Few industries have been rocked by digital disruption as much as banking. This is particularly evident in the payments space, where dominant incumbents must contend with a dizzying onslaught of challenges.

According to a report from Accenture, new payment solutions from digital competitors, fintechs and challenger banks are now “threatening the very existence of traditional players.”

And despite the plethora of options consumers have today, they consciously think about payments less than they have in the past. As Accenture explains, payments in the digital age are quickly becoming “invisible.” For example, Accenture cites voice-enabled solutions powered by natural language processing as an emerging trend that could not only upend traditional physical payments but even newer mobile payment tools. Given the popularity of Alexa and its ilk, that’s not at all far-fetched.

Other trends, such as the increasing use of person-to-person mobile payments via Venmo, Zelle, Square’s Cash App, “tap and go” payments, digital wallets, and various faster-pay initiatives are all pushing the payments envelope.

In other parts of the world, where more traditional forms of payments aren’t as deeply rooted as they are in the West, mobile payments and digital wallets have become the default. China, for instance, already leads the world with mobile digital wallets accounting for 40% of in-person spending, according to McKinsey — almost all of it is on nonbank platforms — and that’s not even counting digital commerce.

Here in the U.S., however, where credit and debit cards have been entrenched for decades, and cash remains strong, digital payments have grown steadily, but not exponentially… yet. But the consensus is that they will. And if banks and credit unions invest in their payments ecosystem strategically, Accenture says there is potential for 30% revenue growth by 2022.

Looking ahead, what should retail executives in the banking industry focus on? Here are seven of the biggest trends that will shake up payments in the year to come.

Read More: Why Real-Time Payments Are Quickly Becoming Table Stakes

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

1. Big Threats From Big Tech (GAFA… and Beyond)

How much larger will the role of the GAFA gang — Google, Apple, Facebook and Amazon — become in payments? With GooglePay and Apple Pay already in place, and Amazon expressing interest in offering some form of transaction account, this is literally a billion-dollar question.

CapGemini considers the GAFA incursion as one of the top payment trends to watch in 2019.

“By integrating payments into their platforms and developing their own digital ecosystems,” the consulting firm wrote in a paper on payments trends, “big techs are making a foray into payments.”

There is also a real chance that Chinese e-commerce giants — Alibaba’s AliPay and Tencent’s WeChat Pay in particular — could impact the U.S. market. Experts warn that it would be a strategic mistake for traditional players in the U.S. to underestimate them. They are actively extending their reach across the Pacific, with WeChat Pay having already announced a cross-border payment app in partnership with Travelex for Chinese tourists to shop at U.S. retailers.

“The nightmare for the U.S. financial industry is that a technology company — whether from China or a homegrown juggernaut such as Amazon or Facebook —replicates the success of Alipay and WeChat in America,” caution analysts with Bloomber. “The stakes are enormous, potentially carving away billions of dollars in annual revenue from major banks and other firms.”

Bloomberg acknowledges that U.S. banks enjoy “formidable advantages” in the payments game, including longstanding customer relationships. As industry after industry has seen, however, consumer relationships with brands can change overnight if a better, easier, more intuitive, or cheaper option comes along.

U.S. consumers also have a long-standing love affair with their credit and debit cards. They are easy to use, and afford fraud protection — particularly credit cards. In any event, most digital payment options at this point in this country — even person-to-person — are essentially different form factors for credit card and checking-account payments.

Still, the biggest risk here for U.S. financial institutions is complacency. As Mark Ranta, ACI’s head of Digital Enablement, warns, the “risk of inactivity will be front and center in 2019,” as early movers will start to capitalize on global trends and changes. Ranta urges banks and credit unions roll up their sleeves and wade into the “new payments ecosystem,” or risk being left behind.

2. Payments Baked Into The Customer Experience

As Accenture notes, the simplicity and convenience consumers enjoy on e-commerce platforms has altered their behavior. New payment methods introduced by non-banking players such as Google, Apple, Facebook, and Amazon have raised the bar by changing the way consumers experience payments.

Jordan McKee, Research Director at 451 Research, says there is growing recognition in banking and retail circles alike that payments serve as a “critical digital experience factor that directly influences customers’ likelihood of converting and returning, resulting in an enhanced focus on the role of payments in powering digital commerce experiences.”

As evidence on the retail side, McKee points to the various private-label digital wallets such as Kohl’s Pay wallet as well as order-ahead apps like Shake Shack’s “Shack App”.

Ranta suggests a way that banks and credit unions can boost the consumer payment experience. As more and more functionality moves to the mobile device, he says, payment controls can go beyond the simple on/off debit card function. By integrating the appropriate applications, the financial institution can offer something closer to mobile-based control of consumers’ total payment experience within one app, no matter how or where they are transacting.

Read More: Consumer Frustration With Banking Apps and Mobile CX Lingers

3. All Data, All The Time

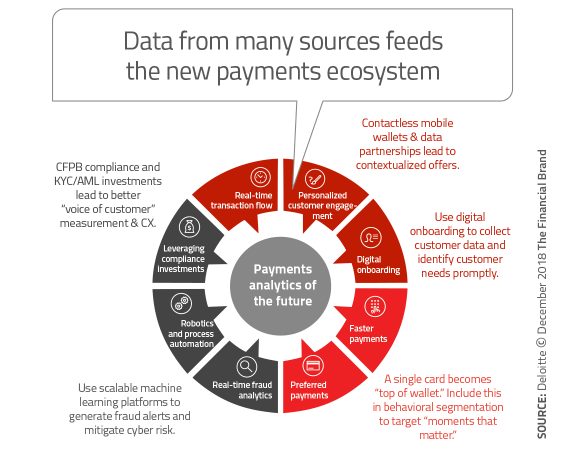

Transaction data represents a vast trove of information about consumer behavior that can be used to personalize the customer experience and specific product offerings. E-commerce giants figured that out long ago, but financial institutions have only recently begun to leverage this data at scale.

Already major payment industry players are building analytics capabilities to harness payments data, Deloitte reports. Advanced payments analytics are key to better understanding the consumer and to help financial institutions drive growth and assess risk.

Individual transaction-level data can help banks and credit unions learn about consumers’ interests, hobbies, and financial position, CapGemini explains. That can translate into meaningful insights for cross-selling and upselling products and services. Machine learning software can combine transaction data with data from other sources to model the characteristics of each account and predict the most appropriate offer for each customer.

Half of U.S. shoppers want location-based discounts sent to their smartphone, according to data from CapGemini. Consumers also want a personalized experience that recognizes and rewards their purchases and engagement. Three quarters of shoppers think loyalty programs should reflect their preferences, and banking providers can now personalize and target loyalty rewards for a specific individual. All this CapGemini calls “data-activated marketing” — marketing based on customers’ real-time needs, interests, and behavior.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Fractional Marketing for Financial Brands

Services that scale with you.

4. Omnichannel Payments on The Rise

Just as consumers expect to buy anytime, anywhere, and anyway they choose, they are no longer partial to just one payment method. They are using whichever channel and payments method suits them — what several sources call omnichannel payments.

As technology has evolved, payments that were once location-focused (in-store versus online, for example) are now device-enabled, according to CapGemini. For example, payments are already being injected into new disruptive technologies such as voice assistants and IoT devices.

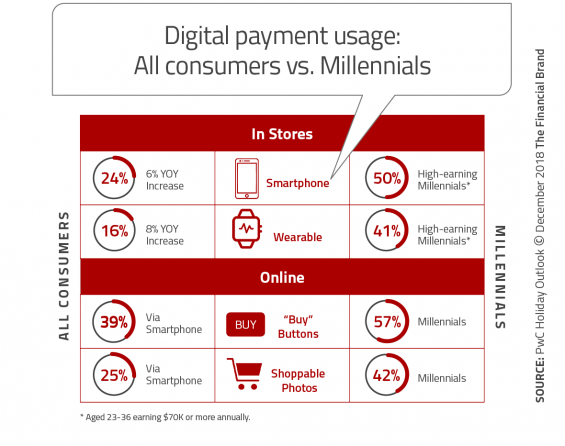

Putting some specific figures to the omnichannel payments trends, PwC’s annual holiday survey revealed that 91% of consumers planned to shop in stores vs. 84% online. Three-quarters said they would shop both online and in stores.

Payment choices are mixed as well, with almost 30% of consumers saying they will use smart payments in stores this holiday — 24% by smartphone and 16% by wearable, with some using both. As shown below, high-earning Millennials (aged 23-36 earning $70,000 or more annually) are much more likely to pay by smartphone as consumers overall.

Mobile commerce is on the move, PwC notes, resulting in a blurring of the lines between shopping and entertainment. For instance, sizeable numbers of consumers now use shoppable photos (click on part the image to buy something shown), buy buttons, videos, and gamification, especially younger consumers.

5. Open Banking, Open APIs

“Collaboration holds the key to success in the future payments ecosystem,” says CapGemini, “and APIs (application programming interfaces) act as the collaborative ‘glue’.” Banks are working to reposition themselves to compete with agile fintech payment entrants that were built from day one with APIs, as well as the Big Tech and e-commerce companies that implemented APIs much earlier, notes the consulting and digital transformation firm.

“With payments migrating into native apps, POS software, wallets and other connected environments … banks and payment companies now have a seemingly endless list of partners to align with, running the gamut from application developers and technology partners to emerging payment gateways and ISVs (independent service vendors), says McKee in an article appearing on Forbes. ” Dealing with this more complex ecosystem requires APIs and agility to meet the needs and expectations of consumers.

APIs are not new to banking and are nothing more than a structure for how software applications should interact. But they provide the gateway for innovative, contextual solutions.

Most of the focus now is on “partner APIs” between a bank and specific third-party partners, and “open APIs.” The latter enable a bank or credit union’s data to be made available to third parties with whom they may not have a formal relationship. This category is particularly significant as open banking initiatives (e.g. Europe’s PSD2 regime) force banks to open their systems to third-party developers. While no such regulation exists in the U.S., the banking industry recognizes there are advantages to moving in this direction.

“Open APIs, combined with advanced technologies, are being used to deliver more personalized and cross-device payment options,” says Accenture. Globally, the firm points to several new payment platforms built on this foundation, among them: Zelle in the U.S., India’s Unified Payment Interface (UPI), MoneyTap in Japan, and New Payments Platform (NPP) in Australia and the U.K.

At a more granular level, open APIs can assist banks and credit unions to distribute data or services through new payment channels or devices (like Alexa), and to leverage emerging artificial intelligence applications far more quickly than with traditional methods.

6. Keeping Pace With ‘Platformification’

Closely aligned with the open banking/API is the concept of “banking-as-a-platform” — what many in the financial industry have dubbed “platformification.” Amazon is generally held up as an example of the platform business model.

As described in an earlier article on The Financial Brand, “a platform is a plug-and-play business model that allows multiple participants (producers and consumers) to connect to it, interact with each other and create and exchange value.”

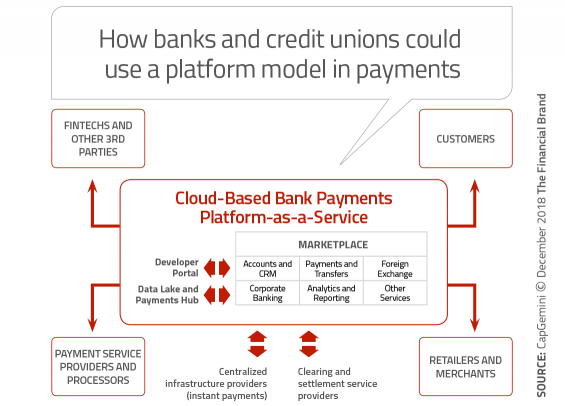

CapGemini in its payment trends report explains that changing customer expectations for more contextual and value-added offerings is forcing banks and other payment players to rethink their business models. Collaboration, whether through partnerships, or less formal arrangements, is the new name of the game as most banks no longer view fintechs as a threat, but as part of the solution.

A cloud-based platform approach would allow traditional financial institutions to connect with fintechs and other third parties to create consumer-payment solutions in a single ecosystem, CapGemini explains. Such an arrangement would enable banks and credit unions to quickly scale up to meet changing consumer demands.

Deloitte agrees that collaboration through partnerships or otherwise is a way for the industry to manage payment-related investments and increase speed to market, but points out in a report that platformification is not all kumbaya. “Key issues to resolve will likely center on data sharing, who owns the customer, ease of integration, and data security.

7. Still Waiting for the Mobile Wallet Revolution

Unlike China, where 40% of in-person spending takes place using digital wallets, the U.S. continues to move more slowly. McKinsey estimates in-person use of digital wallets (Apple Pay, Google Pay, Samsung Pay, plus private-label wallets like Starbucks and Walmart Pay) will increase at a 45% compound annual growth rate to reach nearly $400 billion by 2022. That may sound impressive, but it will represent less than 10% of U.S. consumer in-person POS payments by 2022. McKinsey says the bulk of the growth will come from “pass-through” wallets like Apple Pay, although the private-label wallets will also continue to grow.

According to eMarketer, the number of consumers using Starbucks mobile wallet in 2018 exceeded the #2 wallet, Apple Pay, by over a million. These figures include mobile phone users who made at least one proximity mobile payment transaction in the past six months.

Digital Wallet Transactions in the Past Six Months

+ Starbucks 23.4 million

+ Apple Pay 22.0 million

+ Google Pay 11.1 million

+ Samsung Pay 9.9 million

eMarketer predicts “proximity mobile payment users” will reach 55 million by the end of 2018 and grow to 74.9 million by 2022. Transaction value would increase from $62.29 billion in 2018 to $160.79 billion by 2022, the firm estimates.

By comparison, eMarketer estimates that by 2022 nearly 130 million mobile phone users will use a P2P service such as Zelle, Venmo or Square Cash at least once per month.

Why the disparity? 451 Research’s Jordan McKee says the value proposition for digital wallets remains “undeniably nascent.”

“This will take time, and requires converting the next wave of consumers who are perfectly content with cash and cards, which work well and are accepted ubiquitously,” McKee explains.

McKee says wallet providers must do a better job of aligning with retailers’ goals, such as decreasing transaction costs, driving loyalty and courting new customers.

Raddon suggests that financial institutions adopt incentives to drive digital wallet usage. The researcher lists these four steps to propel growth of wallets:

- Aim to have your institution’s card “top of the mobile wallet.”

- Fully integrate P2P into your mobile app

- Optimize your bill pay within the mobile platform

- Be creative with the use of payments incentives

Even though mobile wallets have not taken off in the U.S. as expected, their success in China and other countries suggests that the potential is there… and quite large.

“There is a rise in demand for seamless and integrated digital payments methods,” CapGemini notes. “As the [payments] industry moves to a collaborative ecosystem, the adoption of mobile wallets is expected to gain prominence.”