Google, Amazon, Facebook and Apple are some of the most valuable brands worldwide. While each firm’s strategy is different, the use of deep consumer insight to provide personalized communication and real-time solutions makes each of these firms the envy of any bank marketer. It’s no wonder thousands of articles dissect their respective journeys to success, and offer ways marketers can mimic their database-driven approaches.

With each of these firms beginning to move into banking’s traditional product territories with payment solutions (and potentially other services), now may be the right time to reassess your current marketing strategies. And it’s not just the big four technology firms encroaching on banking territory – it’s also fintech firms, with the potential to take away $4.7 trillion worth of revenue from traditional financial services institutions.

So, what do the top technology organizations and fintech firms have that is so attractive to consumers? Ease, convenience and most of all – an experience that makes customers feel their needs are met without having to ask for it. They recognize that consumers are hyper-connected, on the go, and have higher expectations than ever before. To cater to those demands, successful digital brands are responding to individual interactions with behavioral marketing.

Behavioral marketing consumes online data and uses this data to power tailored messages to the user. These individualized messages can be sent in real-time, making it easier for brands to stay top-of-mind with busy consumers. More than any other industry, banks and credit unions have a wealth of data at their disposal. So, creating a personalized customer experience should be easier for the financial services industry than other, less connected alternatives.

The challenge, however, has been access to real-time data to deliver responsive, personalized customer interactions that make doing business with you easier and more convenient. Behavioral marketing platforms have made it possible for companies to access real-time and historical behaviors of customers to identify key trends and to individualize customer interactions through responsive digital marketing. More targeted marketing and sales activities are possible as a result, and new opportunities for cross-selling and up-selling emerge.

Here are 3 ways financial organizations can take a page out of the digital-first competitors’ books with behavioral marketing to beat them at their own game.

How Banks Are Fortifying Their Data Against Increasing Cyber Threats

This webinar from Veeam will detail the value of working together across your organization to be better prepared in cyber defense and response readiness.

Read More about How Banks Are Fortifying Their Data Against Increasing Cyber Threats

Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

This webinar will offer a comprehensive roadmap for digital marketing success, from building foundational capabilities and structures and forging strategic partnerships, to assembling the right team.

Read More about Unlocking Digital Acquisition: A Bank’s Journey to Become Digital-First

1. Re-engage Distracted Consumers in Real-Time

With hyper-connectivity, people are now more distracted today than they were just 7 years ago – going from losing concentration after 12 seconds to now losing concentration after only 8 seconds. Successful digital firms know this. They know it very well.

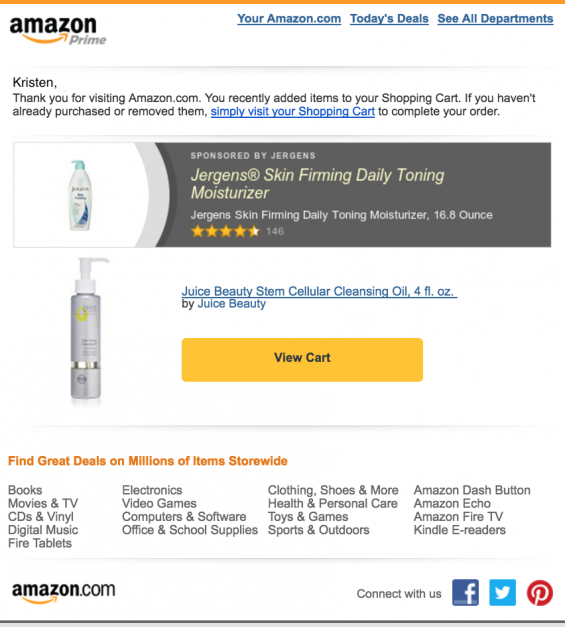

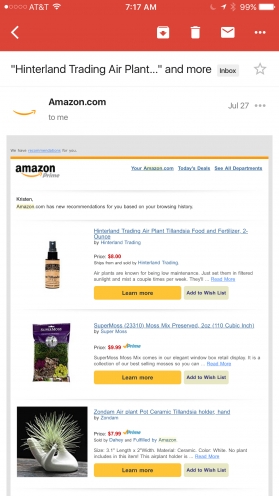

For instance, every time you land on Amazon’s website, they feature new products customized to you based on your previous product views and purchases because they know they may lose your attention otherwise. In fact, 35% of Amazon’s sales are directly attributed to real-time personalization based on individual behaviors to remind them of things they’d looked at or carted to encourage purchases.

The challenge of low attention span is true for consumer banking as well. People may spend a few minutes on your site exploring a savings plan, filling out an auto-loan application, or considering refinancing their mortgage before the current “culture of busy” distracts them from the task at hand. According to research by GfK, 50% of consumers want beneficial services in real-time, but only 23% feel they are getting that from their current institution.

Behavioral marketing allows you to automate responsive email and website triggers that are based on real-time activity, making it easier to respond to immediate opportunities based on prospect or customer’s real-time actions. Any time someone visits a page on your website, engages with specific content, or begins to fill out a form but doesn’t complete it – you can re-engage that person with a web pop-up or email trigger to remind them why they were on your site in the first place.

2. Don’t Just Mass Market; Message to Customers Based on their Behaviors

Behavioral marketing allows marketers to automate not just real-time responsive marketing, but also takes into account a customer’s previous history. Mass marketing is an outdated model – just ask the 52% of brands that have disappeared from the Fortune 500 list in the last decade.

While mass marketing can be effective, it drives pennies in results compared to the dollars targeted marketing can provide. It’s an imperative that brands move away from the Don Draper mindset of persona marketing instead of individual behavior marketing. Otherwise, you run the risk of losing customers who will quickly adjust their money and their loyalty from your banking institution to an easier, more efficient option.

To stay ahead of Google, Amazon, Facebook, Apple and other fintech firms, bank and credit union marketing teams are prioritizing behavioral targeting, personalization and customer journey management. With 55% of organizations planning to increase investment in personalization in 2017, the industry as a whole is recognizing its need for more personalized, real-time marketing tactics.

By messaging to customers based on their behaviors, you’ll be able to help them pick up where they left off – whether to drive an immediate up-sell or cross-sell opportunity, or by sending nurturing content to educate customers on the topic they were originally researching.

Amazon is less discreet about tracking consumers’ behaviors and even now has a “Browsing History” tab on their navbar that allows consumers to select ways to “Improve your Recommendations.” Banks can easily offer the same frictionless experience by showing helpful content that is based on previous content that has interested them.

And the best part is that behavioral marketing platforms take into account any changes in behavior as well. So, if your responsive triggers or drip nurture content do their job, and help convert the customer, the customer will automatically stop receiving that content and begin to receive more relevant content based on their most recent interaction.

3, Detect Friction and Intercede Immediately

According to MarketingSherpa, 97% of website visitors leave without converting. However, you can save 10-15% of lost visitors with lightbox pop-ups. This is one area in which Amazon has not advanced their behavioral marketing; and an opportunity for banking to deliver a better experience.

The issue with most pop-ups today is that they occur almost immediately upon landing on the website – before you’ve even had a chance to show the brand what you are interested in, or that you need a pop-up to help guide your experience. This is what Amazon’s current pop-up experience is like. An ask to donate to Amazon Smile immediately upon entering the site without giving you time to explore the site before welcoming a pop-up distraction.

There are two ways to deploy effective lightbox pop-ups. One, wait until they’ve started to disengage from your website. This can be detected when they make the move to exit the window or when they’ve stayed on one page for longer than the average customer. Alternatively, go a step further and personalize the pop-up based on the content they were engaged with during the session or based on their visit quality – message a highly engaged visitor by offering that they call a banking representative if they have any questions or to sign up to receive emails based on the content they engage with.