In an annual study from CSI, executives at U.S. financial institutions were asked questions about the banking industry as a whole, along with strategic priorities, and spending and planning considerations. The survey also probed mobile, in-branch and digital strategies, tactics for new customer acquisition and perspectives on cybersecurity and compliance trends.

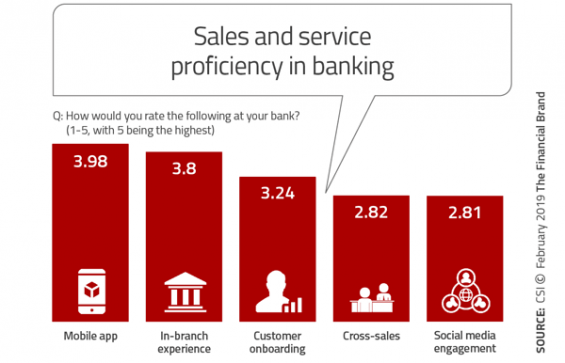

When banking institution executives were asked to rate their proficiency in a number of key areas, nearly 80% of bankers were confident in their institution’s mobile app and digital offerings. This correlates with an annual consumer poll by CSI, which found that 86% of all Americans were happy with their banks’ current digital banking tools.

On the other end of the spectrum, nearly 60% of bankers identified social media as an institutional weakness. This is a problem that needs addressing since, according to American consumers, 47% aged 18-34 think it’s important for their bank to be active on social media. Another area of concern may be cross-selling efforts that were viewed only slightly better than social media engagement. Onboarding efforts, impacted by substandard digital account opening solutions, also showed poorly. The good news is that 47% of respondents plan to focus on cross-sell strategies in 2019.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Biggest Issues Facing Banking Industry

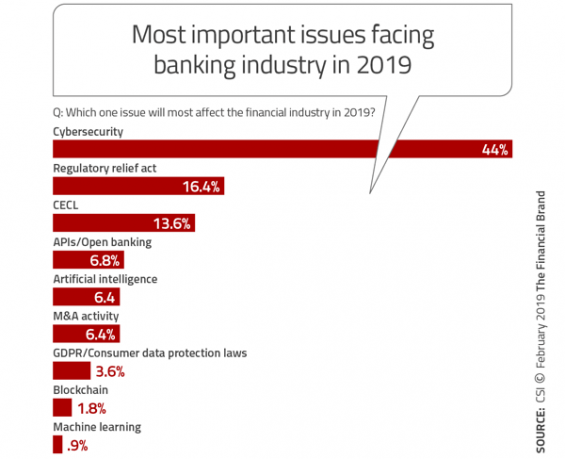

With an increasing number and size of security and data breaches in 2018, it is no surprise that respondents to the CSI survey ranked cybersecurity as the top issue for the upcoming year … by far. The Regulatory Relief Act and the CECL accounting issue ranked number two and three respectively. Because of this high level of concern, it makes sense that 72% of bankers surveyed will spend up to 20% of their budget on cybersecurity.

As was found in the 2019 Retail Banking Trends and Predictions Report, published by the Digital Banking Report, APIs and Open Banking are gaining ground on the list of issues to be addressed despite the reality that the regulators have not provided clear direction on this trend. The importance of APIs and Open Banking becomes even more important when viewed in context of improving the customer experience and identifying consumer needs as part of the customer journey analysis.

Focus on Customer Acquisition

It is clear that the key to growth and competitiveness in the future will rest on the ability for traditional financial institutions to be able to acquire new customers. End-to-end online and mobile applications are the foundation for increasing a customer base and improving cross-sell effectiveness.

Alternatively, new account opening solutions that require the presence of a prospective customer in a branch at any stage of the new account opening process will not only result in application abandonment, but also the potential for the process to be incorrectly attributed to a branch sale (especially when banks and credit unions track using last-touch attribution).

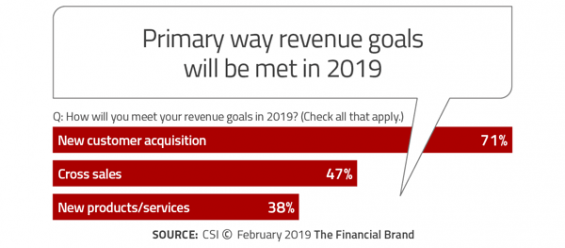

According to the CSI study, seven in ten institutions stated that new customer acquisition was a primary tactic toward reaching their revenue goal, with 47% saying that they will focus on cross-selling and another 38% stating that new product development will be important.

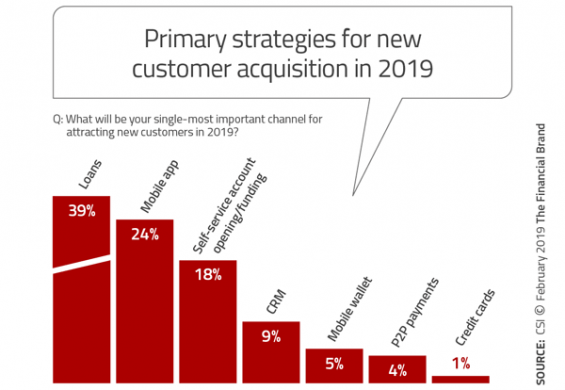

Digging deeper into the strategy of new customer acquisition, 39% indicated that loans were most important, followed by mobile apps (24%) and self-service strategies (18%).

Growing Importance of Digital Solutions

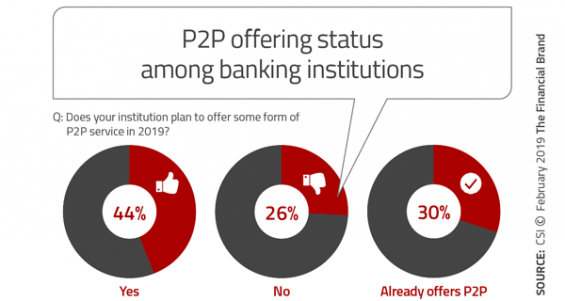

Beyond the importance of digital account opening for all products, new digital solutions are quickly gaining users and becoming a key part of the focus on self-service options. The best example would most likely be person-to-person solutions. According to CSI, 75% of financial institutions in the U.S. state that they will be offering some form of P2P solution by the end of 2019 (this assumes that 44% will introduce their first P2P solution this year).

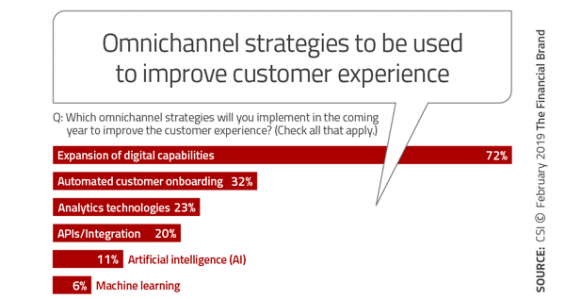

With all organizations wanting to improve their customer experience, omnichannel strategies will be at the forefront for most organizations in 2019. The expansion of overall digital capabilities is at the top of the list, even though traditional delivery options (such as branches) will continue to need upgrading. The key is to make sure all channels are delivered seamlessly and are focused on engagement as opposed to simply transactional efficiency.

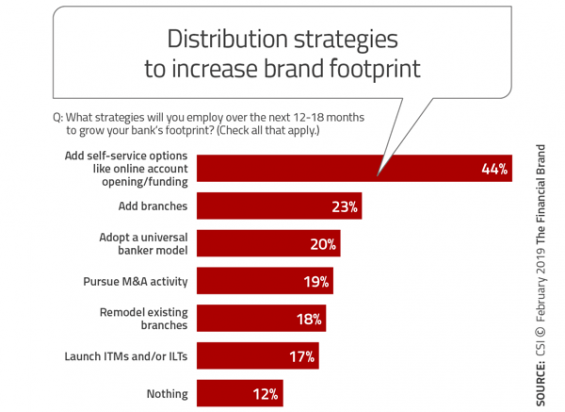

According to CSI, adding self-service options is nearly twice as important (44%) as adding the next possible channel (branches, at 23%). That is not to say branches will be ignored. In fact, 18% of those surveyed indicated that they will be remodeling branches, with 20% stating they would be implementing a universal banker model.

Path for the Future

Financial institutions of all sizes must seriously consider becoming more digitally mature, investing in back-office processes and infrastructure as opposed to front-end tactical projects that only impact the consumer experience on a superficial level. This will require banks and credit unions to build from within and partner externally to become more digitally enabled. Only with investment in digital functionality will traditional financial institutions be able to keep up with fintech and big tech alternatives.

“As banks plan to expand their customer base, they must consider the impact of digital banking and the migration to self-service automation on every line of business,” said Steve Powless, CSI’s chairman and CEO. “Partnering with financial technology companies enables banks to develop strategies for maximizing customer growth and keeping ahead of competition from the largest international banks — as well as tech giants like Amazon and Google.”

It is more important than ever to make moves to catch up to the marketplace. It is obvious that change will not slow down in the future and those organizations failing to act will be in a position to not being able to meet the needs and expectations of the consumer.