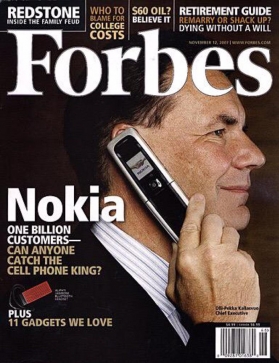

Case studies citing the casualties of innovation usually include cautionary tales about Kodak, Blockbuster and Borders. Seldom does Nokia come up, however. Once the high flying cell phone manufacturer, the inability to innovate ultimately led to the company’s demise.

Case studies citing the casualties of innovation usually include cautionary tales about Kodak, Blockbuster and Borders. Seldom does Nokia come up, however. Once the high flying cell phone manufacturer, the inability to innovate ultimately led to the company’s demise.

Apple’s market cap prior to the iPhone launch ten years ago was $80 billion; Nokia’s was $100 billion. But over the next five years, Nokia’s capitalization fell to $10 billion. Then in 2014, Microsoft purchased Nokia’s main for just $6 billion, only to sell it again in 2016 for $350 million. Meanwhile, Apple’s market cap flirted towards the $1 trillion mark, sitting today at an astonishing $815 billion.

This situation raises two critical questions.

First, how did this happen? The most interesting theory exploring such situations comes from Clayton Christensen, Harvard professor and businessman. In his famous study, The Innovator’s Dilemma — a book that Steve Jobs says “deeply influenced” his world view — Christensen argues there are two types of innovation: “sustaining innovation,” and “disruptive innovation.”

Second, do the dominant players in today’s financial industry face the same threat? If so, what might be done to avoid Nokia’s fate?

The Innovator’s Dilemma

The main idea of The Innovator’s Dilemma is that any industry develops along a path of constant improvement. The problem is internal resistance to change. Therefore, most companies focus on meeting the most demanding customers, implementing “sustaining innovations.”

“Disruptive innovations,” on the other had, often struggle initially. They typically don’t meet consumers’ needs because they are not fully developed, which results in poor performance. But disruptive innovations tend to catch on with certain niche customers who prefer them based on their specific criteria — e.g., price, operating conditions, key features, simplicity, etc.

Disruptive innovations begin by satisfying the needs of these small, unique niches. Then, as the technology begins to mature and improve, they begin to rival the quality of traditional solutions. It’s at that moment when disruption in the market occurs.

Nokia was definitely an innovative company; that’s why they achieved success. The problem was that their innovations were sustaining only. They became so powerful that they believed the market was completely under their control. Мaybe they even saw themselves as trendsetters who could determine where the market would go tomorrow.

Looking at the banking industry from this point of view, you can see how dangerous this trap could be. Huge bank resources, combined with a large number of different digital innovations they are working on today, could create the illusion of market control and future success. At the same time, truly disruptive innovations can go unnoticed, then completely redefine the financial market overnight.

How Banks Are Fortifying Their Data Against Increasing Cyber Threats

This webinar from Veeam will detail the value of working together across your organization to be better prepared in cyber defense and response readiness.

Read More about How Banks Are Fortifying Their Data Against Increasing Cyber Threats

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

1. Disruptive Innovation is Hard to Integrate

The problem is that disruptive technologies offer simpler and often cheaper solutions. For example, there are a number of fintech startups offering apps that facilitate cross-currency P2P wire money transfers with nearly no fees. Compared to existing banking services, there is no need to fill out long forms, wait several days for manual processing of the operations, or pay large fees. Disruptive P2P technologies provide a fast and automatic alternative.

Unfortunately for the typical retail bank today, it is difficult to integrate and offer a similar service. First of all, it is unprofitable because it will can’t even cover the cost of the bank’s infrastructure. Second, this does not correlate with the technology that banking providers are currently using, nor their existing work processes, nor banking regulations. Third, such a product could seem unusual and even incomprehensible to the institution’s customer base.

We saw this in 2007, when the smartphone from Apple was given critical reviews, and doubts were cast about the device’s success from pundits and the media alike. Even those who were enthusiastic about the first iPhone didn’t fully understand the new capabilities and advantages it made possible.

A future-focused organization should obsess over innovations that simplify service and reduce costs. And if there is an inability to integrate them into the existing business, you should consider developing potentially disruptive technology as a separate business which has a real chance to fly if/when your breakthrough solution captures the market.

2. Disruptive Innovations Live on Micro Markets

To show the expected growth to shareholders and cover the costs of a huge team, large companies must derive a significant amount of revenue from a sizable market.

Let’s look at international P2P payments again. Even realizing the promise of this service, it would be difficult for a bank to take advantage of it. The bank’s scale, its culture, and its decision-making mechanisms do not correspond with the small size and flexibility required to grow niche micro-markets. That’s why small startup teams are more likely to succeed in such situations.

A fintech startup can be more flexible, faster and innovative than a large bank with all its legacy formalities, regulations and internal competition. And such situations, banks typically like to wait until the market grows large enough to enter into it. Unfortunately, this strategy often fails, according to Professor Christensen. Large companies can- and should vigorously develop potentially breakthrough innovations, even if the only way they can pull it off is by running an separate arm with an independent team working on it.

3. Disruptive Innovation Can’t Be Calculated

Fintech startups usually follow a strategic vision and change the service, technology and processes on the go to ensure the most rapid and effective formation of a disruptive technology. This can be nearly impossible for a large institution contending with internal inertia, which is always high.

Decision-making in large organizations is based on numbers and forecasts. But in the case of breakthrough innovations, this does not work because it is terra incognita. There is no data, no clues to predict how the market will behave or react. That is why trailblazers can gain a significant advantage, and how they ultimately become leaders in new markets.

Realizing this, a large organization must abandon its familiar methods of evaluation and planning in case of disruptive innovation. The decision is to create small “startup-like” experimental teams for the work on disruptive markets. Development and management of these teams have to be based only on insights obtained and verified on-the-go.

4. Disruptive Innovations Don’t Grow on Old Yeast

Processes and approaches in a large company are focused on its most highly profitable products. However, these products are not typically well-suited to disruptive innovations. Often, not only a different approach is required, but an entirely different way of thinking.

Therefore, it can be nearly impossible to create a laboratory of disruptive thoughts and technologies from a large organization’s employees. A disruptive team should consist of people who are not influenced by the bank’s existing culture and are unfamiliar with processes that have traditionally defined “the right way” to do things. The management of such a structure should be the responsibility of an independent “agent of change,” someone not associated with the bank’s old ways.

This is the best way to cultivate and master new ideas and principles — a cultural foundation that will become the basis for success in a disruptive market, as well as a source for possible organizational transformation.

Even though Apple was already a large corporation, Steve Jobs formed a separate team driven with its own culture and a passion to innovate; that’s how they created the iPhone. They weren’t bogged down by a legacy in traditional telecommunications. In fact, Jobs leveraged his vast experience of developing successful, disruptive products.

5. Disruptive Innovation Don’t Fit Into the Market

Usually, the potential of a disruptive technology is very difficult to detect. This is because, at its initial stage, it doesn’t correspond to the existing level of market infrastructure and, therefore, has limitations in its use.

For example, at the start, the iPhone experience was limited by internet speeds and coverage, and there were a small number of truly useful applications. But at some point, the necessary infrastructure was formed, and the advantages of the new technology became apparent to all.

This means that disruptive technologies often look inappropriate, raw and out-of-place at the outset. From the mass consumers’ point of view, they do not provide sufficient quality and don’t meet their needs. Moreover, favorable conditions for explosive growth of disruptive innovation should be formed in the market.

The use of sustaining innovations to preserve a company’s position of dominance can cause the quality of products to outperform the market demand, leading to an increase in the product’s price. At this moment, a big window of opportunity opens for a disruptive innovator, someone who can offer consumers a lower-quality niche alternative at a cheaper price.

Imagine that you ask users about popular fintech products and why they prefer them instead of their banks. Suddenly, you find many of them are attracted by simple solutions, without over-featuring. This despite the fact that banks created and developed this functionality to please customers with ultra-excessive opportunities. Suddenly, we face the fact that some users prefer to use only a few cropped-but-fast functions that are both easy and cheap. This is how the “window of opportunity” for disruptive financial technologies can become “industry standard”.

What can be done? Track promising technologies that offer fundamentally new and somewhat more accessible solutions for users, then take these technologies seriously and test them in narrow niches, releasing experimental products.

The Future of Disruptive Innovation in Banking

You may wonder where the next disruptive idea in the financial industry will come from. Honestly, know one knows; that’s why it is called “disruption” — almost no one sees it coming. It could be full-market decentralization caused by blockchain combined with P2P technology. Or a global open banking platform connecting banks through API and managed by AI. Or maybe all of this is just a precursor for disruption from tech giants such as Google, Apple, Amazon or Facebook.

You also need to take into account challenger banks that may be small today, just like Facebook and Google were years ago. No one takes these challenger banks seriously… yet. Just remember what we learned from the iPhone; the world of finance could change dramatically in the next 10 years. So keep your eyes open and be ready to step aside from outdated patterns quickly, or you could miss out on your own future.

Read More:

- iPhone X: The Next Wave of Mobile Banking Disruption

- Financial Institutions in the U.S. Are Falling Behind In The Innovation Arms Race

- Digital Innovation Transforming the Banking Industry

Apple Didn’t Kill Nokia… Nokia Did

Of course the iPhone changed the phone market, and this influenced Nokia’s position. But Nokia had a chance to retain some market share by choosing the right strategy at the onset of the market disruption. They didn’t use it, but Samsung did.

Unlike the iPhone, Samsung’s strategy more closely resembles Nokia’s — a huge selection of devices for different segments and at different prices. Perhaps when looking at capitalization they are not as successful as Apple, but by the number of sold devices, Samsung is even slightly ahead.

Could Nokia be in this place instead? It seems obvious that they had the perfect opportunity, if only they had approached a touchscreen disruptive innovation seriously.

Ultimately, these are valuable lessons for any company, but especially for those in the financial industry.