In financial marketing, there is a heavy emphasis on acquisition. There are goals — a specific number of new customers must be acquired in a given timeframe and within budget. While quality of those new customers is often discussed and debated, quantity usually takes priority. Then everyone is stuck with making these customers (more) profitable.

The first step is to take a look backward. The key to moving the needle is your ability to understand why someone decided to start doing business with you — and continues (or doesn’t continue) to do business with you.

Surveys and marketing research may provide a general understanding at a broad level, but they aren’t very effective when you want to know what will motivate an individual customer to take action. The answer is to use the information you do have at the individual level to reveal your customers’ needs and motivations.

It’s Time to Change Your Focus

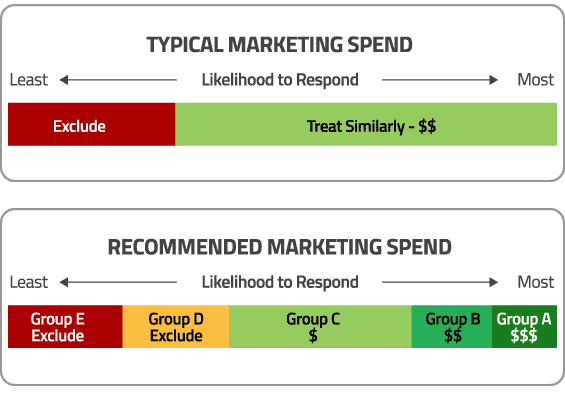

Most marketing efforts touch customers who will never change their behavior. No matter how good your targeting is, data is usually the most effective at the extremes (i.e., those least likely and those most likely to be affected). Instead of just eliminating the worst responders and treating the rest the same, consider a different treatment for those who are predisposed to your offering.

That means spending more on the top and “near-top” ends and potentially less on the rest. In the recommended strategy below, Group (D) would be excluded to cover the increased marketing spend on Groups (A) and (B).

To achieve this, you must be able to differentiate among customers, and your response model must have a steep slope for the top response deciles. This leads us to the first of the three pillars of success.

Read More:

- Acquisition, Onboarding and Cross-Sell Marketing Showcase

- Busting the Top 5 Customer Onboarding Myths

- New Customer Onboarding Goes Beyond Slick Marketing

- 7 Steps to Improve Customer Onboarding

Pillar 1: Data

We do not know whose behavior we can change at any point in time (for most customers), nor what is most likely to motivate that behavior. Therefore, we need to seek out the most informative data and use a variety of messages.

The available and needed data varies at different stages of the customer life cycle. The ability to determine a customer’s receptivity early on is essential. When needs shift over time, capturing those “change” signals will enable you to continue effectively segmenting your customers.

When it comes to onboarding, do you know why prospects became customers? At a minimum, can you reasonably distinguish between the “Tire Kickers” (i.e., came in for the offer), “Committed” (i.e., bought into your product or service), and everyone else? Here is some acquisition data that can help you find the answers:

- Source – Are there similarities among certain lists that might provide some behavioral insights? For example, those from a financial publication subscription might indicate not only a higher income or wealth, but also a level of financial savvy. Did they come through search or a display ad?

- Contact history – How many interactions did it take for you to convert someone? Factoring in influences like seasonality and changing marketing channels, was it just a case of getting lucky as to timing, or did some prospects take more work to convince?

- Offer – How rich was your offer? Was the offer just enough to spark interest, or was it the primary reason for becoming a customer?

How Banks Are Fortifying Their Data Against Increasing Cyber Threats

This webinar from Veeam will detail the value of working together across your organization to be better prepared in cyber defense and response readiness.

Read More about How Banks Are Fortifying Their Data Against Increasing Cyber Threats

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

How can you use that data? Start by looking historically at the above information. Which segments were more responsive in the long run vs. others?

In addition to the acquisition data above, these are also helpful as customers move along the customer lifecycle:

- Initial Product/Service – Did they start with a product that indicates commitment or one that was more transactional in nature? For example, someone who opens a CD or a credit card without activating it is different than someone who opens a checking account with a large balance.

- Engagement – How engaged are your customers? Many products are more “purchase and forget” (e.g., closed-end loans and CDs), while others have more potential for ongoing usage (e.g., checking accounts and open-end loans). To what extent are your customers responding to non-marketing messages or contacting customer service?

- Lifestage and Behavior Triggers – What significant changes are you seeing with your customers’ product usage (e.g., bill pay, large deposits or withdrawals, loan payments)? What external changes are you seeing (e.g., marriage/divorce, births, moving, children starting or finishing college)?

When it comes to retention, sadly most efforts tend to focus on closing the barn door after the horse has already run away. It’s not hard to understand why this happens. After all, it’s hard to predict who is likely to leave, and it’s expensive to make offers to a wide audience that was probably going to stay anyway.

At a minimum, the use of trigger data is warranted to initiate early intervention and initiate immediate action (and even then it is usually after a customer has already decided to do less business with you)

Pillar 2: Behavioral Psychology

What are the primary reasons someone will do more business with you? More importantly, what are the reasons they are not? Make a list, and be very specific. Use this list to craft different messages, each emphasizing hot buttons and unique motivators.

Humans are primarily motivated by avoiding pain (or loss) and seeking pleasure (or gain). And we will do significantly more to avoid pain. From a messaging perspective, try a positioning that talks about what your customer is losing by not taking advantage of doing more business with you, versus what they will gain.

Even if they are convinced of the value to changing their behavior, inertia prevents many from doing so. The “pain” of the effort is not worth the “gain” of the solution. Therefore, you not only need to make it easy for change through processes and systems, you also need to convince your customer that it is easy.

People tend to make decisions based on emotion and then rationalize it based on facts. Therefore, use emotion to motivate the decision and rational arguments to support it. For example, don’t just talk about the amount of savings a customer might get by refinancing a loan, but also what they could do with all that extra cash.

Pillar 3: Cadence

It is very difficult (or nearly impossible) to know exactly what motivates someone, given the available data. Therefore, varying your messages over time to the same audience will increase the likelihood of the right message reaching the target. While it is OK to include multiple secondary messages, trying to equally stress every reason to purchase tends to be ineffective. You only have a few seconds to capture someone’s attention, so don’t dilute the message. That is why a cadence strategy will increase the likelihood of them seeing the motivators that speak to them.

Closing Thought:Data, behavioral psychology, and cadence work hand-in-hand to change consumer behavior. When designing plans incorporating any one of these pillars, take a moment to consider how it might impact- or complement the other pillars of your plan. This will significantly increase your success.