We live in an era of digital Darwinism, when technology and society evolve so rapidly and profoundly, that organizations in every industry face a stark reality, adapt or die. While that may seem dire, with adaption comes great opportunity to connect with an evolving generation of consumers and employees seeking more relevant and meaningful experiences.

And, that’s the thing, as times, tastes and trends change, so must products, services and processes. How and why organizations work, what they sell, and the value they offer, must advance to align with customer behaviors, expectations and predilections. That’s the hard part.

In just the last year, I’ve presented to executives leading innovation and digital transformation efforts at banks and credit unions all around the world. The one thing I consistently leave with is hope that these leaders see the criticality of change in these disruptive times.

In all honesty, I also walk away with concern. There’s much to do, much to learn and much to unlearn to reshape convention into invention in real time. Disruption is a pandemic and digital Darwinism doesn’t measure past success or current business momentum. It simply shifts. The good news is that digital Darwinism also favors those that try (strategically) and prioritize investments in technology, people, operations and mindset.

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Customer Experience (CX) is a Prime Catalyst for Innovation

Over the years, in my research of corporate innovation, digital transformation and service innovation, I’ve found that the most progressive organizations are prioritizing customer experience as a means of orchestrating focused advancement.

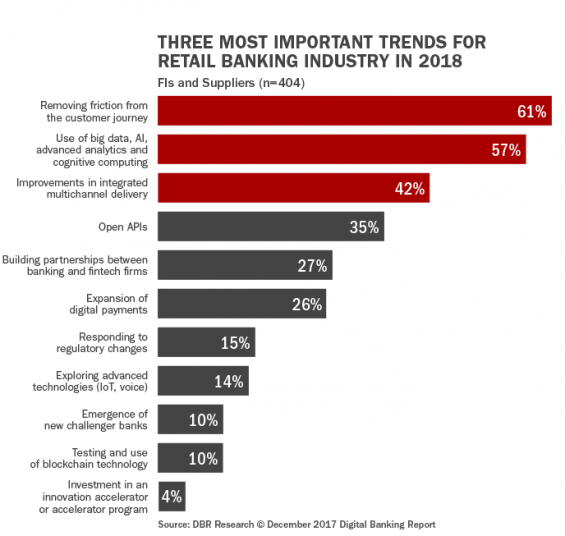

In its latest research that studies how the financial industry is planning ahead, the Financial Brand learned that the number one, single most important trend for 2018 is, optimizing the customer experience (61%).

Specifically, 86% of financial organizations are aiming that optimization at key touchpoints that define the journey. More so, organizations are looking to personalize those touchpoints. 69% are investing in data to optimize online experiences.

When you combine the previous points, 1) optimizing the customer experience. 2) modernizing key touchpoints and 3) using data to personalize touchpoints, other top priorities for the year represent a playbook for others financial institutions to follow.

- Train teams in new techniques, channels and disciplines – 55%

- Understand how mobile users research and buy products – 53%

- Understand when and where customers use different devices – 45%

Banks and Credit Unions Must Operationalize Innovation and Adaptation

There’s still much work to be done however. Remember, digital Darwinism is the result of technological and societal evolution. Evolution is constant. Banks and credit unions must not only strive to adapt and improve, they must also explore the unremitting gaps that separate current roadmaps from important digital and behavioral trends

The previously referenced data is promising and demonstrates how companies seek to get closer to connected customers and deliver more relevant products and services. At the same time, Financial Brand, found that many companies may believe they’ve achieved digital maturity.

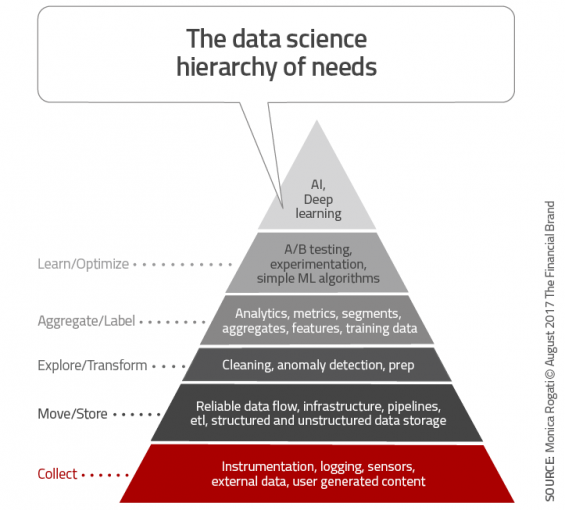

In its research, it was discovered that a stunning 71% of companies cite that they already understand customer needs and behaviors. When you dive a bit deeper, it’s difficult to imagine how. Only 40% reported that they have studied customer/member journeys. And, just 21% stated that they are investing in AI/machine learning to assess data to help predict future customer/member needs.

The disruption that banks and credit unions face isn’t simply solved by investing in modern digital solutions. Innovation is everything from operations to products and services to experiences must now also be systematized. Banks and credit unions don’t just compete against one another, they also compete against any brand that’s pushing customer behaviors, expectations and predispositions forward.

Take for instance, the recently published “Millennial Disruption Index,” a three-year study conducted by Viacom, banking ranked highest for risk of disruption ahead of household goods and discount retail. Over 10,000 Millennials were surveyed about 73 companies across 15 industries.

Of those who participated, 53% don’t think their banks offer anything different than other banks. In five years time, 68% and 70% Millennials respectively believe the way we access our money and pay for things will be completely different. Furthermore, one-third believe that they won’t need a bank at all. Scary isn’t it?

Millennials believe that innovation will come from the tech sector. Nearly half of participants are counting on start-ups to overhaul the way banks work. Three out of four Millennial consumers stated that they would be more excited about a new financial offerings and services from Google, Amazon, Apple, etc., than from their own bank.

Inspiration Comes from Unlikely Sources and It’s Always Human

When it comes to innovation, executives should look beyond banks and credit unions. For inspiration and to also feel the shock of urgency, look no further than the technology brands mentioned by Millennials. But to really break through the constraints of legacy thinking, learn from Mark Zuckerberg and Facebook. Despite some recent challenges, one of Zuckerberg’s greatest assets is his adeptness in identifying threats in competing and surrounding markets.

For example, he’s constantly tracking where younger consumers spend their time and the technologies that change their behaviors. In the last several years alone, Facebook has spent billions in its acquisitions of Instagram, WhatsApp and Oculus. Facebook is becoming more than a social network, it’s becoming a lifestyle. A lifestyle that is continuously needing to adjust based on changing human behavior.

A recent shakeup among the executive staff at Facebook signal big things to come, and financial executives should shudder first, then act. Zuckerberg moved some of the company’s best executives to lead new blockchain efforts “to explore how to best leverage Blockchain across Facebook, starting from scratch.” The company is also rumored to soon launch its own cryptocurrency to facilitate payments on the platform.

It’s reported that Zuckerberg is enthusiastically watching fast-growing Telegram, a private messaging app based on blockchain and also Robinhood, a wildly popular investing app and crypto trading platform targeted at young audiences.

If Facebook is making big shifts and bets on technologies that today, do not affect its business model, while also trading at record highs, then there’s a lesson here for every executive.

Customers, and employees for that matter, are evolving faster than most executive mindsets and banking models. To survive and thrive in digital Darwinism, takes innovation, not just in technology, but also in people, processes, products and services.

The greatest insights lie among evolving customers and the brands that are pushing them in new directions. It’s time to learn to unlearn to build anew. Start with these questions, what do consumers value and why among the brands that they use and love and what does it mean to be a bank or credit union that serves them in ways that align with their immediate needs and their goals and aspirations