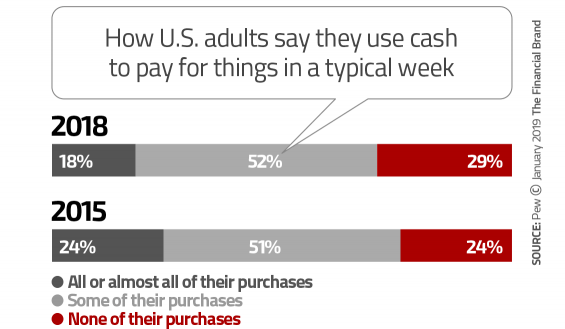

Almost a third of Americans have stopped using cash for their typical weekly spending, according to the Pew Research Center. This continues a trend the organization has been tracking since 2015.

In the latest research, 29% of adults don’t use any cash for weekly purchases, up from 24% in 2015. Those consumers who claim that they still make all or nearly all purchases for cash fell to 18%, versus 24% in 2015.

As in the earlier survey, generally the higher the household income, the less likely the consumer is to use cash for everyday spending. The study found that 41% of adults with household income of $75,000 or more used no cash versus 18% of consumers making under $30,000.

Age makes a difference in cash usage, with 34% of adults under 50 using no cash, versus 23% among consumers 50 and older.

The Pew research also found differences among racial groups in use of cash. For example, 34% of blacks use cash for all or nearly all of their regular purchases, while only 15% of whites do so and only 17% of Hispanics.

In the another study from the Federal Reserve, the number of ATM withdrawals among the largest depository institutions fell by 2.8% just from 2016 to 2017.

Understanding and recognizing such trends is important for financial marketers and retail bankers involved in many decisions, including where to locate ATMs, and the marketing strategy for alternative payment channels, such as Zelle.

Read More: 7 Trends Disrupting The Future of Payments – From Apple Pay to Zelle

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

What’s Not in The Wallet?

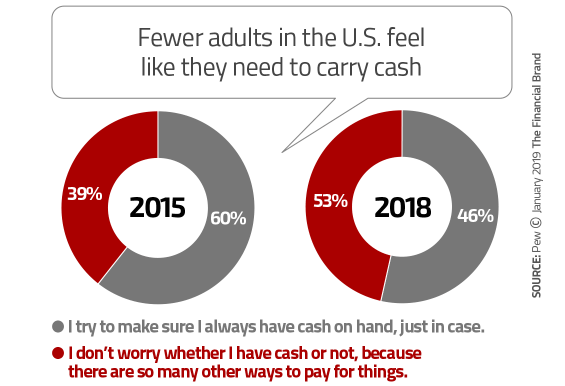

A corollary of the rising avoidance of cash purchases is that more and more Americans feel comfortable leaving home with little or no currency on them at all. In 2015 60% of Americans surveyed said they made sure to always carry at least some cash “just in case.” In the latest research, that’s fallen to 53%, with the remainder claiming that they don’t worry about having cash on hand because they have many other ways to pay.

Gizmodo blogger Victoria Song feels the Pew Research aligns with her own cashless lifestyle, noting how American’s payments systems and habits aren’t ready for a cashless future.

“Recently, my partner and I were forced to scramble when a cash-only parking garage held his car hostage,” Song recalls. “In our defense, the ‘Cash Only’ sign was covered up by sticky notes in the window. We had to beg a nearby friend to lend us $25, run two blocks to get it, and then sprint back to the garage.”

“I immediately paid my friend back on Venmo,” adds Song, somewhat ironically.

Pew’s research doesn’t examine what consumers are using instead of cash. That answer, however, comes from research conducted by the Federal Reserve. In the latest edition (2017), the Fed estimates that the split, by number of payments, was 30% cash, 26% debit cards, 21% credit cards, with the remainder consisting of prepaid cards, checks and electronic transfers and payments of various kinds. Cash payments tend to be smaller and more frequent, checks and certain electronic payments, such as financial institution billpay, tend to be larger.

Read More: Banking Providers Not Selling The Benefits of Mobile Payments

Cashless By Choice? Or By Design?

Going cashless in the digital age involves a certain “cool factor.” For instance, at the Amazon “Go” retail store, you can forget about trying to pay with cash; people just grab what they want and technology handles any payments automatically as they exit the shop. People don’t have to stop at a checkout counter, nor swipe a card, nor enter in a PIN. They just walk out — almost like shoplifting.

Some American retail chains, such as 7-Eleven, have been adding streamlined checkout for non-cash payers using mobile wallets. Ikea is experimenting with cashless checkout in Sweden, with plans to roll it out worldwide at some future point. In the UK, Marks & Spencer groceries offer consumers the convenience of their “Mobile – Pay – Go” service, allowing shoppers to scan up to £30 of goods with their smart phones, then checkout with Apple Pay or a card linked to their store account.

Going cashless isn’t just a trend isolated to brick-and-mortar retailers. Consider ride-hailing services. Uber, as founded, was cashless. Late in 2018 the service introduced a “cash” feature to the app, but it is a matter of pre-loading it with cash, like a reloadable prepaid card. (Tips can be paid with currency, but not fares, versus traditional taxis.) And it’s only for tips. Lyft remains totally cashless.

“You have ‘Johnny Cash and ‘Sally Cashless’ — these are two different customers,” said venture capitalist Ryan Gilbert in an interview with Digiday. “Retailers realize that they’re very different from the Amazons of the world, they have different customer relationships, they’re probably selling different products, they’ve got different inventory management and supply chain solutions, and just to say ‘We’re going to be Amazon,’ may not be the right solution.”

Cashless Mandate Creates Controversy

Requiring consumers go cashless, as some public transportation systems have done, can be controversial. The argument to go cashless is obvious: cut costs and by trimming the number of employees devoted to transactions. But in places like New York City and Washington, D.C., legislation has been considered to mandate acceptance of cash, in part because of the belief that not accepting it discriminates against “unbanked consumers” (a euphemism for low-income, predominantly minority segments).

On the other end of the spectrum, entire nations have moved towards cashless economies, Sweden and India among them. In both cases, the jury is still out, for different reasons.

In late 2018 India’s The Financial Express observed that “the Narendra Modi government has been constantly endorsing the idea of cashless India post demonetization to help formalize the world’s sixth largest economy but a consensus is evolving that that is not possible.” The same report notes that in many sectors there has been reversion to cash. Some people still prefer paying that way.

Meanwhile, Sweden has called a timeout on its cashless strategy to see where things are headed in the bigger picture. According to an article in the New York Times, financial authorities who once embraced the trend are now asking banks to “keep peddling notes and coins until the government can figure out what going cash-free means for young and old consumers.” The article notes that Swedish legislators have been considering the consequences and potential risks — e.g., what if the power grid fails, or servers crash, or hackers, or even war.

In the UK, a formal commission, the Access to Cash Review, has been studying that country’s natural evolution towards a cashless society. An interim report in late 2018 found that about 17% of the country still finds cash essential.

Natalie Ceeney, Chairman at the commission, is concerned that the UK might end up “sleepwalking” into a cashless economy, inadvertently leaving almost a fifth of the country behind.

UK-based digital payments pundit David Birch of Consult Hyperion echoes that sentiment: “We need to go cashless, not drift into cashlessness.