One of the most frequently asked questions in the banking industry is, “What separates the winners from the losers when you evaluate digital competency and innovation success.” Unfortunately, while there is no one single answer, organizations will not reach full potential in their digital transformation efforts without a strong, focused digital culture.

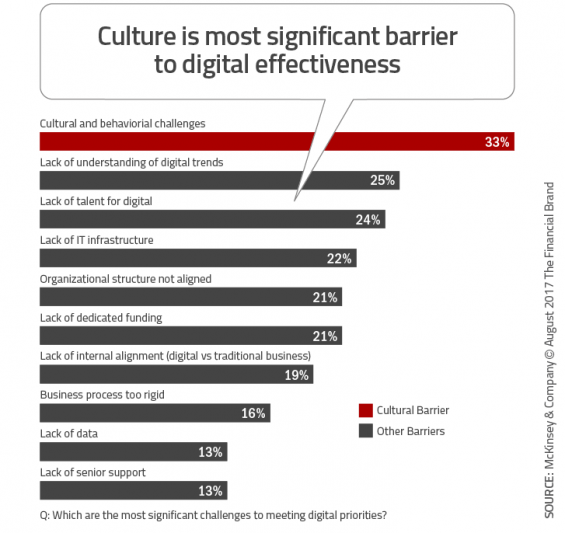

This hurdle is reinforced when we look at the results of a survey done by McKinsey & Company on the most significant self-reported challenges to implementing digital strategies. Cultural and behavior challenges were at the top of the list across all industries.

The top three digital culture impediments are an aversion to risk, presence of functional and departmental silos and the challenge of putting the customer first, according to the study. These three obstacles are not new to the banking industry, and become more costly in the digital age, where the marketplace is more demanding and the speed of change is faster.

How Banks Are Fortifying Their Data Against Increasing Cyber Threats

This webinar from Veeam will detail the value of working together across your organization to be better prepared in cyber defense and response readiness.

Read More about How Banks Are Fortifying Their Data Against Increasing Cyber Threats

Navigating the Role of AI in Financial Institutions

83% of FI leaders agree investing in AI is essential for 2024 but how you leverage AI is instrumental in success and meeting customer expectations.

Read More about Navigating the Role of AI in Financial Institutions

Cultural Change Requires Proactive Attention

The good news is that the three impediments are also the keys to driving cultural change if banking executives are proactive. “Executives must be proactive in shaping and measuring culture, approaching it with the same rigor and discipline with which they tackle operational transformations,” the report said.

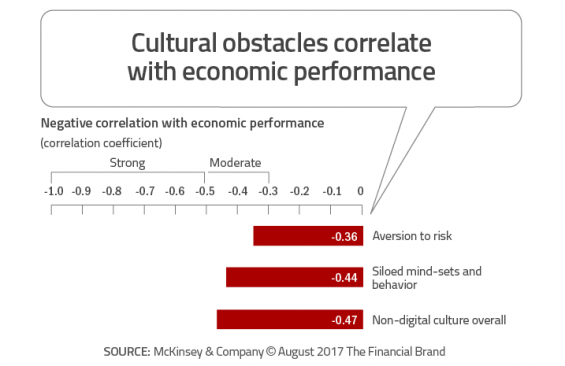

Organizations and their top executives who wait for digital cultures to change organically will be most impacted by customer dissatisfaction and competitive pressures. Just as importantly, the cultural obstacles correlate with negative financial performance.

The Case for a Digital Culture Shake-Up

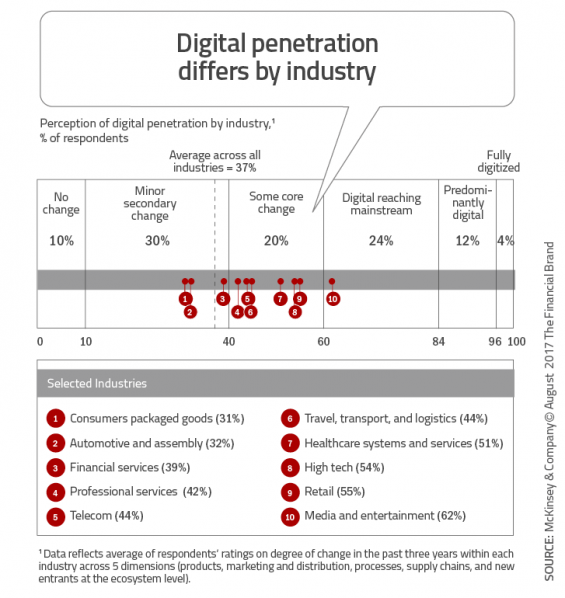

Despite a great deal of talk about digital transformation, the reality is that digital technologies have only just begun to penetrate the banking industry. In fact, according to McKinsey, the forces of digital technologies have not yet become mainstream, with penetration of the financial services industry just now approaching 40%. As the speed of transformation picks up, the impact on revenues and opportunities will become increasingly dramatic.

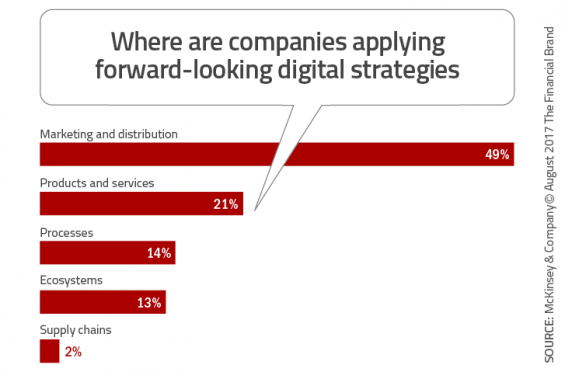

To date, many organizations have focused their digital investment on customer-facing categories such as marketing and distribution as well as products and services. Fewer strategies have been built around much more bottom line impactful categories such as processes, ecosystems and supply chains. In other words, the areas of digital transformation that have the greatest potential financial impact are internal and less customer facing.

To date, many organizations have focused their digital investment on customer-facing categories such as marketing and distribution as well as products and services. Fewer strategies have been built around much more bottom line impactful categories such as processes, ecosystems and supply chains. In other words, the areas of digital transformation that have the greatest potential financial impact are internal and less customer facing.

“The focus on marketing, distribution and products is sensible, given the impact digitization has already had on customer interactions and the power of digital tools to target marketing investments precisely,” states the report. “By now, in fact, this critical dimension has become ‘table stakes’ for staying in the game. Standing pat is not an option.”

In the end, digital transformation winners are either those that lead the charge or are fast followers. In either case, the strategy selected requires cutting edge agility and a culture that encourages top-down organizational support, the breaking down of silos and a laser focus on the customer.

Importance of a Customer-Centric Digital Banking Culture

Despite continuously talking about putting the customer first, the digital age is forcing financial institutions to actually take appropriate action. With best-in-class user experiences being provided by the large technology companies (Google, Amazon, Facebook and Apple), the consumer has a benchmark to measure their bank or credit union against.

A customer-centric digital banking culture has become a matter of survival. The good news is that becoming customer-centric reduces the risk of experimentation, with the results of tests being available in close to real-time. It is also fortunate that there is such advancement in data analytics, allowing financial organizations to know each customer on a 1:1 basis.

Steps to Achieve an Improved Digital Banking Culture

Once your organization builds a digital strategy and removes some of the key barriers to success, how do you get your culture in alignment with your strategies? After a great deal of research, McKinsey found that the following areas had the biggest impact.

Support from the Top: While most would agree that digital transformation requires active top-down support, starting with the CEO, support has to spread beyond one key executive. To change a culture, support must be evident across the entire management hierarchy and reach every customer-facing employee. Beyond talk, the management team must have a digital vision and be aware of digital market opportunities in order to have credibility, according to McKinsey.

Removal of Silos: Silos in any organization stifle the ability to collaborate and interact on behalf of the customer. Digital organizations remove silos between departments, creating cross-functional teams that are empowered to execute internal and external digital initiatives. To succeed, these agile, non-hierarchical teams focus on the customer journey as opposed to product or departmental goals.

Willingness to Take Risks: According to McKinsey, “One of the biggest risks [to digital success] is not taking risks. Companies standing still are the ones that lose the most from digital disruption.” Taking risks does not mean going ‘all in’ on every idea that comes down the road. Due diligence is still required, with the outcome potentially being more small investments in new digital experiments.

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

It All Starts With A Digital Banking Culture

When you look at the most innovative financial services organizations that are doing the best at improving their ‘digital maturity,’ you will always find a strong digital culture that starts at the top and has traveled across the organization. The outcome of getting the culture component right has been found to result in a 30% variance in performance.

More importantly, it may be the deciding factor in the survival of an organization. This is most important for those organizations that want to pursue a strategy of being a ‘fast follower’ – leaving others to lead the digital disruption.

While cultural change will almost always lag technological change, the gap in time must be narrowed significantly, even for fast followers. This makes it even more critical for executives to be proactive as they move forward.