Emirates NBD – Future Banking Lab

This innovative design incorporates three zones. The “Digital Banking Zone” provides self-service banking options like interactive teller machines and video conferencing stations. The “Future Banking Zone” showcases digital innovations developed with technology partners such as the Visa “Connected Car,” MasterCard’s Virtual Shopping Experience, and SAP’s augmented reality real estate solution. In the “Advisory/Relationship Zone,” provides a relaxed environment for customers to meet one-to-one with a financial advisor to discuss the banks products and services.

Design Credit: Allen International

Fractional Marketing for Financial Brands

Services that scale with you.

Why Industry Cloud for Banking?

PwC’s Industry Cloud for Banking helps deliver personalized products and services that today’s customers expect.

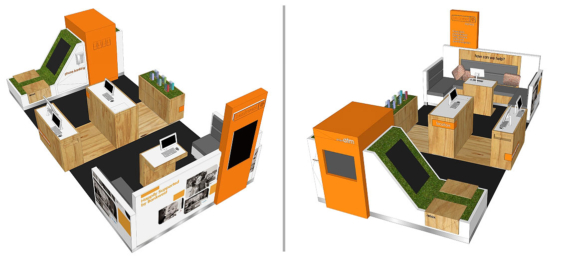

SNS Bank – Sales Center

SNS Bank’s vision is that physical retail environments should not just build relationships but also play a key role in driving sales. The result is something that The Financial Brand has never seen before (and that’s saying something, because we have over 10,000 photos of branches in our archives dating back to the 1990s). This concept is so retail, you have to look twice to make sure it isn’t a mobile phone store.

Design Credit: Vbat + The Reaction Chamber

Piraeus Bank – E-Branch

Piraeus has 700 branches in Greece. They recently developed three new prototypes — one hub, one spoke, and one independent model — for testing before rolling out any changes across its wider network. Shown below is the spoke concept “E-Branch”.

The intent was to design a space that married both digital and physical — to create “a warm internal environment inspired by home, a connection between high-tech and humanity,” as they put it. For instance, the video teller machine (VTM) is housed in a table intended to evoke a more personal and casual experience — like an island you might find in someone’s kitchen.

It only takes two people to staff this branch, thanks largely to the video teller that can handle withdrawals, deposits, balance inquiries, money transfers, bill/credit card payments and even loan applications.

Design Credit: DINN Design

See More: 10 Branches Designed To Wow The Digital Banking Consumer

Addiko Bank Express

This branch in Slovenia includes two ATMs (one 24-hour), a welcome desk, a sit-down space for consulting with customers, one online workstation, and a mobile banking demo station. What else do you need? The contemporary design, bold use of color and simple merchandising make this an efficient and pleasing space.

Design Credit: Brigada

ADCB – uBank Digital Financial Center

A compact concept that squeezes one sales and service station, a video wall, an interactive table and a pair of online workstations into an island at a shopping mall. It doesn’t look like anything like the palatial branches of yesteryear, which is the point. Its mall location makes it conveniently accessible, but drastically reduces the size of the footprint while still delivering a high-touch sales and service experience.

Design Credit: Crea International

mBank – Light Branch

The Financial Brand has written about this concept before, but it’s worth a second look and belongs in a showcase such as this. Rather than trying to reconfigure existing branches — which were generally oversized — this much smaller “Light Branch” concept is being relocated to higher consumer traffic hubs, such as shopping malls. The focus of these branches will be on acquisition, communication, experience and simple services. mBank says over 40 light branches will be operating throughout Poland (where they are based) by 2018.

Design Credit: ARS Retail+Shopfitting

Instant Messaging. Instant Impact.

Connect with your customers and provide lightning-fast support as effortlessly as texting friends. Two-way SMS text messaging is no longer optional.

The Financial Brand Forum Kicks Off May 20th

Explore the big ideas, new innovations and latest trends reshaping banking at The Financial Brand Forum. Will you be there? Don't get left behind.

Read More about The Financial Brand Forum Kicks Off May 20th

Bankwest Express

This kiosk features ATMs, internet terminals for online banking and sales consultants on hand to answer any questions or open accounts. If a more confidential conversation is necessary, customers are directed to the nearest Bankwest store.

Design Credit: Design Clarity

ATB – Localized Art

ATB tapped some of Alberta’s best illustrators to create artistic interpretations of local life near each branch. The installations demonstrate ATB’s focus on local communities, and its cultural leadership as a supporter of the arts. These murals also convey a subtle brand message — “a personal touch” that only human, hand-wrought illustrations like these could connote. And hey, if that’s too deep and philosophical for you… just admit it: they’re just fun to look at.

Design Credit: Workspace

Oaken Financial

Oaken describes the space as a combination of modern design, relaxed ambiance, and interactive tech. The design reflects Oaken’s “forest” brand identity — natural woods and organic leafy themes — which is nicely counterbalanced by digital displays.

See More: 14 ‘Branch of the Future’ Designs

Regions Bank

The newest branch concept from Regions places universal bankers in paired teller pods. There are also two video banking units — one in the drive-through, and another in the secure, 24-hour vestibule.

Design Credit: Shikatani Lacroix

Shikatani Lacroix

IDFC – Un-Bank

The designers of this concept say the strategy was to merge themes from both banking and retail industries while drawing inspiration from international brands — fresh, professional, friendly and approachable. The first iteration of this concept opened in October 2015 and IDFC says the design will be rolled out across the country.

Design Credit: I-AM

Absa Bank – Test Lab Branch

Absa wanted to create a more interactive environment for customers and explore new ways to deliver banking services. They created this branch concept — including quick-service pods, Microsoft Surface tables and a 75-foot wide digital screen — to test new ideas prior to rolling them out across the entire branch network.

Design Credit: Allen International

Industry Cloud for Banking from PwC

PwC’s Industry Cloud for Banking applies our deep industry knowledge to your specific business needs

Send the Right Offers to the Right Consumers

Achieve a better return on your marketing investment. Leverage behavioral data and analytics to target the right customers with the best possible offers.

Read More about Send the Right Offers to the Right Consumers

Dupaco Credit Union – Learning Lab

Features a single interactive video teller pod, an electronic wall display, LED-powered signage, and iPad training counters to teach members how to use the credit union’s mobile services.

Elevations Credit Union – Branch 2.0

Elevations Credit Union says this location was modeled after retail concepts deployed by the likes of Starbucks, Apple and brewery tasting rooms. It features Colorado artwork, and was built using locally-sourced sustainable materials.

Design Credit: Weber Marketing Group