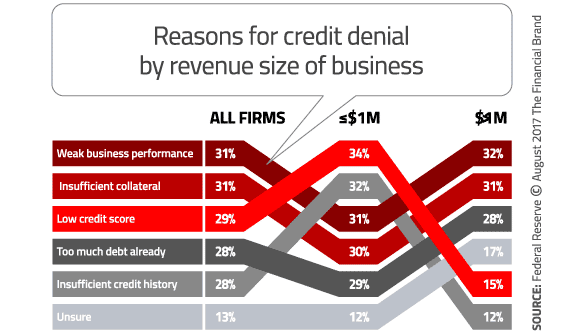

Small and micro businesses struggle to get the cash they need. According to the Federal Reserve’s small business credit survey, 60% of applicants obtained less financing than they needed.

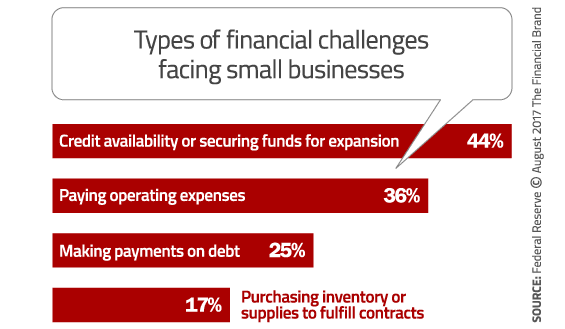

And they need money. The top challenge facing small businesses, says the Fed, is credit availability or securing funds for expansion (44%), followed by paying operating expenses (36%), making payments on debt (25%), and purchasing inventory or supplies to fulfill contracts (17%).

Unfortunately, size makes these loans unattractive to many banking providers. More than half (55%) of small businesses needed $100,000 or less and three-quarters sought $250,000 or less.

Show Me the Money

When traditional banking providers are unable — or unwilling — to fund small businesses, small businesses will look elsewhere for capital. One of the fastest growing segments of the alternative lending market is merchant cash advance (MCA). With MCA, small businesses take an advance (it’s not technically a loan) against future credit card receivables at a discounted purchase price.

The business gets a lump sum and pays it back daily or weekly based on future sales. Most MCA products were structured to be repaid over six months, but the payback terms are evolving, compressing to 90 days or expanding to 18-month terms.

Unlike banks, MCA providers are largely unregulated. While a case can be made that MCA is nothing more than predatory lending to small businesses, it’s fallen under the regulatory radar. That could of course change, but for now, MCAs can charge whatever the market will bear.

The benefits of an MCA are convenience and fast access to the funds. Most of the MCA providers promise same-day funding and a streamlined application process. Apply today, get your money today.

Compare the MCA process to a traditional bank loan. Federal Reserve research says that small business borrowers spend an average of 24 hours to research and apply for bank loans. And, they often have to approach multiple banks before they find a bank that will lend to them.

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Merchant Cash Advance Strikes a Nerve

MCA is booming. Bryant Park Capital estimates that the MCA market will reach $15.3 billion in 2017, up from $8.6 billion in 2014. CAN Capital, which was a pioneer in the field almost twenty years ago, reports on its website that it has provided $6.5 billion in capital to more than 75,000 business.

Kabbage, another large MCA provider, boasts $3.5 billion in funding to more than 100,000 businesses. It also just announced an infusion of $250 million from Japanese telecom giant SoftBank, it’s largest equity fundraising to date.

Newer entrant Shopify Capital, an offshoot of ecommerce platform Shopify, says it has funded more than $60 million in aggregate cash advances between January and the end of April.

And small businesses don’t seem to be discouraged from the insanely high borrowing costs, which can range from 40% to 350% including fees and interest charges, according to Nerdwallet. The Stawhecker Group says about half of these borrowers come back for at least one more loan.

Can Smaller Banks and Credit Unions Compete? And Should They?

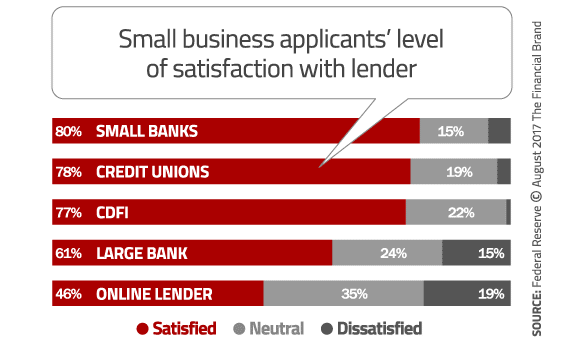

In focus groups of “mom and pop” businesses asking about how they perceive alternative online lenders, small business had two major beefs. First, while online lender websites may be alluring, small business owners are still concerned about data security and privacy — particularly with these neo-lender startups. Second, the product features among fintechs are not always clearly stated, making it difficult to compare product offerings and costs.

These issues mean many small businesses still prefer to get a loan from a bank. Half (50%) seek financing from a large bank, and 21% from online lenders. And their preference is for loans not credit cards; 86% say they applied for a loan or a line of credit vs. only 31% who just applied for a credit card.

Smaller loans can be profitable, if you approach them in new ways using new tools. Here are a couple of ideas:

1. Reengineer the Process with Big Data. With so much data available on small business owners and more computing power, banks can use big data in innovative ways to decision loans. No longer limited to a credit score, big data can analyze the behavior of the business and predict its ability to pay back the loan. Big data also means that fewer applications must be sent to a human for decisioning. Real-time decisioning cuts costs for the bank and since so much customer data is already digitized, there’s less need to require borrowers to submit reams of documentation.

2. Partner with Fintech. Rather than try to compete with online alternative lenders, consider joining them. IN 2015, J.P. Morgan Chase & Co. announced a partnership with On Deck Capital to create online small business loans. Called Chase Business Quick Capital, it provides Chase customers with faster access to cash than a traditional bank loan. Chase states that the capital can be available in the same day. In the past, a small business loan could take weeks to decision and then fund.

On Chase’s website, the bank calls the partnership with On Deck “A game-changing credit product with a streamlined application process, almost real time approvals and same- or next-day funding.”

Also in 2015, Regions announced a partnership with online lender Fundation Group. Regions customers can access Fundation’s online application from the Regions.com website. In a statement, Regions said “This new co-branded online customer experience will allow small businesses to expedite their loan applications for Regions lending products or elect to apply for a Fundation loan.”