An increasing number of frustrated financial consumer are finding out that Twitter can work as a service “express lane.” As the following stories show, more and more people are expressing their displeasure with various companies — including financial institutions (or rather, particularly financial institutions). Banks and credit unions alike seem to be listening. Those financial institutions responding to consumers’ concerns on Twitter have enjoyed heaping servings of praise.

Some financial institutions are providing more than reactive customer service though. Some are actually being proactive, as story #2 illustrates. Can you imagine that…

But all this gushing over the caliber of customer service available through Twitter raises some tough questions about the quality of service in other channels. As one analyst in the financial industry recently wondered, “Why can’t people get this level of service through traditional channels? What makes them feel like they need to turn to Twitter as a last resort?”

For that matter, when will consumers learn to turn to Twitter first? If stories keep circulating about how awesome customer service is on Twitter, regular people — not just chronic complainers and the techno-elite, but everyone — may start using Twitter accounts to get their service issues resolved.

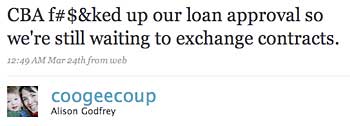

#1 – Mortgage app goes from “months” to “minutes”

After months of offline frustration, a reporter in Australia turned to Twitter to vent about delays in her mortgage application with Commonwealth Bank in Australia. One of the bank’s employees, Derek Jenkins, is on Twitter (@ozdj) and caught the tweet. Within minutes, he contacted her to let her know that the message made him “feel like crap,” and the bank was only just beginning to understand how crucial social media sites were in maintaining the corporate giant’s image. By 3:00 p.m. the next day, her loan was formally approved. And the twist is that Derek isn’t even part of some official Twitter effort from Commonwealth Bank. He was just helping out.

#2 – Bank anticipates customer need, sends DM

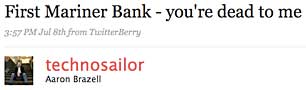

A “DM” in Twitter is a direct message sent privately from one individual to another. And that’s what Matt Sparks, an employee of 1st Mariner Bank, sent to Aaron Brazell, the editor of a technology blog after Aaron posted this on Twitter:

See how Matt at 1st Mariner (@FMBCustServ) was able to turn things around and create a positive service experience. After all was said and done, Aaron published a glowing article about the experience on his website. It would seem Aaron’s relationship with 1st Mariner is not dead, and is indeed alive and well.

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

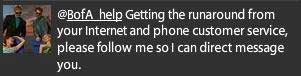

#3 – Bank of America on Twitter = WIN!

BofA was the first financial institution to provide dedicated customer service on Twitter (@BofA_help). Months after launching the experiment, the bank is still seeing a steady stream of positive feedback — on Twitter, in the media and in blog posts.

BofA was the first financial institution to provide dedicated customer service on Twitter (@BofA_help). Months after launching the experiment, the bank is still seeing a steady stream of positive feedback — on Twitter, in the media and in blog posts.

This is yet one more example. It includes words like “impressed,” “refreshing,” “courteous” and “quick.” In this case, the guy actually went and sought out a customer service rep on Twitter rather than just bitching publicly (and hoping someone might be listening).

Note: This is now the third example in a row where a customer was frustrated by a lingering issue that required reactive customer service (i.e., “damage control”) on Twitter.

#4 (Bonus) – Credit union uses Twitter to foster dialogue

Churches Co-operative Credit Union in Jamaica (@Churches_CCCU) uses a cocktail of Web 2.0 tools that includes Twitter, Facebook, YouTube, MySpace and blogging. The credit union says it’s using online social media to foster dialogue and feedback.

“The digital age consumer doesn’t want to be dictated to, they want to have dialogue,” said the credit union’s marketing and public relations manager.

“Digital communication is a win-win solution,” said a representative. “We recognize the power of the digital revolution, and we adapted early in the game to be able to take full advantage of it.”