If consumers are increasingly moving to digital channels, why does anyone care what branches look like anymore? Aren’t branches obsolete? Irrelevant?

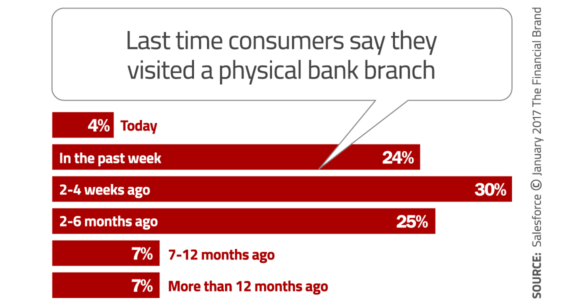

It may contradict intuition, but even as consumers migrate more and more of their daily banking activities to mobile and online banking channels, branches remain an important touchpoint in the financial ecosystem. More than half of all consumers are still visiting branches at least once a month, some even more frequently than that. This finding correlates with research from Fiserv, revealing that 61% of all consumers visited a branch operated by their primary institution within the last 30 days. Another study from TimeTrade found that one in four consumers visited a branch roughly five times in the past year.

You could argue that people simply continue using branches because they have no other option. No one really wants to use branches, so the argument goes, but they have to because digital channels haven’t caught up with consumers’ expectations and preferences yet. That may be, and perhaps some day financial institutions will be able to shutter locations.

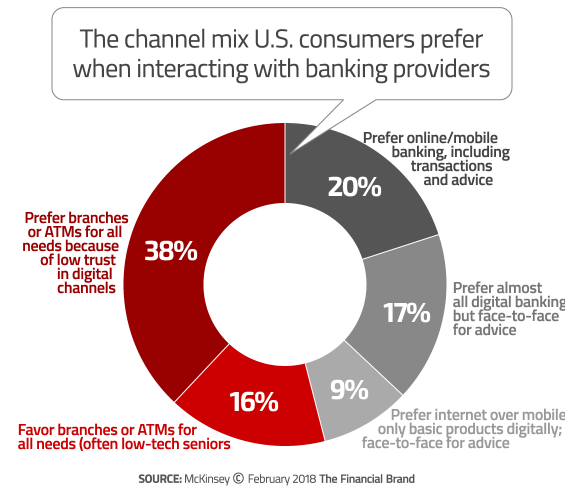

Or maybe people really like branches. After all, there is data suggesting that may actually be the case. Many studies have found that a large swath of consumers prefer handling certain financial matters in person, face-to-face.

Whatever the case might be, retail financial institutions will have to keep branches open, at least for the foreseeable future. That’s why over one-third of retail banks and credit unions say they are retooling their branch experience to make them more relevant and cost effective.

Read More: Do Banks Need Branches in the Digital Age?

CFPB 1033 and Open Banking: Opportunities and Challenges

This webinar will help you understand the challenges and opportunities presented by the rule and develop strategies to capitalize on this evolving landscape.

Read More about CFPB 1033 and Open Banking: Opportunities and Challenges

How Banks Are Fortifying Their Data Against Increasing Cyber Threats

This webinar from Veeam will detail the value of working together across your organization to be better prepared in cyber defense and response readiness.

Read More about How Banks Are Fortifying Their Data Against Increasing Cyber Threats

Closing Branches… Or Not?

Some banks and credit unions are closing branches. Since 2009, ultra-low interest rates and a slough of thorny regulations have squeezed profits, forcing retail financial institutions to trim branches from a heady peak of about 100,000 to roughly 90,000. But just looking at the raw data might lead you to draw the wrong conclusion (e.g., that branches are burdensome cost centers).

These closures haven’t affected all communities equally. The number of branches in affluent neighborhoods are virtually unchanged, while low-income neighborhoods have been hit hardest. Data from the FDIC shows that the top fifth of all postal codes by household income lost only around 3% of their branches between 2009 and 2016. During this same period however, the bottom fifth saw their branch numbers decline by 10%. The data suggests that financial institutions are simply pruning less profitable locations from their branch networks — branches they might not have opened in the first place, had it not been for the foolishness that was the subprime mortgage bubble.

In 2017, an average of three bank branches were closed every day. That statistic might seem alarming, but other financial institutions are still very much bullish on branches, like JPMorgan Chase. In a statement, the bank announced that it will be opening 400 new branches, an essential component in its strategy to expand into 15 new markets over the next five years.

JPMorgan Chase acknowledges that consumers manage 80% of their transactions outside the branch — either online or at ATMs — but they believe that branches are clearly still important for acquisition.

“Seventy-five percent of our deposit growth comes from customers who use our branches,” said Thasunda Duckett, JP Morgan Chase’s Chief Executive of Consumer Banking.

Similarly, Bank of America said it plans to put more branches in Pittsburgh and other cities into which the bank has expanded its brick-and-mortar network in recent years. In January 2018, BofA announced it signed leases around the Pittsburgh region, and that it would be opening additional branches and stand-alone ATMs over the next few years.

This continues to be a trend at BofA, who has entered new markets with branches since 2015. In 2017 the bank opened 30 new branches across the U.S. Of those, 25 were in areas not previously served by retail branches.

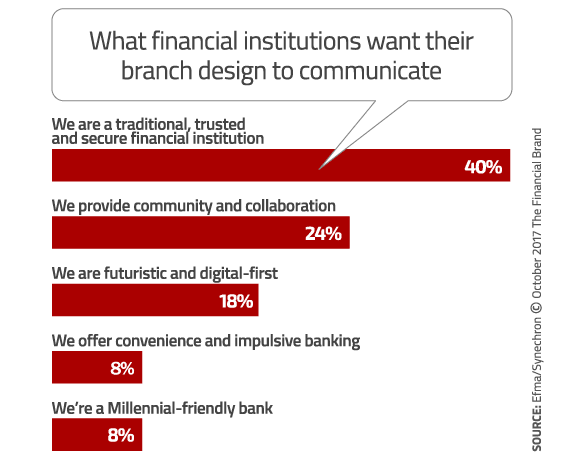

Branch Design Remains a Struggle

Chances are pretty good that all these new branches will look different than those opened in prior years. The focus will be less on transactions and more on experiences. But according to McKinsey & Company, few banking providers have done branch transformation well, translating digital experiences into the branch experience. No financial institution has cracked the nut on creating what McKinsey calls “an omnichannel offering that capitalizes on the unique strengths of branches.”

Branches have a few things stacked up against them. The costs of branches are high —both the physical structure and the employees needed to staff them. Many branches are old, too big, and not well maintained. They look old. Managing capacity remains challenging, even with staffing algorithms. Employees don’t stay long, partly due to the low pay.

“Branches are expensive, accounting for half of operating costs at some banks,” McKinsey notes. “Providing a consistent customer experience across far-flung branch networks is challenging. Nevertheless, at one US bank, we estimate the value of the physical network in just a single market to be equivalent to millions of dollars of annual marketing.”

Making branch transformation even more difficult, there’s no single “cookie cutter” design financial institutions can emulate. The “right design” for any individual financial institution will depend on a host of different variables, notes CSI, including size, budget, geographic footprint, products and services and consumer demographics. It’s not like you can walk into a branch you like and simply copy the design.

Read More: 14 Breakthrough Branch Designs From Banks & Credit Unions

Open Floor Plans: Changing Up the Layout

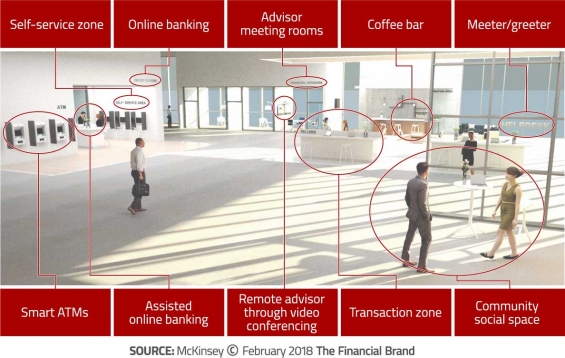

So how do you turn brick-and-mortar into a customer experience hub? Not with a teller counter and long lines. The branch experience has to be aligned with the consumers’ digital experience.

Think about the Apple store. Apple associates are always on the move — there is no “counter” where they all gather at and wait for consumers to approach them. They circulate freely through the store (some are assigned to specific “zones”), chatting and helping consumers as they wander. The key is the open floor plan, where employees and customers mix and mingle in a shared space.

Now think about the traditional branch layout. There’s always a desk and a counter between the branch employee and the visitor. Tellers are on one side while accountholders are on the other, and lenders sit on one side of a desk with borrowers on the other. There is — quite literally — a barricade between them, making it difficult to create a human connection and build a relationship.

A branch redesign should offer flexible, central spaces where universal bankers can mingle with consumers. A redesign doesn’t mean a bigger branch footprint. The branch can (and probably should be) smaller, since the space will serve multiple purposes depending on the task any individual universal banker will be doing.

According to McKinsey, financial institutions must rethink branches and the services they offer.

“The physical network can still play a critical role in building trust and credibility, providing financial advisory services, offering convenience, and assisting in the transition to digital channels,” notes McKinsey. “Getting the operating model within the branch right will be critical to a bank’s success with its customers.

McKinsey says the ideal model will likely include several features, many of which represent fundamental shifts from today’s traditional model:

Fully automated cash and coin handling. McKinsey says all cash and coin deposits and withdrawals should be migrated to ATMs and other machines. When cash is handled by machines, banks can reduce security costs, compliance costs and staffing requirements.

Noncash transactions and sales through digital capabilities. No transaction or sale should require a branch visit, but branches should be able to support them. Wire transfers, cashier’s checks, loan applications, new card issuance, and signature cards should all be accessible through digital and physical channels so people can then decide which channel is right for them.

A digitally enabled customer ecosystem. Although multiple channels are often required to complete a single process, such as signing an application that started online, banking providers must provide a consistent customer experience across channels. Doing so will force them to move away from assigning customers to specific branches and instead focus on the broader ecosystem.

Leverage consumers’ trust. McKinsey says retail banking providers should think about what safety deposit boxes represent. The idea here is that people can trust their bank and no one else with their most valuable possessions — a fundamental strategic advantage for traditional institutions over their nonbank attackers. McKinsey says virtual safe deposit boxes that can store digital documents such as tax returns and medical records with bank-grade security builds on this trust. In an integrated physical and digital offering, physical branches reinforce a bank’s unique value to the customer.

On time and uptime. Customers now expect to be able to bank around the clock, and branches must adapt to meet this expectation. A branch’s level of uptime should be consistent with digital channels. McKinsey suggests “on-demand access”, a locker-based pickup and drop-off that allows people to sign documents or pick up large amounts of cash outside standard hours. Another option to consider are mobile branches.

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

Universal Bankers Gaining Steam

Good design is worthless if consumers visit a great-looking branch but the employees can solve their problem or answer their questions. If consumers are indeed performing 80% of their transactions using online, mobile and ATMs as JPMorgan Chase states, what’s left for branch employees to do? Plenty. They may not be handling long lines of consumers waiting to deposit checks, but when someone walks through the door, every branch employee should be prepared to handle it.

Similarly, when a consumer comes in looking for advice on a mortgage investing for retirement, you’ll want staff to handle these requests. However, from a cost perspective it probably doesn’t make sense to have a branch manager, tellers, platform folks, and lenders all sitting around twiddling their thumbs, waiting for a consumer with that need to walk through the door.

The universal banker is a jack-of-all-trades and can handle a number of different consumer requests. They can answer consumer questions, although probably not the most complex questions, but they know how to contact an expert to get the answer.

Universal bankers have higher level skill sets than your traditional tellers, so you’ll need to pay them more, but not as much as you would other branch employees like commercial lenders. CSI has a wish-list of what a universal banker should have:

- Prior sales experience

- Proven ability to build and nurture consumer relationships

- Working knowledge of all products and services

- Technology skills

- Willingness to do sales as well as service

- Good communication skills and a friendly demeanor

Where do you find “universal bankers”? While some large banks are creating new positions and hiring new employees, community banks and credit unions can look internally. Find those who fit at least some of the criteria outlined above, and train them to be universal bankers.