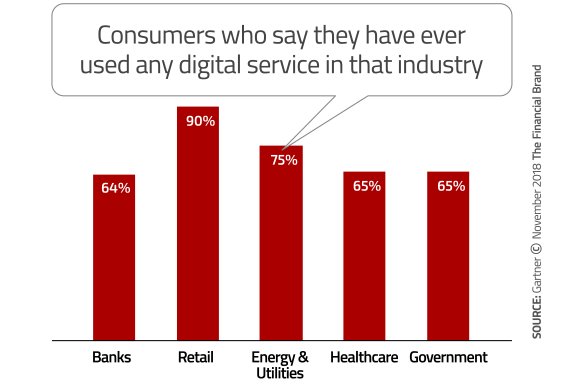

When Gartner surveyed consumers about their perceptions of digital services provided by banks and ten other verticals, there was some surprising good news. Consumer perceptions of banking providers’ digital services actually ranked highest, tied for first place with the retail industry.

The bad news? That doesn’t mean consumers are impressed, or even mildly satisfied. They believe banking has substantial room for improvement.

Gartner’s survey probed consumers’ feelings surrounding three factors: ease of use, level of trust, and benefits received. Overall, consumers were generally underwhelmed with all industries. While banking has made some strides, the lukewarm results show there is still a long way to go.

Gartner used a 100-point index system to rank industries. Despite leading the pack, banking providers only scored a rating of 61 — a mere nine points higher than the lousy score collectively given to government providers.

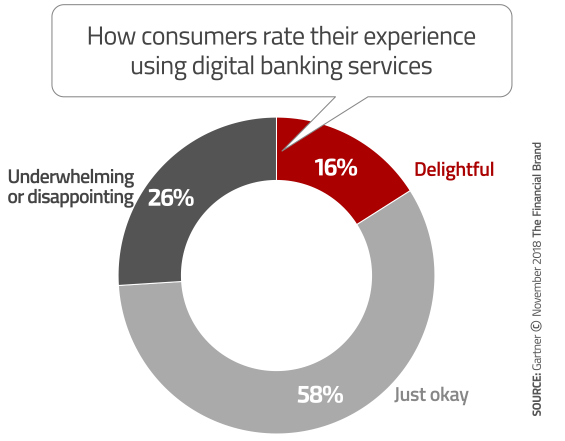

While banks’ digital banking tools and solutions seem to be “delightful” to 16% of users (with an index score of 75-100), the report notes that a substantial 26% of those using banks’ digital services find them “underwhelming” (scores 25-50 in the index) or downright “disappointing” (scores 0-25).

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

58% of the study’s respondents fell into the “okay” rating category. This level of indifference is something most financial institutions should find troubling. You don’t create passionate brand advocates by scoring a “meh” in satisfaction studies.

As tempting as it may be for the banking industry to pat itself on the back for ranking highest and keeping pace with retail, that would be a big mistake. Banking providers should instead see the results of Gartner’s study as a clear warning. As the report says, “even avid users of many organizations’ digital tools, services and advice endure less than ideal experiences in order to extract what value they can from those interactions.”

“There is a lot of room for improvement among banks,” says Brad Holmes, Managing Vice President at Gartner and one of the authors of the survey report. “It’s a glass-half-empty situation, with a lot of room still to fill.”

The report notes that both banks and retailers put more stress on trust, ease of use, and benefits for the public than some of the other categories do, but added that “organizations in every industry still have an opportunity to differentiate on basis of better digital experiences.”

Many People Still Prefer In-Person Interactions: Luddites or Legitimate Concerns?

The report finds that less than two-thirds (64%) of banking consumers use the industry’s digital offerings. Of the many that don’t, 51% say they still prefer to deal with humans. One in ten don’t even see how digital services could be useful.

Gartner says it’s critical that banking providers improve their digital services significantly, or they will never be able to wean these holdouts from traditional channels like brick-and-mortar branches and the contact center.

Holmes also suggests that consumers’ security concerns — worries about hacking of bank accounts and credit cards, or theft of personal information — is also an influential factor that financial institutions must address before converting holdouts over to digital banking solutions.

One bright spot in the findings, according to Holmes, is that banks came in first place among all industries for consumer trust. “Banks have recovered quite far from the crisis in 2008,” says Holmes. Nevertheless, 18% of consumers surveyed said they aren’t using banks’ digital services because they still don’t fully trust banks.

Digital Banking Tools Aren’t What They Could Be

The survey asked consumers about benefits associated with their digital services, using an eight-part test tailored to each industry.

“Banks led the pack in delivering benefits like saving time, saving money, or providing people with convenient and easy payment methods so they can pay friends and family,” Holmes says.

However, few consumers felt providers in any category studied delivered on all eight potential digital benefits. Among banking consumers, only one in ten thought banking institutions were giving them six to eight benefits, and 44% felt they were only receiving one or two benefits out of the possible eight. Banks hit an average of 2.92 benefits — not much beyond the average 2.25 provided by the government category.

Focus on Ultimate Utility, Not Fancy Functionality

With so much room for improvement remaining, where should banking providers start? Gartner suggests that keeping the design of digital services simple would be a big first step. Don’t design things that are cool for their own sakes, Holmes suggests. Instead, design them to help consumers get their banking done more quickly.

“People’s attention spans are very short,” Holmes explains. “Sometimes digital designers can make things unnecessarily complicated.”

Improving both chat and voice digital assistants will also help, according to Holmes, potentially saving financial institutions money and providing return on investment as consumers shift from expensive phone calls to staff and shifting to self-service.