Cross selling is important to banks for many reasons. It costs less to sell to an existing customer than to a new customer, and it helps support retention, as customers with multiple products are less likely to leave.

According to Bank Intelligence Solutions from Fiserv, a customer with one product at their bank will stay for 18 months, while a customer with two products will stay with the bank for 4 years on average. If a customer holds three products with a bank, they will stay with that bank for 6.8 years on average.

The problem is not that banks don’t focus on cross selling – it is in their approach. With so much deep insight available on customers, and so many ways to communicate, there is little tolerance for push-based selling, where employees focus on persuading existing customers to sign-up for multiple products. Now is the time to move to a more non-intrusive “pull-based” approach to build customer awareness and demand.

Read More: 7 Common Sense Ways to Increase Cross-Selling

Move the Needle from Attrition to Acquisition

Vericast’s 2024 Financial TrendWatch explores seven of today’s most critical financial services trends to provide a complete view of the current loyalty landscape.

Read More about Move the Needle from Attrition to Acquisition

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Cross-Selling Is Tough

Cross selling in banking is difficult to get right. “To succeed at cross-selling, you have to do a thousand things right,” wrote John Stumpf, the CEO of Wells Fargo from 2007 to 2016. This includes employing “proper team member incentives,” to motivate employees to cross sell.

While incentive compensation can positively influence an organization, it can also work against the organization. In a report based on a survey of 1,461 North American CEOs and CFOs, 20% of respondents believe the incentive compensation system works against the organization’s culture. Among the reasons cited: attracts/retains the wrong type of people to the firm; focuses employees on short-term objectives; and leads to a fear of failure and insufficient risk taking. “People invariably will do what you pay them to do, even when you’re saying something different,” notes the report.

Illegal Sales Tactics Commonplace

TD Bank employees admitted to CBC News that they have broken the law at customers’ expense in a desperate bid to meet sales targets and keep their jobs. In an NPR segment, former Wells Fargo employees explained that while managers did not directly tell employees to do anything deceptive, employees who did not meet their sales goals were reprimanded, given warnings and questioned.

In “Banking on the Hard Sell: How Cross-Selling can Kill your Culture,” it was mentioned, “Low-wage frontline workers often find themselves engaging in sales tactics that range from the uncomfortable and unethical, to some that border on illegality. Bank employees walk a tightrope between offering professional, helpful customer service and cross-selling products that profit their employer.”

We must also recognize that when it comes to money, we respond more to our emotions than to logical thinking, making us particularly susceptible and vulnerable to aggressive and pushy salespersons. Behavioral economists have long known that we tend to choose immediate gratification over the long term. We fear loss more acutely and we are easily overwhelmed.

In a paper published in the Psychology, Public Policy & Law Journal, researchers describe 14 human cognitive and social psychological phenomena that can prevent rational decision-making in mortgage lending. The paper contends that unscrupulous mortgage brokers and lenders have been able to take advantage of these cognitive and psychological barriers to induce borrowers to enter into predatory loans.

For example, there is a strong motivation to trust and misplace trust in mortgage brokers based on the norm of reciprocity, according to the paper. It is the idea that if we fail to trust our mortgage broker, then the mortgage broker will be under no obligation to trust us in return.

Read More: Banking on the Hard Sell: How Cross-Selling Can Kill Your Culture

A New Way of Engagement

Instead of pushing and pressuring, the banking industry needs to begin considering non-intrusive, pull-based approaches to motivate customers to enter into a multi-product relationship with them.

A push-based approach, where a seller guides a customer towards certain products, is not necessarily the best model for banking. This process should be used only when there is a need to narrow choices to a manageable number, and where the financial impact of decisioning is low.

By comparison, a pull-based approach is more suitable when the number of product choices is manageable, purchasing occurs infrequently, and the product is a necessity. This is precisely the case with banking, where customers can get better results by making the decision on their own, based on their unique situations, personal needs and preferences. Here, the seller’s role is to simplify the path of purchasing especially if the product is complex.

From Cross-Selling to Cross-Buying

In pull-based cross buying, propositions are developed with incentives and rewards that make cross-holdings attractive to the customer. Digital choice architecture is also simplified to improve the buying experience and configure rewards.

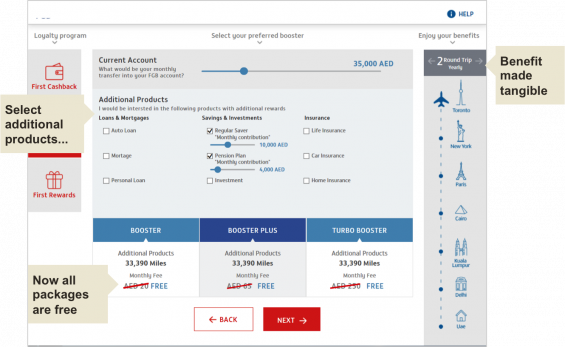

Recently, a well-known bank in the Middle East developed a digital interactive account configuration where customers can self-select and customize their relationship with the bank. Users are presented with three product choices: Booster, Booster Plus or Turbo Booster. They see that a standalone checking account is the minimum requirement at this bank, and that it comes with a small fee.

Few people want to pay a checking account fee. In the picture below, the customer notes that if they commit to a monthly auto deposit or select other products from the bank like loans, mortgages, savings or insurance, the checking account fee will be waived. They also immediately grasp that they will receive attractive rewards like air miles or cash-back based on how many other products they buy with the bank.

This bank was able to increase customers with multi-product holdings by a dramatic amount. For example, before the new digital configuration, only 20% of customers had three or more products with the bank. After the digital configuration, the number of customers with three-or more products increased to 60%.

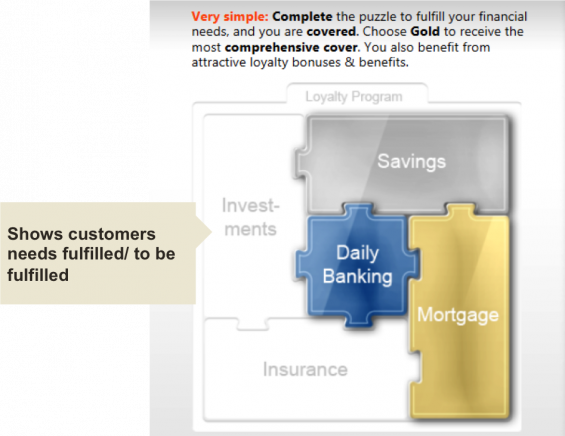

In another example of how to leverage digital architecture to motivate cross buying, an organization lets the customer see what needs they have left unfilled in the shape of a puzzle. This ‘gamifies’ the proposition and creates a challenge for the user to ‘complete’ the set.

Instead of static websites and mobile apps that exhaustively list products and services, organizations can use interactivity and advanced digital choice architecture to make the buying process more engaging. To nudge clients towards a deeper relationship, bank representatives can describe what is required in order to achieve the next loyalty level, visually tracking progress and rewarding appropriately.

Psychologists and video game designers from Pokémon have long understood that the succession of challenge – achievement – reward delivers a rush of dopamine to the brain.

Different industries require different approaches to selling. An intrusive, push-based approach is simply ill suited for banking and financial services. It is time to try something different.