There are no shortcuts to an effective branch transformation strategy. While most banks have a sound branch strategy, and branch technologies that are fairly reliable, many of the transformation efforts are more cosmetic. What technologies should be used in a branch? What’s the ROI on a coffee machine? Should we try the most recent ‘silver bullet’?

The reason why many banks have not reaped the benefits from their branch projects is the execution. Branch executives have to balance between conflicting priorities – costs must be contained at the same time that revenue targets get higher.

Customer experience is critical, but is only executed well for activities if the bank (and the employees) benefit. Staff who did a great job educating customers on digital and self-service see their branches closed and jobs lost. Faced with these challenges, many banks took the easy way out. Instead of carefully executing on the strategy, they dove head first into gimmicks or cosmetic changes and hoped that the touch-up job would lead to transformation.

Guiding Real Transformation

In the IBM whitepaper, Branch Transformation in the Digital Era, a new model was proposed to help banks remove guesswork and easily take on transformation that result in sustainable business values. The first question banks need to consider is where should branch resources be deployed so that customers have easy access to them while helping the bank achieve its performance objectives.

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Banks invest heavily in the branch network through personnel, facilities, ATMs, devices, etc., so it’s important that the distribution challenge is analyzed and optimized methodically.

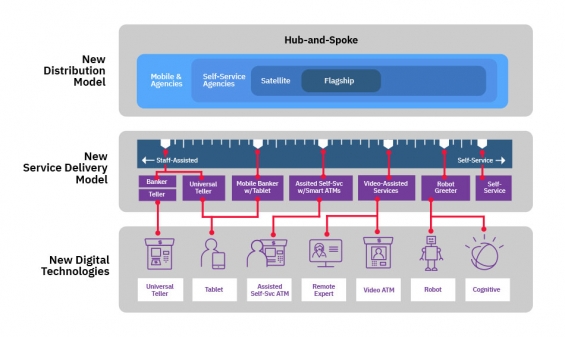

There are three parts to this question: topology, formats and locations. Topology deals with how different resources interact with each other. For example, a hub-and-spoke topology requires organizational changes so the satellite branches can share resources and get support from the hub. Many banks are also increasing the number and sophistication of branch formats. Smaller and more specialized branches may be cheaper to operate and provide more tailored services to customers they serve, but they also bring unique challenges including staffing and customer referral. Once topology and formats have been determined, the location challenges can be addressed mathematically as long as the bank has access to good geographical data and analytical skills.

After the deployment question is answered, the second question is how should resources be deployed? That is, how the bank actually delivers services to customers inside the branches. A service delivery model can be either purely face-to-face, completely self-service, or anywhere in between.

We have observed a plethora of innovative service delivery models in recent years, including video-assisted delivery, tablet-assisted delivery, smart-ATM-assisted delivery and more. We have even seen robots working as greeters in branches, so AI-assisted delivery may not be far-fetched.

It is recommended that banks carefully evaluate the impacts of different service delivery models against customer experience, employee productivity, and key business processes before deciding on the optimal delivery model. Service delivery is really at the heart of branch operation. Most of the inefficiencies and poor experiences are the result of inadequate design of service delivery models.

After the ‘where’ and ‘how’ questions are addressed, the third question is ‘what’. That is, what technologies does the bank need to successfully implement the service delivery model? If the bank has done a good job designing the target service delivery model, answering this question should be no more than an evaluation of vendor solutions.

Branch Transformation Prerequisites

1. Know the Behavior. Simple analysis of what happens in the branch can yield significant insights into customers’ behavior. Teller system and ATM logs are invaluable and can reveal what customers do during different times and in different locations. Banks and credit unions also need to have a clear picture of the desired customer behavior … which is usually determined based on the bank’s channel and customer experience strategy.

It is imperative to know what the current behavior is and what the future behavior should be. The resultant gaps from comparing the as-is and to-be states can be used to guide various branch projects including queue reduction, channel migration, new branch formats, new service delivery model, etc.

2. Manage the Wait. What’s the average waiting time in the lobby during busy hours? In some countries it’s not uncommon to have peak waiting time over 30 minutes. People’s tolerance on waiting varies by culture, location and even ambience, but generally 7-10 minutes is a good rule of thumb.

Before the wait is cut to a more manageable level, forget about service, experience or relationship. Few customers will be in a mood to enjoy any experience after an excessive waiting time, unless you are a young customer in a Disney theme park.

Fortunately, queuing is a function of supply and demand, and can be managed quantitatively by either reducing the demand or increasing the supply. An effective demand-reducing tactic is encouraging customers to use self-service or digital channels. Supply can also be increased without hiring more tellers by improving efficiency.

3. Fix the Metrics. Branches are about people – the place where bank employees and customers interact. Real branch transformation always involves changing people’s behavior, which unfortunately is one of the most difficult things to do. To make matters worse, many banks measure branch staff the same way it was done before the world saw the first smartphone.

In this era of omnichannel and digital technologies, customers do not solely rely on the branches for their banking needs, although most do expect branches to be able to take care of everything for them: convenience, services, new products, etc. How should banks measure branch performance? Different roles in the branch have different missions and must be measured depending on whether the role is to sell (therefore a revenue center) or to serve (therefore a cost center).

As for customers’ need for convenience, it is not provided by a single branch, but is met by a combination of branch/ATM network and digital channels. It is the regional manager’s job to ensure the optimal distribution of resources in a market. Only at the market level should the overall customer experience and the profitability that comes with it be measured (i.e., profit center at market level.)

Getting Branch Transformation Right

Experimenting gimmicks is easy – changing people’s behavior is hard. Making cosmetic changes is easy – getting real business value is hard. It’s not that banks do not understand why they should transform branch banking. Most established banks have a sound strategy with charts and graphs in a nice leather-bound book.

Risk goes through the roof when a project intends to change the behavior of customers and employees. Many eventually resort to touch-ups instead of real transformation because of the guesswork and uncertainty anticipated. Banks need to execute with discipline toward a clear target, and avoid the temptation to dive head first into technologies.

A top-down approach starting at the distribution model, followed by a focus on innovative service delivery, will allow banks to minimize the risks and achieve the return on investment.

Danny Tang leads Channel Transformation and Front Office Digitization Solutions for IBM’s Global Banking organization. Prior to his current role, he was on assignment to Shanghai between 2009 and 2011 as the Executive leading IBM Software Group’s Financial Services Industry Solutions team for the Greater China Group. He is the author of 2 patents, speaks at many conferences and events and has authored numerous business and technical articles. He is a member of the IBM IT Architect Board, and participates in setting strategic directions for the IT Architect profession within IBM.

Danny Tang leads Channel Transformation and Front Office Digitization Solutions for IBM’s Global Banking organization. Prior to his current role, he was on assignment to Shanghai between 2009 and 2011 as the Executive leading IBM Software Group’s Financial Services Industry Solutions team for the Greater China Group. He is the author of 2 patents, speaks at many conferences and events and has authored numerous business and technical articles. He is a member of the IBM IT Architect Board, and participates in setting strategic directions for the IT Architect profession within IBM.