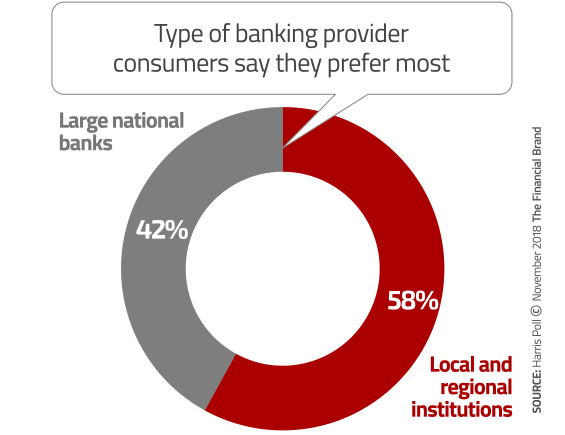

According to a study from The Harris Poll, a majority of consumers (58%) also said they prefer to deal with local and regional banking providers instead of large national institutions.

Considering that the top three banks in the country — Chase, Bank of America and Wells Fargo — have added $2.4 trillion in new deposits since the financial crisis, the survey results are a bright spot for beleaguered smaller banking providers.

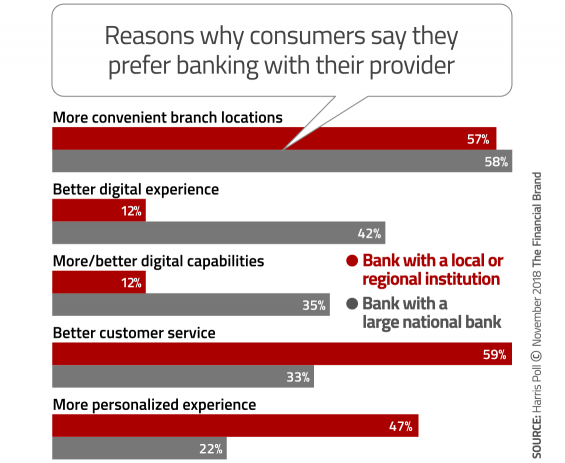

But the survey also probed why consumers prefer dealing with a larger or smaller bank or credit union. Here the results were mixed. Community and regional institutions handily win in “better customer service” and providing a “more personalized experience” — defined as using the customer’s name when greeting them and offering relevant products. Large national banks, however, deliver a “better digital experience” (ease of access) and “more/better digital capabilities” (e.g., mobile deposit, P2P payment, mobile account opening).

Mark Vipond, CEO of D3 Banking that sponsored the Harris survey, admits he didn’t expect as many consumers would prefer large national banks because of their superior digital offerings. That figure will continue to grow — something Vipond says should concern community banks and credit unions.

Vipond says smaller institutions have a slight leg up for now, but they will lose that edge if they don’t continue to advance digitally.

“It’s their game to lose,” he warns.

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Bigger Doesn’t Always Mean It’s Better

Alex Jimenez, senior strategist for Zions Bancorp ($67 billion assets), says that even for institutions at their size it’s tough competing against the megabanks. And for all the chatter about Amazon as a potential competitor, Jimenez says he worries more about Chase and BofA.

“Never mind Amazon. Chase and BofA are taking an unfair number of Millennials away from community banks and regionals.”

— Alex Jimenez, Zions Bancorp

“Never mind Amazon. The megabanks are taking an unfair number of Millennials away from community banks and regionals,” he gripes. “We don’t even make the short list.”

Despite the huge advantage in resources of the top banks, Jimenez and others believe they have vulnerabilities — lack of speed in development being one.

Michael Carter, EVP with Strategic Resource Management, observes that given their massive infrastructures, most of the large banks spend much more of their tech dollars on maintenance than they do on innovation. Things like toolkits for application programming interfaces (APIs) are out there now and affordable for smaller institutions, giving them a means to catch up, says Carter. But they have to take advantage of the opportunity.

Nobody’s Nailing Personalization

More than three in five consumers (61%) want their financial institution to anticipate their financial needs the same way online retailers do, the Harris survey found. Women and younger consumers in particular strongly agree on that point. The survey also found that more than three quarters (78%) of consumers are more comfortable with their bank or credit union having access to their personal data than a large technology company.

“Banks and credit unions own the trust card,” Carter points out, “for now.”

Taken together, these two findings clearly suggest a path forward for traditional banking providers, provided they seize the moment to upgrade their digital capabilities and mindset — particularly to deliver a more personalized experience.

Nearly everyone in banking agrees personalization should mean much more than using someone’s name in an email message. Broadly it should be anticipating consumer financial needs and interests and proactively presenting them with offers and messages in their preferred channels.

“Too often we define ‘customer service’ as something reactive,” says former banker turned consultant Ginger Schmeltzer. “It should be proactive — like Amazon and Apple — getting ahead of consumer needs.” According to Schmeltzer, customer service should be about helping people meet all their financial needs. This could take the form of something as simple as: “We see you just moved. Can we help?”

Banks and credit unions, however have quite a ways to go, according to Jimenez.

“Banking is woefully behind on personalization,” bemoans Jimenez. He has accounts at a couple of big banks, and he’s frequently surprised by how little they personalize communications, particularly considering how much his data tell them; it’s nowhere near the level of personalization that the banking trade media so often writes about. For example, he recently received an email from one of them with the salutation, “Dear Valued Customer.”

Consultant Michael Carter recounts how he received a message from his bank recently suggesting he should consider refinancing his home loan. The problem was, he received the message while he was waiting to wrap refinancing his mortgage… with the same bank!

Not everyone buys into the Amazon hype either. Jimenez, for one, doesn’t believe Amazon is as great at personalization as they get credit for. As an example, it’s not uncommon for Amazon users to get “You might also like” messages showing the very product that person purchased the day before.

“That’s not personalization,” Jimenez quips. “That’s just a lazy algorithm.”

The banker admits he is impressed by the Happy Birthday messages he gets from Capital One Bank. “But they’ve been doing that for ten years.” He asserts that little else has been done in the industry beyond that.

Nevertheless, Schmeltzer thinks things like the birthday message are important. “Look at how such a small thing can be so memorable,” she says of Jimenez’s experience. While she isn’t as pessimistic as some analysts in the banking industry — indeed she thinks that a lot of work toward personalization is happening — she does agree that progress is slow.

Digital Systems Suffer From Age and Decay, Too

When the term “legacy systems” comes up, most often it’s in reference to aging core processing platforms and how their decrepit inflexibility hampers financial institutions’ to implement many advanced digital features.

There’s another, counterintuitive perspective though. According to D3’s Vipond. He maintains the websites and mobile banking apps used by well over 90% of banks and credit unions in the U.S. are now getting creaky themselves. They’re anywhere from 5 to 15 years old and their functionality is very static.

Tech that’s 5-15 years old may not seem so when compared to 25-40 year-old mainframe systems. But for customer-facing technology, that’s pretty elderly, because digital capabilities change and evolve so quickly. Two examples Vipond cites are card-control features and data analytics.

According to Vipond, the industry suffers from additional issues rooted in its past. For instance, the vast majority of banking providers still see branches, online, and mobile as separate channels. He contends that they are — or at least should be seen as — all part of one evolving channel that will eventually include features like conversational banking from a consumer’s car and more.

“Progressive banks think of branches as part of their digital transformation.”

— Michael Carter, Strategic Resource Management

“Progressive banks think of branches as part of their digital transformation,” he adds, so that consumers can, if they wish, start an application on their phone and continue in the branch without missing a beat.

But alas, nothing in the financial industry moves fast, a point the veteran banking technology executive readily concedes. But that doesn’t temper his ultimatum: banks and credit unions must get their digital acts together in the next two to five years. If they don’t they will face one of two likely futures: either they will get acquired or become dinosaurs.

To avoid that fate, Schmeltzer strongly recommends that “those who control the purse strings be deeply involved in digital.” She encourages banks and credit unions assemble teams to better understand the needs and preferences of younger consumers, and to have a large number of employees actively involved in the organization’s digital transformation.

Michael Carter has seen the most success where banks and credit unions have true buy-in from the very top — not just easily forgotten words in an all-staff email once a year. But real commitment includes things like new org charts. And compensation packages.