Banking was once a local game where a Main Street presence dictated the share of deposits and loyalty was based on trust. Today, it is all about digital interaction, convenience and service. The better the digital experience, the bigger the share of deposits and the more loyal the customer base.

An article from McKinsey says banks that excel at digital brand-building, advanced analytics and machine learning will protect and even grow their market. “In the coming years, digital presence will start to outweigh local scale, and therefore significant digital investment will continue to drive higher growth or ROE,” says McKinsey.

In addition, analysis from The Wall Street Journal reveals that by the end of 2017, the three largest U.S. banks held just under one third (32%) of the country’s deposits.

The truth is that, in a digital world, the more deposit customers you have the more products you can sell to those customers, growing revenues and profits. And it’s a virtuous circle. As revenues, profits and customer numbers grow, so does the brand, and digitally focused banks can invest more in digital.

Read More: Financial Institutions Need Digital Banking Solutions, Not Branches

Navigating Credit Card Issuing in an Uncertain Economic Environment

Build a modern credit card strategy that balances profitability and risk, adopts the latest technology and delivers the customization that cardholders demand.

Read More about Navigating Credit Card Issuing in an Uncertain Economic Environment

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Competition Grows for Digital Consumers

The big banks, however, don’t have the field to themselves. Competition increasingly is coming from non-traditional players whose heart is pure digital and whose aim is to provide a better service cheaper.

For example, Ant Financial, the financial-services arm of Chinese internet giant Alibaba, offers insurance, loans, payments and money management all on a digital platform. And the organization has its eyes set on expanding quickly beyond China.

With a market cap in excess of $150 billion, almost twice that of Goldman Sachs, Ant Financial has deep pockets and has just raised $14 billion for global expansion. The threat of disintermediation, where a third-party such as Ant Financial comes between a bank and its customers, is very real, making digitization vital. Already, it is common for consumers to hold up to eight different bank accounts, often from different providers including digital-only challenger banks.

The Power of ‘Being Digital’

The situation is far from hopeless for traditional financial institutions, so long as they acknowledge the necessity of becoming digital. Truly being “digital to the core” addresses the increasing competition, the threat of disintermediation and the unrelenting pressure of new regulations. Being digital end-to-end allows banks and credit unions to work easily with fintech firms, regtech organizations and other third parties to provide a level of service that will impress consumers and build loyalty. In return, these consumers become brand champions, telling friends about easy-to-use services, innovative solutions and highly personalized products.

Banking of old was a pretty standard affair, where a one-size-fits-all offer was presented in a take-it-or-leave-it manner. In the past, most consumers would “take it.” Personalizing digital solutions to meet individual needs was unheard of. Real-time engagement was inconceivable. The technology did not exist to do the former at scale, or the latter at all. Business stemmed more from trust than great service. Loyalty was a given.

Today, all that has changed. Consumers want convenience — many times at their fingertips, while on the go. All other areas of their lives offer digital convenience, from online shopping to calling an Über ride to Googling questions to using social media.

People increasingly look to their financial provider for similar levels of service now. If they don’t find it, they’ll ask their friends about what’s good and go there.

Financial Institutions are Responding

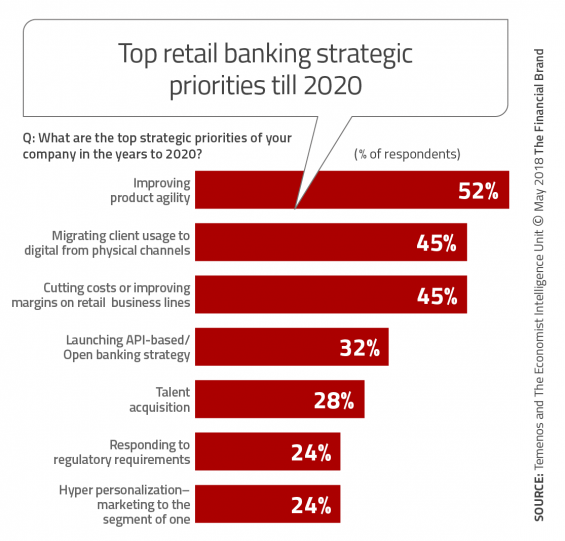

Some banks are on the case. A banking survey from Temenos/EIU found that 52% of respondents put product agility as a top strategic priority, and are keen to restructure their business models to ensure new products and features can be integrated fast.

Read More:Banks Play Catch Up With Technology As They Concede The Battle for Payments

Banks and credit unions realize that just as other industries capitalize on technology, financial institutions must also provide personalized, rapid fulfillment via easy, seamless customer journeys. While trust is still vital, great service is playing an increasingly critical role. Get it right, and not only will loyalty follow, but so will new customers.

The changed expectations of today’s consumer demands new approaches to banking technology, including:

- Straight-through processing to provide real-time banking;

- Omni-channel access;

- Data analytics and artificial intelligence (AI) to create offers and advice tailored to personal circumstances;

- Open banking to facilitate value-add services with third-party providers.

Think about how tedious it is to get a loan for a car. You must fill out forms, have your credit rating checked and application approved before the money can be released. It can take days — maybe just hours, if you’re lucky. But it doesn’t need to be like that. It could be instant and it could save financial institutions money while giving them a competitive edge.

All the technology exists for consumers to take a picture of their driver’s license and send it to the financial services provider, who will pull up that individual’s details and decide there and then whether the would-be car buyer is eligible. The application can include being able to check the car’s history via its vehicle identification number (VIN), for which the bank or credit union can issue a valuation to ensure the customer is not overcharged.

For this type of service, data, digital and real-time go hand-in-hand. The same goes for automation and AI. With open banking, the potential for financial institutions to be at the heart of a customer’s daily life, providing a 360-degree experience, is suddenly very real.

Traditional Institutions Have an Advantage

Legacy banks and credit unions have two significant advantages over those who threaten to disintermediate them — trust and data. Trust as an advantage, however, will only last so long now that consumers are becoming increasingly comfortable with non-traditional players. But by leveraging data and becoming digital financial institutions can build on that trust.

Those that succeed in doing this won’t just create a loyal customer base, they’ll create loyal brand evangelists.