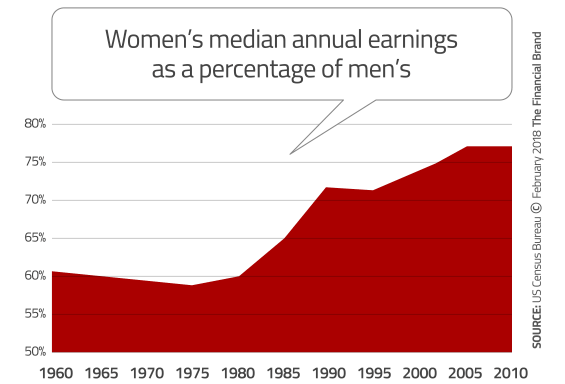

Over 50 years ago, President Kennedy signed the Equal Pay Act into law, making it illegal to pay men and women employed in the same establishment different wages for “substantially equal” work. At that time, the ratio of women’s to men’s average pay was about 58%.

Although the difference between women and men’s wages has narrowed substantially since the signing of the Equal Pay Act in 1963, there still exists a significant disparity that is difficult to explain. Over the last 50 years, the wage gap between women and men has closed by only 17 percentage points.

The problem extends well beyond male-dominated sectors like finance and tech. Take Hollywood, for instance. When the film “All the Money in the World” needed to reshoot scenes, four-time Oscar nominee Michelle Williams was paid less than $1,000 while co-star Mark Wahlberg, a two-time nominee, was compensated $1.5 million.

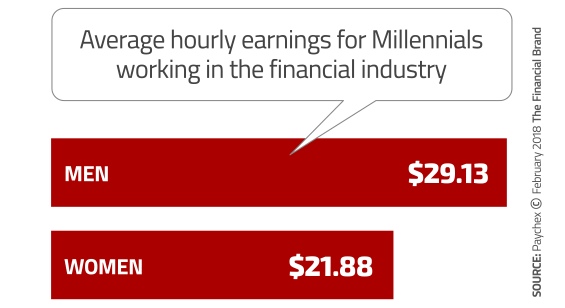

In January 2018, both Wells Fargo and Citi released results of their pay equity studies, which revealed that roughly half the employees at both major banks were women who were paid — on average — less than their male counterparts in similar positions. Similar compensation discrepancies were found with minority employees.

Some banks have started accepting the unfairness of the situation, and how things must change. Bank of America, BNY Mellon, Wells Fargo and Citi are among those who have announced a corporate commitment to equal pay for all, regardless of gender or ethnicity. To take it another step, hiring managers at Bank of America can no longer ask how much job candidates made at their last job as a means to further bridge any pay gaps.

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

“This is not just about paying women a fair wage, it’s about transforming an industry that has overlooked and mistreated women for far too long,” explains Natasha Lamb, managing partner at Arjuna Capital, the firm largely responsible for getting banks and other companies to close the gender pay gap. “It’s critical that the Big Banks address what has so long been the elephant in the room — whether women and minorities are being treated equitably on Wall Street.”

Arjuna Capital has taken up the cause of women, playing the role of activist investor. In 2015, Arjuna Capital created a model shareholder campaign for addressing gender pay issues in the technology sector. In 2015, Arjuna filed a first-of-its-kind shareholder proposal asking eBay to close the gender pay gap. Shortly thereafter, Salesforce’s CEO came out with a commitment to pay women fairly. Eight of nine proposals were eventually approved by tech giants to disclose and close their gender pay gaps. Last year, Arjuna shifted its focus to women in finance.

“It’s no secret that Silicon Valley has a problem with women — for starters, there aren’t many,” bemoans Lamb, who is spearheading Arjuna’s crusade. “Women are almost absent from the boardroom, occupy a mere 11% of executive positions, and make up only a quarter of the workforce.”

In response to pressure from shareholders like Arjuna, tech giants like Apple, Intel and GoDaddy have all committed to equal pay, including full transparency and accountability for pay equity.

What Arjuna did in Silicon Valley — where eight of nine of the world’s largest tech firms were pressed to disclose and close the gender pay gap — it is doing now on Wall Street. Arjuna Capital shifted its focus in 2017 to the treatment of women in finance.

Lamb says the announcements from Citi, Wells Fargo, BofA, and BYN Mellon represent a tipping point for the Wall Street banks. Lamb says women should not only receive the pay they deserve, but that more women should be given opportunities to move into leadership roles.

“Women are 20% more likely to leave a career in finance than any other industry,” Lamb says. “That’s bad for business and it’s bad for investors.”

According to McKinsey & Company, the business case for the advancement and promotion of women is compelling, finding companies with highly diverse executive teams boasted higher returns on equity (10.7% higher), earnings performance (91.4% higher) and stock price growth (36% higher). McKinsey advocates best practices to attract and retain women, including tracking and eliminating gender pay gaps.

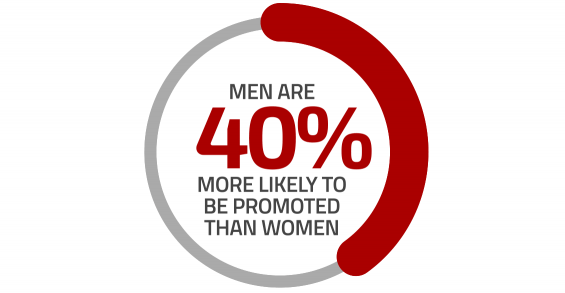

But paying women the same as men isn’t the only problem, says Lamb. Not only should the situation have been addressed decades ago, other concerns surrounding the treatment of women in the workplace remain.

“Despite recent attention to equal pay in the banking world, other problems remain entrenched, such as few women on boards and sexual harassment in the workplace,” Lamb explains.

Many women in banking are now getting long-overdue raises as a result of Arjuna’s campaign in the banking sector.

“It is clear that progress is being made,” notes Lamb. “Unfortunately, women still hold the majority of lower-paying positions, while men dominate the executive suite. And while current disclosures show improvement based on an adjusted equal pay for equal work basis, there is still work to be done to close the median pay gap.”

“Step one is paying women fairly for the work they are doing now,” Lamb concludes. “Step two is moving women to higher paying positions, and reaping the performance benefits that more diverse leadership affords.”

As a result of the overall gender pay gap between women and men, women tend to have less money and therefore less money to invest — another example of gender inequality in the investment space.

Sallie Krawcheck is the co-founder of Ellevest, an online investment platform tailored specifically to women.

“Investing has been so unapproachable for women, and so not in our language,” Krawcheck explains. “We wanted to make it as approachable as possible. We are not going to be equal with men until we are financially equal.”

While the first banks to respond to the gender pay gap are two of the biggest, banks and credit unions all over the U.S. should take note. With the pressure mounting from Arunja Capital’s request, it’s likely only a matter of time before the remaining large institutions cooperate and publish their gender pay gap numbers. That could create a ripple effect within the banking industry as a whole and catch many smaller banks and credit unions off guard if they aren’t already researching their own gender pay gap and taking measures to correct it.