Acquisition of new customers and members is a primary marketing focus for most banks and credit unions. Getting a consumer’s attention, and encouraging them to open a new relationship, can take dozens of marketing messages over an extended period of time.

The purpose of customer solicitation messages is to position a financial institution as the ‘best choice’ among an increasing array of financial services options. Most of these messages focus on the enhanced experience that can realized by opening a new account.

Given the level of attention given to initiating a new relationship, most consumers reasonably expect their new financial institution partner to continue the communication well past the new account opening process. Even if they didn’t walk into a branch to open their new account, they have been conditioned by automotive, retail, hospitality, healthcare and technology industries to expect a series of communications that welcome them and assist in the onboarding process.

So why, knowing what is needed to effectively communicate with new customers and members, are 80% of financial institutions still not satisfied with their onboarding program?

The Power of Localized Marketing in Financial Services

Learn how to enhance your brand’s local visibility, generate more leads, and attract more customers, all while adhering to industry regulations and compliance.

Read More about The Power of Localized Marketing in Financial Services

Fractional Marketing for Financial Brands

Services that scale with you.

1) Forgetting to Say “Thank You”

In the 75-page Digital Banking Report, ‘State of the Digital Customer Journey,’ sponsored by Kofax, financial institutions globally were asked to provide a progress report on their ability to onboard new customers. The research sought to determine:

- What percentage of organizations currently have a structured onboarding process?

- How many times are customers/members contacted during the first 6 months?

- What communication channels are used, and how effective is each channel?

- What products and services are recommended during the onboarding process?

- How successful is the onboarding program?

Surprisingly, only 55% of financial institutions indicated that they had a structured ‘Thank You” onboarding process after account opening. When we looked at the responses by size of organization, the largest financial institutions seem to have a slight edge in the implementation of new customer onboarding solutions, with over 60% of the largest organizations having an onboarding process. When analyzed by type of organization, larger banks and credit unions were more likely to have an onboarding program, while community banks don’t seem to be drinking the “importance of onboarding” Kool-Aid (less than 50% of community banks have an onboarding process).

Through the years, financial institutions have always been optimistic about the desire to implement an onboarding program. Our research fount that 27% of organizations planned to implement an onboarding program within one year. Ultimately, actions speak louder than words … 25% indicated the same intentions one year ago.

The absence of an onboarding process has serious implications for financial institutions — not only in terms of customer acquisition, but also in growing the business through follow-on cross-sell and up-sell activities. According to one research firm, “effective onboarding and activation that emphasizes customer engagement can help financial institutions boost profitability by $212 per customer.”

2) Suboptimal Channel Strategy

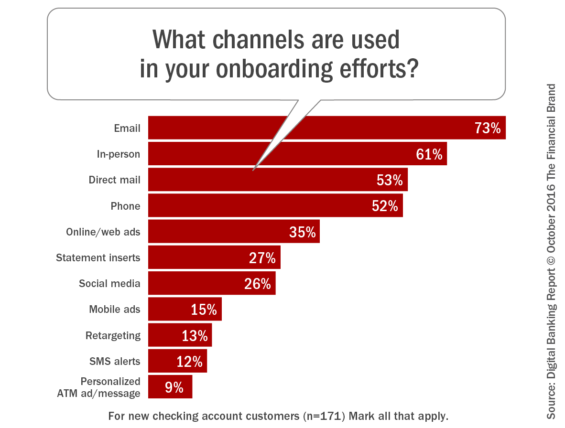

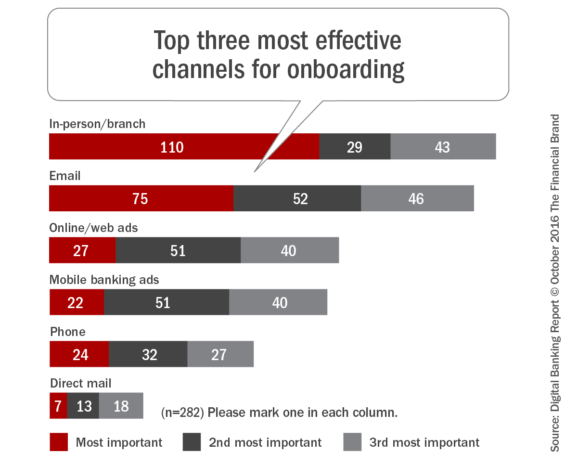

Email was found to be the workhorse of most onboarding efforts, but email alone was not the only channel used. Most onboarding programs leverage a multi-channel approach that includes email, phone, direct mail and other targeted communication channels.

When we asked about the effectiveness of different communication channels, the responses were very aligned with other research the Digital Banking Report has done regarding channel effectiveness. Based on both cost and results, the initial branch engagement (and even subsequent engagement) with the customer drives the best results. The use of human resources already committed is a great way to increase results.

It was interesting to note that mobile banking ads were noted to be highly effective despite the lack of overall use. It is believed that the low responses regarding the effectiveness of SMS alerts and retargeting are caused more by lack of use than by results that are measured. Both of these channels should be included in any advanced onboarding process.

Using multiple channels will not only increases retention, but will also improve engagement, cross-selling and customer satisfaction according to J.D. Power. While email may be a lower cost alternative compared to some other channels, combining email efforts with other communication channels will improve marketing ROI.

3) Failure to Develop a Cadence of Communication

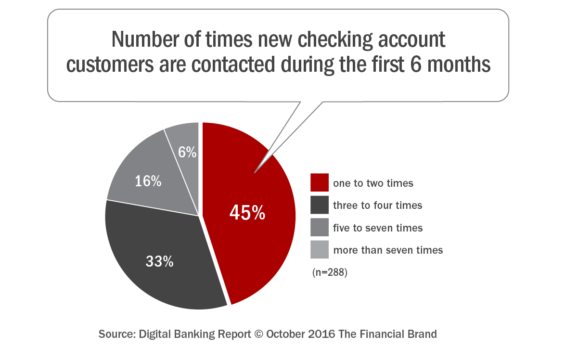

Research has shown that consumers want frequent, quality communications from their financial institution, especially during the early days of the relationship. The customer who has just purchased a product or service with your organization wants guidance and recommendations for how to make their relationship more valuable.

A study from J.D. Power shows that customer satisfaction increases as the number of communications from a financial institution increase. Unfortunately, only 6% of of the institutions who had an onboarding program delivered the optimal number of messages (7+) to their new customers during the first six months.

Even worse, 45% of banks and credit unions who had an onboarding program indicated that they communicated only 1-2 times during the initial 6 month onboarding period. For many institutions, this contact frequency was less than what they did to get the new customer in the first place. Given the value of retention and growth of a banking relationship, the fact that 78% of the institutions that have an onboarding program contact their new customers less than once a month in the 6 months after purchase is unacceptable.

4) Lack of Personalized Offers

When we asked financial institutions which services were sold during the onboarding process, the top three services mentioned were online banking (88%), mobile banking (82%) and a debit card (74%). Most likely these three services are ‘sold’ at the new account desk or are integrated in the online and/or mobile account opening process.

The next most likely services to be integrated into the onboarding process are online billpay (64%) and direct deposit (51%). Given the importance of direct deposit to making the new checking account the primary account for a customer, it is surprising that only a little over half of institutions with an onboarding process include this important engagement service. It is also surprising the lack of using alerts and notifications as an engagement service.

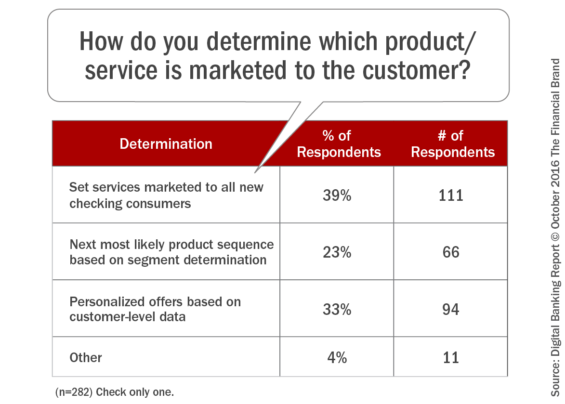

When we asked how the services sold were determined, the answer most provided was that the services were already pre-determined for all new checking customers. This indicates a lack of personalization and targeting during the onboarding process by 39% of those responding.

The good news was that 33% of those surveyed indicated that the offers communicated were personalized on the customer level. Close to a quarter (23%) indicated some form of ‘next most likely product’ selection criteria. It is hoped that as more firms use advanced analytics, the ability to leverage real-time, personalized offers will increase.

Tremendous Opportunity for Improvement

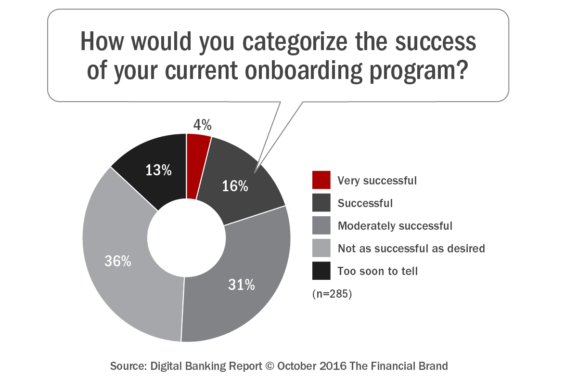

Despite what many might call lackluster levels of sales (most likely caused by a lack of commitment to a strong sequence and cadence of communication) 20% of those with onboarding programs considered them to be ‘successful’ or ‘very successful’. Another 31% found their programs to be moderately successful, indicating that slightly more than 50% feel their program is making an impact.

There is obviously room for improvement, however, with 36% saying their program was not as successful as desired. As noted in the Digital Banking Report, Guide to Multichannel Onboarding in Banking, success would be much stronger if the communication was done more frequently and used more channels.

When we broke down the responses by size and type of organization, we found the most successful programs to be implemented by the largest organizations. In fact, only 13% of the very largest organizations (over $50B in assets) thought their program was not as successful as desired.

The large national and regional banks also indicated success with their programs followed by credit unions. Again, community banks, despite their close relationship with their communities and clients they serve, were the least satisfied with their onboarding efforts.

As was emphasized in the Digital Banking Report, “Banking has seen a steep decline in face-to-face interactions with customers and members as well as prospective new clients. How do you tackle onboarding for people who don’t visit your branches? If you don’t offer some form of digital onboarding, you better at least be building future strategies for the digital consumer.”

The State of the Digital Customer Journey

The State of the Digital Customer Journey report, sponsored by Kofax, provides comprehensive insight into the minds of consumers and the activities of financial institutions around digital account opening, onboarding and cross-selling. The report includes the results of a survey more than 300 financial services organizations. The report includes 75 pages of analysis and 60 charts.