Though branches still offer some value for consumers, comfort with using automation and non-traditional financial firms for banking transactions continues to gain traction. This change in consumer behavior requires attention from the banking community, especially those firms that hope that the movement to digital solutions will either slow or stop altogether. This isn’t going to happen.

In a survey fielded by Fiserv, it was found that most consumers are split on their preferred mode of interaction with their primary financial institution. While over half of consumers had visited a branch in the most recent month, the mean number of branch visits per month had fallen compared to 2016.

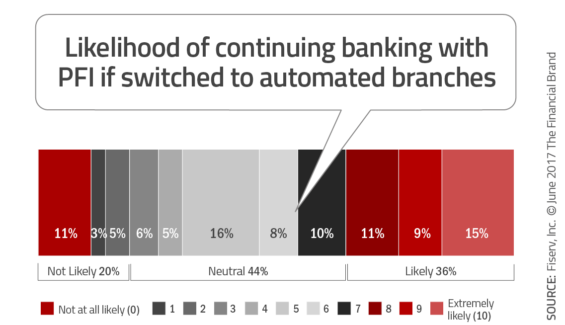

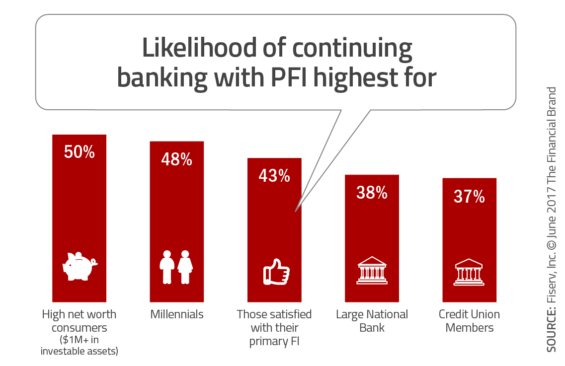

When asked about branch automation, consumers were split on the likelihood of staying with their primary financial institution (PFI) if it switched to full automation. Not surprisingly, Millennials and high net worth consumers were more open to staying with their institution amid a change to full automation.

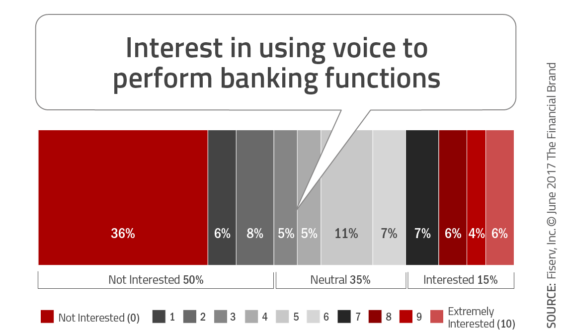

With regard to advanced technology, such as voice-activated banking, consumers believed the benefits would be similar to other voice-activated apps (notably speed and convenience). That said, given the newness of the technology, many view using voice activated devices to perform banking functions as more of a hassle and not making life any easier.

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

Digital Services Continue to Gain Traction

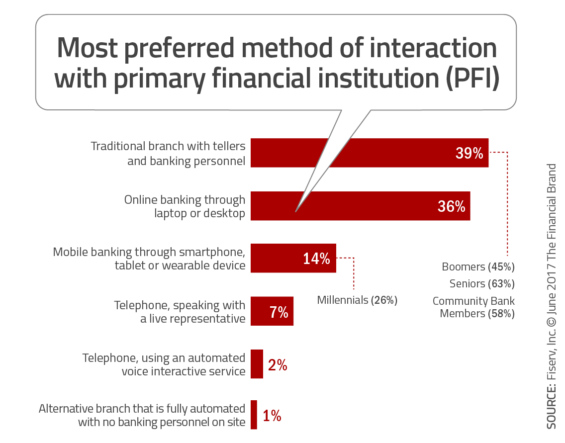

At first glance, it might seem that in-lobby versus digital transactions are at near-parity in terms of preferred banking modes. After all, 39% of respondents said they’d rather interact with live bodies in a branch setting, which barely outnumbers the 36% who prefer banking via personal computer. But PCs are only part of the digital banking equation. Adding in the 14% who prefer banking via mobile and wearable devices (26% for Millennials) brings the number who prefer electronic banking in one form or another to a full 50%.

Not surprisingly, checking an account balance remains the top reason for logging in, coming in at 79%, up from just 54% the previous year. Digital bill payment is also growing. Last year, 75% of respondents used bill pay, as opposed to 64% the prior year. And, in the month of the survey alone (May 2017), 45% of respondents used online bill pay, followed by 34% who executed account-to-account transfers.

Chief among the benefits that attract consumers to online bill pay are speed and accuracy. In fact, they’d like to see it speedier. Consumers aren’t fond of float, it seems. Banks should note that their bill pay service offers a distinct advantage over payment via individual merchant sites, and it’s a benefit that the latter cannot knock off – consumers like being able to pay multiple bills from one site.

Branches are Still Loved (by Fewer Customers)

Though the number of people who actually walk into a bank lobby may be shrinking – 54% of consumers said they visited a branch in the month of the survey, down from 61% at this time last year – the 39% who prefer live bodies can’t be ignored. Moreover, consistent with other surveys, the majority of consumers (60%) named “branch location” as a determining factor in their choice of primary financial institution.

Of respondents who reported visiting a branch in the month of the survey, 72% said the purpose was to deposit or cash a check, with cash withdrawals accounting for 46% of the visits. Wanting to speak with a teller or other banker ranked only at 19%. This could be an indication that continued branch visits are driven more by function than by a feeling of having a relationship with the bank.

Mulling the switch to being only an automated bank? Respondents are all over the board regarding preferences of automated banking, but appear to be trending towards an acceptance of this option. Millennials and higher net worth households seem to be most accepting of digital branches, as are those already satisfied with their primary financial institution. A word of caution, however – reliance on respondents’ predictions of their own behavior can be misleading.

Voice Banking Provides New Opportunity

Though relatively new and not yet widely offered, voice-activated banking holds strong appeal not just for Millennials, but for high net worth clients across the age spectrum. While we’ve come to expect early adoption of innovative services from Millennials, perhaps the appeal to high net worth clients shouldn’t surprise us, either. Voice activation is no longer the newfangled stuff of science fiction. It has fast become fairly common, almost mundane.

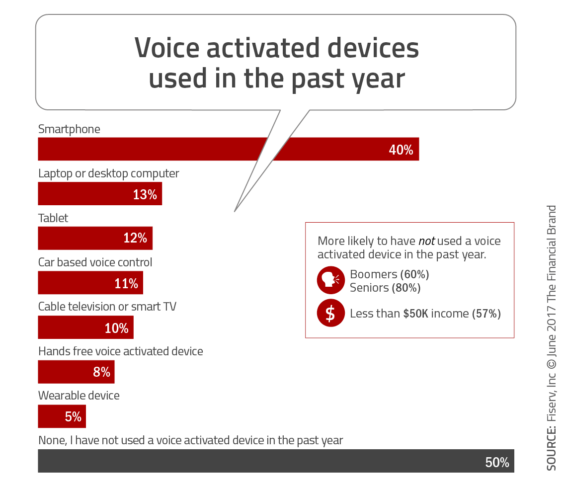

According to the Fiserv study, half of consumers already voice-activated apps in one form or another. The majority (40%) use their phone for voice activated transactions, with laptop/desktop (13%), tablet (12%) and car-based voice engagement (11%) being the most popular methods.

For those using voice-activated apps, 70% use it for search, 56% for directions to a destination, 56% to compose text messages, and, despite limited availability, 26% indicated using voice for banking. Most respondents who indicated an interest in voice-activated banking said they might use it to check account balances (68%), pay bills (46%), and to log into accounts (46%).

The driving benefits of voice-activated banking’s incipient popularity seem to be speed and convenience. Of respondents interested in voice-activated banking, about half favor access via smartphone. That number makes sense, since half of respondents already use a smartphone for other voice activation purposes.

If in the not too distant future voice-activated banking proves important for client retention, it may prove important for client acquisition even sooner. Ten percent of respondents whose bank doesn’t offer voice-activated banking said they’d switch for a competitor that did.

While survey responses may not lead to immediate action (switching accounts), bankers should be aware of the desire to use voice to simplify activities and facilitate multi-tasking. The banking industry also should keep an eye on the major tech companies (Google, Amazon, Facebook and Apple) who are setting the digital engagement expectations for all industries.

Speaking of client retention, here’s encouraging news: 75% of respondents are happy with their primary financial institution, with 24% being neutral. These ‘close to satisfied’ households present an opportunity improve both satisfaction and engagement by improving digital delivery of services. The remaining one percent expressed unhappiness with their bank … can’t please everyone.

Are You Ready for a Digital Transformation?

Unlock the potential of your financial institution's digital future with Arriba Advisors. Chart a course for growth, value and superior customer experiences.

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Summary points from the survey:

- Consumers appear split on whether they prefer in-person vs. online banking via personal computer, however, smartphones, tablets and wearables tilt the scale toward digital banking.

- Interest in voice-activated banking is growing, especially among Millennials and high net worth clients.

- Over half of respondents visited a branch in the past month, usually to deposit or withdraw.

- Respondents were split on whether they’d stick with a financial institution that switched to full automation, however, Millennials and high net worth consumers appear more open to using branch automation.

- Many respondents, especially Millennials, are comfortable with the idea of non-banks providing bank-like services.

About the Expectations and Experiences Research

Fiserv releases four consumer Expectations & Experiences surveys per year. The study described above, the first for 2017, examines consumers’ channel usage. Remaining studies for 2017 will explore, in order: Consumers’ behaviors, attitudes and satisfaction with the loan process as well as their approach to managing investments; households’ management of finances; and awareness, familiarity, and usage of various payment methods.

All respondents reported having used a checking account for payment or purchase within 30 days prior to the survey. The data was weighted to ensure that relevant demographic characteristics of the sample matched those of the U.S. General Population. All respondents (not just those meeting qualifying criteria) were weighted to U.S. Census Bureau demographic profiles for the U.S. population, age 18+ on education, age, gender, race, income, region, household size and number of hours spent on the Internet (with targets for this variable coming from Nielsen Scarborough).

Matt Wilcox is the Senior Vice President of Marketing Strategy and Innovation for Financial Services at Fiserv. Wilcox is a recognized industry expert on channels and payments, and is a frequent speaker at industry conferences on topics including payments, digital channels, marketing, multi-channel integration, social media and risk management.