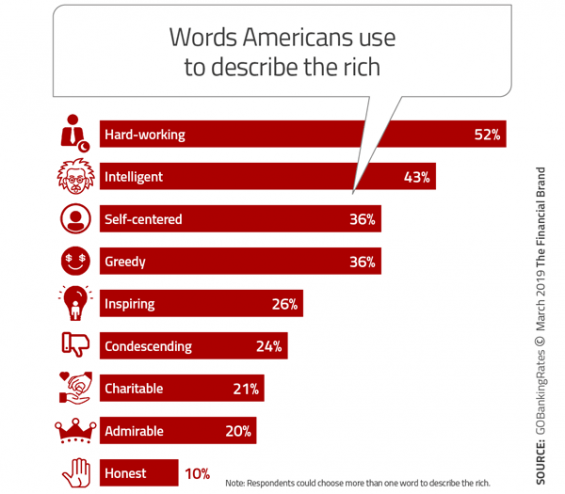

According to GoBankingRates, just over half (52%) of Americans describe the rich as “hardworking,” and four out of ten (43%) use the word “intelligent,” even while more than three out of ten use words like “self-centered” and “greedy.”

Results from a 2018 Charles Schwab study found a similar strong belief in the American Dream, with 49% of respondents saying that saving and investing is the “key to wealth,” and another 40% pointing to “hard work,” as the key.

Whether the rich are seen as hardworking or greedy or both, more than half of Americans (56%) think raising taxes on the wealthy is a great idea, the GoBankingRates study found.

Another finding from the same study shows that more than half of Americans (56.6%) believe that the government favors the rich over any other income group.

Read More:

- 5 Things Financial Marketers Should Know About Love and Money

- Millennials and Money: 30+ Trends Financial Marketers Need to Know About

What Exactly is “Rich”?

Data from Pew Research Center show that after decades of contraction, the size of the American middle class stabilized between 2011 and 2016 at just over half (52%) of the population. However, the research firm also found that financial gains for middle-class Americans were modest compared with gains among higher-income households.

Pew says the minimum household income needed to qualify as “upper income” is $78,281 for a one-person household, $110,706 for a two-person household, and $156,561 for a four-person household.

By contrast, the national median household income in 2016 was $57,617.

Obviously these averages will vary by region. The coastal areas of the Northeast and the West have the largest shares of adults in upper-income households. In New York City, for example, a couple told a New York Times interviewer that they had spent $600,000 the year before, but felt very far from living the “high life.” They described their lifestyle as “frenetic,” even including eating peanut butter and jelly sandwiches. Not exactly “conspicuous consumption.” In the Big Apple, the cost of housing, taxes and private school for children — and, well, okay, nannies and second homes in the Hamptons — is astronomical.

There is more to wealth than income, of course — net worth being one obvious measure. When looked at strictly by income, for example, Millennials appear to be doing quite well. Pew reports that they earned more, adjusted for inflation, in 2017 than comparable households did over the last 50 years. However, as Slate observes, Federal Reserve data show that older Millennials’ median net worth is 34% lower than for people of comparable age in the past. Why? A much higher ratio of debt to income, driven in large measure by student debt.

For the population overall, the net worth figures required to be “financially comfortable” are much higher than Pew’s income averages. According to Schwab’s research (which surveyed people from 21 to 75), Americans say it requires an average of $1.4 million in net worth to be comfortable. And to be wealthy? That requires $2.4 million.

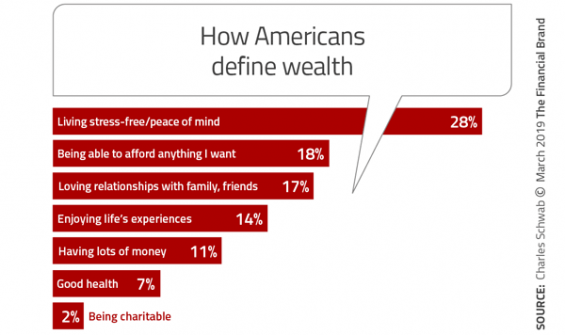

The Schwab study asked respondents to choose from several phrases to describe their personal definition of wealth. “Having lots of money” came in relatively low at 11% compared with “Living stress free” at 28%. As Bloomberg observes, living stress free doesn’t sound too money-centric on the face of it — until you consider that money, or the lack of it, is a major source of stress.

Still, the fact that Americans young and old regard relationships with family and friends on par with being able to afford anything they want is encouraging. So is a comment by author Rachel Sherman that many of the affluent people she interviewed for her book, Uneasy Street: The Anxieties of Affluence,” are very concerned about their children. They don’t want them to think they are “entitled” to more just because of their class advantages, she says in an Economic Times interview. “They need to work for it … and be polite to others no matter what their class,” was the hope of these affluent parents.

Read More: The Massive Millennial Shake Up in Traditional Wealth Management

‘We’re Broke. But No Worries, We’ll Still Retire Early’

At the opposite end of the wealth spectrum are the “99%.” Many of these “not wealthy” are striving to join the 1%, or at least get a little closer. Yet there’s no shortage of dire indicators pointing to economic stress for large swaths of Americans. One that comes up regularly is the overhang of student loan debt. Forbes puts it a $1.5 trillion among 44.2 million borrowers, many in the Millennial generation.

A 2019 survey sponsored by mobile banking app Varo Money reports that about one in five Americans (19%) live paycheck to paycheck, and that two-thirds of American adults — and seven out of ten Millennials — do not have a three-month emergency fund.

Clearly these folks have a long way to go to be rich.

But there is also some good news uncovered by research about Americans’ views on money.

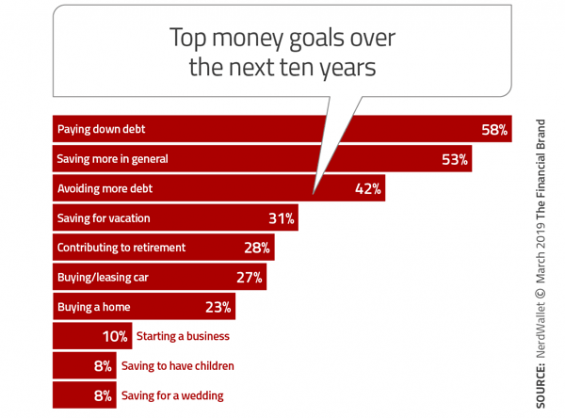

Although seven out of ten Americans express regrets about money management, according to NerdWallet, more almost nine out of ten (89%) say they are taking steps to achieve their financial goals.

In addition, the 2018 Acorns Money Matter Report observes that half of Americans invested money in 2018. Of those who did, 60% invested more than what they spend in a year on coffee — $1,100.

Asked how they feel about their financial future, the respondents to Acorns’ survey, who were between the ages of 18 and 44, responded:

- “Anxious” 26%

- “Meh” 44%

- “Confident” 30%

Despite that less-than-robust outlook, nearly 50% of these younger Americans think they will be financially secure enough to retire somewhere between 45 and 65 years of age! That’s not just talk. Nearly half (49%) say they are saving up to $100 a month on average.

And just maybe something has permanently shifted in the Americans’ money attitudes. Gallup reports that almost three out of five (59%) Americans say they enjoy saving more than spending, compared with 40% who say the opposite. Both figures. Gallup notes, have remained remarkably steady since 2009.

Asked by Acorns what they would do if given $1,000, the top three responses given by American consumers were: Pay down debt 38%; Save it 27%, Use it to start a business or Give it to charity — a tie at 15%. Only one out of ten said they would splurge on a big trip.