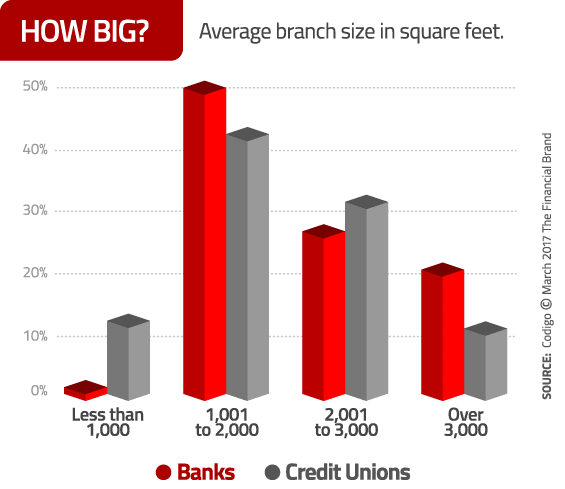

Footprints Shrinking. The average square footage per branch location for all respondents is currently 1,933 s.f. This is a massive reduction from the 5,000 square foot palatial locations banks and credit unions operated in the past. Last year, four out of five institutions saying they would be adding branches had no plans to reduce the size of their new locations. This year, it’s less than half — 44% say they plan for their new branches to be smaller.

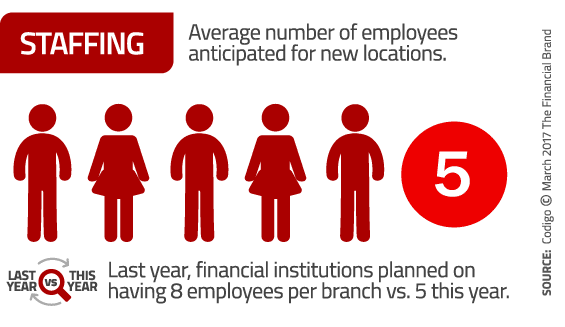

Fewer Employees. Say goodbye to those sprawling teller zones staffed with a dozen employees. Banks and credit unions say they plan for an average of five employees in their new branches, but one in five say they will be able to get by with three or fewer employees. Among those remodeling locations, it will now only take four employees to staff the branch as opposed to six for remodeled locations in the year prior. In 2015, 26% of banks and 10% of CUs reported that they’d have ten or more employees in new branches. But in 2016, nobody anticipated having ten employees. In fact, 0% of banks reported having any more than seven employees at a given branch. This shows that financial institutions are adapting to the lower transaction volumes in their branches, and that they are acclimating to the notion that they can staff at a bare bones level.

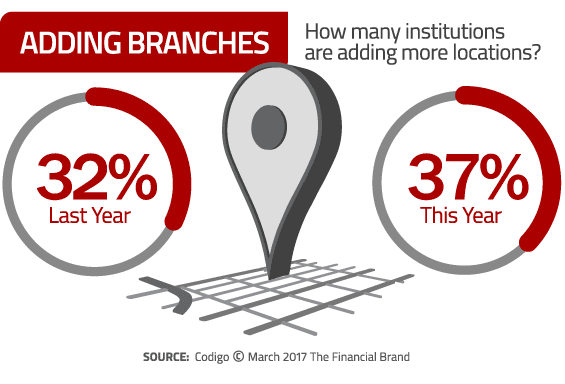

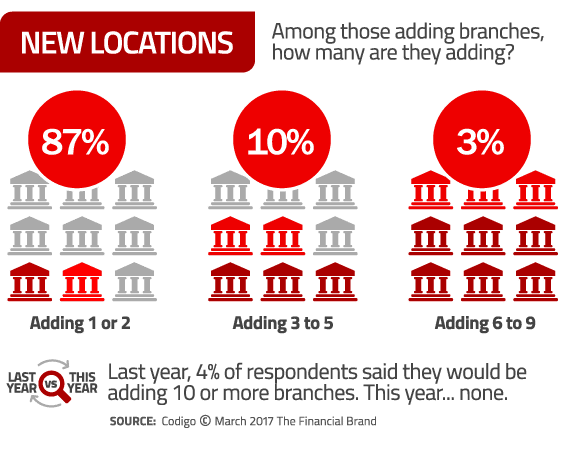

Less Growth. More banks and credit unions say they intend to bring more branches online this year than last year, but they will be adding fewer in number. Last year, 4% of respondents said they would be adding 10 or more branches. This year… none. The vast majority of retail financial institutions (87%) say they will only be adding one or two new locations in the coming year. Last year, just over half of banks and credit unions (53%) reported “expanding the branch network” as their primary reason for new branches, but this year that option was so infrequently given by respondents that it didn’t even register.

Fractional Marketing for Financial Brands

Services that scale with you.

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services