Do you know the difference between a chef and a cook? Often, the two terms are used interchangeably to indicate someone who is working in a kitchen, without distinguishing whether the person is cutting vegetables as opposed to a person who has either had advanced education, a long apprenticeship or both. The chef is the mastermind behind a menu that creates buzz and supports a successful restaurant with an amazing culinary experience.

According to the Reluctant Gourmet, “Most people agree that a cook is lower-ranking than a chef, and that chefs themselves vary in rank. For example, an executive chef is the top of the line, while sous chefs, chefs de partie, and other professionals might have the right training, but are still working toward their top professional goals.”

So, what does the restaurant business have to do with banking. On the surface, it means that there are different designations of bankers, with different skill levels based on education and training. More importantly, it means that certain bankers are more replaceable than others. And, as automation, data, and advanced analytics play a larger role in the banking industry, it means that there may be increased need for more ‘chefs’ and more risk of being a ‘cook’.

Fractional Marketing for Financial Brands

Services that scale with you.

CFPB 1033 and Open Banking: Opportunities and Challenges

This webinar will help you understand the challenges and opportunities presented by the rule and develop strategies to capitalize on this evolving landscape.

Read More about CFPB 1033 and Open Banking: Opportunities and Challenges

Technology Impacts Future of Work

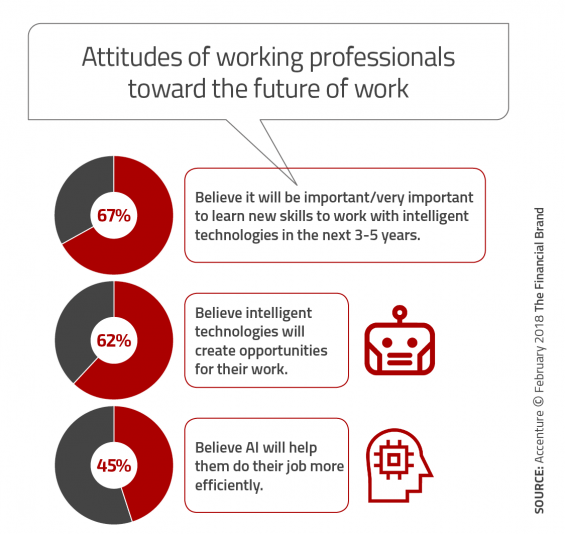

Losing a job to a robot might be a fact of life for many workers across all industries. A new study predicts that up to a third of all American jobs will be lost to automation within the next 13 years. The study by McKinsey Global Institute, says that nearly 70 million U.S. workers would have to find new occupations by 2030. This will happen due to advances in robotics, artificial intelligence and machine learning.

Vikram Pandit, who ran Citigroup Inc. during the financial crisis, said developments in technology could see 30% of banking jobs disappearing in the next five years. The basis of this prediction is that artificial intelligence and robotics reduce the need for staff in roles such as back-office functions.

“Everything that happens with artificial intelligence, robotics and natural language – all of that is going to make processes easier,” said Pandit, in an interview with Bloomberg. “It’s going to change the back office.” In fact, many of the larger banks are using technologies including machine learning and cloud computing to automate their operations, forcing many employees to adapt or find new positions.

The Importance of Great ‘Chefs’

Visiting top rated restaurants illustrate the importance of great chefs to a memorable experience. My wife and I dined at Alinea recently. Rated one of the top restaurants in the world, combining amazing food with unique preparation and artistic delivery, reservations need to be made months in advance. Our experience at Alinea exhibited a culinary level of mastery reserved for artisans like Michelangelo, Beethoven and the Beatles.

Dan Egan, Head of Behavioral Science at Betterment, on with me discussing AI, Machine Learning and the impact on the average person built an analogy as follows: there are two types of people involved in food preparation, chefs and cooks; chefs create recipes, cooks execute them.

The rise of digital banking, automation and AI is quickly making the jobs of cooks obsolete. That doesn’t mean we don’t need humans, but what we need from them is changing. I’ve debated this with Jon Stein, Betterment’s CEO since his founding days: While I used to want to meet an advisor regularly, I now only want to talk to my advisor when I need to talk to my advisor.

Retraining and Replacing

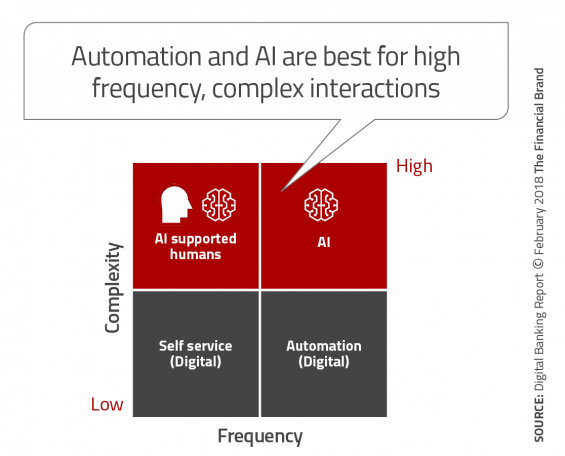

Historically, humans were the customer’s primary interface in most industries, and they were supported by technology. Today, machines are better suited to meet most consumer needs. Machines are better at gathering data, processing it, and applying it, just-in-time, based on behavioral cues.

Machines can execute either food or banking ‘recipes’ with perfection. When I need to interface with a human, it is because I need a chef, not a cook. I might have a request that the machine hasn’t (yet) been trained to accommodate, the problem I’m looking to solve isn’t something I can articulate, or it requires empathy (a skill machines and some humans haven’t yet mastered).

The massive investment in digital channels, machine learning, and kiosks squeezes out greater profitability by replacing humans, but that doesn’t mean human interaction should go away. Humans are primarily being kept in customer service roles under the belief that empathy improves outcomes.

While relational skills are important, research from Case Western University shows that ‘solver skills’ are far more important in determining satisfaction, even if the outcome is the same. As the amount of data available grows exponentially, humans alone can’t keep up.

Self serve digital channels are at a relative advantage only when the problem has been encountered before and tools can be automated. For complex, infrequent problems, humans assisted by Artificial Intelligence meld the benefits of processing power, insight and instinct. This is the realm of chefs, not cooks.

It’s Time to Invest in Chefs

The future will require more chefs and fewer cooks. Most chefs wil still need more training and experience to develop mastery in a changing industry. Chefs will need advanced tools tailored to their adjusted roles.

The barriers between the digital channels, the back-end data lakes and front line interaction need to be broken down. Chefs need to be curated and grown to take full advantage of these new capabilities. As Brad Leimer, Head of Fintech Strategy for Explorer Advisory & Capital, expressed it well when he stated, “Banks are at near record profitability. Now is the time to be investing in chefs, not short-sightedly maximizing short-term profits with more and more cooks.”

We can’t look at our human resources as merely an expense to be reduced. No one would confuse the value of a chef unless you were using that person in a cook’s role. And no restaurant earns a Michelin star when it’s menu was designed by a line cook whose real job is execution of someone else’s menu.

Walking through Grant Achatz’ kitchen at Alinea, you quickly realize he has very few cooks. He cultivates a team of chefs that can execute works of art with mastery. They are optimized for executing perfection in the face of complexity, not volume.

The value they bring cannot be automated, outsourced or industrialized. And they are the reason I’ll keep coming back, no matter the price.