More and more marketing budgets are being spent on direct communications to acquire, welcome, onboard and cross-sell customers and members. Without an aggressive multi-channel welcome and onboarding communications process, the investment in building awareness and pre-sale engagement will be lost. The negative impact of losing a customer or member after acquired is often several hundred dollars, with the impact of customers who attrite rarely measured by financial institutions.

The examples of direct mail, email and web communications in this financial service direct communication showcase were provided complements of Mintel Comperemedia. Their searchable competitive database tracks direct mail, email, print advertising, mobile advertising and online banner advertising and is a go-to resource for The Financial Brand. We thank them for their partnership in this effort to show some best-in-class bank and credit union marketing examples.

New Customer Welcome

Welcoming new customers to a new financial institution can not be taken lightly. As they say, “You never get a second chance to make a good first impression”. Whether the new account has been opened in a branch, online or with a mobile account opening tool, the welcoming of the new customer/member is the first step in the important onboarding and engagement process.

Without immediate engagement, the new household could be lost as quickly as they have been acquired. This is the stage of the onboarding process where a financial institution describes how to maximize the value of the new account, what communications may come next, and how to connect with customer care if there are issues.

Remember, you can not over communicate in this step of the customer journey. You can send multiple communications through multiple channels to determine what channel(s) the new household prefers. If email is used, you can also build links to other important parts of your website to explain account use and/or connect other services to those being opened.

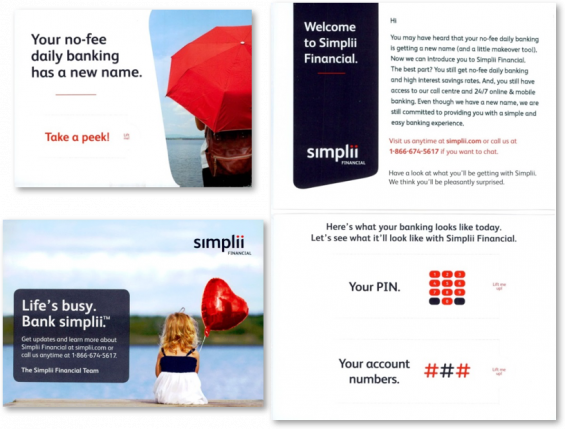

In the example of a welcome communication below, CIBC re-branded their Simplii Financial product and provided customers with a pin and account number concealed below pull-tabs, adding a layer of protection for personal information.

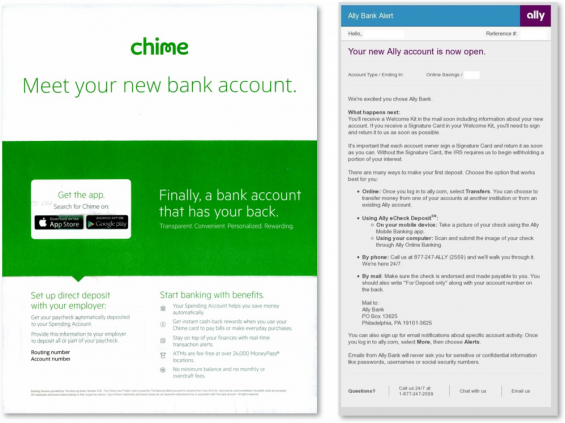

Online banks Chime and Ally welcomed new customers with informational direct mail and email campaigns. In its welcome direct mail campaign, Chime encouraged new customers to take advantage of benefits such as automatic savings, instant cash-back rewards, and alerts.

In emails, Ally informed new customers that a welcome kit would be arriving via direct mail. The email then provided information on making an initial deposit.

How Banks Are Fortifying Their Data Against Increasing Cyber Threats

This webinar from Veeam will detail the value of working together across your organization to be better prepared in cyber defense and response readiness.

Read More about How Banks Are Fortifying Their Data Against Increasing Cyber Threats

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

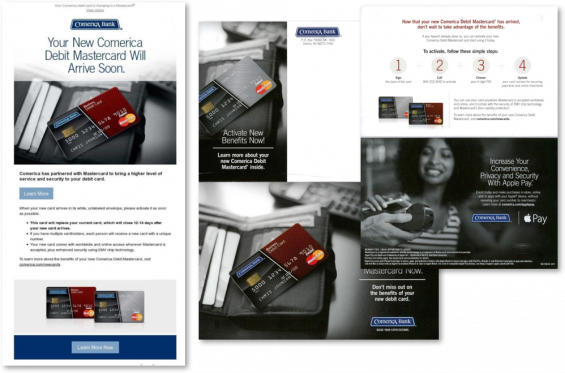

Comerica Bank used direct mail and email to welcome new debit card customers. The communication featured images for both its consumer debit card and its business debit cards. Both communications encourage immediate activation and use of the card. The direct mail communications promoted Apple Pay as well.

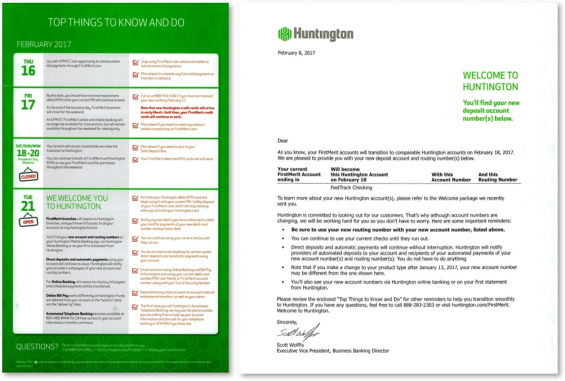

Huntington provided FirstMerit customers with a timeline of “Top Things to Know and Do” as they welcomed and began to onboard business banking customers acquired through the purchase of FirstMerit in 2017.

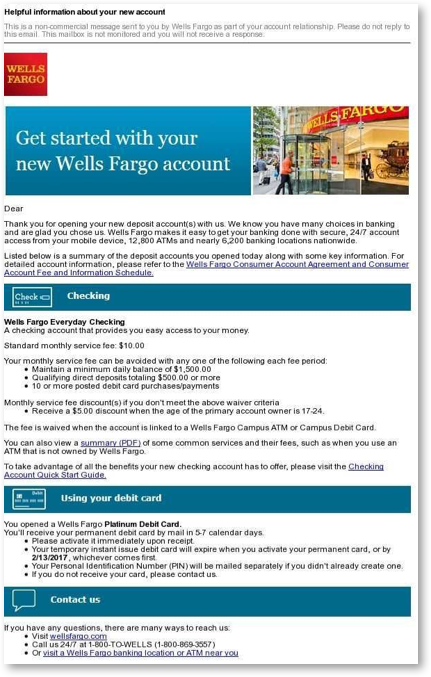

Wells Fargo used direct mail to not only welcome new deposit customers, but to also provide them a recap of all accounts opened at the time of branch visit. While the tactic may be partially in response to recent cross-selling controversy, the strategy of providing a detailed, personalized ‘receipt’ of all accounts opened is a great way of communicating the value of the multiple accounts.

TCF bank welcomed new customers with an email thanking them for opening their account. Not only did the campaign provide a list of account features, the email also included a “What’s Next?” call-to-action button that moved the communication to pages on how to better use the account and open new ancillary services.

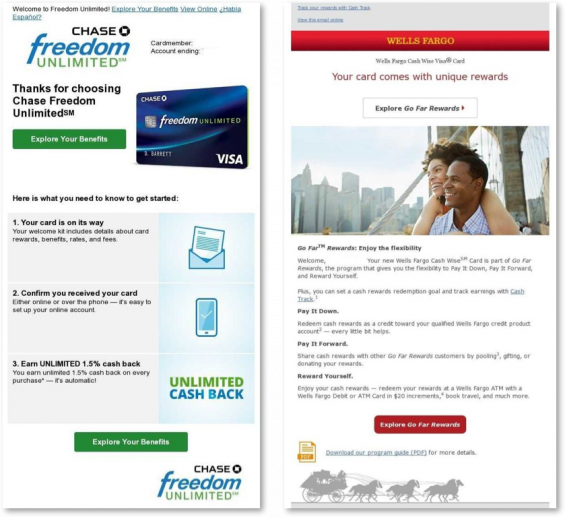

Chase Freedom Unlimited and Wells Fargo Cash Your Way customers were invited to explore the benefits of their cards. Chase’s email was sent as part of the onboarding and activation process. Wells Fargo’s benefits email was part of a sequence of customer engagement emails after the card was activated.

Citibank welcome emails featured account management options that could be done online, including going paperless, setting up alerts, and paying bills. As an added feature, Citibank developed personalized welcome videos that could easily be watched on a computer or mobile device. The personalized video used the customer’s name and was specific to the type of card opened.

Banking isn’t the only industry to use welcome communications to begin onboarding and engaging with a new customer. Travel, hospitality, loyalty programs and other industries use email and direct mail to welcome customers. Amazon is no exception, using email to welcome new customers to Kindle, Amazon Prime and even to purchasers of their digital voice assistant, Echo Dot and Alexa.

To see great examples of new customer onboarding for deposit products, credit cards and lending solutions as well as a discussion of the importance of central management of early customer communications and the customer journey, go to the following page.

New Customer Onboarding

Beyond the initial welcome (that is delivered within 2-5 days of relationship initiation), the new customer onboarding process usually extends an additional 3-6 months. The purpose of onboarding communications is to increase broader usage of the new account.

Beyond the initial welcome (that is delivered within 2-5 days of relationship initiation), the new customer onboarding process usually extends an additional 3-6 months. The purpose of onboarding communications is to increase broader usage of the new account.

These communications many times focus on products like mobile banking, digital billpay, direct deposit and additional services like mobile deposit, account alerts, etc. Often, the sequence and cadence of communications is determined by the new customer’s level of engagement and actions taken by the new customer at each stage.

Despite the value of this stage of the customer journey, only half of the financial institutions surveyed by the Digital Banking Report currently have a structured new customer onboarding process. This is the same as leaving hundreds of dollars in potential customer value untapped. More importantly, without an expansion beyond the original account opening process, there is a greater possibility the new customer will never make your organization their primary financial institution (PFI) and may leave your institution altogether.

Below we illustrate some of the best implementations of onboarding we have seen. Each example uses a multi-step communications process over an extended period of time. These are excellent examples which can provide a guide to organizations wanting to begin or improve an onboarding process. Again, we would like to thank Mintel Comperemedia for access to their searchable competitive database that tracks direct mail, email, print advertising, mobile advertising and online banner advertising and is a go-to resource for The Financial Brand.

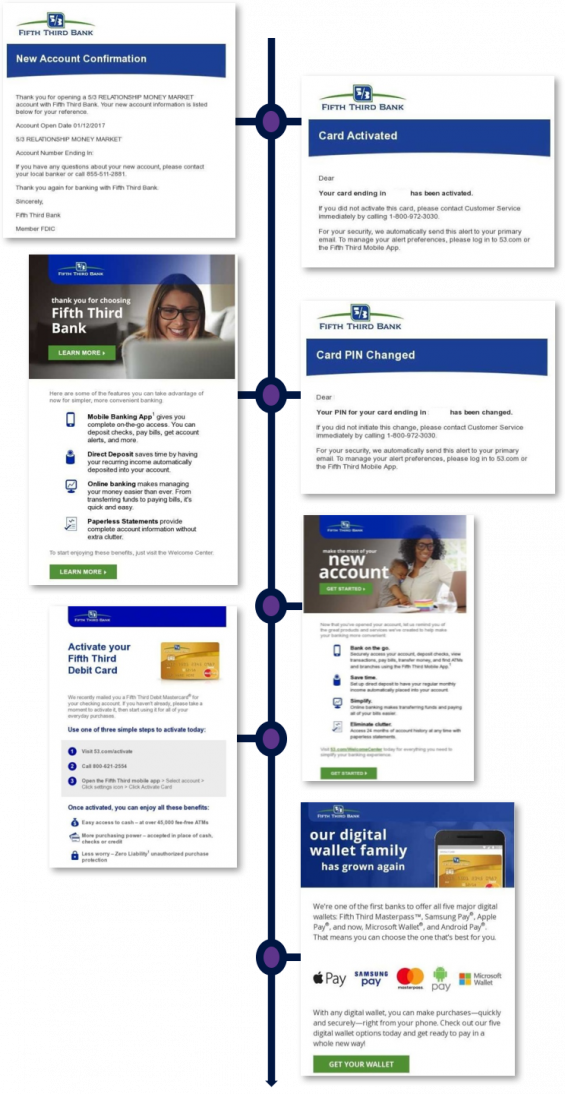

Fifth Third sought to keep customers informed of account details while promoting account benefits and mobile payments in the first three months of the relationship.

Fractional Marketing for Financial Brands

Services that scale with you.

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

PayPal had a set, five-part onboarding series for new cardholders with each email addressing a different feature. Further campaigns encouraged cardholders to use PayPal for online purchases, or to pay taxes.

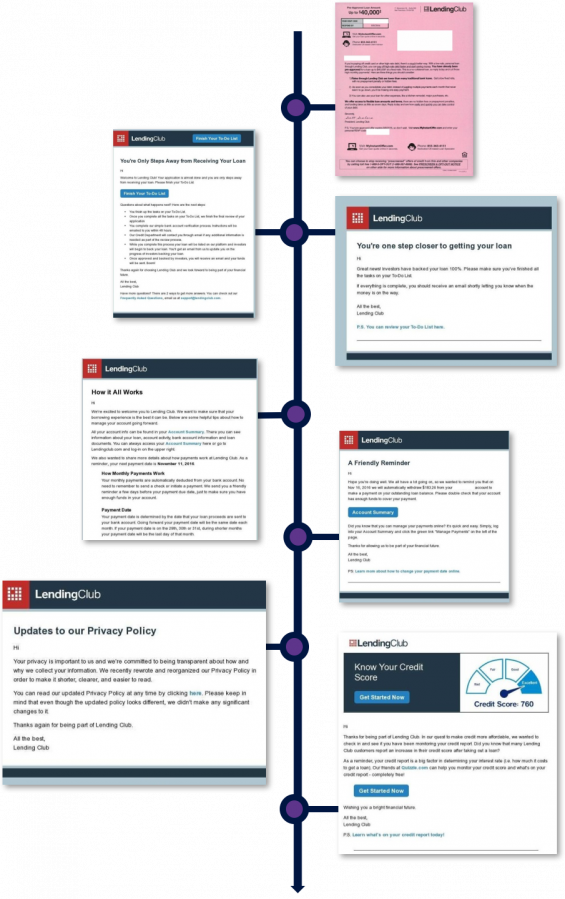

LendingClub welcomes customers to its lending service while the customers’ application is still being processed, but keeps them informed throughout the entire borrowing process. Emails then provided information on the process, online account management, as well as its privacy policy and an offer to view their credit scores.

Building a Powerful Customer Journey

Financial services organizations try to ensure that consumers will be happy whenever they use their product or interact with an employee or customer service. Focusing only on the use of a product misses the bigger, and potentially more important, component of satisfaction – the customer’s end-to-end experience. It is important to look at the customer’s experience through their eyes – during every step of the customer journey. With this perspective, value can be optimized and satisfaction maximized.

Customer journeys include communications and interactions that occur before, during, and after the product or service is purchased. These customer journeys can be long, across multiple channels and touchpoints, often lasting weeks or months. Welcoming a new customer and building engagement through an onboarding process is a perfect example of how to improve the customer experience beyond the use of the service. Even cross-selling can improve the experience if the service(s) offered are in alignment with the consumer’s needs at the time the need is highest.

The challenge with building a strong customer journey is the siloed nature of a banking organization. In many cases, each individual silo is the keeper of the touchpoint communications the customer receives. This can create an overload of uncoordinated communications that remain in silos and not sen from the perspective of the customer.

According to McKinsey, “Whether because of poorly aligned incentives, management inattention, or simply human nature, the individual product and service owners that manage the communication touchpoints are constantly at risk of losing sight of what the customer sees (and wants) – even as the groups work hard to optimize their own contributions to the customer experience.” This is why most organizations use a singular centralized team to coordinate early communications that are built using multiple channels and delivered with the customer experience front and center.