Consumers aren’t always logical in their banking habits. They’re scared to death about data security and privacy, but that doesn’t stop them from using online or mobile banking tools heavily. In fact, consumers’ digital banking engagement overall is growing.

People are also fairly adventurous, willing to try new things even when it means taking a few risks. Despite years of bad press about cyberattacks and data breaches, their enthusiasm for digital banking solutions has not dampened. Indeed, they want to do more things digitally related to their financial lives.

In its annual survey on consumer payments, Fiserv found that consumer use of online bill pay grew steadily year over year, with 59% of consumers saying they use it today. They have also expanded their use of newer services, including digital wallets, person-to-person payments, and mobile bill pay. And the increases weren’t just slight, they were significant:

- Digital wallet use is up 53%

- Mobile bill pay is up 48%

- Use of P2P services provided by a financial institution are up 44%

This is not to say consumers still don’t have major security concerns; of course they do. Fiserv’s survey of more than 3,100 adults found that 53% of them “strongly distrust internet security and privacy.” Somewhat paradoxically, an equal percentage say they “want to be connected to the web at all times.” The good news? Most people see more advantages than risks when it comes to digital commerce and digital banking.

Read More:

- Building The Killer Mobile Banking App

- Consumers Threaten to Bail If Banking Providers Can’t Improve Digital CX

- Banking Providers Fail to Sell Benefits of Mobile Banking and Payments

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

The New Mobile Features Consumers Want Most

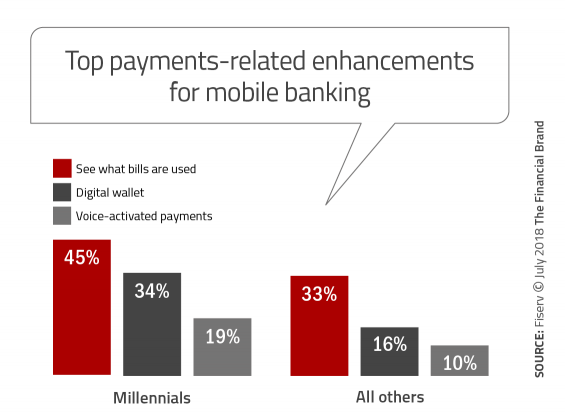

Fiserv probed respondents about what new mobile banking features consumers are most interested in. For active mobile banking users, the top payments-related enhancements, as shown in the chart below, are the ability to see when bills are due, digital wallets, and voice-activated payments. Not surprisingly, Millennials are more likely to express interest in these enhancements across the board.

Other mobile banking enhancements for which consumers expressed interest include:

- Ability to temporarily deactivate credit and debit cards in case of loss or theft (48%)

- Instant balance information (36%)

- Touch ID (31%)

- All-account access (29%)

“One third of consumers say they want to use mobile banking features but don’t know how.”

Even though interest in new features and functions is growing, the study found that nearly half (46%) of consumers are confused by the array of financial products and services available today. Furthermore, one third (33%) said they want to use mobile banking features but don’t know how. No doubt some of the confusion comes from the plethora of new payment apps that have poured into the market, often with quirky names (think: Venmo, Zelle). Their frustration presents both a challenge and opportunity to financial marketers.

“Consumers are continually raising the bar for what they need and expect when it comes to moving and managing their money,” says Devin McGranahan, senior group president of Fiserv. “The study reinforces the idea that payments are more than a transaction and central to the brand experience.”

Mobile All About ‘In The Moment’

Consumers who use online and mobile banking use the two channels for different purposes to some extent, the study found. As the report states, “Online banking is used to get things done, but perhaps not always urgently.”

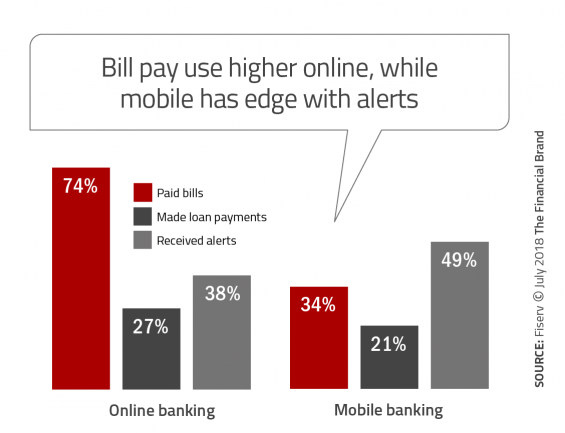

As shown in the chart below, three quarters of consumers use online banking to pay bills compared with just over a third that use mobile banking to pay bills. Like all surveys, this one is a snapshot in time, and it’s likely this gap will almost certainly shrink by the time the next survey is conducted.

Mobile banking has the edge in the percentage of consumers who rely on this channel to receive alerts for bills that are due or for potential fraudulent activity. People making loan payments on the two platforms is about even — both less than three out of ten.

84% of consumers use mobile banking to check balances — often an “in the moment” function — and 55% of consumers use online banking to transfer money between accounts at the same financial institution.

Other key points uncovered by Fiserv in their research:

- Mobile bill pay ‘high rollers’. Among those most likely to use mobile bill pay are those with more than $1 million in investable assets (82%) and Millennials (74%).

- Prime auto-pay users. High-net-worth consumers also are the biggest users of automatic payments at 83%, followed by seniors actively involved in household bill management at 75%. Use of this payment convenience is common across all age groups, however, with the overall average at 67%.

- P2P on the move. Person-to-person payments offered by a financial institution were used by just 17% of the survey respondents (a figure that is bound to change given the rapid growth in use of Zelle, the P2P service offered by financial institutions). The three most-cited reasons for P2P use were “saves time and hassle (54%); “it’s convenient” (50%); and “I have more control” (36%).

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Security Still Troubles Many, Especially Millennials

As noted earlier, consumers’ strong distrust of internet security and privacy generally has not curtailed their interest in online and mobile banking and bill pay. It would be foolish, however, to think that the security issue is toothless.

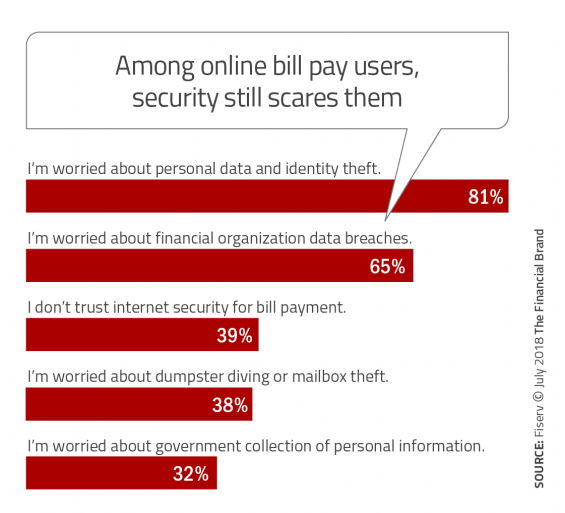

The survey’s findings make clear that concern over data security and privacy is near universal — eight out of ten consumers say they’re worried about it. And almost four out of ten users of online bill pay say they don’t trust internet security for…wait for it: Bill Pay!

As Fiserv notes, this data is both a reminder to banks and credit unions to do everything possible to prevent data breaches as well as an opportunity to educate consumers about security steps and best practices they can take.

Lest you think that younger consumers — the digital natives — shrug off security and privacy issues, think again. Of all the age groups in the research, “early millennials (roughly age 28-38) involved in bill management are most likely to have security concerns,” says Fiserv. 64% of this cohort say they are worried about paying bills digitally.